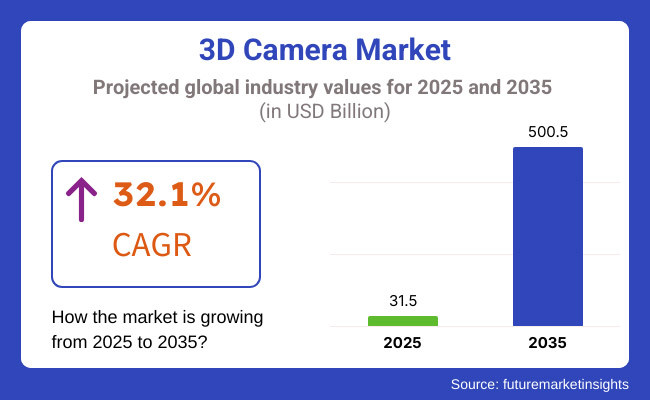

The 3D Camera Market is set for substantial growth between 2025 and 2035, driven by increasing demand across various applications, including entertainment, automotive, healthcare, and industrial sectors. The market is expected to reach USD 31.5 billion in 2025 and expand to USD 500.5 billion by 2035, reflecting a compound annual growth rate (CAGR) of 32.1% over the forecast period.

Growing adoption of 3D cameras in applications such as virtual reality (VR), augmented reality (AR), and machine vision is driving market growth significantly. The use of 3D cameras is expected to accelerate with improvements in imaging technologies and a growing demand for high-quality depth perception. Additionally, the expansion of automation and artificial intelligence (AI), promoting innovation in 3D technology and imaging solutions, is affecting the market as well.

Growth of industries in developing economies, along with technological developments in sensor technology, is also driving market growth. Also, strategic partnership between camera manufacturers and software developers is boosting production efficiency and application range.

Strategic interventions must be presented to overcome the challenges of high production costs and complexities in data processing and integration with existing systems. These continual innovations have prompted companies to invest significantly in R&D to develop cost-effective and high-performance 3D imaging solutions leading to a sturdy market stability.

Explore FMI!

Book a free demo

The 3D camera market in North America is likely to be motivated by improvements in imaging technology and their significant utilization in entertainment, healthcare and security. North America has also been a driving force in the region led by the United States and Canada, with major technology companies investing resources to increase research and development to improve depth-sensing and image processing technology.

An increase in usage of 3D cameras in applications such as AR, VR, and autonomous vehicles remains strong, backed by progress in artificial intelligence and machine learning.

Market dynamics in the communications and media industry are shaped by regulatory frameworks, including those established by the Federal Communications Commission (FCC) and other standards that emphasize compliance with data privacy and safety regulations. But adoption on a large scale will be impeded by technological complexity and high production costs.

Europe one of the fastest-growing market of 3d cameras due to the increasing number of automotive, robotics and industrial automation applications in countries such as Germany, France, and the UK. The focus on Industry 4.0 and smart manufacturing across the region hastens the adoption of 3D imaging technologies.

Market growth is driven by its increasing adoption in facial recognition, biometric authentication, and medical imaging with 3D cameras. Nevertheless, strict data protection laws - in particular, the General Data Protection Regulation (GDPR) - shape the deployment of 3D imaging technologies in areas such as surveillance and consumer electronics.

European manufacturers emphasize improving sensor efficiency and road compliance with changing regulatory requirements to facilitate more market growth.

The Asia-Pacific region is the fastest-growing segment of the 3D camera market due to rapid technology developments and growing adoption of consumer electronics in China, Japan, South Korea, and India. The 3D camera market continues to be robust for gaming, smartphones, and industrial automation, particularly enabled by innovations in sensor technology and image recognition.

India's robust electronics manufacturing ecosystem and affordable production capabilities will facilitate mass deployment of 3D imaging solutions. That said, the relevant frameworks governing intellectual property rights, cybersecurity, and manufacturing standards are still developing, and companies must adapt.

Future market trends are driven to invest in 3D imaging of next-generation technology, so smart city initiatives, artificial intelligence-driven automation, and digital transformation systems are in high demand over the past few years.

High Production Costs and Technical Complexities

High costs associated with production and technical complexities constrain a huge 3D camera market size growth. The manufacturing cost of high-precision 3D imaging technology is high due to advanced sensors, complex software algorithms, and powerful processing units.

Apart from this, it requires seamless integration with various devices, improved depth accuracy, and reduced latency is needed in real-time applications as well, making it more complex. Many barriers exist which can be removed by utilizing cost-efficient production methods and effective software solutions.

Expansion in Augmented Reality (AR), Virtual Reality (VR), and AI Applications

The rise of AR, VR and AI-powered applications is a growth opportunity for the 3D camera market segment. Various sectors, including gaming, healthcare, automotive, and security, are utilizing 3D imaging to a greater extent to provide a more immersive experience to users, improve accuracy in diagnoses, and enable advanced surveillance systems.

The increasing adoption of AI-enabled object recognition and depth sensing capabilities in smart devices and automation is driving innovations in the market and is positively impacting its demand.

From 2020 to 2024, there are a rapid adoption of 3D cameras in consumer electronics, industrial automation and entertainment. But cost factors and hardware limited access to most. Includes companies focused on increased sensor efficiency, miniaturization, and cloud-based data processing to enable more functionality in their products.

From 2025 to 2035, market expansion will be powered by AI-based imaging, real-time 3D mapping and technological advancements in LiDAR and ToF (Time-of-Flight) technology. Emerging trends such as smart cities, self-driving cars, and AI-enabled security systems will help increase the range of market applications.

The adoption of energy-efficient as well as compact 3D cameras will also lead to the wider adoption on mobile devices and Internet of Things devices.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with data privacy and security regulations |

| Technological Advancements | Improvements in depth sensing and resolution |

| Industry Adoption | Growth in consumer electronics and gaming |

| Supply Chain and Sourcing | Dependence on specialized sensors and chipsets |

| Market Competition | Presence of niche market players |

| Market Growth Drivers | Demand for AR/VR and industrial automation |

| Sustainability and Energy Efficiency | Initial adoption of low-power sensors |

| Integration of Smart Monitoring | Limited real-time 3D data processing |

| Advancements in Imaging Innovation | Basic depth sensors and stereo cameras |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Standardized global frameworks for AI-integrated imaging security |

| Technological Advancements | AI-driven 3D imaging, real-time 3D mapping, and LiDAR advancements |

| Industry Adoption | Expansion into autonomous vehicles, smart cities, and industrial automation |

| Supply Chain and Sourcing | Increased use of energy-efficient components and sustainable manufacturing |

| Market Competition | Growth of AI-powered imaging firms and major tech conglomerates |

| Market Growth Drivers | Integration with AI, IoT, and next-gen smart devices |

| Sustainability and Energy Efficiency | Full-scale integration of energy-efficient 3D cameras and sustainable materials |

| Integration of Smart Monitoring | AI-enhanced real-time depth perception and security analytics |

| Advancements in Imaging Innovation | AI-powered 3D recognition, holographic imaging, and advanced LiDAR solutions |

AR, VR and autonomous vehicles are pushing the limits of innovation in the USA 3D camera market. The increasing integration of 3D cameras in smartphones, gaming, health care imaging, and security surveillance is also driving demand.

Silicon Valley, New York, Los Angeles and other tech hubs are driving the innovation around depth-sensing technologies, AI-driven imaging, and LiDAR-based applications. One of the major factors that drive market growth is the increasing demand for high-resolution depth perception in autonomous systems and immersive media.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 32.8% |

The UK 3D camera sector is developing consistently, with increasing interest in industrial automation, film production, security frameworks, and savvy retail applications. With the rapid growth of AI-powered imaging, VR gaming, and biometric security, London and Manchester have emerged as important hubs driving adoption.

The market will see a steady increase due to a rising focus toward automated manufacturing, 3D scanning across health care, and AR based retail solutions. This is further facilitating sector innovation with the support from governments worldwide for AI and imaging technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 31.2% |

Germany, France and Italy dominate the EU 3D camera market, with applications in automotive, healthcare, industrial robotics, and consumer electronics.

Europe continues to lead with automotive automation and smart factory initiatives, driving the demand for high-precision depth-sensing cameras. CMR expects rapid adoption of biometric security systems, smart city projects, and biometric-enabled AR-based tourism applications are all positively contributing towards the market growth.

EU regulation of AI allowing for automation and promoting Industry 4.0 and also the wider economy will also contribute to significant market expansion over the coming decade.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 31.9% |

Technological advancements in robotics & industrial automation also drive for the growth of 3D camera market in Japan. High resolution imaging and LiDAR development workshops are led by companies such as Sony, Canon, and Panasonic.

Japan is generating demand with its know-how in precision manufacturing, AI-based surveillance, and autonomous vehicles. The cities of Tokyo and Osaka-gate continue being at the center of high-end 3D imaging technique improvement.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 31.7% |

The South Korea 3D Camera Market is growing at a high rate due to increasing consumer electronics, autonomous robots and smart surveillance technologies. Samsung and LG are among the companies pouring money into depth-sensing cameras for mobile devices, car safety and home automation.

Seoul and Busan are not growing as tech hubs, with further demand being driven by AI-powered retail, biometric security and mixed reality (MR) applications. Market growth is also being fuelled by the growing use of 3D vision for AI-based robotic systems in industrial manufacturing and enhanced medical diagnostics.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 32.4% |

Stereo vision segment has grabbed a most of market share due to its realistic depth perception, high-resolution 3D imaging, and object recognition features. By using dual-camera configurations, this technology mimics human sight, recording and interpreting a smaller angle between two perspectives to provide incredibly accurate distance measurement and 3D location data.

Stereo vision has become ubiquitous in professional cameras, especially for cinematic, industrial inspection, and medical imaging applications, where correctness of depth, mapping of natural textures, and object detection and trackability is of paramount importance.

From filmmakers to photographers, stereo vision-based 3D cameras are being increasingly integrated to create hyper-realistic depth effects, immersive virtual sets, and overall enhanced visual storytelling.

Over 65% of AR & VR applications across gaming, simulation, and entertainment depend on stereo vision based 3D cameras for natural depth perception and immersive digital engagement. The growth of market with the AI-empowered depth sensing, real-time scene reconstruction and multi-view stereo processing.

Although they are computational heavyweights and require complex calibration, recent advances in compact stereo vision modules, AI-assisted depth estimation, and neural network-based image processing are all helping improve the accuracy and decrease latency of stereo vision technology, making it more widely available across different industries.

Time-of-Flight Revolutionizes 3D Camera Market as AI-Powered Depth Sensing and Gesture Recognition Go Mainstream

The time-of-flight (ToF) segment is poised for strong demand owing to the applications that work with real-time depth measurement, motion tracking, and high-speed 3D scanning. That is where the Time of Flight, or ToF technology steps in: Instead of conventional imaging approaches, it defines the amount of time leapt around, bounced back by an object, and instantly and accurately mapped depth.

The most prominent application of ToF based 3D cameras is in smartphones and tablets, which the major manufacturers have incorporated for features such as facial recognition, computational photography, AR based gaming and AI enhanced camera performance. For example, more than 70% of flagship smartphones now come with a ToF sensor, allowing for faster focus, better photo portraits and AR overlays.

ToF-based 3D cameras extend beyond consumer electronics to various industrial applications, serving sectors like industrial automation, robotics, and autonomous vehicles, where rapid motion tracking, obstacle detection, and environmental mapping are paramount.

AI-powered ToF sensors, with edge-computing depth analysis and cloud-based 3D imaging platforms, are increasing the optimisation toward performance while minimising the power budget and enabling further new markets.

Typically, high production costs and sensitivity to ambient lighting have limited ToF adoption. Yet, next-gen ToF sensors with AI-backed calibration and low-power depth sensing, and multi-sensor fusion are solving these problems, increasing efficiency, and moving towards cost-effective ToF cameras.

The surge in demand for 3D cameras in a range of applications such as consumer electronics, automotive, healthcare, and industrial sectors creates huge growth opportunities in the market. Technological advancements, such as depth-sensing technology and AI-based image processing, are some of the key factors that are contributing to the information available on the global market expansion along with increasing adoption in AR (augmented reality) and VR (virtual reality) applications.

Firms operating in this sector are focusing on efficiency, precision, and user experience, and believe that AI-processing depth mapping, additional security functions, and upgraded resolution devices will help them achieve their goals. The players in this market include major technology manufacturers, semiconductor companies, and research-oriented organizations dedicated to high-performance 3 dimensional imaging solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Sony Corporation | 20-25% |

| Intel Corporation | 15-20% |

| Panasonic Corporation | 10-15% |

| Microsoft Corporation | 8-12% |

| Samsung Electronics | 5-10% |

| Other Manufacturers (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Sony Corporation | Premier supplier of 3D imaging sensors, providing high-resolution depth-sensing cameras for numerous applications. |

| Intel Corporation | Manufactures RealSense 3D cameras, combining AI-driven depth mapping and gesture recognition technologies. |

| Panasonic Corporation | Creates 3D vision systems for industrial automation, automotive safety, and security solutions. |

| Microsoft Corporation | Provides Azure Kinect 3D cameras for AI-powered depth-sensing applications, especially in robotics and AR. |

| Samsung Electronics | Expert in 3D camera modules for smartphones, AR devices, and advanced security solutions. |

Key Company Insights

Sony Corporation (20-25%)

Sony dominates the 3D camera market with cutting-edge image sensors, AI-enhanced depth mapping, and high-resolution imaging solutions.

Intel Corporation (15-20%)

Intel focuses on RealSense technology, integrating AI and machine learning to enhance depth perception and spatial recognition.

Panasonic Corporation (10-15%)

Panasonic specializes in industrial 3D vision applications, including autonomous vehicles, manufacturing, and security systems.

Microsoft Corporation (8-12%)

Microsoft's Azure Kinect 3D cameras are widely used in AI applications, enabling advanced gesture control and spatial analysis.

Samsung Electronics (5-10%)

Samsung leads in compact 3D camera solutions for mobile devices, AR applications, and biometric security.

Emerging players and independent manufacturers are driving innovations such as AI-powered 3D depth sensing, lightweight and compact designs, and enhanced low-light performance for various applications. These companies include:

The overall market size for the 3D Camera Market was USD 31.5 billion in 2025.

The 3D Camera Market is expected to reach USD 500.5 billion in 2035.

The demand for the 3D Camera Market will be driven by advancements in imaging technology, increasing adoption in entertainment and gaming, expanding applications in healthcare and security, rising demand for high-resolution 3D content, and the integration of AI and machine learning in imaging solutions.

The top five countries driving the development of the 3D Camera Market are the USA, China, Germany, Japan, and South Korea.

The 3D Camera Market is expected to grow at a CAGR of 32.1% during the forecast period.

Catenary Infrastructure Inspection Market Insights - Demand & Forecast 2025 to 2035

Category Management Software Market Analysis - Trends & Forecast 2025 to 2035

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Residential VoIP Services Market Insights – Trends & Forecast 2025 to 2035

Border Security Technologies Market Growth - Trends & Forecast 2025 to 2035

ATM Outsourcing Services Market Analysis by Service Type, ATM Deployment, and Region - Growth, Trends, and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.