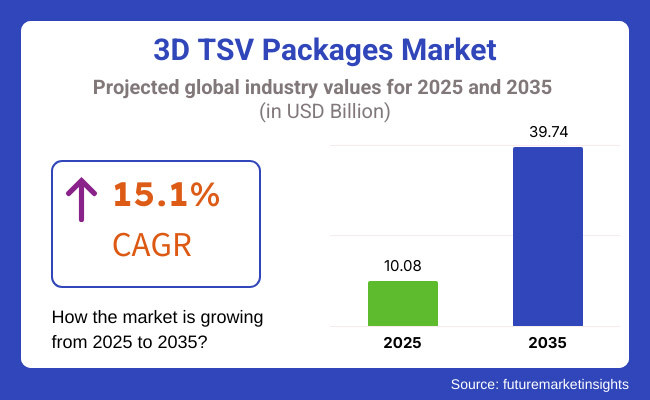

The global 3D TSV packages market is set to attain USD 10.08 billion in 2025. The industry is poised to register 15.1% CAGR from 2025 to 2035, reaching USD 39.74 billion by 2035.

The industry is expected to expand significantly between 2025 to 2035, owing to the growing demand for high-performance computing, miniaturized semiconductor devices, and advanced packaging methods. 3D TSV (Through-Silicon Via) packages are a type of advanced packaging technology that enables true 3D integrated circuits through high density, high-performance multi-die stacked packages.

TSV technology ensures direct electrical contacts via the silicon substrate, minimizing signal loss, power consumption, and latency compared to conventional 2.5D packaging, but maximum processing speed and bandwidth. 3D TSV packaging, which is being utilized in high-performance computing, artificial intelligence, data centers and smartphones, is propelling miniaturization and efficiency.

Basing on the increasing demand of smaller and faster electronics, TSV technology continues to evolve with improved performance and power efficient next-generation semiconductor applications. 3D TSV technology is visible in AI processors, high-bandwidth memory (HBM), and system-in-package (SiP), as its higher interconnect density, thermal management, and lower power consumption enable scaling.

The use of 3D TSV packages in advanced microchips and heterogeneous integration is also aided by 5G networks, IoT, and edge computing. As the demand for high-speed, low-latency computing continue to rise, companies are turning to next-generation 3D packaging technology to improve scalability and performance.

Main regions contributing to this growth are North America and Asia Pacific, driven by a rise in R&D expenditure on semiconductor manufacturing, growing requirements for high-speed memory solutions, and rising government-sponsored initiatives to increase in-house semiconductor production.

The increasing prevalence of AI, the cloud, and autonomous driving is forcing semiconductor companies to employ 3D TSV packages to allow for efficient power expenditure and next-level data processing. The miniaturization of semiconductor components is accelerating the adoption of 3D TSV in these segments, for greater HPC in a compact form factor.

The semiconductor leaders ramp up the activity in R&D and collaborate with foundries and packaging firms for manufacturing efficiency. Additionally, growing use of heterogeneous integration and new age memory technologies including HBM and NAND flash are significantly contributing to the growth of this industry.

Explore FMI!

Book a free demo

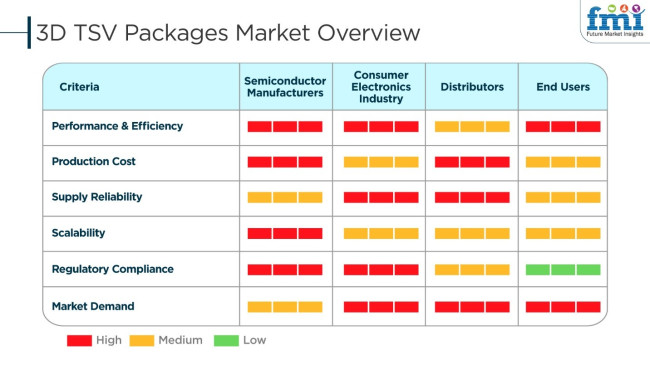

The global 3D TSV (Through-Silicon Via) packages industry is expanding due to the rising need for power-efficient, high-performance semiconductor components in consumer devices, automotive, healthcare, and artificial intelligence applications.

Semiconductor firms focus on the application of premium packaging techniques for enhancing scalability, power consumption, and miniaturization. Consumer electronics focus on performance and efficiency, vital in devices such as smartphones, gaming consoles, and wearables. Distributors aim at the reliability and cost of the supply chain, and end users insist on low-cost, high-performance electronics.

With growing use of AI, IoT, and high-speed computing, the 3D TSV industry is expected to expand at a fast pace. Major trends are heterogeneous integration, demand for high-bandwidth memory (HBM), and the transition to more energy-efficient and space-saving semiconductor solutions. Challenges like high production cost and complicated manufacturing processes are to be confronted by the industry, but continuous technology development is likely to propel wider use across multiple industries.

Contract & Deals Analysis

| Company | TSMC (Taiwan Semiconductor Manufacturing Company) |

|---|---|

| Contract/Development Details | TSMC secured a multi-year contract with a leading AI hardware company to supply advanced 3D TSV (Through-Silicon Via) packages for high-performance computing (HPC) and AI-driven processors. |

| Date | March 15, 2024 |

| Contract Value (USD Million) | Approximately USD 100 - USD 110 |

| Renewal Period | 5 years |

| Company | Samsung Electronics |

|---|---|

| Contract/Development Details | Samsung entered into an agreement with a global memory chip manufacturer to provide 3D TSV packaging technology for next-generation DRAM and NAND flash memory solutions, enhancing speed and efficiency. |

| Date | July 22, 2024 |

| Contract Value (USD Million) | Approximately USD 90 - USD 100 |

| Renewal Period | 6 years |

| Company | Intel Corporation |

|---|---|

| Contract/Development Details | Intel expanded its semiconductor packaging portfolio through a strategic partnership with a major data center operator, focusing on 3D TSV-based integration for high-speed server and networking applications. |

| Date | October 10, 2024 |

| Contract Value (USD Million) | Approximately USD 80 - USD 90 |

| Renewal Period | 5 years |

| Company | ASE Technology Holding Co., Ltd. |

|---|---|

| Contract/Development Details | ASE announced a collaboration with a top-tier consumer electronics company to develop compact and power-efficient 3D TSV packages for mobile and wearable devices. |

| Date | January 5, 2025 |

| Contract Value (USD Million) | Approximately USD 60 - USD 70 |

| Renewal Period | 4 years |

Challenges

High Fabrication Costs and Yield Management

The adoption of 3D TSV packages presents a significant challenge due to high fabrication costs and yield management issues. Semiconductor manufacturers face difficulties in justifying the expense of complex wafer stacking and interconnect technologies, especially in cost-sensitive applications.

The integration of AI-driven defect detection and advanced process control further raises concerns about production efficiency, scalability, and regulatory compliance. Additionally, ensuring thermal management and reducing electromigration effects create barriers to seamless implementation. To overcome these challenges, 3D TSV manufacturers must focus on cost-effective fabrication methods, advanced process integration, and improved wafer-level testing strategies to ensure broader adoption and industry growth.

Opportunities

AI and High-Performance Computing-Driven Innovations

AI and high-performance computing (HPC) technologies are revolutionizing the 3D TSV packages industry by enabling ultra-fast data transfer, energy-efficient computing, and multi-functional chip integration. AI-powered chip designs and heterogeneous integration approaches provide enhanced processing capabilities, reduced latency, and improved signal integrity for various industries.

3D TSV packaging enables high-bandwidth memory (HBM) solutions, critical for AI accelerators, gaming, and cloud computing applications. As industries prioritize data-intensive processing, compact form factors, and high-speed connectivity, the adoption of AI-driven 3D TSV packaging solutions will accelerate. Companies investing in AI-based chip design, advanced TSV interconnect architectures, and power-efficient semiconductor packaging will gain a competitive advantage in the rapidly evolving 3D TSV packages market.

From 2020 to 2024, the 3D TSV packages market experienced significant growth driven by rising demand for high-performance computing, AI, and advanced semiconductor applications. Manufacturers prioritized miniaturization, power efficiency, and enhanced thermal management to meet the needs of data centers, consumer electronics, and automotive sectors. Geopolitical tensions and disruptions in the supply chain made companies to design sourcing strategies. Rising R&D spending powered innovations in interposer technology and heterogeneous integration that improved package performance and functionality.

Incorporating next-generation chiplet architectures within 2025 to 2035 will make the industry transition to scalability and efficiency. Incursions of quantum computing, edge AI, and 6G networks will demand sophisticated 3D TSV solutions. Sustainability issues will catalyze innovations in materials and manufacturing processes to minimize environmental footprint. Geopolitics and government policies shall influence supply chains in the years to come; as example, localization efforts create inner strength within their domestic semiconductor ecosystems in strategic regions.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments implemented more stringent semiconductor supply chain security laws, compelling local chip manufacturing and high-end packaging advancements. | AI-powered design verification and quantum-resistant security mechanisms become commonplace for TSV-based semiconductor packaging, providing robust and secure chip architectures. |

| 3D TSV technology facilitated heterogeneous integration of RF devices, memory, and logic with improved performance at lower power consumption. | 3D-stacked, AI-directed chiplet designs control semiconductor design to offer high power efficiency, acceleration, and thermal management for workload-specific applications. |

| 3D TSV packaging enhanced memory efficiency and bandwidth in 3D NAND and HBM technologies. | Memory designs for AI-enabled workload consolidation for fast data transfer and real-time processing. |

| Ultra-low-power compact 3D TSV packaging for edge AI chips and IoT sensors has become quite in demand for real-time data processing. | Edge computing chips with AI onsite use advanced TSV stack-up to perform data processing close to real-time and to enable real-time autonomous decision-making in the IoT landscape. |

| Advancements in the TSV process and making thin wafers led to improved performance with smaller semiconductor package sizes and reduced power consumption. | AI-enabled thermal and power management solutions over TSV and ultra-low-power packages enhance the chip performance across the wearable, mobile, and AI-based edge application spectrum. |

| AI-driven EDA reduces the time needed to design and uplifts performance for the 3D TSV interconnect solution. | AI-driven self-optimizing semiconductor designs advance, dynamically modifying interconnect geometries for maximum efficiency in real-time AI and ML applications. |

| Telecom operators utilized 3D TSV technology to improve signal integrity and processing speed in high-frequency 5G networking chips. | AI-guided 6G semiconductor designs utilize 3D TSV for ultra-high-speed, low-latency communication to support terahertz spectrum and quantum networking applications. |

| The chip shortage hastened the investments in locally made chips, with more dependency on cutting-edge packaging solutions such as 3D TSV. | Automated, AI-driven chip factories mass-produce cutting-edge 3D TSV packages with decreased lead times to provide a resilient and self-contained global semiconductor supply chain. |

| Greener TSV manufacturing processes were adopted by chipmakers, reducing energy use while optimizing materials. | Artificial intelligence-based semiconductor recycling and green TSV packaging support circular economy patterns, minimizing e-waste and enhancing resource utilization in chip manufacturing. |

The key risk in the 3D Through-Silicon Via (TSV) packages sector is the high production costs and the complexity of the operation. The manufacturing process is a combination of advanced wafer thinning, precise alignment, and high-density interconnects making it a costly deal. Any inefficiencies in the process can easily exacerbate the situation and yield losses can be the result which will ultimately affect the profitability.

Supply chain problems share another critical risk. The 3D TSV industry is dependent on a consistent stream of semiconductor materials, such as silicon wafers, bonding agents, and special tools. Whether any equipment is delayed or not firmed, those shortages caused by the disputes between states regarding the material, the lack of Logistics, or the problems with transportation can easily incapacitate production and hence product releases.

In addition to this, the technical problems and reliability worries are also things, which must be taken under consideration. Although 3D TSV packaging is the answer to high performance and miniaturization, problems like inadequate cooling systems, failure due to stress, and migration of electrons can lower the reliability factor for long time.

It is, therefore, compulsory for the companies to allocate resources for research and development in the proper direction by choosing the right materials and to innovate design practices so that the effects of these problems can be decreased.

In addition to that, the regulatory compliance and intellectual property (IP) boundaries create additional difficulties. The semiconductor industry is under significant scrutiny, and non-compliance with international safety, environmental, and trade regulations can lead to legal issues and financial penalties. Also, patent rights and licensing difficulties, as a result, become potentially the reasons why innovations are not being implemented, which, in turn, leads to the bad consequences for industry expansion.

Leading semiconductor firms like TSMC, Samsung, and Intel use via-first TSVs in AI accelerators, GPUs, and high-performance computing (HPC) applications. For instance, Samsung HBM2 and HBM3 memory stack, widely adopted in AI and data center applications, are based on this TSV technology to provide ultra-high bandwidth and less power consumption. It is an ideal candidate for 3D/2.5D integration due to its scalability, better wafer thinning, and heterogeneous integration compatibility.

This process creates TSVs after front-end-of-line (FEOL) processing while still before back-end-of-line (BEOL) metallization, which is ideally suited for 5G devices, automotive electronics, and MEMS sensors.

The logic & memory devices segment is growing due to the demand for high-bandwidth memory (HBM), DRAM, and NAND flash storage .TSV technology dramatically speeds up data transfers - both in terms of greater width and speed as well as less power and increased density for memory chips overall - directly enhancing the efficiency of AI accelerators, data centers and gaming GPUs.

Samsung, SK Hynix, and Micron Technology are among the top TSV-based HBM solution providers. SK Hynix's HBM3 memory is another example of their ultra-high bandwidth memory for NVIDIA and AMD AI processors, contributing to improving computational capabilities in AI workloads.

3D TSV packages are utilized extensively in consumer products, specifically smartphones, tablets, and wearables. The small form factor and high-functionality nature of these devices mean they need small, high-performance solutions. Higher integration density is facilitated by 3D TSV technology, enabling more devices to be accommodated in reduced space.

This translates to increased performance, less power consumption, and better utilization of space. As customers require quicker, more powerful devices with greater battery life, 3D TSV packages meet these needs for speed and miniaturization.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 9.0% |

| China | 9.6% |

| Germany | 8.3% |

| Japan | 8.5% |

| India | 9.8% |

| Australia | 7.9% |

FMI states that the USA 3D TSV package market is slated to grow with a projected CAGR of 9.0% over 2025 to 2035. It is driven by increasing demand for high-end semiconductor packaging, high-performance computing, and increased investment in AI and data centers.

The USA semiconductor industry uses 3D TSV technology to drive chip performance, power, and miniaturization. Government and corporate investments in semiconductor R&D in 2024 surpassed USD 15 billion, further solidifying the market's technology leadership.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| AI and High-Performance Computing Growth | High-density TSV packages are needed in AI, cloud computing, and data centers. |

| Semiconductor Packaging Advances | Next-generation chip designs demand higher interconnect density and better thermal management. |

| Emerging Uses in Consumer Electronics & Automotive | TSV technology is increasingly used in smartphones, gaming consoles, and self-driving cars. |

Germany's 3D TSV package market is gaining momentum, with a projected CAGR of 8.3% during 2025 to 2035, cites FMI. The robust automotive and industrial semiconductor industry and the rising adoption of AI-based automation in the nation are major growth drivers.

Germany invests in TSV-based semiconductor solutions for industrial automation, telecommunications, and automotive electronics. The country's environmental sustainability also drove energy-saving semiconductor packaging solutions.

Growth Drivers in Germany

| Primary Drivers | Description |

|---|---|

| Solid Automotive Industry Integration | German automobile firms employ TSV-stacked chips in ADAS and EV markets. |

| Industrial Automation Demand Bounce | A growing demand for automation and IoT sensor applications where TSV packages provide enhanced performance. |

| Power-Efficient Chip Packaging Breakthroughs | Low-power TSV developments are revolutionizing semiconductors to be performance-driven. |

FMI is of the opinion that Japan's 3D TSV packages market will register a CAGR of 8.5% during 2025 to 2035 due to semiconductor miniaturization, memory technology innovation, and 5G communications advancement.

Japan is a world leader in semiconductor technology for high-speed data transfer, power efficiency, and ultra-dense chip implementation. The country's equipment and material ability in semiconductors facilitates the quick adoption of TSV.

Growth Drivers in Japan

| Drivers | Description |

|---|---|

| TSV Integration in Advanced Memory Solutions | Japan dominates high-performance DRAM and 3D NAND production. |

| 5G & Telecommunications Expansion | High-bandwidth networking solution demand propels TSV adoption. |

| Semiconductor Packaging Material Achievements | TSVs are boosted by high-thermal conductivity material usage. |

China's 3D TSV package market is slated to register CAGR of 9.6% during 2025 to 2035, states FMI. The country's high-speed industrial automation and increasing investments in local semiconductor manufacturing increase the demand for high-performance packaging solutions. Government-sponsored programs are throttling back China's dependence on foreign chip manufacturers, and smart city programs are spurring TSV-integrated chip market growth.

Growth Drivers in China

| Critical Drivers | Description |

|---|---|

| Government Support for Chip Self-Reliance | Government programs for domestic chip manufacturing spur the application of TSV. |

| Industry Growth of Consumer Electronics & AI | TSV-assisted processor manufacturing for premium applications soar. |

| Innovations in Memory & 3D NAND Technology | China is dominating the high-density memory solutions on TSV interconnects. |

FMI states that the Indian 3D TSV package market is poised to experience 9.8% CAGR from 2025 to 2035. It is driven by enhanced semiconductor investment, electronics manufacturing base expansion, and high-performance computing use demands. The 'Make in India' initiative and higher investments in the manufacture of semiconductors have generated massive demand for low-cost, low-power packaging solutions. Higher growth in AI chips and high-speed memory solutions are also driving further applications of TSV.

Growth Drivers in India

| Key Drivers | Details |

|---|---|

| Government Initiatives Toward Chip Production | Local chip manufacturing initiatives drive demand for TSV. |

| Data Center and AI Infrastructure Growth | Cloud computing enabled by artificial intelligence drives the adoption of TSV. |

| High-Performance Computing and Mobile Devices Growth | Expansion in demand for memory and processors based on TSV drives the industry. |

The industry is very competitive and the key players include TSMC, Intel, Samsung Electronics, ASE Technology Holding, and Amkor Technology, which are growing owing to advanced integration of TSV technology, materials innovation, and AI-oriented design optimization. New entrants, niche suppliers, and up-and-comers continue to find their way into the industry and concentrate specifically on TSV architectures and customizable packaging solutions.

The competitive landscape continues to be influenced by R&D investments, strategic collaboration, and innovation in wafer-level manufacturing. Meanwhile, hybrid bonding, heterogeneous integration, and chipset-based designs are being leveraged to improve capabilities and efficiencies. As AI, 5G, and IoT applications push semiconductors to evolve, firms embracing high-density interconnects, resilient supply chains, and scalable processes will remain well-positioned in this rapidly shifting marketplace.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| TSMC | 20-25% |

| Intel Corporation | 15-20% |

| Samsung Electronics | 10-15% |

| ASE Group | 8-12% |

| Amkor Technology | 5-10% |

| JCET Group | 4-8% |

| Other Companies (combined) | 30-38% |

| Company Name | Key Offerings/Activities |

|---|---|

| TSMC | Advanced 3D IC packaging, high-density TSV solutions, and AI-driven semiconductor integration. |

| Intel Corporation | High-performance 3D TSV technology for AI, data centers, and next-gen computing applications. |

| Samsung Electronics | TSV-based high-bandwidth memory (HBM) and advanced semiconductor packaging solutions. |

| ASE Group | Innovative 3D packaging solutions for mobile devices, HPC, and IoT applications. |

| Amkor Technology | Cost-effective TSV packaging solutions for consumer electronics and automotive applications. |

| JCET Group | Advanced wafer-level 3D integration and heterogeneous packaging solutions. |

Key Company Insights

Silicon Foundry (20-25%)

TSMC is ruling the industry of 3D TSV packages through its state-of-the-art semiconductor packaging technologies. The company's focus on using highly integrated VLSI chips, AI optimization, and advanced 3D IC packaging keeps it in its leadership position.

Intel Corporation (15-20%)

Intel stands tall as one of the major players in this arena, which works with 3D TSV solutions in high-performance systems for AI, data centers, and 5G or next-generation computing. Industry presence is further enhanced due to the focus on hybrid bonding and TSV architectures.

Samsung Electronics (10-15%)

Samsung manufactures high-bandwidth memory (HBM) using TSV technology solutions for its concentration in industry fragmentation of various applications in AI, Gaming, and HPC. Its major advancements in semiconductor packaging assure its ranking in the lead.

ASE Group (8-12%)

ASE Group is recognized for it is a brand in 3D packaging solutions for mobile, HPC, and IoT devices. The company continues innovation in technologies for high-speed interconnects and TSV-based semiconductor integration.

Amkor Technology (5-10%)

Cost-effective TSV packaging solutions designed by Amkor can be used in consumer electronics as well as by the automotive industry. The company's other focus is on improving the thermal performance of its products and on trying to bring down power consumption rates with 3D ICs.

JCET Group (4-8%)

JCET deals with wafer-level 3D integration and heterogeneous packaging solutions. The company is investing in TSV-based packaging technologies to enhance semiconductor performance and reliability.

Other Key Players (30-38% Combined)

The industry is slated to reach USD 10.08 billion in 2025.

The industry is predicted to reach USD 39.74 billion by 2035.

Key companies include TSMC, Intel Corporation, Samsung Electronics, ASE Group, Amkor Technology, JCET Group, UMC, Powertech Technology Inc., SPIL (Siliconware Precision Industries Co.), and Micron Technology.

India, slated to grow at 9.8% CAGR during the forecast period, is poised for the fastest growth.

Consumer electronics is the key end user.

By process realization, the industry is classified into via first, via middle, and via last segments.

By application, the industry is divided into logic & memory devices, MEMS & sensors, and power & analog components.

The industry caters to multiple industries, including consumer electronics, information & communication technologies, automotive, military & defense, aerospace, and medical sectors.

The industry spans key global regions, including North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.