The 3D-printed labels and stickers market is changing at a fast pace as companies embrace high-definition, customizable, and eco-friendly printing technologies. As the need for personalization and green materials increases, companies are embracing digital 3D printing, laser embossing, and smart labeling technologies. Companies are using AI-driven design automation, high-speed UV printing, and micro-texturing precision to improve branding, security, and durability.

Industry players are spending on IoT-enabled interactive labels, green materials, and biodegradable adhesives to comply with strict environmental laws. The market is gravitating towards ultra-rugged, printable, and intelligent labels that contain NFC chips, QR codes, and blockchain-supported verification for anti-counterfeiting.

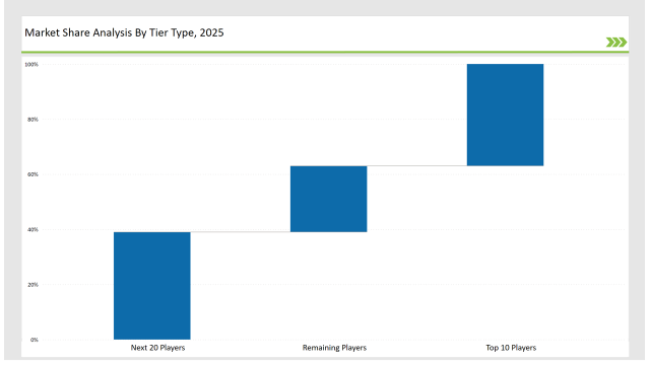

Tier 1 players like Avery Dennison, CCL Industries, and HP Inc. control 37% of the market through their proficiency in high-resolution digital printing, security labeling, and supply chain efficiency on a global scale.

Tier 2 players such as Xeikon, Epson, and Roland DG have 39% of the market through innovative UV-cured printing, industrial-sized 3D label printing, and eco-friendly print-on-demand options.

Tier 3 players are local and niche companies that offer customized, green, and RFID-based smart labels, representing the remaining 24%. These companies emphasize custom design functionality, holographic security, and AI-based quality control systems.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Avery Dennison, CCL Industries, HP Inc.) | 18% |

| Rest of Top 5 (Xeikon, Epson) | 11% |

| Next 5 of Top 10 (Roland DG, Domino Printing, Durst, Konica Minolta, Mark Andy) | 8% |

The 3D-printed stickers and labels industry serves multiple sectors where customization, branding, and anti-counterfeiting are critical. Companies are integrating smart printing technologies to meet evolving consumer demands and compliance standards. Businesses are also adopting AI-driven quality control systems to enhance label precision and reduce production errors.

Manufacturers are refining 3D-printed label solutions with ultra-precise micro-embossing, real-time variable data printing, and sustainable material innovations. Companies are integrating AI-driven pattern recognition for brand security and authentication. They are also developing heat-sensitive labels that change color to indicate temperature variations.

Automation and sustainability drive the 3D-printed stickers and labels industry forward. Companies invest in cloud-based printing, high-resolution UV curing, and RFID-integrated security solutions to provide enhanced customization and tracking capabilities. They develop AI-powered design tools to streamline production workflows. Firms integrate biodegradable materials to align with sustainability regulations. Businesses enhance label durability with nanotechnology coatings. Companies adopt machine learning for predictive maintenance in printing operations. Manufacturers optimize ink usage to reduce waste and improve efficiency.

Year-on-Year Leaders

Technology suppliers should emphasize AI-driven automation, sustainable materials, and advanced security features to capture market growth. Collaborating with industries such as retail, healthcare, and high-value consumer goods will drive innovation and adoption.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Avery Dennison, CCL Industries, HP Inc. |

| Tier 2 | Xeikon, Epson, Roland DG |

| Tier 3 | Domino Printing, Durst, Konica Minolta, Mark Andy |

Leading manufacturers are advancing 3D-printed stickers and labels through AI-powered design automation, sustainable materials, and intelligent branding solutions. Companies are embedding encrypted serialization codes and tamper-proof features to ensure authenticity and traceability. They are also implementing high-resolution UV printing to enhance label durability. Additionally, firms are leveraging AI to optimize printing efficiency and reduce material waste.

| Manufacturer | Latest Developments |

|---|---|

| Avery Dennison | Launched NFC-integrated security labels in March 2024. |

| CCL Industries | Developed holographic track-and-trace labels in April 2024. |

| HP Inc. | Introduced precision 3D inkjet personalization in May 2024. |

| Xeikon | Released AI-powered variable color printing in June 2024. |

| Epson | Strengthened eco-friendly label solutions in July 2024. |

| Roland DG | Innovated tactile label embossing in August 2024. |

| Domino Printing | Pioneered security microtext labels in September 2024. |

The 3D-printed stickers and labels market is evolving as companies invest in AI-driven automation, blockchain-backed authentication, and cloud-enabled print solutions. Firms are adopting tamper-proof, interactive packaging for brand security and customer engagement. Companies are developing temperature-sensitive labels to ensure product integrity during transportation. They are also integrating smart sensors into printed labels for enhanced tracking capabilities.

Manufacturers will develop AI-driven personalization, blockchain-secured authentication, and ultra-durable printing technologies. They will integrate forensic-level printing and real-time tracking analytics to optimize logistics, branding, and security. Companies will refine high-speed 3D printing to enhance label durability and efficiency. They will expand their use of machine learning algorithms to detect counterfeit products. Businesses will also invest in interactive packaging that engages consumers through augmented reality applications. Furthermore, firms will enhance temperature-sensitive labels to monitor product storage conditions. These advancements will ensure supply chain transparency and improve overall customer trust.

Leading players include Avery Dennison, CCL Industries, HP Inc., Xeikon, Epson, Roland DG, Domino Printing, Durst, Konica Minolta, Mark Andy

The top 3 players collectively hold 18% of the global market.

The market shows medium concentration, with top players holding 37%.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.