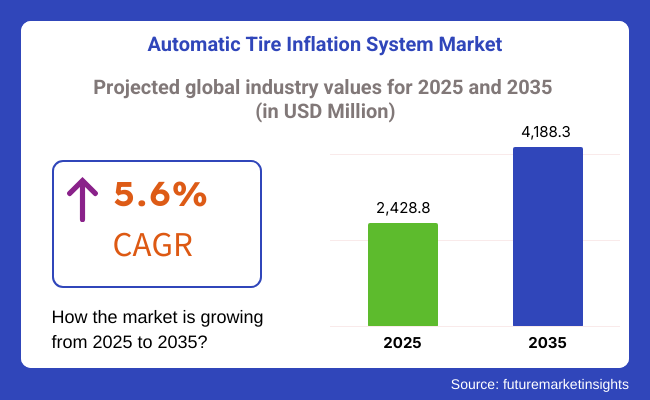

The Automatic Tire Inflation System (ATIS) market is poised for significant growth over the next decade, driven by increasing demand for fuel efficiency, extended tire lifespan, and improved vehicle safety. The market is projected to grow from USD 2,428.8 million in 2025 to USD 4,188.3 million by 2035, at a compound annual growth rate (CAGR) of 5.6% during the forecast period.

During the coming decade, the Advanced Traffic and Intelligent Systems (ATIS) market is expected to undergo stable growth, chiefly propelled by the synergy of technological progress, a higher need for automation, and the ever-evolving character of the transportation and logistics sectors.

The introduction of smart technologies such as sensors, data analytics, and vehicle-to-vehicle communication is a breakthrough in transport system management. With time, such technologies anticipated to be less expensive will bring a tremendous rise in the need for advanced traffic management and autonomous vehicle systems.

The growth of the transportation sector will be a result of the increased demand for more efficient, safer, and greener transport. ATIS will be the primary solution to the concerns faced by cities that are increasingly crowded and those that are under pressure to meet their emission reduction targets.

Systems that are automated due to the cutting-edge technology have the capability to manage the traffic better, thus reducing the congestion, enhancing safety, and better fuel efficiency.

Moreover, the logistics field is experiencing a similar scenario where the reliability on these innovations is always on the increase leading to the improvement of route planning, fleet management, and tracking, and most importantly, the increase in the demand for ATIS solutions.

The ATIS sector will see inventiveness as the centerpiece for manufacturers in the programming, which will be devoted to devising more intelligent and interconnected solutions that are capable of addressing the complicated needs of the transport network.

This is going to include cutting-edge technologies like 5G connectivity, artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT). The achievement of these innovations will not only result in smarter vehicles and infrastructure but also make it possible to do real-time decision-making in an effective way thus increasing the overall system performance.

The growth of the market will entail the major role of regulatory frameworks and standardization efforts. In the negotiations with the ATIS manufacturers, the governments and international bodies must work together in order to create an organized system of safety standards, data privacy regulations, and system interoperability that will be beneficial for all parties involved and will ensure the easy adoption of ATIS solutions.

The updates of these policies would also address the possible issues with security, privacy, and ethical aspects and thus, would gain the necessary confidence of the end users as well as the companies which would make it possible for them to use the newly introduced high-tech devices in a broader field.

The ATIS market, as a result, is flourishing with the support of technological innovations, demand from the automation sector, and the regulatory frameworks that have come together to create a perfect environment for advancement.

The steady growth that is a prognosis for the ATIS sector can be noted as a gain for manufacturers, consumers, and governments ultimately leading to a complete transformation in the system transportation and logistics in the whole planet.

Explore FMI!

Book a free demo

The highest holder of the market for Advanced Traffic and Intelligent Systems (ATIS) in North America is based on the intermingling of tough tire pressure regulations; high market demand, and a solid logistics system.

The region is relatively orientated, for example, the USA Federal Motor Carrier Safety Administration requires the use of a tire pressure monitoring system, which in turn increases the need for smart solutions. The key leaders dominating the market are the automotive and technology industries that push forward innovation and integration of ATIS systems.

Furthermore, the logistics sector expansion that has particularly taken place in the e-commerce sector has added substantially to this demand pertaining active fleet management, the real-time tracking, and automated traffic management systems. These factors combined are evidently qualifying North America as the leading area in the ATIS market.

Europe is considered to be a major Advanced Traffic and Intelligent Systems (ATIS) market, which is prompted by involvement in vehicle safety, environmental care, and the regulatory support. The region is historically proven for managing emissions and ensuring road safety improvement, for example, Germany, France, and the United Kingdom are ahead in using smart technologies for the vehicles of these sectors.

European regulatory policies that prescribe safety standards by the EU along with the green programs are the bread and butter for the services connected with the application of ATIS solutions. The automotive industry in Europe is also a pioneer of innovations, hence it is a very attractive place for the development of applications such as vehicle and traffic management.

The Asia-Pacific region is showing the fastest growth in Advanced Traffic and Intelligent Systems (ATIS), thanks to the development of cities, new roads, and increased fleet sizes. The demand for ATIS solutions is surging in countries like China and India, which are both adopting these technologies in areas like fleet management, traffic monitoring, and vehicle safety.

Government programs that focus on advancing vehicle technologies, reducing emissions, and enhancing transportation systems are some of the major reasons for the uptake of smart technologies. The outlays for smart infrastructure, initially in terms of intelligent transportation, and for the electric and autonomous vehicle markets are promoting ATIS as well as creating new opportunities in Asia-Pacific, making the region a hub for development.

Challenges

High Initial Investment Costs

Among the prohibitive problems hindering mass ATIS adoption is the high start-up investment needed for both infrastructure and technology. Using state-of-the-art facilities such as the real-time traffic management, vehicle-to-infrastructure communication, and smart sensors incur huge upfront costs.

Fleet operators, who are predominantly small and medium-sized enterprises, find it extremely challenging to incur such expenditure upfront which consequently delays the general implementation of ATIS solutions. The return of income in terms of efficacy and safety over time is unquestionable, but overcoming the initial funding issue continues to be a considerable bottleneck for the deployment in various sectors.

Integration Complexities

Besides, one of the important challenges is the difficulty of the integration of ATIS technologies with existing infrastructure and vehicles. The majority of the transportation network operators and fleet units` use the old systems, which can be the biggest hindrance to incorporating new technologies, thus, the process might be very hard and consume a lot of time.

These costs may involve the extensive retrofitting of vehicles or the considerable upgrading of infrastructure, causing the sidelining of no normal operations. Costly integration solutions are then required to streamline deployment and ensure compatibility across various systems.

Opportunities

Advancements in IoT-Enabled Monitoring

The rapid growth of IoT (Internet of Things) based applications brings to the ATIS market a great potential. These IoT connections that the vehicles will have will allow us to track with real-time data tire health, traffic flow, and also vehicle performance. This shift towards data-driven solutions is aimed to be more efficient, thus minimizing downtime and enabling predictive maintenance.

The fleet operators will get vital tips with shared tire pressure, wear, and driving conditions, the prevention of accidents will be improved, and the maintenance cost will be reduced, holes in tire risk will be eliminated and the road use will be optimized. As IoT technologies develop, the transport systems become even more intelligent, creating space for the innovation driver.

Electric and Autonomous Vehicle Adoption

The ongoing trend of integrating electric and autonomous vehicles into society offers one of the biggest opportunities for the ATIS market. With the increasing popularity of electric vehicles (EVs), the need arises for systems to optimize energy consumption, monitor battery conditions, and improve the overall vehicle performance.

Autonomous vehicles are equipped with state-of-the-art sensor technologies and work with the data-driven algorithm; thus, they provide additional channels for the connection of the ATIS solutions. All the vehicles need correlated networks of direct visibility of the environment to operate safely and efficiently, therefore, the ATIS ecosystem gets new products and services, which are high changes in the Automatic Tire Inflation System (ATIS).

The market for the Automatic Tire Inflation System (ATIS) has seen considerable growth from 2020 to 2024. The growth has been attributed to increased attention towards fuel mileage, tire longevity, and vehicle safety issues. The rising regulatory tire pressure monitoring mandates, in amalgamation with technological advancements like telematics and IoT connectivity, have activated the diffusion of ATIS onboard commercial and heavy-duty trucks.

The fleet operators have lately grasped the fact that besides the safety cars the most. adopted treatment for problems with tires pressure is repetitive repair, thus, the first-ending, pressure monitoring ATIS not only aids in preventing accidents and tire wear but also lowers fleet operating costs has actuated the market further.

In the following years, the ATIS market is projected to be subject to significant structural changes from the initial state to that of the emergent technologies including AI-based tire analytics, automated fleet management systems, and eco-sustainability innovations.

The transition to electric and autonomous vehicles will be the main determinant of the ATIS market in the future, thus spotlighting the issues of energy consumption and equipment that maintains itself.

New discoveries, industrial energy resources, and intelligent transport systems are the driving forces for the commendable performance of the ATIS sector.

The AI-inflated, ATIS will provide not only predictive but also insightful analytics for the vehicle's performance which will ensure safety and lower the risks. Also, taking on the powerful theme of sustainability, the producers are going to increase the use of recyclable materials and will innovate low-energy inflation techniques to be in line with the carbon reduction efforts across the globe.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Increased government mandates for tire pressure monitoring systems (TPMS). |

| Technological Advancements | Integration of IoT and telematics for remote tire monitoring. |

| Industry-Specific Demand | Adoption in trucking, agriculture, and military vehicles. |

| Sustainability & Circular Economy | Focus on fuel savings and tire waste reduction. |

| Market Growth Drivers | Cost savings, safety regulations, and fleet operational efficiency. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter compliance standards for smart tire technology and sustainability goals. |

| Technological Advancements | AI-driven predictive maintenance and automated tire pressure optimization. |

| Industry-Specific Demand | Expansion into electric and autonomous vehicle fleets, last-mile delivery, and off-road applications. |

| Sustainability & Circular Economy | Development of eco-friendly materials and energy-efficient inflation mechanisms. |

| Market Growth Drivers | Rising demand for automated mobility solutions, green transportation initiatives, and smart city integration. |

The USA ATIS market is flourishing, due to the implementation of rigorous safety regulations, the urgent need for rising fleet management efficiency, and more and more companies are realizing the benefits of smart tire technology.

The governmental policies that promote vehicle automation and sustainability are essential to the growth of this market. The trucking and logistics industries are the first to embrace ATIS, thus improving efficiency and decreasing tire-related failures. Technological progresses like integrating IoT into ATIS solutions, also lead to a faster implementation of these systems in various sectors. The rise in electric and autonomous vehicle adoption is also contributing to the TS market.

Also, fleet operators are making use of ATIS as it enables them to save on both maintenance costs and ensure they meet the regulations. The agricultural domain is experiencing a notable demand surge for ATIS due to their capability to enhance tire performance and productivity of heavy-duty vehicles, which have to work in extreme conditions.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.4% |

The UK government is working towards reducing carbon emissions and improving vehicle efficiency, leading to an expansion of the ATIS market. The use of ATIS in commercial fleets and public transport is the primary factor behind the increase in fuel economy and decrease in maintenance costs.

Smart mobility initiatives are also important to the ATIS development as they, in turn, support logistics and agriculture by increasing vehicle performance and minimizing downtime. Thanks to the rise in investments in autonomous and electric transportation, ATIS technology has become an integral element of vehicle health and performance improvement.

Furthermore, partnerships between the fleet operators and the tech companies are what make progress in the matter assured. The agricultural sector is not left behind as it is also turning to ATIS that guarantees the appropriate tire pressure, which consequently leads to higher market yield and less fuel consumption.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.3% |

The ATIS market in Germany is mainly propelled by the developed automobile industry, the rigid car safety measures, and the considerable emphasis on the smart mobility solutions. To date, the increasing application of ATIS in commercial trucks, military vehicles, and agricultural machinery has been the strongest encouragement for the market operations.

Strict road safety and emission regulations of the EU serve as the positives that will bring the ATIS technology to the forefront, thus, conserving fuel and cutting down on available expenses. Investments in the logistics of automation and the mobility of artificial intelligence are the main stimulants that take the lead in the ATIS installation.

The rapid development of the defense sector in Germany is accompanied by the employment of ATIS in military vehicles to increase their effectiveness and resilience in conflict areas. The country’s endeavors in environmentally-friendly transportation and the intelligent fleet management solutions are other important factors for the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 5.8% |

The constantly changing ATIS market in Japan is heavily driven by cutting-edge technologies in the fields of automation, smart transportation, and vehicle safety. The auto sector has been the most focus driver of the ATIS with ATIS installed in the electric and commercial vehicles of the future.

The vigorous government regulations governing the utilization of lightened transportation and ecofriendly mode of transport serves as a catalyst in the ATIS deployment procurement across crop cultivation and transportation. The strong concentration of Japan in the area of AI vehicular technology and self-driving solutions has also a positive impact on the autonomy fleets for ATIS.

The well-established tire manufacturing industry in the land of the rising sun is also the one that has always been applying different techniques in order to get better the ATIS performance. Also, the rising investments in zero-emission transportation and connected vehicle ecosystems lead to the expansion of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.7% |

The ATIS market in South Korea is gaining momentum largely due to the automotive industry's rapid growth, investment in self-driving vehicles, and the focus on climate-friendly transportation.

The ATIS logistics and defense sectors are also engaging in the integration of ATIS for the reason of vehicle efficiency and cost reduction. Furthermore, increasing customer knowledge regarding road security and the optimization of tire maintenance is the other major factor contributing to the growth of the market.

In addition, the strong research and development ecosystem in Korea results in innovations in the ATIS technology, and the technology is thus used in many different industries. The support of the government for the connected vehicles and smart infrastructure projects being rolled out has prompted the acceleration of ATIS deployment in the commercial fleet and public transport.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.6% |

Vehicle Concerns Drive Market Growth of Passenger Cars amid Increase of Safety

The implementation of Automatic Tire Inflation Systems (ATIS) in passenger vehicles is experiencing a considerable surge due to factors such as safety concerns, fuel-efficiency needs, and government policies.

Through the use of ATIS technology, tire pressure is automatically controlled so that the driver can avoid blowouts, and can benefit from improved vehicle handling and reduced fuel consumption. The acceptance of ATIS by car makers has led to the growing demand, especially in the case of premium and electric vehicle (EV) models.

Tire pressure monitoring is among the regulations that the European Union has in place to promote the use of ATIS, while North America is also a big player in the game, assisted by strict rules. ATIS will be the norm in smart mobility offerings, thus doing the part of technology development in overcoming the challenges of increased traffic congestion, costlier maintenance, and insecurity for machine operators.

Fleet Efficiency Demand Drives Commercial Vehicles as Major User

Commercial vehicles, however, are the primary users of ATIS being fleet efficiency, reduced downtime, and lower operational costs as driving factors. Long-haul trucks, buses, and trailers constantly need tire pressure monitoring to improve fuel efficiency and to avoid tire-related issues.

Embedded in logistics, construction, and agriculture sectors, investments made to AI-assisted vehicles and monitoring systems help companies achieve better vehicle uptime and more safety to drivers. North America holds the major market share in this sector, using such regulations as the FMCSA’s tire pressure guidelines to increase usage.

The Asia-Pacific gains momentum through the soaring e-commerce and logistics industries causing it to expand. The connection of truck automation and commercial electric vehicles leads to a situation where ATIS will be an intrinsic part of the system for optimizing fleet performance and carbon reduction.

Compressor Units are the Most Important Part of the ATIS System

Compressor units, which regulate the air pressure and maintain optimal tire inflation, are a vital part of an Automatic Tire Inflation System. These units are mainly used in commercial trucks, agricultural cars, and heavy-duty machines that require continuous adjustments of tire pressure.

Development in the technology, such as lightweight energy-efficient compressor integration with IoT-based monitoring, is improving the performance and lifespan of the compressor. The primary producers are working on the reduction of compressor sizes while increasing the air delivery rates to achieve the utmost efficiency.

The North American and European markets are thriving in demand with off-highway vehicles and military applications increasingly being adopted. The popularity of electric and hybrid vehicles will be met with an upsurge in battery-powered and low-noise compressors.

Speed Control Units Develop with AI and IoT Integration

Control units in the ATIS- tire pressure monitoring system are undergoing integration with AI, cloud connectivity, and real-time data analytics, which build up the intelligence in the system.

Apart from tire pressure, temperature, load, and etc. - the smart units are able to automatically optimize the levels of air. The Smart control units with wireless connectivity allow fleet managers and drivers to access real-time pressure data through mobile apps and vehicle dashboards.

OEMs and aftermarket providers are investing in the automated, predictive maintenance capabilities that are provided, thus eliminating the unwanted tire-related breakdowns. The Asia-Pacific region is thriving due to the presence of connected vehicle technologies and intelligent transportation systems. The intelligent control units, developed alongside, will become a powerful instrument in defining road safety and improving vehicle performance.

he ATIS market is now booming as more and more sectors of the industry are focusing on vehicle efficiency, fuel saving, and tire life. Tire pressure automatic solutions, which are the ones that keep the tires inflated with the suitable air pressure without any intervention from the driver, are replacing the manual ones in a considerable range of areas like the commercial trucking, trailers, military vehicles, and parts of agricultural equipment.

The technology not only helps to increase the vehicle performance but also helps to reduce fuel and costs as well as increase the tires' lifetime by the avoidance of under-inflation, which is a problem that many other vehicles face and that in turn increases operational costs and safety risks.

The advent of the strict regulatory framework on tire pressure monitoring along with the fleet efficiency is expected to ensure the continued growth in the market for intelligent and automated tire management systems.

The shifts mentioned earlier besides the emphasis on environmental sustainability and safety will push the ATIS market even further thereby creating more avenues for technologies and the next generation of tire management solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Dana Incorporated | 12-18% |

| SAF-Holland | 10-15% |

| Michelin | 9-13% |

| The Goodyear Tire & Rubber Company | 7-12% |

| Hendrickson USA | 5-9% |

| Other Companies | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Dana Incorporated | Offers advanced ATIS solutions integrating real-time monitoring and telematics. |

| SAF-Holland | Specializes in tire inflation systems for trailers and commercial fleets. |

| Michelin | Provides smart tire inflation systems with AI-driven analytics. |

| Goodyear Tire & Rubber | Focuses on fleet management solutions integrated with ATIS. |

| Hendrickson USA | Develops automatic inflation systems for off-road and heavy-duty applications. |

Key Company Insights

Dana Incorporated

Dana Incorporated is the forerunner in ATIS technology, providing imaginative solutions that are exclusively for the augmentation of fuel efficiency and tire performance. The company blends telematics and tire pressure monitoring to achieve a more efficient fleet management.

The ATIS products from Dana are designated to commercial vehicles, military applications, and agricultural machinery. The corporate establishment allocates financial resources to R&D for discovering better features for automation and predictive maintenance in tire inflation systems. Thanks to a global footprint and strategic partnerships, Dana keeps on its expansion phase in various markets.

SAF-Holland

SAF-Holland, being a main player in the ATIS sector, offers specialized solutions for trailers and commercial fleets. The company’s focuses vehicle safety, reducing maintenance costs, and thus improving overall operational efficiency.

The ATIS solutions from the company are appreciated for their reliability and the possibility of easily being integrated with the current fleet management systems. The company is actively expanding its product line through acquisitions and technological advancements, thus strengthening its position in the industry.

Michelin

Michelin introduced the most recent ATIS solutions, which include AI-driven analytics and IoT-based monitoring. The firm’s smart tire technology optimizes air pressure adjustments in order to enhance fuel economy and extend tire life. The ATIS solutions going to be implemented by Michelin are primarily in commercial trucking and agricultural sectors.

The company is constantly innovating and is determinant on sustainability projects, therefore, it is a leader in the area of tire management systems that are smart, environmentally friendly, and economical.

Goodyear Tire & Rubber Company

Goodyear is a strong contender in the ATIS market, providing integrated tire inflation and fleet management solutions. The firm’s advanced ATIS technology helps fleets to achieve reduced downtime, improved fuel efficiency, and enhanced safety.

Goodyear has been investing in AI-based tire analytics that prognosticate maintenance and offer real-time monitoring. These solutions have a vast acceptance in North America and Europe and are continuously penetrating the new markets.

Hendrickson USA

Hendrickson USA's specialty is in self-tire inflation systems that are for heavy-duty and off-road applications. The firm’s ATIS technology is designed to bear the brunt of extreme conditions, making it the best fit for military, mining, and construction vehicles.

Hendrickson's constant commitment to durability and innovation has supported its market presence. The company cooperates with OEMs and fleet operators in order to provide customized ATIS solutions for better vehicle performance and safety.

The global Automatic Tire Inflation System Market is projected to reach USD 2,428.8 million by the end of 2025.

The market is anticipated to grow at a CAGR of 5.6% over the assessment period.

By 2035, the Automatic Tire Inflation System Market is expected to reach USD 4,188.3 million.

The commercial vehicle segment holds the largest share in the Automatic Tire Inflation System (ATIS) market. This segment includes trucks, trailers, and buses, where tire maintenance is critical for safety, operational efficiency, and cost management.

Major companies operating in the Automatic Tire Inflation System Market include Pressure Systems International (PSI), Aperia Technologies, Meritor Inc., Haltec Corporation, Airgo Systems, Stemco, Parker Hannifin.

In terms of Vehicle Type: the industry is divided into Passenger Vehicles, Commercial Vehicles, Off-Road Vehicles, Electric Vehicles (EVs)

In terms of Technology, the industry is divided into Central Tire Inflation Systems (CTIS), Automatic Tire Pressure Monitoring Systems (TPMS), Direct Inflation Systems, Indirect Inflation Systems

In terms of Component, the industry is divided into Compressor Units, Control Units, Sensors and Valves, Pneumatic Lines and Connectors

In terms of End-Use Application, the industry is divided into Transportation and Logistics, Mining and Construction, Agriculture, Military and Defense

In terms of Sales Channel, the industry is divided into OEM (Original Equipment Manufacturer), Aftermarket

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

Automotive Load Floor Market Growth - Trends & Forecast 2025 to 2035

Automotive Glass Film Market Growth - Trends & Forecast 2025 to 2035

Automotive Sensors Market Growth - Trends & Forecast 2025 to 2035

Bicycle Components Aftermarket Growth - Trends & Forecast 2025 to 2035

Automotive TCU Market Growth - Trends & Forecast 2025 to 2035

Automotive Wires Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.