The nanomaterials market is growing at a rapid rate, with an estimated value of USD 16.7 billion in 2025, which is likely to reach around USD 68.2 billion by 2035, growing at a CAGR of 15.1%. This growth is driven by increasing applications in healthcare, electronics, energy, and advanced manufacturing.Health care is among the most rapidly increasing consumers.

From antimicrobial coatings to tissue regeneration and cancer-targeted drug carriers as well as biosensors, these materials are transforming the practice of contemporary medicine. Precision and biocompatibility make possible targeted therapy with fewer side effects and greater ability to diagnose.

In electronics carbon nanotubes, graphene, and quantum dots find applications in the manufacture of high-performance semiconductors, OLED screens, batteries, and sensors. The demand for more conductive, flexible, and heat-resistance materials is pushing the applications at a rapid pace.Energy storage and sustainability are also high-priority growth opportunities.

They are enhancing the performance and efficiency of lithium-ion batteries, solar cells, fuel cells, and hydrogen storage systems. They can enhance charge retention, minimize energy loss, and enable renewable technologies, all of which are essential to global energy transformation.

Though having enormous potential, the industry is not exempt from some of the challenges. High cost of production, scalability limitations, and regulatory hurdles in the areas of toxicity and environmental effects are critical issues. Nanomaterial safe handling, waste disposal, and life cycle assessment are being watched closely by global regulatory agencies.The USA, South Korea, and China have a leading-edge advantage in propelling nanomaterial uses at scale from pilot lab stages to commercial production.

Growing trends feature nano-enabling packaging, textile antiviral coatings, nanomedicine, and nano remediation applications. With growing global industries aiming for sustainable, high-performance, and downscaled solutions, it will take on a core mission in powering emerging technologies. The industry is an intersection of material science, innovation, and industrial change. As investment and regulation continue, these materials will determine the future for advanced manufacturing, digital technology, clean energy, and precision medicine.

Market Metrics

| Metrics | Value s |

|---|---|

| Industry Size (2025E) | USD 16.7 billion |

| Industry Value (2035F) | USD 68.2 billion |

| CAGR (2025 to 2035) | 15.1% |

Explore FMI!

Book a free demo

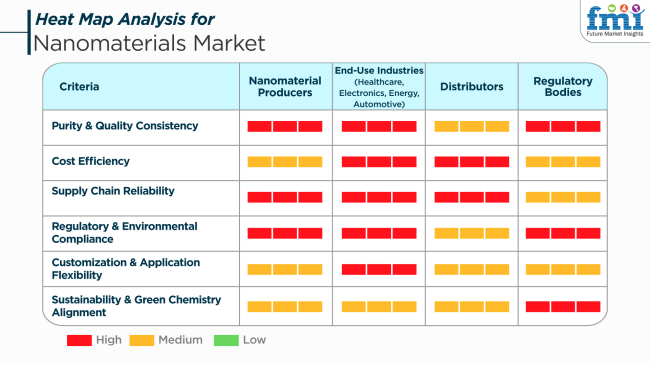

Theindustry is increasing at a rapid pace due to the increasing demand in industries such as healthcare, electronics, energy, and transportation. These materials are characterized by their unique properties at the nanoscale, are vital for product performance optimization and the creation of new applications.

In medicine, these materials find application in drug delivery and diagnostic devices; in electronics, they improve semiconductor and sensor performance; in energy, they help improve efficient batteries and solar cells; and in automotive, they help in manufacturing light-weight yet strong parts.Distributors focus on providing economical solutions and dependable supply chains that can fulfill the varied requirements of their customers. Distributors are instrumental in filling the gap between producers and final consumers by providing timely delivery and nanomaterial product availability.

Regulatory Organizations implement standards driving adoption of environment friendly and safe nanomaterials. These regulate the industry with rules and frameworks that facilitate effective implementation to maintain safety and efficiency of the used nanomaterials for diversified applications. The nanomaterial industry depicts a convergence towards developing and leveraging materials complying with performance requirements, environmental specifications, and accommodating shifting consumer expectations.

In the time span of 2020 to 2024, the industry experienced tremendous growth across the entire industry, be it electronics, medicine, energy, or the automobile industry. Carbon nanomaterials like carbon nanotubes and graphene were in extremely high demand and were being increasingly used for their conductivity, tensile strength, and lightness.

The medical industry also seized nanomaterials in drug delivery, diagnostics, and imaging, especially following innovation in the COVID-19 crisis. In contrast to the, electronics applied for display technology and semiconductor use. Scalability, expected demand strength, production expense, and regulatory risk stalled mass-scale implementation.

The period from 2025 to 2035 will have the industry working in mass commercialization with precision performance and sustainability in focus. Nano-enabled batteries, water purification systems, flexible electronics, and implants that are biocompatible will be the innovation leaders.

Governments and regulators will prescribe more accurate standards for environmental and safety evaluations. Manufacturers will rely ever more on green synthesis protocols and recycling processes to fulfill international environmental requirements. Convergence of nanotech with AI and IoT will also introduce new applications, rendering them a source of strength in future industries' technologies.

Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Widely used applications across sectors from electronics and healthcare to energy. | Clean tech, intelligent materials, and nanoelectronics development grow significantly. |

| Drug delivery, energy efficiency, and light weight material development. | Need for environment-friendly materials, green technology, and emerging computing. |

| Carbon nanotubes, graphene, and metal oxides targeted because of specialist application. | Multifunctional options emerging for responsive, intelligent, and degradable systems. |

| Pioneered by North America, Europe, and Asia-Pacific region technology leaders. | More use in the emerging economies with scale-up manufacturing and R&D facilities. |

| Scarce but growing concern with toxicity and environmental relevance. | Application of global safety protocols and green synthesis techniques. |

| Tuned for increased performance in electronics and medicine. | Extended to water purification, agrochemistry, AI-enhanced materials, and more. |

The industry is unstable to changes in raw material prices and the production cost. Instability in these costs has significant impacts on production costs and makes it difficult for producers to maintain competitive cost structures and therefore affect profit margins.

Stringent environmental and safety regulations pose major risks to business. Compliance with various regional regulations requires constant monitoring and adaptation. Failure to comply can result in legal problems and brand reputation loss, affecting industry share and customer trust.

Supply chain disruption, such as transport delays or geopolitical tension, can influence the timely supply of raw materials and finished products. Occasional disruption can cause production halts and deficiency in customer orders, hurting sales and long-term business relationships.

The sector is faced with the challenges of increased competition and technological evolution. Companies must invest in research and development to innovate and strengthen product offerings on a continuous basis. Otherwise, they risk becoming obsolete and losing industry share to more nimble competitors.

Relevance to major industries like electronics, healthcare, and energy implies that declines in these areas can have a direct effect on the demand. Diversifying the customer base among different industries can mitigate this.

Carbon will be expected to propel the industry in 2025, contributing the highest, that is, about 50% of the total share of the public industry. It paves the way for a segment named metal-based nanomaterials that shall hold an estimated 21% of the total industry share.

Carbon-based nanomaterials like carbon nanotubes (CNTs), fullerenes, and graphene are used in different high-performance applications owing to their extraordinary mechanical strength, electrical conductivity, and thermal stability. Their vast applications in fields such as electronics, energy storage components (for example, lithium-ion batteries and supercapacitors), and biomedicine have spurred the need for more materials.

For example, electronic giants, such as Samsung and IBM, employ carbon nanomaterials in their futuristic design of chip technologies as well as flexible displays. Graphene technology has brought in lightweight composites and flexibility in wearables; this again expands its footprint in terms of business. The performance enhancement capacity of carbon nanomaterials in materials science and energy contributes to their strong industry share.

The final category includes the metal-based nanomaterials- silver, gold, titanium dioxide, and zinc oxide nanoparticles, which together comprise a modest 21% of the industry. Increasingly, such materials are being applied in areas like antimicrobial coatings, catalysis, sensors, and drug delivery systems.

For example, silver nanoparticles are an important component in the production of wound dressings, textiles, and medical devices because of their significant antibacterial properties. Some of the companies that develop and industry metal nanomaterials for industrial and healthcare purposes include NanoComposix and American Elements.

Both carbon- and metal-based nanomaterials are likely to witness demand growth at a steady pace because of the innovations in nanotechnology, the higher investments in R&D, and the uptake of nanomaterials across electronics, healthcare, and energy industries.

The industry is predicted to be dominated by the Healthcare sector in 2025, accounting for almost 39% of the total application-based industry share. Following this is the Electrical & Electronics segment, with about 21% industry share.

The healthcare sector has emerged as the largest application of nanomaterials due to their potential use in diagnostics, drug delivery, imaging, and regenerative medicine. Silver nanoparticles, liposomes, and dendrimers are widely used in targeted drug delivery systems with enhanced therapeutic efficacy and few side effects.

For example, CytImmune Sciences and Nanospectra Biosciences use gold nanoparticles in precision therapy for oncology. Quantum dots and iron oxide nanoparticles enhance imaging techniques in diagnostics via MRI and fluorescence imaging. Furthermore, nanomaterials are used in wound dressings, implants, and surgical tools due to their antibacterial and biocompatible properties. The rise in chronic diseases, aging populations, and demand for personalized medicine will continue to drive healthcare applications of nanomaterials.

In second place is Electrical & Electronics with a solid 21% share, all triggered by the miniaturization of devices and demand for high-performance, energy-efficient components. Nanomaterials, including carbon nanotubes, graphene, and metal oxides, are used in conductive inks, transistors, sensors, and memory devices.

Technology giants such as Samsung, LG, and Intel are investing in nanotechnology to advance battery efficiency, display flexibility, and chip performance. The advancement in the incorporation of nanomaterials into flexible electronics and printed circuit boards is bringing a change in the landscape of consumer electronics.

These two application areas illustrate the paradigm shift nanomaterials introduce to the innovation and performance of health and electronic technologies. These increases in interlinking across the two industries are likely to provide a spin-off for future industry expansion.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 10.2% |

| UK | 8.1% |

| France | 7.8% |

| Germany | 8.5% |

| Italy | 7.3% |

| South Korea | 10.7% |

| Japan | 8.4% |

| China | 12.3% |

| Australia | 6.9% |

| New Zealand | 6.1% |

The USAindustry is anticipated to increase at a CAGR of 10.2% during 2025 to 2035, driven by strong R&D infrastructure and widespread uses in the aerospace, electronics, and biomedical sectors. Government funding and planned partnerships among universities, private enterprises, and national laboratories continue to drive innovation in engineered nanomaterials.

Key participants such as DuPont, Nanocomposix, and Arkema are investing in high-performance nanomaterial platforms to find use in drug delivery, advanced coatings, and energy storage. Applications in defense and environmental cleanup technologies are increasingly significant, with new opportunities for growth both in the public and private sectors.

The industry in the UK is projected to grow at a CAGR of 8.1% between 2025 and 2035. Growth is supported by industrial-academic collaboration and government-initiated frameworks for innovation in advanced materials. Domestic demand is being led by the rising application in life sciences, particularly diagnostics and imaging.

Leading companies such as Thomas Swan & Co., Haydale Graphene Industries, and Renishaw are building carbon nanomaterial and nano-additive manufacturing capacities. Green energy transitions and healthcare innovation are priority areas that the UK is targeting, providing important opportunities for nanomaterial-based technologies, particularly in solar cells, batteries, and biosensors.

France is anticipated to achieve a CAGR of 7.8% in the industry over the period from 2025 to 2035. Developments lead to growth in nanostructured coatings, catalysts, and nanocomposites applied across different automotive, aerospace, and pharmaceutical applications. National research institutes play a central role in transferring laboratory technologies to industrial scales.

Major players such as Arkema and Saint-Gobain are emphasizing sustainable paths of production as well as multifunctional design of materials. The demand is also emerging in cosmetic formulas and water purification technologies. Partnerships between industries across the EU strengthen France's regional value chains for high-precision nanomaterials.

Germany's industry is to expand at a CAGR of 8.5% through 2035, with the driving force being a strong engineering culture and emphasis on material technology innovation. High-end nanostructured material demand verticals include automotive production, electronics, and additive manufacturing.

Key players like BASF, Evonik Industries, and Bayer MaterialScience are heavily investing in nanomaterial research, especially in graphene, quantum dots, and nanoporous materials. Policy stimuli for Industry 4.0 technologies and circular economy frameworks also boost the industry. Germany is also aided by robust cross-sector collaborations that facilitate the rapid commercialization of new nanomaterial applications.

The Italian industry is expected to register a CAGR of 7.3% during the forecast period. It is increasing on the strength of demand from construction, textiles, and electronics, as well as the pharmaceutical sector. The need for nano-coated materials for construction and coating industries drives the broader application of nanotechnology in the creation of infrastructure.

Key players such as Colorobbia Group and Finceramica Faenza are investing in functional ceramics' applied nanotechnology and smart coatings. Italy also benefits from EU-sponsored projects on green nanotechnology and material recycling, which encourage local firms to integrate nanomaterials into product design for sustainable products.

South Korea is projected to be among the fastest-growing markets between 2025 and 2035, with a CAGR of 10.7%. A highly industrialized ecosystem leads the growth with vast experience in electronics, semiconductors, and display technologies. They are increasingly becoming critical in high-resolution imaging, sensors, and energy storage systems.

These companies consist of LG Chem, Samsung SDI, and Hanwha Solutions, being pioneers in the commercialization such as carbon nanotubes, nano-silicon, and conductive inks. Government backing for commercializing nano-enabled products promotes global competition and encourages investment in R&D infrastructure in the long term.

Japan's industry is expected to record a CAGR of 8.4% from 2025 to 2035. Technological maturity and established presence in life sciences and advanced electronics facilitate industry growth. The application is increasing in fuel cells, nanoelectronics, and functional food packaging.

Industry leaders such as Sumitomo Chemical, Mitsubishi Chemical, and Showa Denko continue to improve their portfolios through strategic R&D and international collaborations. The focus on energy efficiency and green performance is supplemented by the use in clean energy and sustainable coating, which helps create resilience in the industry.

China is likely to lead world growth in the industry at a CAGR of 12.3% during the forecast period. Government-led initiatives, as well as significant industrial demand along with enormous investment in nanotechnology infrastructure, drive development in applications ranging from energy to construction and biomedicine. Government-led initiatives also drive commercialization.

Industry leaders such as BYK Additives, Jiangsu Cnano Technology, and Beijing Dk Nano Technology are increasing their capacity to serve local as well as overseas industries. Leadership in supply chains for inorganic and nanocarbons positions China at the top of the global leadership table. Continued policy attention to frontier technologies attracts considerable private capital into the manufacture and study of the industry.

Australia's industry is projected to grow at a CAGR of 6.9% from 2025 to 2035. It possesses a robust start-up and research ecosystem in environmental nanotechnology and bio-nanomaterials. Applications in mining, water treatment, and agriculture are emerging as high-growth areas.

Key companies such as Antaria and Bluechiip are pioneering nano-enabled antimicrobial and diagnostic technologies. The national advanced manufacturing and clean energy strategy will drive demand for nanostructured materials in future manufacturing industries. Harmonization of regulatory environments with international standards makes commercial scale-up easier.

New Zealand is projected to exhibit a CAGR of 6.1% in the industry during the forecast period. Research-based efforts in nanobiotechnology and sustainable agriculture drive growth in the industry. Applications in food packaging and intelligent sensing technology have promising prospects.

Key advancements are made possible with the help of academic-industrial partnerships. Small companies are taking advantage of advancements in biodegradable nanocomposites and advanced diagnostics. While the industry size is limited, strategic concentration on life sciences and environmental applications ensures steady development in the field of nanomaterials.

The industryis very competitive. Important entrants here focus on material innovation and advanced manufacturing techniques in addition to penetrating different application sectors. Major firms, such as BASF, Evonik Industries, and Bayer AG, dominate due to large R&D investments, ownership of nanotechnology patents and large-scale production infrastructure at their disposal. These give them huge competencies in the automotive, electronics, health, and energy sectors and serve to enhance competition.

Some focused companies such as SkySpring Nanomaterials, NANOCYL S.A., and NANOCO TECHNOLOGIES LIMITED are emerging strongly with custom-made nanomaterials possessing improved conductivity, mechanical strength, and lightweight. These companies enjoy specialized applications of their products in coatings, composite materials, and environmental remediation. Their business strategies of product differentiation and partnerships with research institutes will help expand industry uptake.

The companies in Asia-Pacific, such as LG Chem and Altair Nanotechnologies, are strongly pushing toward a footprint expansion through low-cost nanomaterial production while collaborating with national manufacturers. They are also strong because of their capacities for large-volume output and the funneling of products into electronics and energy storage applications.

Both start-ups and other developing organizations are impacting the competitive landscape by introducing unique nanomaterials with enhanced capabilities, such as self-healing polymers, conductive inks, or aerogels. In addition, growing government funding toward nanotechnology and increasing cross-industry collaborations intensify competition among both established and emerging players.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| BASF | 18-22% |

| Evonik Industries | 14-18% |

| Bayer AG | 12-16% |

| SkySpring Nanomaterials | 10-14% |

| LG Chem | 8-12% |

| Others (combined) | 30-40% |

| Company Name | Key Offerings and Activities |

|---|---|

| BASF | Develops advanced nanomaterials for coatings, automotive, and healthcare industries. |

| Evonik Industries | Specializes in silica-based and functionalized nanomaterials for chemical and electronics applications. |

| Bayer AG | Focuses on nanotechnology for pharmaceuticals, agriculture, and high-performance materials. |

| SkySpring Nanomaterials | Provides customized nanoparticles and carbon nanotubes for research and industrial use. |

| LG Chem | Integrates nanomaterials into battery technology, electronics, and sustainable packaging solutions. |

Key Company Insights

BASF (18-22%)

A leader in nanotechnology innovation, focusing on high-performance nanomaterials for coatings, energy, and medical applications.

Evonik Industries (14-18%)

Strengthens its industry position through advanced silica nanomaterials and specialty chemical applications.

Bayer AG (12-16%)

Expands its nanotechnology research in pharmaceuticals, sustainable materials, and precision agriculture.

SkySpring Nanomaterials (10-14%)

Specializes in high-purity nanomaterials and nanocomposites for industrial and scientific use.

LG Chem (8-12%)

Leverages nanomaterial integration in next-generation batteries and electronic devices.

The global industry is estimated to be USD 16.7 billion in 2025.

Sales are projected to grow significantly, reaching USD 68.2 billion by 2035.

China is expected to experience a 12.3% CAGR.

The industry itself is experiencing growth, with strong demand for products like carbon nanotubes and nanocomposites, which are used in a variety of advanced applications.

Prominent companies include BASF, Evonik Industries, Bayer AG, SkySpring Nanomaterials, LG Chem, EMFUTUR Technologies, Sigma-Aldrich Co. LLC, Altair Nanotechnologies Inc., NANOCO TECHNOLOGIES LIMITED, and NANOCYL S.A.

The industry is segmented into carbon-based, metal-based, dendrimers-based, and composite segments.

The industry is segmented into transportation, electrical & electronics, healthcare, construction, packaging, consumer goods, and energy.

The industry is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

Aluminum Phosphide Market Growth - Trends & Forecast 2025 to 2035

LATAM Road Marking Paint & Coating Market Analysis by Material Type, Marking Type, Sales Channel, and Region Forecast Through 2035

Refinery and Petrochemical Filtration Market Analysis by Filter Type, Application, End-User and Region 2025 to 2035

Plastic Market Growth Analysis by Product, Application, End Use, and Region 2025 to 2035

Medical Grade Coatings Market Trends – Demand, Innovations & Forecast 2025 to 2035

Fertilizer Additive Market Report – Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.