From 2025 to 2035, the scope of the bulk material handling system market is expected to expand steadily owing to growth of industrial automation, infrastructure development and demand for effective material handling solutions across various industries. From mining to construction to agriculture to manufacturing and beyond, industries make use of powerful bulk material handling systems to improve efficiency, minimize downtime, and decrease overall production costs.

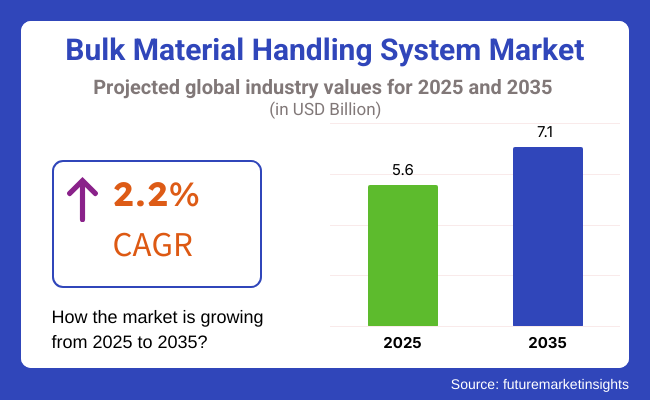

The market is expected to reach USD 5.6 Billion by 2025 and is projected to grow further to around USD 7.1 Billion by 2035, at a CAGR of 2.2%. The increasing trend toward automated and semi-automated handling solutions is actively enhancing market growth. With companies trying to achieve more throughput and accuracy, they are also increasingly adopting advanced technologies like conveyor systems, stackers and ship loaders.

The combination of IoT enabled monitoring systems along with predictive maintenance is revolutionising the traditional material handling industry. Smart systems allow real-time tracking, which enables performance optimization and prevents downtime, helping to ensure seamless operations and better return on investments.

Additionally, the worldwide inclinations towards eco-friendliness and energy efficiency are affecting the design and engineering of next-generation material handling equipment. Contemporary systems use renewable energy resources, recyclable materials, and energy-efficient motors, following strict environmental laws and company sustainability targets.

The need for advanced bulk material handling technologies to enable industries to streamline processes, enhance safety, and uphold productivity levels driven by innovation, and will drive the long-term market growth.

Explore FMI!

Book a free demo

A strong industrial base and strong investments in infrastructure projects in North America are driving the bulk material handling system market. The USA and Canada are at the head of the region, supported by strong activity within important sectors like mining, construction and agriculture. High output and cost efficiency are critical in these industries which rely heavily on efficient material handling systems.

There is large investment in modernising ports and terminals in the region, also needing modern bulk-handling equipment to suit growing cargo volumes. Moreover, increasing emphasis on autonomous handling solutions and intelligent material tracking systems is supporting organizations to enhance overall logistics effectiveness.

In addition, strict environmental protection regulations and labor safety standards are driving enterprises to use low-emission and high-efficiency equipment. The growing transition towards sustainable material handling systems will fuel the growth of this market in upcoming decade.

Europe continues to be a key market for bulk material handling systems, driven by the region's mature manufacturing sectors and emphasis on energy-efficient solutions. Germany, France and the United Kingdom are among the countries leading the way in using intelligent system handling that provides precision and repeatability.

Europe's focus on renewable energy projects, recycling plants and greener industrial processes is creating demand for new-generation handling equipment to comply with the EU's stringent emissions regime. Furthermore, Europe’s mature mining and agricultural industries depend on efficient transport systems to sustain competitive production levels.

With investments in automated and digitalized bulk handling technologies continuing across the region, Europe will undoubtedly remain front and centre in the global market.

Bulk Material Handling System Market Stringent Government Regulations and Rapid Industrialization Are the Main Reasons for Market Growth in Asia-Pacific bulk material handling system market is expected to expand at a high growth rate during the forecast period, attributed to rapid industrialization and expanding manufacturing sectors in numerous nations, along with large-scale infrastructure projects.

Others such as China, India, Japan, and South Korea are seeing growing demand for advanced handling equipment as they expand their focus on logistics efficiency and cost containment.

China, in particular, is forging ahead of the region with significant investments in industrial automation and port development, while India’s drive for modernization of infrastructure is creating a growing demand for reliable bulk handling systems. Moreover, both countries are experience expanded mining operation which drives demand for innovative material handling solutions in the agriculture industry.

Driven by the proliferation of advanced technologies, growing investments, and rising emphasis on operational efficiency, Asia-Pacific will witness dominating bulk material handling system market by the.

Challenges

Significant Upfront Investment and Complex System Integration

The Bulk Material Handling System Market is hindered by the high upfront investment costs, complex system integration, and need of specialized maintenance. Industries like mining, construction, and manufacturing are heavily dependent on these systems for efficient material transportation, but the costs involving capital expenditure on installation and maintenance can be a barrier for many organizations.

Moreover, implementing bulk material handling systems in already established operations while ensuring that existing processes remain undisturbed presents a technical challenge, often necessitating careful tailoring and specialised supervision.

There is no denying the need for organizations to harness more modular and scalable solutions, predictive maintenance technologies, and real-time monitoring tools to improve efficiency and cut long-term costs. The partnership with system integrators and automation experts will also expedite the process of adoption and extend the lifecycle of the system.

Opportunity

Automated Handling System Broadened and Sustainability Initiatives

Expansion of automation as well as sustainability initiatives into industrial operations is one of the key opportunities in the Bulk Material Handling System Market. So conveyor automation, robotic loading/unloading and real-time process optimization are revolutionizing the way material is transported in various sectors.

Companies are also implementing energy-saving strategies, including electric-powered conveyor belts and regenerative braking systems to improve environmental impact. Industry 4.0 is increasing the demand smart handling systems cross-integrated with cloud computing’s, and remote monitoring platforms.

As we progress towards an enhanced integration of innovative automation technologies, energy optimization strategies, and utilization of AI-powered predictive analytics within bulk material handling systems, the companies that lead the way will emerge as decisive market leaders.

Bulk Material Handling System Market Report Overview: The market for the bulk material handling system is projected to grow significantly from 2020 to 2024 due to the rise in industrialization, urban development projects, and growth in the logistics sector.

Investments in high-capacity handling solutions were driven by an increased need for efficient material movement in mining, construction, and waste management. But equipment availability suffered from supply chain disruptions and labour shortages, delaying project execution.

They provide data-driven insights that help manufacturers identify vulnerabilities in existing approaches while allowing them to adopt highly automated handling systems divided into individual components, leading to an end-to-end orchestrated material flow. Firms also placed a major focus on system durability and safety improvements designed to meet changing industry safety related regulations.

2025 to 2035: upcoming years bring technological innovation, green energy, and digital connectivity new possibilities such as AI-powered logistics planning, real-time predictive maintenance, and robotic-assisted bulk handling will enhance operational efficiency and minimize downtime. Moreover, industries will move towards electrification and hybrid-driven handling systems to reduce carbon footprint.

Modular and customizable handling systems will be adopted, leading to increased flexibility and enabling businesses to scale operations effectively. Bulk material handling solutions to the next generation features with focus on sustainability, digitalization and automation will quickly gain their place in the market.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with workplace safety and material transport regulations |

| Technological Advancements | Adoption of automation and conveyor system enhancements |

| Industry Adoption | Increased demand in mining, construction, and logistics |

| Supply Chain and Sourcing | Dependence on global suppliers for system components |

| Market Competition | Presence of legacy manufacturers and industrial system providers |

| Market Growth Drivers | Rising industrialization, infrastructure expansion, and logistics automation |

| Sustainability and Energy Efficiency | Early adoption of energy-efficient conveyor systems |

| Advancements in Real-Time Monitoring | Limited use of sensor-based tracking for bulk materials |

| Customization and Scalability | Standardized material handling solutions with limited flexibility |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of stringent environmental policies promoting low-emission handling systems. |

| Technological Advancements | Integration of AI-driven logistics planning, predictive maintenance, and robotic automation. |

| Industry Adoption | Widespread implementation in renewable energy, smart factories, and circular economy industries. |

| Supply Chain and Sourcing | Localization of manufacturing and increased use of recycled materials for sustainable solutions. |

| Market Competition | Growth of tech-driven start-ups offering innovative automation and efficiency-driven solutions. |

| Market Growth Drivers | Expansion of sustainable material transport solutions, AI-driven efficiency models, and smart industry adoption. |

| Sustainability and Energy Efficiency | Full integration of renewable energy-powered material handling, regenerative braking, and zero-waste initiatives. |

| Advancements in Real-Time Monitoring | Deployment of AI-powered remote monitoring, smart analytics, and predictive fault detection for real-time process optimization. |

| Customization and Scalability | Modular, scalable handling systems tailored to industry-specific requirements with enhanced adaptability. |

The United States bulk material handling system market is expected to witness steady growth in the coming years, attributed to increasing demand in mining, construction, and port logistics. The conveyor companies found themselves selling to the mining industry in the United States, which is a large user of conveyor systems, stackers and reclaimers, especially with coal, iron ore, and aggregates.

The construction and infrastructure industries are another significant contributor, as the nation consistently invests in road, railway, and commercial projects requiring the seamless handling of bulk materials like as cement, sand, and aggregates. The growth of automated and AI integrated conveyor systems is making the manufacturing and logistics sector more efficient.

The ongoing industrial growth, in addition, with increasing investment in smart material handling solutions, the USA market for bulk material handling systems is anticipated to grow steadily.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 2.5% |

The UK bulk material handling system market is moderately growing due to the expansion of construction activity, greater need for automated logistics, and an increase in the investment in port infrastructure. With multiple ongoing infrastructure development projects, primarily rail and road expansion, the demand for sophisticated and sophisticated conveyor and bulk handling systems is growing in the UK.

Key end-user industries include agriculture and food processing, especially for bulk handling equipment in the grain storage, mill, and feed sector. Moreover, the proliferation of warehouse automation and industrial logistics is driving the need for sophisticated conveyor and robotic material handling products.

As smart material handling is soaring, the UK bulk material handling system market would also witness steady growth with the leap in the industrial automation.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 2.0% |

The market for European Union bulk material handling systems is steadily growing, supporting the industrial automation, increasing mining and process, & solid government help for efficient logistics frameworks. The cement, mining and manufacturing industries in countries such as Germany, France and Italy have been some of the largest implementers of bulk handling systems.

Driving industries to invest in advanced conveyor belts, automated storage systems, and AI-driven material handling solutions, the EU is making it a focal point for sustainable and energy-efficient logistics solutions. Moreover, rising investments in smart ports and automated bulk terminals are driving the growth of the market.

The EU bulk material handling system market's steady growth is anticipated, thanks to increasing acceptance of digitalization in industrial logistics and robust infrastructure investment.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 2.3% |

Japanese bulk material handling system market is expanding at a stable pace owing to robust demand from manufacturing, construction, and mining sectors. Japan’s sophisticated manufacturing industry is one of the largest end users of automated bulk handling equipment, especially in steel, automotive, and electronics production.

There is a growing scope for bulk handling solutions in the construction and infrastructure industries as well, where demand for effective solutions for such projects is being supported by large investments being made in the transport as well as smart city projects. Moreover, Japan’s emphasis on robots and AI-driven material handling machines is enhancing their effectiveness in industrial logistics.

The Japanese bulk material handling system market is expected to grow steadily as the demand for automation continues to increase, as well as innovation in technology.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.2% |

The market for bulk material handling systems in South Korea is steadily growing due to increased demand from the construction, mining, and industrial automation sectors. The industrial growth story in South Korea is as good as that of Japan, paving the way for movement of materials through bulk conveyors, stackers, and reclaimers in cement, aggregates, and steel sector.

Smart factories and automated logistics hubs are increasingly driving adoption of AI-enabled material handling systems. Moreover, the development of South Korea’s shipping and port infrastructure is driving up the demand for bulk loading and unloading systems in ship terminals.

The South Korean bulk material handling system market is projected to achieve steady growth owing to mounting investments in smart logistics and industrial automation.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 2.1% |

Industries across the globe are spending on automated and high-capacity handling solutions for the mining and manufacturing segment owing to raw material transport optimization and economic operation leading to a substantial share of segment in the bulk material handling system market.

Bulk handling applications are essential across heavy industries, infrastructure development, and global supply chains, improving efficiency, reducing material loss, and increasing workplace safety.

The mining sector is becoming one of the biggest consumers of the bulk material handling systems as the mining companies look for ways to improve efficiency as well as reduce the waste generated from the material as well as optimize the extraction and processing operations.

Automated bulk handling systems move ores, coal, aggregates, and minerals from extraction sites to processing plants at a much faster pace than traditional manual handling methods, enabling the systems to overcome bottlenecks and improve production throughput.

Increasing extraction of iron ore, copper, and rare earth metals has resulted in rising demand for high-capacity material transport in open-pit and underground mining, thus driving the adoption of advanced bulk handling equipment, as mining companies seek cost efficiency while improving productivity. According to studies, modern bulk material handling solutions can cut operational costs by as much as 25% simply by streamlining throughput and reducing downtime.

Market demand has been bolstered by expanding conveyor-based transport systems in surface mining, including long-distance belt conveyors, high-angle and in-pit crushing and conveying (IPCC) systems, further boosting adoption of continuous material transport solutions.

The implementation of their automated loading and unloading functions for large stockpiles in combination with bucket-wheel excavators and stacker-re claimers has increased adoption of automated machines further due to the availability of better efficiency in material storage and handling at the mining sites.

Continual AI powered predictive maintenance solutions, real time monitoring of belt conveyors, bucket elevators, and ship loaders keep the market growth optimized and drive the use of technologically smart bulk material handling solutions further.

The increased adoption of dust suppression and environmental control technology, including enclosed conveyor technologies and automated flow control of materials has strengthened market growth, making further compliance with safety and environmental regulation in mining operation much easier.

However, the challenges that prevent the precious metals industry from adopting bulk material handling systems with the same zeal are the high capital investment, infrastructure limitations due to remote mining locations, automation for continuous operation at low cost, and the complexity of maintenance requirements.

Nonetheless, trending innovations such as artificial intelligence-assisted automation, energy-efficient conveyor designs, and hybrid electric material transport solutions are enhancing their operational reliability, sustainability, and long-term cost-effectiveness, promising sustainable market growth for mining-associated bulk material handling applications.

The manufacturing sector is a prominent end-user with a sustained direction for the technology, particularly in cement production, steel manufacturing, chemical processing, and food & beverage industries, as industrial facilities leverage bulk material handling systems to efficiently transfer raw materials, intermediate products, and finished goods.

Automated bulk handling solutions provide continuous flow of material which are not found in traditional batch processing and this reduces manual activity providing better productivity to the plant.

Increasing demand for precision material handling in high throughput manufacturing environments, including automated conveyor systems, robotic loading solutions, and smart tracking technologies, has contribute to the adoption of bulk handling automation, with manufacturers focusing on operational efficiency and reduction of labour costs. Data also shows a 30% improvement in process efficiency through minimizing bottlenecks and optimizing material flow via integrated bulk handling systems.

Furthermore, the rising adoption of bulk and large scale solutions for materials handling across various core end use industries including the cement and construction sectors involving heavy investments in high-volume clinker transportation systems, raw material conveyor systems and pneumatic material conveying solutions, is likely to amplify growth in the market during the forecast period.

Additionally, the integration of IoT-enabled bulk handling systems with real-time inventory monitoring, automated weighing, and predictive maintenance analytics have further accelerated adoption, enabling improved process optimization and cost savings in the manufacturing installation.

The customization of features in modular bulk handling equipment type based on the characteristics of material like powders, granules, and aggregates has optimally attributed to the growth of the market by providing increased flexibility and scalability within the manufacturing facilities.

Introduction of green manufacturing and solutions for sustainable bulk handling systems, with minimal energy pneumatic conveying, regenerative braking for conveyors, and dust-free transfer technologies has further reinforced the growth of the market, ensuring better compliance with green manufacturing initiatives.

This is a problem that can rely on the use of bulk material handling systems in the manufacturing industry despite their widespread use in the automation of workstations, improving the overall efficiency of processes, storage, and reducing waste.

Emerging innovations in AI-assisted process optimization, robotic material handling, and high-efficiency conveyor designs are now contributing to enhanced scalability, cost-effectiveness and long-term reliability, to sustain expanded growth for bulk handling solutions in manufacturing applications.

Shifting focus to individual segments, both the stacker and band conveyor segments are significant market growth contributors, with deployments in industries looking to optimize material transport and storage operations with high-paced solutions, minimizing manual intervention, and increasing overall process performance and with industries seeking efficient stockpiling solutions for intermediate goods, raw materials and finished products, stackers have become one of the most-used bulk material handling systems.

Stackers offer automated, high-capacity stacking operations, unlike traditional manual stacking methods, resulting in better organization of materials, minimized handling time, and enhanced inventory management.

The increasing need for the stacker at industrial commercial storage facilities in case of piles are pushing the adoption of high consumer spacing for bulk storage solutions for large industries, particularly the automated stacker, which is based on design projects of a large number of iron ores coupled with coal and aggregates. If we look at studies, it is stated that modern stackers can increase storage density by 40%, which helps eliminate material waste and improves retrieval efficiency.

Additionally, consolidated stacker-reclaimer designs, capable of both material storage and automated reclaiming to ensure a continuous supply of process feedstock, have bolstered overall demand in material handling applications across segment verticals including cement, mining, and steel production; further encouraging product adoption.

Adoption has also been driven by the implementation of AI-powered stacker positioning systems that come with real time load distribution analysis and automated movement tracking systems to ensure overall efficiency and reduce the chances of operational errors.

While stackers have disadvantages like high maintenance costs, limited mobility in some configurations, and reliance on complementary bulk handling systems, they offer clear advantages in high-capacity storage, automation, and efficiency. But new leaps in AI-powered stacker automation, robotic reclaiming options and demand based load management systems are sparking performance, dependability and cost competition that will keep the stacker-based bulk-products handing market growing.

Due to their ability to add to rich quality in constant material transport, especially in the mining, manufacturing, and seaport sectors, the demand for these conveyors has increased as industry continues to use high-capacity conveyors that guarantee constant material throughput and maximum efficiency in bulk material transport. Unlike traditional manual transport methods, band conveyors are can work seamlessly, providing high-speed transportation at all times; resulting in better throughput and lesser operational delays.

Further, the growing need of long-distance band conveyors with low-friction design for energy-efficient conveyance of materials, increasingly rely on long-range belt conveyors that provide cost-scalable solutions for bulk handling at lengths greater than traditional options would allow.

Enclosed and dust-free conveyor designs, such as those with completely sealed conveyor belts, and integrated dust suppression systems have propelled extensive market demand implications, offering increased adoption in environments that are sensitive to the project guidelines in industrial zones.

In addition, the introduction of automated conveyor belt monitoring, which includes sensor-based real-time wear detection and predictive maintenance systems in conveyor belt systems, has further consolidated demand while providing for better reliability and reduced downtime in industrial bulk handling applications.

Though this conveyor solution is cost-efficient, automated, and capable of continuous transport, there are certain challenges that come with band conveyors, such as limited space, belt wear issues, and the inability to operate in extreme weather conditions.

Nevertheless, Chain Conveyor based bulk material handling solutions market is set to maintain upward growth due to new innovations such as AI-powered conveyor optimization, regenerative energy recovery systems, self-cleaning conveyor designs and others as these IoT technologies improve efficiency, sustainability and long-term durability of these systems.

Growing demand of automated material transport logistics and industrial process optimization across various applications such as mining, construction, agriculture, chemicals and manufacturing industries, are expected to positively influence the growth of bulk material handling system market over the projected period. Businesses are increasingly emphasizing on AI-based automation, intelligent conveyor system, and energy-conscious bulk moving systems to improve operational efficiency, speed, and sustainability.

It comprises global industrial equipment manufacturers and specialized advanced material handling system providers, each providing ergonomic support through emerging conveyor belts, stackers, reclaimers, silos, and robotic-based handling solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Thyssenkrupp AG | 15-20% |

| Metso Outotec | 12-16% |

| FLSmidth & Co. A/S | 10-14% |

| Hitachi Construction Machinery Co., Ltd. | 7-11% |

| Komatsu Ltd. | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Thyssenkrupp AG | Develops automated conveyor systems, bucket elevators, and smart loading/unloading solutions for mining and industrial applications. |

| Metso Outotec | Specializes in bulk handling solutions for mining, material processing plants, and high-capacity belt conveyor systems. |

| FLSmidth & Co. A/S | Manufactures integrated bulk handling equipment, including stackers, reclaimers, and ship-loading systems. |

| Hitachi Construction Machinery Co., Ltd. | Provides intelligent excavation, automated bulk transport, and AI-powered heavy equipment for material handling. |

| Komatsu Ltd. | Offers robotic bulk loading solutions, conveyor automation, and AI-driven mining equipment. |

Key Company Insights

Thyssenkrupp AG (15-20%)

Thyssenkrupp is a leader in the bulk material handling market, with its high-capacity conveyor belts, automated stackers and smart industrial logistics solutions.

Metso Outotec (12-16%)

Metso Outotec builds in Internet of Things (IoT)-enabled monitoring systems as part of their machines' formal engineering designs to optimize machine efficiency in mining and processing industries.

FLSmidth & Co. A/S (10-14%)

FLSmidth offers smooth operation for the storage and industrial bulk transport of materials in cement, construction, and mining.

Hitachi Construction Machinery Co., Ltd. (7-11%)

Hitachi specializes in robotic excavation and automated bulk materials handling systems, with a key focus on AI-driven predictive maintenance for large-scale operations.

Komatsu Ltd. (5-9%)

Bulk material handling system at any scale for mining & industrial logistics, energy-efficient automated operation.

Other Key Players (40-50% Combined)

Several industrial automation and heavy equipment manufacturers contribute to next-generation bulk handling system innovations, AI-driven material transport optimization, and energy-efficient solutions. These include:

The overall market size for Bulk Material Handling System Market was USD 5.6 Billion In 2025.

The Bulk Material Handling System Market expected to reach USD 7.1 Billion in 2035.

The demand for the Bulk Material Handling System Market will be driven by the growing industrialization, expansion of the mining, construction, and agriculture sectors, and increasing demand for automation in material handling. The need for efficient, cost-effective, and safer transportation of bulk materials will further propel market growth.

The top 5 countries which drives the development of Bulk Material Handling System Market are USA, UK, Europe Union, Japan and South Korea.

Stackers and Band Conveyors Drive Market Growth to command significant share over the assessment period.

Airfield Fencing Market Insights by Material, Height, Product Type, and Region through 2035

Korea Electric Sub-Meter Market Analysis by Product Type, Phase, Application and Region: Forecast for 2025 to 2035

Internal Gear Pump Market Growth, Trends, Analysis & Forecast by Product Type, End-Use Industry and Region through 2035

Radial Piston Motor Market Analysis & Forecast by Product Type, Automation, End-Use Industry and Region through 2035

Automation COE Market Insights by Organization Size, Service Type, End User Verticals, and Region through 2035

Rubber Conveyor Belt Market Analysis by Product Type, End Use, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.