The 3D reconstruction technology market is valued at USD 1426.16 million in 2025. As per FMI's analysis, the market will grow at a CAGR of 7% and reach USD 2805.47 million by 2035.

The 3D reconstruction technology industry worldwide was driven by various sectors, including construction, healthcare, and cultural preservation. Demand increased as many organizations incorporated AI-based 3D modelling for city planning and forensics, according to analysis by FMI.

On the other hand, the rise in digital attempts against the backdrop of a government priority onheritage preservation has been concomitantly increasing the resource input towards such projects. However, in substance, supply chain repercussions had limited hardware availability, i.e., for LiDAR and photogrammetry purposes. Software manufactures, on the other hand, competed with those increasing automation of their tools and minimizing the need for manual processing.

FMI opines that in 2025, the sector is poised for accelerated growth, fueled by advancements in real-time 3D rendering and increased accessibility of cloud-based reconstruction platforms. Infrastructure projects are poised for a rebound, giving way to a renewed demand for 3D modeling tools within the construction sectors.

Another major factor in fast-tracking AR growth will be the contribution of gaming as well as entertainment applications, which broaden the horizon for immersive experiences powering quick adoption.

The long-term outlook is set to shine brighter, as such unique applications for AR/VR, robotics, and smart city planning come to the fray. As industries are now showing interest in spatial imaging solutions that are more efficient and accurate, investment into R&D is set to ramp up.

This will act as a second layer of automation, driving down costs and allowing more real-world applications to materialize, thus creating a push for digital transformation in the industry.

Key Metrics

| Metric | Value |

|---|---|

| Estimated Global Size in 2025 | USD 1426.16 Million |

| Projected Global Size in 2035 | USD 2805.47 Million |

| CAGR (2025 to 2035) | 7% |

Explore FMI!

Book a free demo

(Survey Conducted in Q4 2024, n=500 stakeholder participants evenly distributed across software developers, hardware manufacturers, cloud service providers, and end users in the USA, Western Europe, China, Japan, and South Korea)

Regional Variance:

High Variance:

Convergent and Divergent Perspectives on ROI:

Consensus:

Regional Variance:

Shared Challenges:

Regional Differences:

Software Developers:

Hardware Manufacturers:

Cloud Service Providers:

Alignment:

Divergence:

High Consensus:

AI-driven automation, cloud-based modeling, and cost pressures are common concerns worldwide.

Key Variances:

Strategic Insight:

A standardized approach will not work. Companies must adapt solutions regionally-AI and automation in the USA, sustainable processing in Europe, AI-led smart city modeling in China, and compact, high-precision solutions in Japan and South Korea.

For a deep dive into stakeholder priorities and customized strategic recommendations, contact FMI today and gain an edge in the evolving industry.

| Country | Policies, Regulations & Mandatory Certifications |

|---|---|

| United States | Government-funded infrastructure programs are accelerating the adoption of 3D reconstruction for urban planning. The National Institute of Standards and Technology (NIST) provides guidelines for digital twin applications. Strict FCC regulations govern LiDAR-based data collection, particularly for mapping and surveillance applications. |

| United Kingdom | The National Digital Twin Programme mandates standardized 3D data integration for public infrastructure projects. GDPR compliance is required for cloud-based 3D modeling to ensure data privacy. Construction projects must adhere to Building Information Modeling (BIM) Level 2 regulations, requiring high-precision 3D models for public-sector developments. |

| France | The BIM 2022 Mandate requires all public construction projects to use 3D modeling for efficiency and sustainability. CNIL (Commission Nationale de l'Informatique et des Libertés) enforces strict data privacy laws, impacting cloud-based 3D reconstruction platforms. LiDAR use in public spaces requires approval from the Ministry of Ecological Transition due to environmental concerns. |

| Germany | The EU Digital Twin Strategy influences 3D reconstruction for smart cities and industrial automation. DIN EN ISO 19650 compliance is required for 3D modeling in large-scale projects. The Federal Cartography and Geodesy Agency regulates photogrammetry-based mapping for urban planning and infrastructure. |

| Italy | The National Recovery and Resilience Plan (NRRP) encourages 3D reconstruction for heritage preservation and construction. UNI 11337-2017 certification is mandatory for digital modeling in public infrastructure. General Data Protection Regulation (GDPR) applies to cloud-based 3D applications. |

| South Korea | The Smart City Act mandates AI-driven 3D reconstruction for urban development. Korean Spatial Information Quality Certification (K-SQC) is required for geospatial and mapping-based 3D modeling. Government incentives are offered for 3D reconstruction in robotics and industrial automation. |

| Japan | The Digital Transformation Act promotes AI and 3D modeling in infrastructure projects. Japan BIM Standards (J-BIM) require standardized adoption of digital twins in construction. The Ministry of Land, Infrastructure, Transport, and Tourism (MLIT) regulates LiDAR and photogrammetry applications for public projects. |

| China | The National AI Development Plan prioritizes 3D reconstruction for smart cities and defense applications. The Cybersecurity Law of China imposes strict data localization requirements on cloud-based 3D services. Companies must obtain Surveying and Mapping Qualification Certificates to conduct large-scale geospatial 3D modeling. |

| Australia & New Zealand | The BIM Acceleration Committee enforces 3D modeling standards in public construction. New Zealand Geospatial Strategy regulates photogrammetry-based mapping. Privacy Act 2020 governs cloud-based 3D data storage and processing. |

The 3D reconstruction technology industry is set for robust growth, supported by the evolution of AI-based modeling, higher immersion in development and heritage protection and its applications in AR/VR and smart city projects.

Users of automation and cloud-based 3D reconstruction tools will be the beneficiaries, while the manual modeling method will be rendered unnecessary. High-precision 3D reconstruction services will only rise in demand as businesses place a value on effectiveness and digitalization.

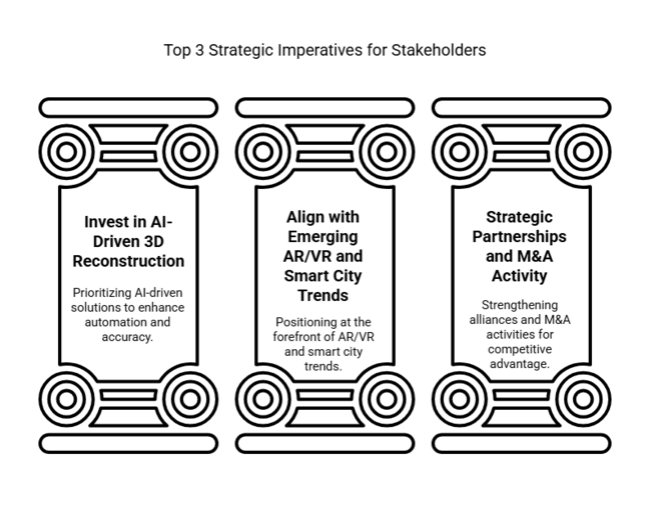

Invest in AI-Driven 3D Reconstruction

Executives should prioritize AI-powered modeling solutions to enhance automation, reduce processing time, and improve accuracy. Investing in machine learning and cloud-based platforms will enable seamless scalability and integration across industries.

Align with Emerging AR/VR and Smart City Trends

Companies must position themselves at the intersection of 3D reconstruction, augmented reality, and smart infrastructure development. Collaborating with urban planners, gaming studios, and metaverse developers will unlock new revenue streams and expand technological capabilities.

Strengthen Strategic Partnerships and M&A Activity

To stay competitive, businesses should pursue strategic alliances with hardware manufacturers, software developers, and cloud service providers. Mergers and acquisitions in niche 3D reconstruction segments will help consolidate expertise, enhance product portfolios, and accelerate innovation.

| Risk | Probability & Impact |

|---|---|

| Supply Chain Disruptions in 3D Hardware - The industry's reliance on LiDAR sensors and photogrammetry equipment makes it vulnerable to semiconductor shortages, trade restrictions, and production bottlenecks. Limited component availability could delay project timelines and increase costs, necessitating diversified sourcing and supplier partnerships. | High Probability, Severe Impact |

| Data Privacy & Security Concerns - The widespread adoption of cloud-based 3D reconstruction raises risks related to data breaches, intellectual property theft, and compliance with regional data protection laws. Strengthening cybersecurity frameworks and ensuring regulatory compliance will be essential to maintaining trust and mitigating legal risks. | Moderate Probability, Significant Impact |

| Regulatory Challenges in Heritage & Infrastructure Projects - Stringent government policies on digital mapping, historical site documentation, and urban planning approvals can create project delays and compliance burdens. Proactive engagement with policymakers and aligning solutions with regulatory frameworks will be crucial for sustained growth. | Moderate Probability, High Impact |

| Priority | Immediate Action |

|---|---|

| AI-Powered 3D Reconstruction Adoption | Conduct feasibility studies on integrating generative AI for automated 3D modeling and rendering. Assess software capabilities, invest in AI-driven tools, and collaborate with tech firms to enhance automation and scalability. |

| Cloud Security & Compliance Strategy | Implement enhanced encryption and regulatory frameworks to address data security concerns in cloud-based 3D reconstruction. Conduct cybersecurity audits, ensure compliance with regional data protection laws, and develop contingency plans for data breaches. |

| 3D Hardware Supply Chain Resilience | Develop alternative sourcing strategies and establish direct partnerships with LiDAR and photogrammetry hardware manufacturers. Secure long-term contracts, diversify supplier networks and explore localized manufacturing to mitigate component shortages and cost volatility. |

To stay ahead, the companies must invest aggressively in AI-based 3D reconstruction, strengthen cloud security infrastructure as well as achieve long-term hardware supply chain stability. This insight points to automation direction, which needs to be ushered in with generative AI for improving modeling efficiency on an urgent basis.

Enhancing cybersecurity protocols is essential as cloud-based uptake widens, achieving compliance and confidence. The client also needs to diversify LiDAR and photogrammetry sources for protecting operations against supply chain dynamics.

By leveraging these priorities, the client can speed up innovation, lower operating risks, and seize upcoming opportunities in construction, heritage conservation as well as AR/VR technologies.

Software for 3D reconstruction is projected to grow at a CAGR of 6.5% from 2025 to 2035. Accounting for nearly 70% of industry revenue, software remains the backbone of 3D modeling, ensuring precision, automation, and efficiency. Leading the segment are the AI platforms Agisoft Metashape, MicMac, and 3DF ZEPHYR.

Increased demand for such software from real estate, gaming, and digital content creation has contributed to wide-scale acceptance of 3D reconstruction software. An AI-driven automation solution offered as a cloud service makes the software more accessible, helping implement real-time rendering and photogrammetry in workflows. The rise of the metaverse and virtual reality is further driving growth in this segment.

While demand is robust, challenges such as high licensing costs and the need for skilled people impede the adoption of software in cost-conscious industries. This is where businesses are starting to find solutions by investing in open-source platforms and AI automation tools. Thus, as industries shift toward digital transformation, software will still remain as the foundation for advanced spatial imaging and modeling solutions.

Active 3D reconstruction is projected to grow at a CAGR of 6.3% from 2025 to 2035.This is one of the most powerful segments powered for extremely accurate applications in industrial automation, defense, and imaging in medicine. LiDAR and laser scanning technologies are the most prominent since they guarantee extremely high accuracy in acquiring complex structure views.

At the same time, passive 3D reconstruction is visible as a formidable competitor with a CAGR of 8.2%. The demand for photogrammetry for applications like underwater exploration and remote sensing continues to raise its tide as cultural preservation benefits fuel it. Its low hardware investment adds to the attractiveness of passive methods as alternatives in small-scale scenarios.

Although passive approaches suffer from poor accuracy under low-light conditions, they are directly enhanced by AI-driven image processing and deep-learning-derived algorithms. The increasing demand for flexible and low-cost 3D reconstruction methods will increase this segment significantly in the coming years.

The SME segment in 3D reconstruction is projected to grow at a CAGR of 7.8% from 2025 to 2035, reflecting an increasing shift toward affordability and accessibility. Historically, large enterprises dominated the industry, but the rise of cloud computing and AI-powered automation is allowing SMEs to scale operations efficiently.

Large enterprises still account for approximately 60% of the industry and are expected to grow at a CAGR of 6.5%. Sectors such as construction, aerospace, and gaming continue to rely on large-scale 3D scanning and digital twin applications. Their ability to invest in high-end solutions ensures their continued leadership in adoption and innovation.

SMEs, however, are bridging the gap by leveraging subscription-based services and open-source software. AI-driven automation and flexible cloud-based tools are making 3D reconstruction more accessible to smaller businesses. With increased adoption across diverse sectors, SMEs are set to drive substantial expansion in the coming decade.

Cloud-based 3D reconstruction is projected to grow at a CAGR of 7.7% from 2025 to 2035, emerging as the dominant deployment model. The transition from expensive, hardware-dependent on-premise solutions to scalable cloud platforms is accelerating adoption across industries.

On-premise deployment, once the industry standard, is now projected to grow at a slower CAGR of 6.0%. While sectors requiring high-security data handling, such as defense and infrastructure, continue to rely on on-premise solutions, rising maintenance costs and a lack of flexibility are limiting long-term growth.

The adoption of cloud-native 3D reconstruction platforms is being driven by AI-powered automation, lower costs, and remote accessibility. Security concerns remain a challenge, but advancements in encryption and compliance standards are making cloud deployment a more viable option. As industries prioritize digital transformation, cloud-based solutions will continue to dominate.

The healthcare segment for 3D reconstruction is set to grow at a CAGR of 8.3% from 2025 to 2035, making it the fastest-growing application area. AI-powered medical imaging, virtual surgery planning, and patient-specific prosthetics are driving rapid adoption. Robotics and 3D scanning are also transforming diagnostics and treatment planning.

The construction & architecture segment, which held over 25% of the industry in 2022, is projected to grow at a CAGR of 7.5%. The increasing use of 3D scanning for non-destructive structural analysis, urban planning, and Building Information Modeling (BIM) continues to sustain strong demand. Large-scale infrastructure projects are further contributing to growth.

The healthcare sector’s accelerated expansion is attributed to continuous innovation, including AI-assisted radiology, 3D bioprinting, and robotic-assisted surgery. Recent advancements, such as automated blood drawing systems and custom prosthetics, highlight the growing importance of 3D reconstruction in medicine. As investments in healthcare technology increase, the segment is expected to surpass construction in overall industry share.

CAGR for the USA from 2025 to 2035 is projected at 7.8%. Strong government backing for smart infrastructure and adoption of the digital twin is fueling expansion. Increased investments in AI-driven 3D modeling for urban planning, construction, and forensic applications are creating lucrative opportunities.

The demand for high-resolution 3D models in construction is surging, particularly in large-scale commercial and residential projects. The adoption of LiDAR technology for geospatial mapping and heritage preservation has gained momentum. Additionally, the entertainment industry is utilizing 3D reconstruction for immersive gaming and virtual production in filmmaking.

Regulatory compliance and privacy laws, particularly regarding AI-driven surveillance applications, pose challenges. However, government funding and incentives for smart city projects provide sustained growth. Increasing collaboration between tech firms and research institutions is expected to drive innovation in automated reconstruction solutions.

The CAGR for the UK from 2025 to 2035 is expected to be 7.2%. Adoption of digital twin technology in infrastructure development and compliance with BIM Level 2 regulations drive growth. Government initiatives to modernize urban planning and transportation further boost demand for advanced 3D modeling solutions.

The UK construction industry is integrating AI-based 3D modeling tools to enhance project efficiency and cost control. The cultural preservation sector is also leveraging 3D reconstruction for the digital archiving of historical sites. Moreover, media and entertainment companies are increasingly investing in 3D scanning for virtual and augmented reality applications.

Data protection laws such as GDPR create compliance challenges for cloud-based 3D services. However, strong public and private sector collaboration in research and innovation fosters technological advancements. Expanding investments in AI-powered automation and LiDAR technology is expected to solidify the UK’s position.

CAGR for France from 2025 to 2035 is projected at 7.0%. France’s ongoing BIM strategy and the EU Digital Twin Strategy are accelerating adoption across infrastructure, real estate, and cultural heritage sectors. Government investments in smart cities and historical site digitization further drive expansion.

The construction sector is experiencing high demand for automated 3D modeling tools, ensuring compliance with sustainability regulations. Meanwhile, France is leading Europe in utilizing 3D reconstruction for historic preservation, with advanced photogrammetry techniques being used to restore heritage sites such as Notre Dame. Growth is also evident in gaming and animation.

Stringent regulatory requirements for data privacy and security pose hurdles for cloud-based solutions. However, strong industry-government collaboration ensures continued innovation. France’s commitment to sustainability and smart city development will drive further advancements in AI-driven 3D technologies.

CAGR for Germany from 2025 to 2035 is projected at 7.0%. The country's leadership in precision engineering and manufacturing accelerates the adoption of industrial automation, construction, and geospatial applications. The EU Digital Twin Strategy further drives demand for high-accuracy 3D modeling solutions.

Germany’s construction sector is integrating advanced 3D modeling tools to enhance energy efficiency and structural safety. The automotive industry is also leveraging 3D reconstruction for prototyping and quality control. Additionally, government investments in smart city initiatives support the expansion of geospatial mapping applications.

Regulatory complexity, particularly in compliance with EU data protection laws, presents challenges. However, Germany’s focus on research-driven innovation fosters breakthroughs in AI-powered automation. Increased adoption of hybrid Photogrammetry-LiDAR solutions is expected to fuel long-term growth.

CAGR for Italy from 2025 to 2035 is forecasted at 6.5%. Investments in cultural heritage preservation and the National Recovery and Resilience Plan (NRRP) are major drivers. The growing adoption of 3D modeling in architecture and restoration projects further accelerates expansion.

Italy’s tourism and heritage sectors are utilizing 3D reconstruction for site restoration and digital archiving. The construction industry is also embracing AI-driven modeling tools for project optimization. Additionally, demand is increasing in medical imaging and virtual surgery planning, enhancing healthcare applications.

Challenges include limited technological infrastructure in certain regions and high costs of advanced 3D reconstruction systems. However, government-backed initiatives and rising private-sector investments in automation and AI are expected to bridge these gaps, ensuring steady growth.

CAGR for South Korea from 2025 to 2035 is expected at 7.4%. The government’s Smart City Act and heavy investments in AI-driven urban planning solutions are major growth catalysts. Increased adoption in robotics, manufacturing, and digital healthcare further strengthens the sector.

South Korea’s gaming and entertainment industry is fueling demand for high-resolution 3D modeling. The country is also leading in robotic automation, utilizing 3D reconstruction for AI-driven industrial processes. Additionally, advancements in medical imaging are enhancing applications in virtual surgery and diagnostics.

Regulatory oversight on AI and data privacy presents challenges for cloud-based 3D services. However, ongoing investments in R&D and technological innovation continue to enhance competitiveness. Government-backed funding and corporate collaborations will drive future advancements.

The projected CAGR for Japan during the period from 2025 to 2035 is 6.3%. Further growth in infrastructure and automation is being spurred on by the Digital Transformation Act. And with the acceptance of robotics, AI-driven manufacturing, and work on cultural preservation, one further boost to growth emerges.

Japan's automotive and electronics industries are harnessing 3D reconstruction for product development and quality control. The nation is also embarking on investing in a digital twin for smart city purposes. What is trending also in Japan is healthcare applications such as 3D medical imaging and virtual surgery planning.

Still emerging are high costs and relatively slow adoption of cloud-based 3D reconstruction. However, these challenges are expected to be countered by R&D projects sponsored by the government and by cooperation between technology companies and research institutes to spur innovation and further growth.

The CAGR for China from 2025 to 2035 is estimated to be at 8.2%. The National AI Development Plan and smart city initiatives are driving rapid adoption of such systems. AI-driven automation and geospatial development leadership will further grease the wheel of acceleration.

The Chinese construction industry is now integrating 3D reconstruction in large-scale urban developments. Similarly, the high-resolution 3D modeling offered by the manufacturing industry is being used for automation and AI-powered quality control. Furthermore, the surge in demand for 3D imaging for e-commerce and virtual retail applications is further bolstering industry prospects.

Strict adherence to data localization and cybersecurity laws has posed several hurdles for cloud applications; nevertheless, robust support from the government for AI and automation would ensure sustained growth. Investment in AI photogrammetry and LiDAR applications will further condition the acceleration.

Autodesk, Inc.: 21-26%

Autodesk strengthens its position with ReCap Pro and BIM 360, expanding AI-driven automation for large-scale infrastructure and heritage site reconstruction. In 2025, enhanced generative design and cloud-based collaboration tools improve efficiency in AEC workflows, boosting adoption in digital twin applications.

Epic Games (RealityCapture): 16-21%

RealityCapture continues to dominate photogrammetry and LiDAR-based 3D scanning, benefiting from deeper Unreal Engine integration. The 2025 update introduces real-time AI-powered texture synthesis and neural radiance field (NeRF) advancements, making it a key player in metaverse development and VFX rendering.

Matterport: 13-19%

Matterport solidifies its leadership in 3D virtual tours and digital twins, particularly in real estate and facility management. The company continues expanding its reach in architecture and interior design applications. The 2025 Cortex AI update enhances spatial intelligence, while its improved collaboration features and real-time 3D modeling drive enterprise adoption.

Pix4D (Parrot Group): 11-16%

Pix4D expands its photogrammetry solutions for agriculture, surveying, and infrastructure, with 2025 bringing enhanced AI-driven point cloud classification. Faster cloud processing, new multispectral imaging features, and advanced thermal mapping strengthen its role in environmental monitoring and disaster response.

Agisoft Metashape: 9-13%

Agisoft remains a leader in photogrammetry and is widely used in archaeology, research, and mapping. The 2025 update introduces further GPU acceleration, enabling faster dense point cloud processing. New automation tools improve cultural heritage preservation, forensic analysis, and precision 3D modeling.

NVIDIA: 6-11%

NVIDIA continues disrupting 3D reconstruction with AI-powered tools like NeRF and Gaussian Splatting. The 2025 Omniverse update enhances real-time physics-based rendering and deep-learning-driven 3D scene generation, accelerating adoption in robotics, autonomous vehicles, and industrial metaverse applications.

Bentley Systems: 6-11%

Bentley’s ContextCapture maintains its lead in infrastructure digitization, with 2025 upgrades focusing on large-scale mesh optimization and AI-assisted structural assessments. Enhanced geospatial analytics improve BIM integration, supporting urban planning and high-precision engineering simulations.

Trimble Inc.: 6-9%

Trimble advances its 3D scanning solutions with AI-powered automation, benefiting construction and geospatial industries. The 2025 improvements include enhanced field-to-office workflows, drone mapping integrations, and faster point cloud processing, boosting applications in land surveying and infrastructure monitoring.

It is used to create accurate digital models for applications in healthcare, construction, gaming, and archaeology.

Photogrammetry uses overlapping images to generate models, while LiDAR relies on laser pulses for precise depth measurements.

Healthcare, real estate, media, entertainment, construction, and defense are among the fastest adopters.

AI enhances automation, improves object recognition, refines textures, and accelerates image-based modeling.

High costs, skilled labor requirements, data processing limitations, and security concerns hinder widespread adoption.

By component, the industry is segmented into software and services.

In terms of type, the industry is segmented into active 3D reconstruction and passive 3D reconstruction.

Based on enterprise size, the industry is segmented into large enterprises and SMEs.

By Deployment Model, the industry is segmented into On-premise and Cloud.

In terms of application, the industry is segmented into Education, Healthcare, Aerospace & Defense, Media & Entertainment, Construction & Architecture, and Government & Public Safety.

The industry is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

The Prurigo Nodularis (PN) Treatment Market is segmented by product, and end user from 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.