From 2025 through to 2035, the 5G system integration market will experience significant growth because many businesses from the telecom and automotive sectors, along with healthcare providers and manufacturing companies, will adopt 5G technology. System integration services have gained increased demand because organizations require unbroken connectivity and advanced data processing together with efficient 5G infrastructure implementation.

Cloud computing, edge computing operations, and IoT implementations drive market growth because business organizations need secure, scalable solutions. Multiple sectors experience a rapid need for reliable 5G integration because of the growing deployment of AI automation alongside smart grids and digital twins. The fundamental role of 5G integration providers becomes decisive for enterprise ecosystem development because they enable a seamless connection between legacy and future network systems.

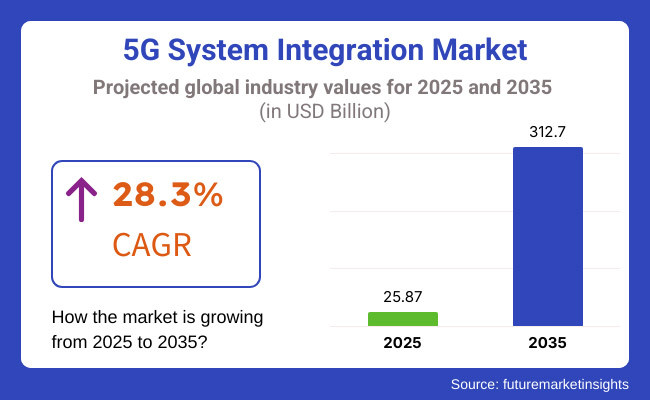

The market evaluation for 5G system integration reached USD 25.87 Billion in 2025 before expecting to reach USD 312.7 Billion by 2035 with a projected Compound Annual Growth Rate of 28.3%. A combination of government 5G deployment initiatives, investment in smart city automation and advanced network solutions, and smart city development drives this market growth.

The inclusion of AI with big data analytics and cybersecurity components within 5G networks strengthens operational security and efficiency throughout every industry sector. The market development advances due to rising demand for low-latency applications such as autonomous driving, remote surgery, and immersive gaming.

Through its improved spectrum efficiency and advanced network slicing abilities 5G system integration facilitates businesses to achieve better digital transformation results which leads to emerging business models and revenue opportunities.

Explore FMI!

Book a free demo

North America is the leading region for 5G system integration, propelled by rapid technological advancements and investments in 5G infrastructure by key players, including telecom providers and cloud service companies. High-speed connectivity is in high demand across multiple industries in the USA and Canada, especially among smart manufacturing and autonomous vehicles.

Moreover, the emergence of cybersecurity challenges and compliance policies drives the design of secure 5G integration services. As more enterprises invest in AI automation and IoT-based industrial applications, the demand for 5G system integration is growing.

On the enterprise side, the implementation of private 5G networks is also catching on, offering secure and high-performance connectivity for mission-critical applications within the walls of a business. Moreover, partnerships between telecommunications companies and technology providers will drive 5G edge computing advancements, supporting quicker data processing and enhanced service delivery.

The 5G system integration market growth in this region is mainly due to the 5G initiatives backed by the government and the implementation of advanced industrial automation. Germany, France, and the UK are leading countries in adopting 5G deployment across smart city projects and healthcare applications.

Aligned with Industry 4.0 and IoT-oriented business models, the demand for seamless integrated 5G solutions is also rising. Strict data privacy regulations such as the GDPR are also shaping market dynamics. The need for high-end 5G system integration is also solidified by emerging AI-powered healthcare systems, AR-based training programs, and smart transportation networks.

This approach includes the application of edge data centres and distributed cloud architectures, which will be instrumental for optimizing 5G connectivity across the entire ecosystem of businesses and organisations. As Europe prioritizes its own digital sovereignty and network security, strategic investments are also being made in localized 5G infrastructure, resulting in a more resilient and independent technological landscape.

Due to rapid industrialization, urbanization, and huge investment associated with telecom infrastructure, Asia-Pacific is expected to witness at the same time the best growth in the 5G system integration market. China, Japan, and South Korea have led 5G deployments, which have been propelled by national government policies and the private sector. The system integration market is rifely driven by growing demand due to the expansion of smart factories, digital healthcare, and various AI-driven applications.

Moreover, the increasing adoption of edge computing and cloud-enabled services drives regional market growth. Connected cars, smart retail, and immersive gaming experiences are rising in the region, contributing to the need for a seamless 5G experience.

Companies for improved network performance, predictive maintenance, and intelligent traffic management are leveraging AI and machine learning. As cybersecurity and data sovereignty become an increasingly important consideration for enterprises, many organizations in Asia-Pacific are investing in customized, secure, and scalable 5G system integration solutions to harness an edge over their competitors in the digital economy.

Integrated Complexity and Infrastructure Readiness

Scope of the Report The 5G System Integration Market struggles against the challenges of integrating the complex 5G technology into the existing network infrastructure. Many enterprises are having a tough time adapting legacy systems to allow the fast, low-latency capabilities of 5G networks. Moreover, interoperability issues, data security navigation risks, and high deployment costs challenge seamless integration.

To tackle these challenges, service providers need to invest in advanced network management, cloud-based integration frameworks, and enhanced security to make the transition easier toward the 5G heat.

Vertical Expansion Across Industries & Smart Use Cases

Adoption of 5G technology is likely to grow in different industries; 5G System Integration Market has huge opportunity to grow in coming years. Industries like automotive, healthcare, real-time data in logistics, and smart cities are utilizing 5G automation, real-time data sharing, and enhanced communication.

The growing of private 5G networks, edge computing, and Internet of Things (IoT) applications also help boost the demand for system integration services. The market's future growth will be driven by a handful of companies primarily focused on delivering scalable, safe, and tailor-made solutions for 5G integration.

2020 to 2024: The 5G System Integration Market matured as telecom providers and enterprises started deploying 5G infrastructure. The need for seamless connectivity, high data transfer, and intelligent automation catalyzed investment in network upgrades and cloud-based integration models.

Nonetheless, obstacles such as high deployment costs, technical complexity, and lengthy regulatory processes limited its broad adoption. This has spurred companies to create modular integration frameworks to streamline 5G development, invest in network virtualization, and implement advanced cybersecurity protocols.

In the 2025 to 2035, AI-powered network management systems will dominate, leveraging big data analytics to maximize efficiency and reduce costs, while edge computing and private 5G networks become mainstream across industries. Industry 4.0, automated cars, and smart city projects will contribute to the growth of the 5G demand, requiring smooth system integration.

Moreover, the next generation of 5G will incorporate advanced cybersecurity measures, refined energy efficiency, and improved machine-to-machine (M2M) communications. The market will also expand for 5G solutions that are flexible, scalable, and industry-specific.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with telecom regulations and initial 5G rollout approvals |

| Technological Advancements | Introduction of network slicing, edge computing, and cloud-based integration |

| Industry Adoption | Increased use of 5G in telecom, smart devices, and cloud computing |

| Supply Chain and Sourcing | Dependence on telecom equipment manufacturers and cloud service providers |

| Market Competition | The presence of traditional telecom providers and emerging 5G solution integrators |

| Market Growth Drivers | Demand for high-speed data transfer, IoT connectivity, and smart city projects |

| Sustainability and Energy Efficiency | Initial focus on optimizing 5G power consumption and reducing network downtime |

| Integration of Smart Monitoring | Limited adoption of real-time analytics and AI-based monitoring |

| Advancements in 5G Applications | Deployment of 5G in mobile networks, smart home devices, and cloud gaming |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Streamlined global 5G policies, enhanced data security regulations, and spectrum efficiency improvements. |

| Technological Advancements | Expansion of AI-driven network management, real-time analytics, and advanced automation in 5G infrastructure. |

| Industry Adoption | Expansion into autonomous systems, industrial automation, and AI-powered applications. |

| Supply Chain and Sourcing | Shift toward decentralized network models, customized enterprise solutions, and multi-cloud integration. |

| Market Competition | Growth of specialized 5G integrators, expansion of private 5G network providers, and increased cross-industry partnerships. |

| Market Growth Drivers | Increased investment in Industry 4.0, ultra-reliable low-latency communication (URLLC), and scalable enterprise networks. |

| Sustainability and Energy Efficiency | Large-scale implementation of energy-efficient 5G solutions, sustainable data centres, and carbon-neutral network infrastructure. |

| Integration of Smart Monitoring | Expansion of predictive maintenance, real-time 5G network optimization, and advanced cybersecurity frameworks. |

| Advancements in 5G Applications | Development of 5G-driven robotics, connected healthcare, remote industrial operations, and next-gen digital ecosystems. |

Rapid advancements in telecommunications infrastructure and widespread enterprise adoption are driving USA leadership in 5G system integration. Key sectors, from manufacturing to healthcare to automotive, are harnessing 5G solutions to boost operational efficiency and enable automation.

Investments in network slicing and cloud-based 5G services find upward momentum due to the need for seamless connectivity and high-speed data transfer across various industry verticals. Also, partnerships between the telecom operators and technology companies are fast-tracking the rollout of united 5G solutions among the smart cities and industrial automation projects.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 29.1% |

The UK 5G System Integration Market has witnessed growth over the last few years due to the increasing adoption of private 5G networks for better connectivity in industries. Demand for integrated 5G solutions is driven by the growing prevalence of smart factories, digital healthcare, and autonomous vehicle testing.

The growing government initiatives on supporting 5G rollouts promote network expansion, which drives the market's growth. Moreover, surge in 5G integration services market is attributed to the growing network security concern, which provides secure and scalable deployment over the network.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 27.8% |

The European Union experiences swift 5G system integration in its essential sectors, which include industrial automation transportation, and energy. The adoption of 5G technology reaches its peak in Germany, together with Italy and France, while they focus on implementing IoT-enabled programs and building new communication networks.

Regulatory backing of 5G implementation and digital transformation funding are essential factors for market expansion. The growing number of smart cities and Industry 4.0 projects require industrial 5G solutions to be implemented across multiple sectors.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 28.3% |

The Japanese 5G system integration market demonstrates rapid expansion because of its advanced infrastructure and national digital transformation initiatives supported by public authorities. 5G technology helps industry sectors such as robotics and automotive manufacturing to process data instantly to automate operations.

Market expansion in smart transportation occurs because of the adoption of 5G-integrated solutions for connected vehicles and intelligent traffic management systems. The expanding needs for edge computing and ultra-reliable low-latency communication (URLLC) strengthen the development of 5G deployment methods.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 27.5% |

South Korea leads 5G system integration because its advanced telecommunications industry benefits from government support for expanding telecommunications networks. Market growth accelerates in the Country because of its dedication to 5G-powered smart cities combined with AI technology for automation and media services advancing to the next generation.

New entertainment technology, along with gaming and virtual reality applications, gradually integrate 5G technology. The market keeps expanding because companies invest in private 5G networks, which strengthen industrial automation systems in conjunction with healthcare operations.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 28.7% |

The 5G system integration market has a dominant share from application integration and smart city & industrial sensors segments because organizations, along with municipal governments and industrial entities, need fast, high-speed, and low-latency interconnected systems to optimize their operational performance.

These 5G-enabled solutions enable automation and improve urban infrastructure and industrial monitoring functions, which make them essential for technology providers and municipal authorities logistics companies, and manufacturing organizations.

Application Integration Leads Market Demand as Businesses Adopt Seamless Connectivity Solutions

The 5G system integration market now has application integration as its main growth segment because this component enables businesses to merge 5G technology with their current systems smoothly. The integration of applications brings legacy compatibility and improved technology interoperability to smart factories while simplifying data exchange processes in smart factories along with logistics centres and digital enterprises.

The market demand for 5G-enabled software solutions using cloud automation, real-time analytics, and AI to optimize processes has acted as the main driver for adoption. Application integration services help more than 70% of businesses that use 5G ensure proper network connectivity alongside scalable deployment and decrease operational interruptions.

The market demand has increased through AI-powered application frameworks that provide automated network provisioning and adaptive bandwidth management, and predictive maintenance solutions to enhance system performance efficiency and resilience.

The adoption of hybrid cloud computing with its multi-cloud connectivity feature, along with real-time data synchronization and edge computing optimization, drives industrial digital transformation smoothly. Plant-level application integration platforms that consist of automated manufacturing and autonomous logistics systems with AI-driven traffic control have strengthened market expansion through enhanced operational agility while cutting costs.

Despite its advantages in system efficiency, automation-driven decision-making, and enhanced data transfer speeds, the application integration segment faces challenges such as compatibility issues with legacy infrastructure, integration complexities across diverse industries, and evolving compliance regulations.

However, emerging innovations in cloud-native system architectures, AI-assisted integration workflows, and real-time network orchestration platforms improve scalability, operational adaptability, and regulatory compliance, ensuring continued market growth for application integration solutions in the 5G ecosystem.

Smart Cities Leverage 5G System Integration for Intelligent Infrastructure Development

The smart city segment has experienced a major take-up of 5G system integration to help authorities urban planners, and utility providers implement fast network solutions that improve widespread city operations. 5G smart cities operate through automated public services and seamless data exchange between IoT devices and powerful interconnections that optimize traffic management and deliver better public safety and efficient energy usage.

The adoption of smart technologies has grown because of the need for immediate traffic monitoring and AI public safety solutions, as well as sustainable urban development strategies. Research shows that 5G-powered solutions form the core of more than 65% of worldwide smart city initiatives, thus supporting robust sales prospects.

Smart urban mobility systems that use AI to optimize traffic patterns and link autonomous vehicles through 5G-based surveillance networks have created a greater market need for better transportation and road safety. Artificial Intelligence systems for waste management have experienced increased adoption because they combine waste disposal real-time tracking with automated recycling stations and environmental monitoring sensors to support sustainability through urban development.

Using emergency response optimization tools with AI-enhanced law enforcement tools and remote-controlled disaster management systems through smart city public service applications drives optimal market growth toward better resource management and improved city governance.

The smart city segment benefits from better urban accessibility, improved resource utilization, and enhanced energy conservation while dealing with the problems of expensive infrastructure implementation, massive security risks, and regulatory requirements. Smart cities powered by 5G continue their global expansion thanks to edge computing improvements of smart city solutions combined with AI and block chain technologies that optimize cost-effectiveness and security, and interoperability.

Industrial Sensors Enhance Manufacturing Efficiency and Automated Process Control with 5G Integration

The industrial sensors segment achieves significant benefits from 5G system integration through which manufacturing plants industrial automation centres, and logistics hubs activate real-time monitoring capabilities and predictive analytics, and AI-enhanced process optimization.

Industrial sensors perform better with 5G networks because they take advantage of remote process automation and AI-driven industrial insights alongside ultra-low latency communication to maximize manufacturing efficiency.

The market has adopted new technologies such as real-time machine health monitoring, AI-assisted predictive maintenance, and IoT-powered workflow automation because of their high demand. Reports show that more than half of industrial automation projects integrate 5G-enabled sensor technology, supporting consistent market demand for this segment.

Artificial intelligence-powered smart manufacturing solutions, including remote-controlled industrial processes and sensor-based material flow optimization, have boosted market growth because they improve factory productivity and minimize operational interruptions.

By unifying 5G-powered quality control systems with real-time defect identification and AI-based production analytics and cloud-connected industrial sensors, the market experienced additional growth to support smart decision-making in industrial facilities.

The market experienced optimization through advanced industrial sensors with AI-calibrated features along with real-time monitoring capabilities and blockchain-supplied chain tracking, which enhanced compliance with global quality and safety standards.

The industrial sensors segment benefits production efficiency and minimizes downtime and automates workflow management, yet encounters difficulties because of high deployment expenses and complex network requirements and privacy restrictions within automated production settings.

Technological advancements in AI for IoT analytics, 5G-connected robotics, and blockchain-based predictive maintenance solutions improve cost-effectiveness and industrial security, along with operational transparency, which guarantees future growth opportunities for industrial sensors in the 5G ecosystem.

Industry Overview

The market for 5G system integration is rapidly advancing because industries need smooth connectivity, and there is a growing number of 5G network deployments. Enterprise organizations implement 5G integration solutions because these solutions help them enhance network performance and connect IoT devices and operate cloud-based programs.

The market experiences growth due to the combination of escalating needs for fast data processing edge computing and smart city implementation. The market leaders dedicate their efforts to developing software-defined networking (SDN) alongside virtualization and AI automation solutions to enhance security and performance in 5G network systems.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Accenture | 15-20% |

| Cisco Systems | 12-16% |

| Ericsson | 10-14% |

| Huawei Technologies | 8-12% |

| Nokia Corporation | 6-10% |

| Other Companies & Regional Players (Combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Accenture | Specializes in end-to-end 5G system integration, enterprise networking solutions, and cloud infrastructure optimization. |

| Cisco Systems | Offers SDN-based 5G integration, network security, and automation solutions for seamless connectivity. |

| Ericsson | Provides turnkey 5G integration solutions, radio access network (RAN) integration, and AI-driven network optimization. |

| Huawei Technologies | Develops cloud-native 5G system integration services with AI-powered analytics and automation. |

| Nokia Corporation | Focuses on 5G private network integration, IoT connectivity, and ultra-reliable low-latency communications (URLLC). |

Key Company Insights

Accenture (15-20%)

The 5G system integration market is led by Accenture because this company provides advanced enterprise solutions to optimize network performance and promote cloud adoption for businesses. The company maintains a strategic advantage through its specialized knowledge in AI-powered automation along with network-based artificial intelligence.

Cisco Systems (12-16%)

Cisco implements critical functions for 5G integration through its SDN-based solutions, security-driven approach, and network automation solutions for telecom and enterprise networks.

Ericsson (10-14%)

Ericsson establishes its position as a leading force in 5G network deployment through its complete set of 5G RAN integration solutions AI-powered optimization software and network slicing capabilities.

Huawei Technologies (8-12%)

Huawei expands its 5G system integration services through cloud-native solutions as well as AI-driven automation and its established end-to-end network capabilities.

Nokia Corporation (6-10%)

Nokia's dedication to connecting private 5G applications alongside IoT systems and ultra-fast response solutions makes the company an important participant in advanced network infrastructure development.

Other Key Players (35-45% Combined)

The 5G system integration market shows intense competition because multiple regional and specialized businesses help push innovative solutions and grow the market. Notable companies include:

The overall market size for 5G System Integration Market was USD 25.87 Billion in 2025.

The 5G System Integration Market expected to reach USD 312.7 Billion in 2035.

The demand for the 5G system integration market will grow due to increasing adoption of 5G networks, rising demand for high-speed connectivity, expanding IoT and smart city initiatives, advancements in cloud computing, and growing investments in digital transformation across industries.

The top 5 countries which drives the development of 5G System Integration Market are USA, UK, Europe Union, Japan and South Korea.

Smart City and Industrial Sensors lead market growth to command significant share over the assessment period.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.