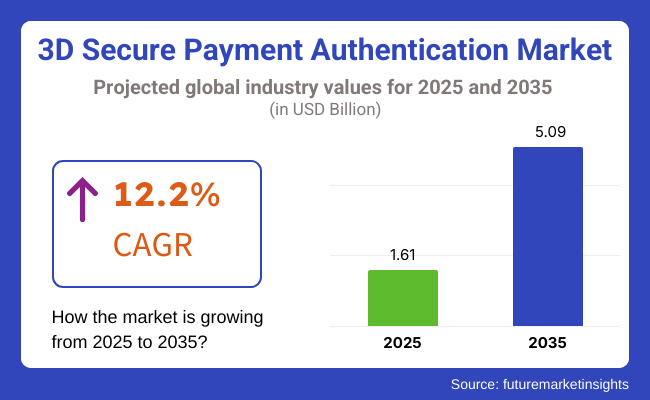

The 3D Secure (3DS) payment authentication business is projected to witness robust growth, driven by increasing online transactions and rising security concerns. According to 3D market authentication estimates, the market is expected to surpass USD 5.09 Billion in valuation by 2035.

The surge in e-commerce sales, which surpassed trillions of dollars globally, along with the rapid rise in mobile payments, is accelerating the demand for secure digital payment solutions. Additionally, the increasing adoption of 3D Secure 2.0, which offers frictionless authentication and enhances user experience, is contributing to business expansion.

The adoption of AI-driven authentication, risk-based verification, and biometric security enhancements is further fueling market growth. E-commerce expansion, driven by smartphone penetration and wider internet access, has further boosted the need for secure payment methods.

Despite occasional transaction blocks, 3D Secure authentication has proven effective in reducing fraud, gaining acceptance across industries such as retail, banking, and hospitality. Moreover, increasing usage of consumer electronics, ATMs, and POS devices is contributing to the growing.

Explore FMI!

Book a free demo

The period between 2019 and 2024 was a period of tremendous improvement for the 3D Secure Payment Authentication market. The increasing trend of e-commerce and mobile commerce demanded more accessible online payment mechanisms but with better security features. This phase introduced 3D Secure 2.0, which enhanced consumer convenience along with better security. Financial institutions and merchants hand in hand worked on implementing these solutions, which had the main aim of minimizing fraud levels and improving transaction speed.

Looking ahead to 2025 to 2035, the economy is looking to evolve. The advancement of digital wallets and cross-border transactions is expected to proliferate demand for the most sophisticated authentication techniques. Biometric authentication and real-time monitoring of transactions are going to be very basic at this point in time; therefore, these will soon become normative, thereby increasing both security and user convenience. Cybersecurity continues to be an ever-relevant concern, prompting the development of robust solutions against newer threats.

| Key Drivers | Key Restraints |

|---|---|

| Rise in e-commerce and mobile commerce demanding secure online transactions. | Implementation and maintenance costs of 3D Secure Payment Authentication solutions |

| Rise in online fraud and cybersecurity threats promoting the adoption of 3D Secure Authentication | Potential user friction due to additional authentication steps causing transaction abandonment |

| Regulatory requirements such as PSD2 pushing for stronger customer authentication | Integration challenges with existing payment infrastructure for smaller businesses |

| Advancements in technology such as the embedding of AI and machine learning to improve fraud detection and authentication techniques | Privacy concerns in relation to the collection and storage of biometric and personal information |

| Digital wallet and mobile payment systems become more popular | Some industry segments are unaware of the idea of 3D Secure. Analyze the influence of all drivers. |

Impact of Key Drivers

| Key Drivers | Impact |

|---|---|

| Rise in e-commerce and mobile commerce driving demand for secure online transactions | High |

| The rise in online fraud and cybersecurity threats boosts the adoption of 3D Secure Authentication | High |

| Regulatory mandates like PSD2 that are demanding stronger customer authentication | High |

| Technological advances like AI and machine learning are enhancing fraud detection and authentication techniques. | Medium |

| Widespread adoption of digital wallets and mobile payment systems | Medium |

Impact of Key Restraints

| Key Restraints | Impact |

|---|---|

| Implementation and maintenance costs of 3D Secure Payment Authentication solutions | Medium |

| Potential user friction due to additional authentication steps causing transaction abandonment | High |

| Integration challenges with existing payment infrastructure for smaller businesses | Medium |

| Privacy concerns related to the collection and storage of biometric and personal data | Medium |

| Lack of awareness and understanding about 3D Secure among some segments | Low |

The business is globally segmented based on component, which covers the major features for making 3D secure payment authentication in Global industry segmentation. The Access Control Server (ACS) serves a fundamental function in authenticating cardholders in an online transaction. As payment networks and financial institutions implement and enhance fraud prevention, the demand will significantly increase (in terms of revenue) between the years 2025 and 2035.

Risk-based authentication is being improved by innovations in artificial intelligence and machine learning, providing secure solutions while maintaining the user experience. Additionally, it has the Merchant Plug-in (MPI), which also helps merchants to communicate with the card issuer in response to requests for authentication.

In order to solve fraud, merchants are using the secure transaction solutions that are now on the e-commerce keeps expanding and digital payments replace more conventional approaches. The economy for MPI solutions is thought to continue expanding as businesses enhance their cybersecurity and obey regulatory frameworks like PSD2.

The application's 3D secure authentication also identified banks, retailers, and payment gateways among the expanding customers. Banks have been at the forefront of implementing 3D Secure technologies to deter fraudsters. Banks are also using biometric authentication and AI-based risk assessment techniques to reduce cyber risk while minimizing interference to authorized users.

The period from 2025 to 2035 is expected to see a widespread adoption of new authentication technologies in banking systems worldwide. Merchants and payment gateways play crucial roles in securing online transactions by integrating 3D Secure mechanisms. As reliance on digital commerce increases, merchants are concentrating on creating seamless and secure checkout processes to lower cart abandonment rates.

In order to guarantee secure transactions, though, payment gateways-organizations that are responsible for flagging transactions and processing payments digitally-are investing in real-time fraud detection and adaptive authentication models that offer safety without sacrificing user experiences. With the evolution of payment technology, it is projected that merchants and payment service providers will gradually embrace 3D Secure authentication for their transactions throughout the next ten years.

3D secure payment authentication is witnessing tremendous growth, primarily because of the increase in online shopping and the consequent requirement for secure transactions. Major payment processors are upgrading their 3D Secure protocols for a better experience for users and to prevent fraud.

The newest version, 3D Secure 2.0, includes frictionless authentication and support for mobile transactions. In response to consumer demands for greater security and regulatory pressures, merchants are implementing these advanced authentication techniques. This reduces cart abandonment rates during online transactions while guaranteeing compliance.

As e-commerce increases, the demand for 3D Secure Payment Authentication in Canada also grows. Canadian financial institutions and retailers are increasingly adopting 3D Secure protocols in order to enhance the security of transactions and reduce fraud.

It focuses on the perfect balance between user convenience and security measures through frictionless authentication techniques that help maintain a seamless shopping experience. Increased business growth is expected due to growing consumer awareness of the need for robust authentication solutions with consumers becoming more conscious of online security.

Due to tighter regulations and a growing e-commerce industry, France is also seeing notable advancements in the 3D Secure Payment Authentication insights. PSD2, which has mandated strong customer authentication, has brought more merchants and banks into the fold of using 3D Secure solutions.

Local players are collaborating with international payment networks to develop enhanced authentication frameworks that would include biometric options and real-time transaction analysis. This will not only ensure better security but also strive for better user experience, which would decrease fraud and increase consumer confidence in online transactions.

France is witnessing significant advancements in the 3D Secure Payment Authentication, driven by the growing e-commerce sector and stringent regulatory requirements. PSD2 has enforced strong customer authentication, thereby increasing the usage of 3D Secure solutions among merchants and banks.

Local vendors, in conjunction with international payment networks, are creating more sophisticated authentication platforms that include biometric features and real-time transaction monitoring. This alone is changing the security paradigm while also focusing on improving user experience, which further reduces fraud and increases consumer confidence in online transactions.

Germany's 3D Secure Payment Authentication industry is growing as the e-commerce industry is expanding and the regulatory requirements are becoming stringent. The implementation of PSD2 has strictly made use of strong customer authentication, hence higher adoption rates in 3D Secure among both merchants and banks. The domestic providers collaborate with global payment networks to enhance these authentication frameworks using biometric options and real-time transaction analysis. This enhances not only security but also attempts at bettering user experience in efforts to curb fraud and raise confidence among consumers toward online transactions.

South Korea's is advancing at a rapid pace as e-commerce and mobile payments expand. Financial institutions and merchants adopt 3D Secure protocols for improving the security of transactions and reducing fraud risks. Focus lies in incorporating biometric verification, risk-based analysis, and advanced authentication methods that can offer seamless security. As consumers increasingly prefer online shopping, the demand for robust payment authentication solutions is expected to drive market expansion.

Japan's 3D Secure Payment Authentication market is evolving with a focus on enhancing security measures amidst growing concerns over cyber threats. Major payment processors are adopting 3D Secure 2.0 protocols to streamline the authentication process while minimizing friction for users. Biometric authentication and machine learning are being leveraged to make fraud detection capabilities stronger.

Furthermore, Japanese consumers are demanding online payment options that are secure. In response, merchants are investing in advanced 3D Secure solutions. Moreover, banks and fintech companies are collaborating with each other to make digital transactions stronger.

The 3D Secure Payment Authentication growth in China is growing at a rapid pace, mainly because of the rapid growth of e-commerce and mobile payments. Companies like Alipay and WeChat Pay are now integrating advanced 3D Secure authentication features to combat fraud effectively.

The focus is on seamless and secure transaction experiences, and technologies such as facial recognition and behavior analytics are being used. The government is further pushing for cybersecurity measures that include payment authentication standards, which further boost the adoption of 3D Secure solutions across various platforms and enhance the protection of the customer.

The momentum building up in the 3D Secure Payment Authentication insights can be seen in India as digital transactions continue to grow. Online shopping, leading to increased adoption of digital wallets, has raised the importance of secure solutions for payments. Payment gateways are improving their 3D Secure solutions by incorporating biometric authentication and risk-based analysis to prevent fraud while ensuring user convenience.

The Reserve Bank of India's directive to have two-factor authentication for online payments has further hastened the adoption of 3D Secure technologies, making them a necessity for financial institutions and e-commerce platforms.

Industry leaders in 3D Secure Payment Authentication will focus on the integration of advanced technologies to enhance security and user experience. Companies will use AI and ML to increase fraud detection. These technologies are able to look at large volumes of data in real-time to identify patterns and adapt to new threats, making it possible to take proactive action against fraudulent transactions. This makes the security system stronger while keeping the transaction smooth for the users.

Emerging startups are focusing on developing innovative solutions that maintain both security and convenience simultaneously. One of the most noted trends is the use of advanced biometric authentication methods, like fingerprint scans, facial recognition, and voice patterns.

These prove to be personalized and highly secure ways of identifying the individual, reducing dependence on traditional password-based methods. By using biometric authentication, the startups seek to thereby harmonize the payment process and offer customers fast, secure validation processes for overall satisfaction.

Established players and new entrants alike are coming to realize the requirement to have exciting security features that are complemented by ease of use. The solution, with the deployment of AI, ML, and biometric technology, reflects a commitment to staying ahead of cyber threats while never losing focus on the user experience. This is essential in building trust as the digital payment landscape continues to evolve.

Rising online fraud, regulatory mandates, and increasing e-commerce transactions are pushing businesses to adopt stronger authentication measures.

It adds an extra layer of authentication, verifying the cardholder's identity before approving transactions, reducing unauthorized payments and fraud.

The integration complexities, potential transaction friction, and the balancing of security with a smooth user experience are issues that some businesses face.

AI, biometrics, and risk-based authentication make the process more seamless while enhancing fraud detection and prevention.

The market is segmented into Access Control Server (ACS), Merchant Plug-in (MPI), Fraud Detection & Risk Management Solutions

The segment includes Banks & Financial Institutions, Merchants & E-commerce Platforms, Payment Gateways & Processors, Digital Wallet Providers, and others.

One time password authentication, biometric authentication, risk-based authentication, and token-based authentication.

The market is analyzed across North America, Europe, Asia Pacific, Latin America, The Middle East & Africa, and others.

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Residential VoIP Services Market Insights – Trends & Forecast 2025 to 2035

Switching Mode Power Supply Market - Growth & Forecast 2025 to 2035

Safety Mirrors Market - Growth & Forecast 2025 to 2035

Heat Interface Unit Market Analysis - Size, Demand & Forecast 2025 to 2035

Induction Motors Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.