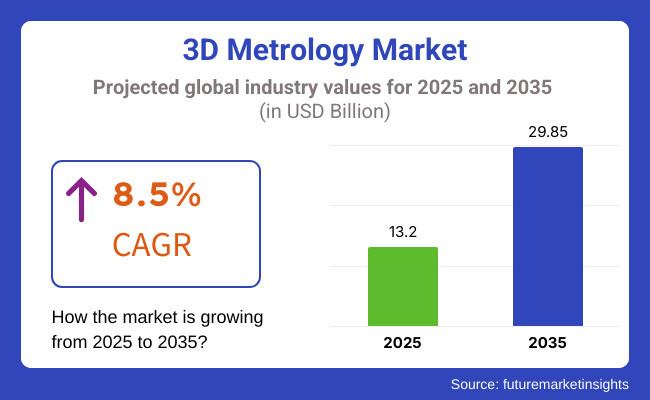

The 3D Metrology Market is set for steady growth between 2025 and 2035, driven by increasing demand across various industries, including aerospace, automotive, healthcare, and manufacturing. The market is expected to reach USD 13.2 billion in 2025 and expand to USD 29.85 billion by 2035, reflecting a compound annual growth rate (CAGR) of 8.5% over the forecast period.

The increasing utilization of 3D metrology solutions in quality control, reverse engineering, and precision measurement applications is emerging as a key driver of market growth.

3D Metrology system market is likely to grow due to the recent developments in optical and laser scanning technologies. The market is further propelled by the increasing emphasis on automation and digital transformation, spurring innovation in measurement and inspection solutions.

The changing industries in emerging economies and the advances in sensor technology, as well as, software integration, continue to drive the market growth. Moreover, strategic alliances between metrology equipment manufacturers and end-use sectors are bolstering the product efficiency and application range.

But such measures are often complicated by high implementation costs, difficulties in processing vector data and a lack of personnel. To ensure constant market stability, companies are preferring to invest in the R&D for cost-effective and high-precision 3D metrology solutions.

Explore FMI!

Book a free demo

North America has a major hold on the 3D metrology market, owing to advancements in precision measurement technologies and their large implementation in aerospace, automotive, and manufacturing industries.

The USA and Canada dominate the regional market, as major companies investing on R&D to improve accuracy, automation, and integration with solutions for the Industry 4.0.

Advancements in artificial intelligence and machine learning further drive strong demand for 3D metrology solutions to be used in quality control, reverse engineering, and digital twin applications.

This market is also affected by regulatory frameworks, such as the ones issued by the National Institute of Standards and Technology (NIST) or industry standards and compliance with calibration and accuracy regulations. Challenges to the widespread adoption of these cutting-edge technologies include high implementation costs and complex integration processes.

Germany, France, and the United Kingdom, all known for their robust industries, industrial automation, and precision engineering, contribute to making Europe a prime market for 3D metrology. Growth of 3D Measurement Solutions in the Region As a result of the industry's collective focus on Industry 4.0 and smart manufacturing in the region, adoption of 3D measurement solutions is accelerating.

Market growth is further driven by the increasing adoption of 3D metrology in automotive production, aerospace engineering, and medical device manufacturing. Nevertheless, strict quality assurance standards and changing regulatory compliance requirements influence how 3D measurement technologies are used.

To maintain growth patterns in the metrology systems market, European manufacturers are working on improving efficiency by ensuring compliance with changing industrial standards.

Asia-Pacific has emerged as the largest region in terms of growth for 3D metrology market, predominantly due to growing industrialization along with increasing need for precision measurement solutions in countries such as China, Japan, South Korea and India.

Ortho-new trends in accurate measurement on the surfaces in industries such as electronics, automotive, and heavy can be attributed to the growing adoption of optical measurement technologies along with laser scanning and coordinate measuring machines (CMMs), a trend which is further contributing to the growing demand for 3D metrology systems.

Regional manufacturing ecosystem and cost-effective manufacturing capabilities allow large-scale deployment of 3D metrology solutions Regulatory frameworks regarding quality control standards, protection of intellectual property rights, and standardization of tech remain in development and will force firms to find ways to adapt.

Upcoming market dynamics of smart factory, Artificial intelligence powered automation, and digital transformation is driving the investment in next-generation metrology solutions.

High Implementation Costs and Complex Integration

The 3D metrology market is expected to grow significantly; however, high implementation costs and a complex integration process are major factors hampering this growth. This calls for sophisticated metrology solutions that combines hardware, precision software and skilled professionals, which result in high operational cost. It also poses a technical challenge for integrating 3D metrology systems into existing production workflows without grinding production to a halt. To mainstream and indeed create an industry, companies should innovate cost effectively and develop marketplace-friendly products.

Growth in Industrial Automation and Quality Control

All industries increasingly demand precision measurement, quality control, and quality assurance, which serve as a tremendous growth opportunity for the 3D metrology market, particularly in automotive, aerospace, and healthcare.

With the growth of Industry 4.0, and industries moving towards the increasing use of automation, there is a demand for high-accuracy 3D scanning and inspection tools. In addition, AI-driven metrology solutions and real-time analytics will further increase efficiency and reduce production errors, thereby accelerating market growth.

The period from 2020 to 2024 witnessed growing adoption in manufacturing, automotive, and aerospace industries for the 3D metrology landscape. Nonetheless, limited implementations were confined due to prohibitively expensive costs and integration difficulties. Snap and developers tackled these issues by refining hardware precision, building up software capabilities, and smoothing the path for data to flow into the right systems.

And finally, the future technologies such as AI-powered metrology, automated quality control and noncontact measurement technology will be the key in the market from 2025 within 2035. The proliferation of smart factories, digital twins, and cloud-enabled metrology solutions will serve to broaden market applications. Also, adoption of sustainable and energy-efficient creation of metrology systems will support adoption in multiple industries.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with industry-specific quality standards |

| Technological Advancements | Growth in optical and laser-based metrology |

| Industry Adoption | Increased use in automotive and aerospace sectors |

| Supply Chain and Sourcing | Dependence on specialized hardware suppliers |

| Market Competition | Presence of specialized metrology providers |

| Market Growth Drivers | Demand for precision measurement and defect detection |

| Sustainability and Energy Efficiency | Initial adoption of eco-friendly measurement systems |

| Integration of Smart Monitoring | Limited real-time measurement tracking |

| Advancements in Measurement Innovation | Use of traditional coordinate measuring machines (CMM) |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Adoption of AI-powered compliance monitoring and global standardization |

| Technological Advancements | AI-driven automated inspection, real-time analytics, and digital twin integration |

| Industry Adoption | Expansion into medical, electronics, and additive manufacturing |

| Supply Chain and Sourcing | Integration of cloud-based metrology and remote calibration solutions |

| Market Competition | Growth of AI-enhanced metrology firms and major industrial automation players |

| Market Growth Drivers | Integration with Industry 4.0, IoT, and real-time quality monitoring |

| Sustainability and Energy Efficiency | Full-scale implementation of sustainable, energy-efficient metrology solutions |

| Integration of Smart Monitoring | AI-enhanced predictive maintenance and automated defect detection |

| Advancements in Measurement Innovation | AI-powered non-contact metrology, 3D scanning, and robotic-assisted inspection |

"Across the United States, the 3D metrology market is growing steadily and consistently owing to its applications in aerospace, automotive, healthcare and industrial manufacturing." Demand is driven by increasing adoption of automated quality control, precision measurement and non-contact inspection technologies.

Many crucial manufacturing and research powerhouses furthering metrology software, portable coordinate measuring machines (CMMs), and laser scanners—Detroit, Chicago, and Silicon Valley, to name a few. The proliferation of Industry 4.0 and smart factories also fuel market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.3% |

The market for 3D metrology in the UK is growing, as a result of demand in precision engineering, industrial automation and healthcare applications. London and Manchester are pioneers in the development of 3D scanning and digital twin technologies, particularly when it comes to additive manufacturing, aviation, and automotive quality control. Further growth is fuelled by government support for advanced manufacturing technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.8% |

Germany, France, and Italy are at the forefront of the market, with robust application in automotive, robotics, and industrial automation segments.

Germany, a world leader in precision manufacturing, launches investment in AI metrology solutions, laser scanning, and high-accuracy CMMs. Growth across Europe is bolstered through the expansion of smart factories, aerospace R&D, and digital measurement technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.9% |

The semiconductor, industrial automation, and automotive industries are driving growth in Japan's 3D metrology market. Mitutoyo and Nikon Metrology, for example, are developing high-precision measuring instruments and automated inspection systems. Robot technology and high-precision engineering in Japan make the market expected to grow steadily.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.1% |

3D Metrology for the South Korea Market, 3D Metrology for 3D Development and include Hardware, Software and Industrial Applications. Companies such as Samsung and Hyundai are focusing on investing in automated measurement solutions and real-time quality inspection solution technologies. As the South Korean government embraces smart manufacturing and drives the economy forward, Seoul and Busan have emerged as significant centers for AI-powered metrology and digital quality control.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.2% |

Coordinate measuring machines (CMMs), 3D scanners, and optical digitizers are part of this segment, which accounts for the largest share in the market. Industries are focusing on contact and non-contact metrology solutions for error-free production, real-time defect detection, and process efficiency.

When it comes to accuracy and repeatability in the realm of automated dimensional measurement and high-accuracy verification, CMMs still reign supreme, particularly in industries such as automotive and aerospace, where precision is paramount to the assembly of components, structural integrity, and quality control. On the other hand, laser and structured light-based 3D scanners are trending as they can capture complex geometries and allow for a fast non-destructive inspection process.

Over 70% of manufacturers are deploying 3D metrology hardware directly into production lines to achieve greater precision in machining, tooling, and part validation. The rise of market share at portable metrology systems and portable CMM Mounted over robotics & AI powered 3D scanning devices further foster the growth of the systems as automation of wells in various industries.

In the face of prohibitive equipment costs and complexities of system integration, advancements in miniaturized, wireless and cloud-enabled metrology hardware are making precision measurement more affordable and scalable. Further optimization can be achieved in industrial quality assurance processes with tools powered by AI-driven measurement, automated robotic inspection systems and real-time metrology analytics.

The software segment is being expanded swiftly as the professional background transitions to AI-based metrics, predictive statistics, and integrated cloud-linked metrology stages.

Unlike manual inspection techniques, which are performed straight through the naked eye, metrology software automatically detects defects, improving accuracy and original CAD models integration by ensuring that measurement data can effortlessly become part of the quality control process and help optimize processes.

For example, the automotive and aerospace sectors carry high demands for AI-driven 3D measurement tools, with manufacturers turning toward virtual simulation (virtual simulated inspection), dynamic flaw analysis, and digital twin modelling for production workflow optimization.

According to research, more than 65% of smart manufacturing sites have implemented AI-enabled metrology software for automated measurement, error prediction and process monitoring.

Adding to this, cloud-based metrology solutions are transforming the space by allowing remote quality control, collaborative defect analysis and the real-time sync of measurement data across global production sites. They are investing in low-code AI-driven software, self-learning measurement algorithms, and digital twin integration to improve process efficiency, minimize material waste, and avoid production errors.

And although the software licensing cost and software compatibility challenges persist, the adoption of AI-assisted metrology software, real-time 3D modelling platform and machine-learning-powered inspection platform is on the rise.

The growth of metrology software segment in last few years has been powered by such technologies as automated measurement analytics, digital twin simulation, and cloud-based defect prediction.

Significant growth opportunities in the market are provided by the increasing demand for 3D metrology across industries including automotive, aerospace, healthcare, and manufacturing. The market's growth will be aided by developments in laser scanning technology, precision measurement solutions powered by AI, and the growing use of Industry 4.0 technologies. Therefore, firms in this sector are using tech advancements, like machine learning-based automated inspection, improved measuring accuracy, and advanced analytics to fuel efficiency, guarantee quality control, and elevate productivity. Companies in the market include manufacturers of key metrology equipment and software, as well as research-oriented companies dedicated to 3D solutions for high-performance measurement.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Hexagon AB | 20-25% |

| FARO Technologies | 15-20% |

| Nikon Metrology | 10-15% |

| Keyence Corporation | 8-12% |

| Creaform (AMETEK) | 5-10% |

| Other Manufacturers (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Hexagon AB | A 3D metrology solutions provider, providing laser scanners, CMM and software. |

| FARO Technologies | Adept also works on portable 3D measurement solutions, laser trackers, 3D scanners, and inspection software. |

| Nikon Metrology | Manufacture mature precision measurement and industrial inspection system solutions such as X-ray CT and laser scanning transcender technology. |

| Keyence Corporation | Providing high-end 3D measurement systems to automation, manufacturing and quality control applications. |

| Creaform (AMETEK) | Specialises in manufacturing portable and handheld 3D scanning and imaging technologies for industrial and healthcare sectors. |

Key Company Insights

Hexagon AB (20-25%)

Hexagon dominates the 3D metrology market with innovative laser scanning solutions, AI-enhanced quality inspection, and high-precision measurement technologies.

FARO Technologies (15-20%)

FARO specializes in portable 3D measurement devices, integrating AI-driven automation for industrial and engineering applications.

Nikon Metrology (10-15%)

Nikon offers high-precision industrial metrology solutions, including computed tomography (CT) scanning and advanced optical measurement systems.

Keyence Corporation (8-12%)

Keyence provides high-speed, high-accuracy 3D measurement solutions designed for manufacturing and automation industries.

Creaform (AMETEK) (5-10%)

Creaform leads in portable 3D scanning technologies, offering versatile metrology-grade solutions for industrial applications.

Emerging players and independent manufacturers are driving innovations such as AI-powered metrology software, automation-integrated measurement systems, and high-speed 3D scanning for various industrial applications. These companies include:

What was the overall size of the 3D Metrology Market in 2025? The overall market size for the 3D Metrology Market was USD 13.2 billion in 2025.

The 3D Metrology Market is expected to reach USD 29.85 billion in 2035.

The demand for the 3D Metrology Market will be driven by the increasing need for precision measurement in manufacturing, advancements in automation, growth in aerospace and automotive industries, rising adoption of Industry 4.0, and the expanding use of metrology in healthcare and construction.

The top five countries driving the development of the 3D Metrology Market are the USA, Germany, Japan, China, and the UK.

The 3D Metrology Market is expected to grow at a CAGR of 8.5% during the forecast period.

Catenary Infrastructure Inspection Market Insights - Demand & Forecast 2025 to 2035

Category Management Software Market Analysis - Trends & Forecast 2025 to 2035

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Residential VoIP Services Market Insights – Trends & Forecast 2025 to 2035

Border Security Technologies Market Growth - Trends & Forecast 2025 to 2035

ATM Outsourcing Services Market Analysis by Service Type, ATM Deployment, and Region - Growth, Trends, and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.