The forthcoming decade will bring gradual growth for the 4-loop Flexible Intermediate Bulk Container (FIBC) market because industries, including agriculture, chemicals, food, and pharmaceuticals, are increasing their need for bulk packaging solutions.

The market has adopted 4-loop FIBCs because these containers provide highly efficient load-carrying ability and enhanced user convenience during handling operations. Market growth benefits from technological improvements that utilize recyclable and sustainable polypropylene.

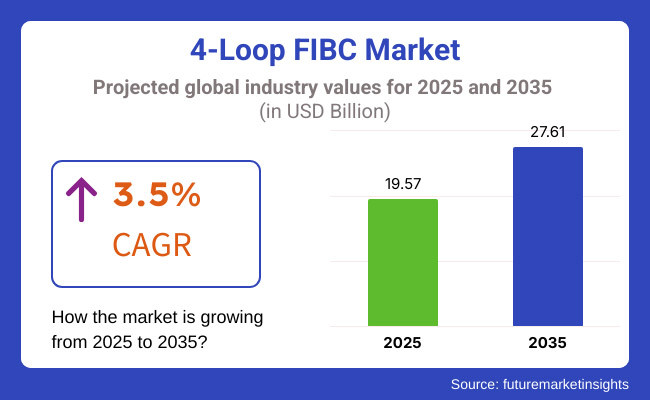

The 4-loop FIBCs market started at USD 19.57 billion in 2025 and is estimated to reach USD 27.61 billion by 2035 at a 3.5% CAGR. The market expands because of three main factors: rising global trade combined with expanding industrialization and growing requirements for effective storage and transportation solutions. Implementing 4-loop FIBCs gets additional momentum from regulations that ensure safe materials transportation for hazardous and non-hazardous goods.

Explore FMI!

Book a free demo

The 4-loop FIBC market continues to thrive in North America where the growing chemical and agricultural sectors maintain their active demand. Bulk material handling along with efficient logistics operations drive the United States and Canada to adopt FIBC solutions as their leading market adopters.

Food safety regulations changes have resulted in increased market demand for FIBCs suitable for handling food products. The increasing focus on sustainable packaging options in the region promotes technological advancement which results in the development of recyclable and biodegradable bulk bags.

The 4-loop FIBC market in Europe displays strong growth because of its active pharmaceutical industry and its food sector and chemical manufacturing activities. Germany and France together with the United Kingdom maintain high demand for hazardous materials packaging since they must follow strict regulations.

European markets are evolving because customers choose sustainable and reusable bulk containers for their operations. The 4-loop FIBC market benefits from the technological progress of automated handling and storage systems that boost system efficiency for various industries.

The 4-loop FIBC market experiences its quickest development rate in the Asia-Pacific area where China, India, and Japan function as market leaders. The market expands because of fast industrial development along with increased agricultural export activities and increased infrastructure investment.

The expanding manufacturing sector together with construction activities drives the market demand for bulk packaging solutions. The FIBC production and consumption in Asia-Pacific continues to grow because manufacturers achieve low costs of production while implementing more sustainable packaging practices.

Raw Material Price Fluctuations and Supply Chain Disruptions

The Standard FIBC Market in the Americas has been impacted heavily by the high cost of raw materials such as polypropylene, which is one of the primary drivers for production costs. Fluctuation of crude oil prices, disruption in supply chains, and political influence impacts the price of raw materials, and further higher input costs lead to lower manufacturing margins.

Transportation and logistics limitations like port congestion, increasing fuel prices and container shortages all prohibit the offer of bulk bags in a timely manner. Such issues are compounded by unexpected events including trade curbs, heat waves and labour crunches in major production centres. Manufacturers should fight back by optimizing purchasing strategies, building a strong supplier base, and tapping new raw materials sources, including bio-based polymers and recycled polypropylene.

Utilizing an advanced inventory management platform and investing in predictive analytics can enable companies to predict and avoid supply chain risks and mitigate cost increases. In addition, manufacturers will overcome market uncertainties and keep profits up and product availability high by automating production and increasing operational efficiencies.

Growth in Industrial and Agriculture Industry

An increasing demand for effective bulk packaging solutions in sectors such as chemicals, agriculture, construction and food processing have provided a significant opportunity for the 4-Loop FIBC Market. The FIBC adoption is fast-growing, as industries are trying to go for cost-effective, durable, and lightweight packaging for bulk storage and transport Furthermore, the rising focus on sustainability has further led to the need for eco-friendly packaging options, propelling the investigation into biodegradable and recyclable FIBC options.

Additionally, the introduction of a myriad of specialized features - such as UV protective coatings, moisture-resistant films, electrostatic discharge control, and increased safety options - is also testing the limits of end user demand for unambiguous product performance. With the tightening of regulations on plastic waste reduction, industries are adopting reusable and recyclable FIBC options at a greater level.

Businesses that focus on innovation, rigorous quality assurance and increased recycling efforts will be ahead of the pack. Developments in global automation and digitalization are further driving the acceptance of smart bulk bags with tracking systems, enhancing visibility within the supply chain. Manufacturers can tap into these trends to drive substantial growth and sustainability.

In the time frame from 2020 to 2024, the 4-Loop FIBC Market grew significantly driven by the rise in demand for bulk handling solutions across various sectors. The rapid growth of e-commerce, growing global trade activities and stringent safety regulations are acting as the primary driver for the adoption of high-quality, durable bulk bags.

But the market also dealt with issues such as volatile raw material costs, labour shortages, geopolitical tensions that led to supply chain disruptions, as well as increased competition from new entrants. Manufacturers responded with the introduction of high-performance FIBCs with improved load-bearing capacities, to automation of production and eco-friendly manufacturing methods.

Furthermore, an increase in the need for food-grade and pharmaceutical-compliant FIBCs also encouraged companies to improve product quality and compliance with regulation. Smart packaging solutions that include RFID-enabled tracking systems and help improve operational efficiency and safety have also gained popularity. There were barriers but the companies that focused on sustainability, tech-integration, and quality control stand strong in the market.

Innovations to watch for (2025 to 2035) in this emerging market are material innovations, smart packaging technologies, sustainability-embedded production processes, synergistic coupling of primary packaging and system solutions, and the development of hardware and bio-economy based smart packaging products and systems. Growing demand for recyclable and biodegradable FIBCs, as well as increasing regulatory pressure to limit plastic waste, are key industry trends.

Additionally, advancements like anti-microbial coatings, improved chemical resistance, and reusability will increase the attractiveness of FIBCs in different applications. NFTs, RFIDs, and AI solutions will all contribute to more efficient operating environments by improving digital tracking systems, RFID-enabled bulk bags, and reducing losses for products and streamlining inventory channels.

Moreover, rigorous environmental regulations will further catalyse the shift towards circular economy considerations, compelling a move towards closed-loop recycling systems in the FIBC manufacturing process. FIBC Market will evolve around customized bulk packaging solutions, enhanced product longevity, and adherence to global level sustainability and companies entirely services such tailored solutions will lead the race and will dictate the future of the next wave of industrial packaging in bulk.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Ensure adherence with industrial safety and material handling regulations |

| Technological Advancements | Adoption of automation in manufacturing and advanced FIBC design |

| Industry Adoption | Increased use in agriculture, chemicals, and food processing |

| Supply Chain and Sourcing | Dependence on polypropylene and traditional manufacturing hubs |

| Market Competition | Presence of traditional FIBC manufacturers and large-scale suppliers |

| Market Growth Drivers | Demand for economical, durable, and lightweight bulk packaging |

| Sustainability and Energy Efficiency | Initial focus on reusable bulk bags and eco-friendly coatings |

| Integration of Smart Monitoring | Limited use of tracking systems in bulk packaging |

| Advancements in FIBC Technology | Use of standard polypropylene bulk bags with UV and moisture resistance |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Tougher sustainability mandates, a growing recycling movement, and innovative biodegradable FIBCs. |

| Technological Advancements | Integration of RFID tracking, smart packaging solutions, and enhanced material engineering. |

| Industry Adoption | Expansion into pharmaceuticals, high-tech industries, and customized industrial applications. |

| Supply Chain and Sourcing | Shift toward bio-based materials, alternative sourcing strategies, and regional manufacturing expansion. |

| Market Competition | Rise of innovative packaging firms, customized bulk solutions, and sustainable packaging providers. |

| Market Growth Drivers | More investment in green FIBCs, smart packaging integration, and smart logistics solutions. |

| Sustainability and Energy Efficiency | Recyclable FIBCs, energy-efficient production, and closed-loop recycling systems. |

| Integration of Smart Monitoring | Expansion of digital monitoring, real-time inventory tracking, and enhanced supply chain visibility. |

| Advancements in FIBC Technology | Development of anti-static, food-grade, and biodegradable FIBCs with enhanced durability. |

Persistent demand from industries like chemicals, construction, and agriculture anticipates a steady growth of 4-Loop FIBC market in the US. Increasing bulk material handling activities along with demands for cost-effective and robust packaging solutions are driving the adoption of FIBC bags.

Growing FIBC bags demand leads manufacturers to offer fully-tailored high-strength FIBC bags to meet quality with safety regulations. Furthermore, sustainability concerns have led to companies transitioning to recyclable and biodegradable bulk bags, driving the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.8% |

The 4-Loop FIBC market itself in the UK is experiencing steady growth as industrialization rises and demand increases both in the food and pharmaceutical industries. To maintain the integrity of their products, businesses are using bulk packaging solutions that meet food-grade and pharma-grade safety standards during packaging.

Such trends include minimalistic packaging that is lightweight, flexible, and targets space economy to meet market demand. In addition, the UK government's efforts to cut down plastic waste are encouraging manufacturers to offer eco-friendly FIBC solutions compatible with the UK's sustainability goals.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.4% |

Large demand for 4-Loop FIBC in Europe also witnesses the evolution of FIBC from cloth bags to specialized bulk bags which also includes 4-Loop FIBC, as industries prefer bulk packaging to improve efficiency and cost-effectiveness. Germany, France, and Italy are major suppliers in the market owing to the high demand from agriculture, food, and chemicals sectors.

Tight environmental laws are prompting producers to prioritize reusable and biodegradable bulk bags. Furthermore, compliance with stringent safety standards is accelerating the adoption of anti-static and conductive bulk bags in hazardous material handling.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.5% |

Japan 4-Loop FIBC Market Part is an experienced researcher in the field of Market. He provides high quality reporting and focuses on strategic trends in the new Market. The demand for premium grade FIBC bags is fuelled by the need for high-quality and innovative packaging solutions.

Another factor driving the growth of the market is the automation in logistics and material handling. Moreover, the increasing interest of Japan towards sustainable development is driving the production of environmental and reusable FIBC bags.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.3% |

Market Size in South Korea’s 4-Loop FIBC market is forecast to progress at a relatively high pace, aided by rapid industrialization in the country and the increasing chemical and construction industries. Rising demand for durable and efficient bulk packaging solutions is expected to augment the adoption of FIBC bags for logistics and transportation.

Weight Efficient, High Strength FIBC bags: Manufacturers are focusing on reusable, lightweight, but sturdy FIBC bags which help in improving all types of handling operations. Furthermore, innovations in woven polypropylene technology are enhancing both the durability and load-bearing potential of bulk bags, which, in turn will boost the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.7% |

The market share for 4-Loop Flexible Intermediate Bulk Container (FIBC) dominantly belongs to the spout top & spout bottom segment alongside the chemicals & fertilizers segment because industries seek efficient bulk handling options. The use of FIBCs proves vital for optimal material transport and spill prevention and cost-efficient packaging solutions thus serving businesses across chemical plants and fertilizer manufacturers together with logistics companies and bulk storage facilities.

Spout Top & Spout Bottom Leads Market Demand as High-Efficiency Bulk Handling Solutions Expand

The spout top & spout bottom segment stands as the primary FIBC pattern for delivering seamless powder and grain material handling through its built-in spouts. High efficiency and reduced material waste make these bulk bag designs superior to other discharge configurations because they offer maximum containment during industrial operations.

Market adoption increases because industries requiring dust-free controlled discharge solutions for fine powders chemicals and food-grade products continue to increase their usage. The market demand for high-precision bulk material handlers who use FIBCs with spout configurations exceeds 60 percent according to industry studies.

The market demand has increased since manufacturers began producing customized FIBCs with anti-static properties and UV-resistant coatings while adding multiple protective linings to deliver safer transportation and longer product shelf life. Using AI-powered filling stations and sensor-based discharge monitoring along with RFID-enabled tracking in automated bulk handling systems promotes seamless industrial bulk packaging operations by boosting adoption.

The development of specialized FIBCs for industries with custom protective coatings now protects moisture-sensitive materials and hazardous substances while featuring food-grade certification for perishable goods thus driving market expansion through better brand recognition and industrial safety compliance.

The market has expanded because FIBC manufacturers now use sustainable solutions including biodegradable fabrics with recyclable polymer structures and environmentally friendly production methods that meet global environmental guidelines.

The spout top & spout bottom segment maintains benefits from precision handling and reduced operating expenses and controlled contamination yet navigates hurdles which include steep initial expenses and restricted recycling capability of standard FIBCs together with stringent product safety rules.

The bulk bag market will persist in growing worldwide because new innovations such as nanotechnology-based bulk bag coatings along with AI-powered bulk material flow monitoring and block chain-backed supply chain tracking systems improve both efficiency and safety and tracking capabilities.

Chemical Industry Expansion Boosts Market Demand for High-Safety FIBCs

4-Loop FIBCs have experienced increased usage by the chemical industry because these bulk containers enable safe chemical handling and storage and transportation of hazardous and non-hazardous substances. High-Safety FIBCs offer reinforced packaging features including protective electrostatic shielding as well as leak-proof material handling which fulfils international chemical safety standards.

The adoption has increased because companies need bulk packaging solutions that combine high strength with chemical inertness and contamination resistance while featuring conductive linings and dissipative layers and barrier-coated inner walls. Research has shown that more than half of bulk chemical producers use FIBC solutions for their production material handling operations which drives continuous market demand.

Chemical processing industries that operate large-scale facilities and pharmaceutical manufacturing and industrial solvent distribution systems support FIBC market expansion by ensuring bulk container standardization worldwide. The market adoption has increased due to smart packaging technologies integrating AI-powered spill detection and sensor-based contamination alerts as well as real-time weight monitoring systems which ensure safer industrial transportation and warehouse storage compliance.

Market development attained progress through the creation of multi-layer protective FIBCs incorporating anti-corrosive linings combined with gas-barrier coatings along with flame-retardant outer shells that produced optimized results for material shelf life extension and supply chain resilience.

The chemical segment of FIBCs has its benefits in bulk handling costs as well as industrial chemical safety compliance and transportation efficiency yet it needs to address issues related to material compatibility and regulatory requirements and specialized packaging waste disposal.

The chemical market for FIBC applications will maintain growth through advancements that combine biodegradable polymers into FIBC manufacturing with artificial intelligence automation of bulk material handling and supply chain monitoring solutions that boost compliance and sustainability.

The fertilizer market uses 4-Loop FIBCs to store and transport powdered and granular alongside crystalline fertilizers as bulk materials. The functionality of FIBCs surpasses woven sacks by offering large volume storage in weather-proof conditions with stackable transport capabilities which deliver superior efficiency to fertilizer producers and agricultural distributors and international export operations.

The market has adopted UV-stabilized and moisture-resistant bulk bags with anti-static additives and breathable woven layers and chemically resistant coatings because of increased customer demand for durable products. FIBC solutions serve as the preferred approach for 45% of fertilizer companies to distribute their goods via bulk methods thus maintaining secure market demand for this segment.

The market growth of FIBC has gained momentum through the expansion of fertilizer production plants based on ammonia, phosphate and potassium compounds which support standardized bulk packaging within worldwide agricultural supply channels.

The market adoption has increased because of bulk storage optimization technologies that implement stackable FIBC configurations combined with tamper-proof sealing techniques and pallet-compatible transport systems. Bio-based FIBC solutions with recyclable fabrics, zero-emission production, and biodegradable polymer linings have become market growth optimizers for sustainability-based fertilizer packaging advancements.

High-volume material handling, along with cost-effective agro-industrial logistics, represents a major advantage of FIBC solutions. Still, the fertilizer segment must deal with supply chain disruptions, bulk packaging disposal hurdles, and fluctuating raw material pricing.

The integration of smart packaging inventory tracking technology with AI-based moisture detection systems along with circular economy recycling initiatives boosts efficiency and affordability and sustainability, thus supporting the expansion of fertilizer-based FIBC applications.

This growth is majorly attributed to the demand for the 4-Loop Flexible Intermediate Bulk Container (FIBC) across agriculture, fluids handling, chemicals, food processing, construction, etc. Bulk bags are an economical and effective method for moving and storing bulk materials and are widely used for transportation and storage.

The all-inclusive Market is driven by the growing degree of industrialization, strict regulation of packaging, and accumulative acceptance of sustainable packaging solutions. Top organizations are incorporating sophisticated manufacturing processes, improved designs, and sustainable materials to enhance durability and marketability.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Greif Inc. | 15-20% |

| Berry Global Inc. | 12-16% |

| Context Sonoco | 10-14% |

| BAG Corp | 8-12% |

| LC Packaging International | 6-10% |

| Other Manufacturers & Regional Suppliers (Combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Greif Inc. | Manufactures high-performance FIBC bags with reinforced lifting loops and sustainable packaging solutions. |

| Berry Global Inc. | Produces lightweight, durable, and custom-designed bulk bags for various industrial applications. |

| Context Sonoco | Specializes in heavy-duty bulk packaging, moisture-resistant FIBCs, and agricultural storage solutions. |

| BAG Corp | Offers multi-use bulk bags with enhanced UV protection and compliance with industry standards. |

| LC Packaging International | Focuses on sustainable and food-grade FIBC manufacturing with global distribution. |

Key Company Insights

Greif Inc. (15-20%)

Greif Inc. leads the 4-Loop FIBC market with a strong portfolio of high-strength, customizable bulk bags designed to efficiently handle and transport industrial goods.

Berry Global Inc. (12-16%)

Berry Global Inc. focuses on innovative material technologies, offering FIBC solutions prioritizing weight reduction, cost-effectiveness, and durability in demanding environments.

Context Sonoco (10-14%)

Context Sonoco stands out with its emphasis on moisture-resistant FIBCs, catering to the agricultural and chemical industries and ensuring optimal product protection during transit and storage.

BAG Corp (8-12%)

BAG Corp is recognized for its high-quality, multi-use bulk bags, which are designed to meet industry regulations and enhance operational efficiency in sectors like food and pharmaceuticals.

LC Packaging International (6-10%)

LC Packaging International leverages its extensive distribution network to provide premium food-grade and sustainable FIBC solutions, addressing global packaging challenges.

Other Key Players (35-45% Combined)

The market is also driven by various regional manufacturers and specialized FIBC suppliers who contribute to advancements in packaging technology, cost efficiency, and sustainability. Notable players include:

The overall market size for 4-Loop FIBC Market was USD 19.57 Billion in 2025.

The 4-Loop FIBC Market expected to reach USD 27.61 Billion in 2035.

The demand for the 4-loop FIBC (Flexible Intermediate Bulk Container) market will grow due to increasing industrial and agricultural packaging needs, rising demand for cost-effective bulk handling solutions, expanding global trade, and advancements in durable and recyclable packaging materials.

The top 5 countries which drives the development of 4-Loop FIBC Market are USA, UK, Europe Union, Japan and South Korea.

Chemicals & Fertilizers lead market growth to command significant share over the assessment period.

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thermochromic Labels Market Insights - Innovations & Growth 2025 to 2035

Topical Drugs Packaging Market Growth & Forecast 2025 to 2035

Vinyl Extrusion Equipment Market Insights - Growth & Forecast 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Top Labelling Equipment Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.