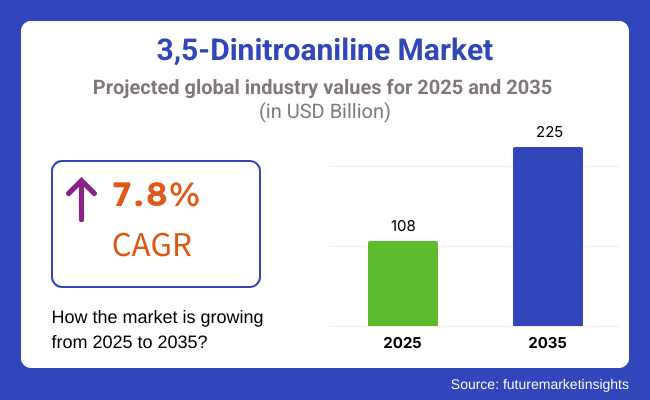

3, 5-Dinitroaniline market is projected to witness significant growth from 2025 to 2035 due to high demand from various industrial uses, such as dyes, agrochemicals, and pharmaceuticals. The market is anticipated to reach USD 108 billion in 2025 and grow to USD 225 billion by 2035 at a compound annual growth rate (CAGR) of 7.8% during the forecasting period.

The increasing application of 3, 5-Dinitroaniline in herbicides, pigments and special chemicals production, the market is entering its most significant period of expansion yet. With chemical synthesis moving forward and agricultural regulation giving far greater support than before, huge sales of this compound are expected to follow. Increasing demand for sustainable and environmentally-friendly solutions has also given a shot in the arm to new chemical formulations.

Industrial growth in emerging markets combined with advanced chemical processing methods that keeps gaining ground, onward the market expansion. A further advantage comes from strategic cooperation between the producers of chemicals and research institutes, which not only makes products more expedient but also extends their range of application.

But strategic measures are required for the ever-present problems of environmental protection, stringent regulations for agriculture, raw material price instability. Enterprises are increasingly investing in research and development to develop cost-effective, sustainable production methods that, if successful, will guarantee long-term market stability.

North America holds a commanding share of the 3, 5-Dinitroaniline market because both its chemical manufacturing sector is robust and it provides applications in agrochemicals and dyes.

The United States and Canada are the main force behind North America's 3, 5-Dinitroaniline market. The most important companies in the business are all in this region, investing heavily on R&D to increase efficiency and make their production process more environmentally friendly. Precision agriculture and textile manufacturings.

This has resulted in rising demand for 3, 5-Dinitroaniline as a herbicide and industrial dye Regulatory frames of laws, such those drawn up by the Environmental Protection Agency (EPA) or health Canada, are (necessarily) influencing market dynamics.

Compliance with safety and environmental standards is required. But strict regulations on nitro aromatic compounds and increasing concern about the environment as a whole are putting a brake on market growth.

With the well-established chemical production and agrochemical applications in countries like Germany, France and the United Kingdom, Eastern Europe is witnessing a rapid spurt of 3,5 dinitroaniline market.

The region's strict environmental regulations, such as REACH (Register, Evaluation, Authorization and Restriction of Chemicals), urge for sustainable production and the production of environmentally friendly alternatives. Companies however have learned of the organic trend, this naturally has implications for growth in synthetic herbicide use and hence the market.

Nevertheless, continuous discoveries in dye synthesis and specialty chemicals keep demand strong. In Europe, where there are high levels of value added taxes and other costs borne by manufacturers in addition to taxes paid directly to government, manufacturers are continually seeking to optimise production methods while satisfying new market standard changes.

Powered by rapid industrialization and rising agricultural activities, countries such as China, India, Japan and South Korea helped to spur the Asia-Pacific market for 3.5-Dinitroaniline into its fastest growth phase ever. With increased food production requirements as well as an expanding textile industry, the demand for intermediates in dye production, herbicides and specialty chemicals survives.

By a well-established infrastructure for chemical mfg. and low-cost labour force, the region is able to achieve massive production and export trade. However, regulatory frameworks with respect to environment impact, worker safety and chemical waste management are changing, forcing manufacturers to change.

And that's just beginning. Green chemistry initiatives on sustainable agriculture are influencing future market strategies, underpinning investment in alternative formulations with safer production technologies.

Regulatory Compliance and Safety Concerns

The market for 3, 5-Dinitroaniline stands ready for notable growth but stringent regulatory frameworks and safety compliance are still major challenge. Being a chemical compound widely used in agrochemicals, dyes, and pharmaceuticals strict environmental, occupational safety regulations apply to every stage of its production and storage.

REACH, EPA compliance and other regional chemical safety standards make a complex web to work within in this market. And the hazards associated with its production, including toxicity to operators as well as neighbours and possible harm for far-off environmental systems, make it necessary; therefore safety protocols ought be as comprehensive possible; manufacturing environments must be kept under control (for example no spillage should occur while) workers trained well in the skills required to prevent collapse in a potentially-dangerous situation.

Expansion in Agrochemical and Specialty Chemical Sectors

As the global agricultural sector aspires to more bountiful yields and better weed control, this is expected to promote market breakthroughs in this aspect. Another reason driving forward expansion of the market is linked with steadily growing investment in research and development pertaining eco-friendly agricultural chemicals anywhere from Japan or Europe to China or South America.

And thus, while manufacturers invest in technologies that reduce the environment’s irritation burden-as well reducing their own costs-more people will be able to afford them.

Between 2020 and 2024, the market continued to grow steadily, driven by applications in the agrochemical and pharmaceutical fields. Regulatory scrutiny and environmental concerns, however, brought about a halt to large-scale expansion.

However, companies were able to put in place compliance measures, enhance safety standards for production lines, and investigate substitutive synthetic routes in order to meet increasingly strict regulatory requirements of the industry.

Looking ahead: for the period 2025 to 2035, market growth will be influenced by advances in synthetic chemistry; greater use of AI in chemical manufacturing; and the drive for sustainability. AI-driven predictive modelling, block chain-based supply-chain tracking and automated quality control systems will raise operational efficiency and transparency. In addition, the incorporation of circular economy principles-chemical recycling/waste minimization-will be the next stage in market development.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Tighter safety and environmental regulations |

| Technological Advancements | Incremental improvements in synthesis efficiency |

| Industry Adoption | Primarily used in agrochemicals and dyes |

| Supply Chain and Sourcing | Dependence on specific precursors and suppliers |

| Market Competition | Presence of regional manufacturers |

| Market Growth Drivers | Demand for herbicides and specialty chemicals |

| Sustainability and Energy Efficiency | Early-stage adoption of green chemistry |

| Integration of Smart Monitoring | Limited adoption of digital tracking |

| Advancements in Chemical Innovation | Basic synthesis methods and quality control |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Increased use of AI-driven regulatory compliance and green production practices |

| Technological Advancements | AI-driven chemical manufacturing, automation, and predictive analytics |

| Industry Adoption | Expansion into pharmaceuticals, sustainable agriculture, and specialty chemicals |

| Supply Chain and Sourcing | Diversification of supply chains, localized production, and sustainable sourcing |

| Market Competition | Growth of global players leveraging advanced chemical engineering and green chemistry innovations |

| Market Growth Drivers | Increased focus on eco-friendly production, AI-powered efficiency, and regulatory compliance |

| Sustainability and Energy Efficiency | Full-scale implementation of carbon-neutral manufacturing and waste recycling |

| Integration of Smart Monitoring | AI-based quality monitoring, real-time safety compliance, and block chain-enabled transparency |

| Advancements in Chemical Innovation | AI-optimized formulations, sustainable catalysts, and high-efficiency production systems |

This growth is spurred by increasing demand for dinitroaniline from agrochemicals, dyes & also pharmaceutical use. With the expansion of the application scope of herbicides and pesticides in cultivation, the workload becomes incredibly complex.

Responsible for a further uptrend in industry growth is their calling on new synthesis techniques, together with environmentally safe methods of manufacture. The USA government's refusal to let down on either regulated manufacture of chemicals or green agrochemicals assures that whatever line might be imagined in this field, it is not only guaranteed but also certain for commercial armament!

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.6% |

The UK market for 3, 5-dinitroaniline is in a moderate growth phase, because of its use in the production of synthetic dyes, pigments and pharmaceutical intermediates. With new focus on clean chemicals production and the green manufacture of dyes, demand is on the rise.

London and Manchester are rapidly becoming important centres for the production of special chemicals, and regulations that encourage the environmentally responsible manufacturing processes which are needed to meet today's rapidly increasing population are fuelling growth in this sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.0% |

Germany, France and Italy dominate the EU 3, 5-Dinitroaniline market, with high demand coming from agrochemicals, pharmaceuticals and textiles. Environmental rules in the EU have forced chemical manufacturers to use green manufacturing, all of which has led to a wonderful outpouring of innovation in sustainable synthesis.

The large numbers of agribusiness octopuses and special chemical companies in Europe have bolstered the market geographically, animating cross-regional market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.2% |

The market for 3, 5-dinitroaniline in Japan is growing; it is mainly used to produce metal complexes that catalyse polymerization reactions or synthesize pharmaceuticals and some dyes for wool.

Modern R&D technology has made Japan’s leading chemical companies-Mitsui Chemicals and Sumitomo Chemical-invest heavily in high-purity synthesis and sustainable agrochemical solutions. The demand for precision agriculture and high-performance dyes in Japan is further increasing.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.4% |

Increasing use in agrochemicals, dye manufacture and pharmaceuticals has contributed to the growth of the South Korean 3, 5-dinitroaniline market. Demand is on the rise with companies like LG Chem and SK Innovation addressing advanced chemical synthesis.

Both the government of South Korea and South Korean companies are focusing high on eco-friendly production techniques. That is one reason why Seoul in South Korea and Busan are becoming more important centers for chemical R & D.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.5% |

Continually growing demand emerging from the chemical industry and the agricultural sector is shaping the 3, 5- Dinitroaniline market, with high-purity grades (>98%) and mid-purity grades (98%-95%) taking up an immense proportion. These segments are essential in the production of special dyes, pesticides, and herbicides, as various industries are striving to find chemical intermediates that are not only effective, but also of high quality.

High-purity 3, 5-Dinitroaniline (>98%) is a favoured grade for any application with strict quality requirements, especially in high-performance dyes and advanced agrochemical formulations. This grade is increasingly popular among manufacturers as a means to improve the efficiency of dye synthesis, bringing better than ever colour constancy and reactivity.

Across textiles, leather, and plastics, customer demand for personalized dyeing solutions is driving an uptick in high-purity compound sales. Meanwhile, purity above 98% is essential for guaranteeing formulation stability in agrochemical production, as one of the essential components of high-end pesticides and herbicides.

Mid-purity 3, 5-Dinitroaniline (98%-95%) remains a powerful force in the market, especially for industrial-grade dyes and large-scale pesticide production. This kind of product combines cost effectiveness with performance, making it the choice for markets sensitive to costs such as those in Asia-Pacific and Latin America. Up with an expanding production capability, manufacturers long in demand from industrial scale to mid-range purity as an approach to megaton chemicals is required.

The segment's significance in large-scale herbicide formulation is evident, with wide applications across commercial farming and the resulting industries of pest control.

The rising evolution that is required internationally agrochemicals must pursue sustainability. As part of this trend, research has furthermore been intensified on how to use mid-purity 3, 5-Dinitroaniline in eco-friendly formulations. Advanced chemical processing techniques certify that its quality suits even middle standards; so that the compound is now legally marketable in North America and Europe.

AI powered quality assurance technology in the production of high-and mid-purity 3, 5-Dinitroaniline has also cycled markets. Automated purification systems, once expensive and complex, with diametrically opposite effects on such matters as formulation uniformity or batch consistency: these lead to advanced filtration techniques; real time chemical monitoring.

Although high-purity and middle-purity fields both gain purity advantages, have expanding uses in industry and can be actively traded for instant profit, production is hindered in terms of cost and regulatory compliance. However incorporation of block chain based supply chain transparency in the second half 2020 clouds chemical database management systems, AI technologies for purity optimization all help free market development from these restrictions.

The 3, 5-Dinitroaniline market is majorly driven by dye's manufacturing and pesticide production application segments. These two applications represent an increasing share of global consumption as industries move toward high-performance chemical intermediates.

3, 5-Dinitroaniline is an important intermediate in the manufacture of high-performance azo and disperse dyes in the dyes manufacturing industry. These dyes find ubiquitous application over coloration of textile, leather, and plastic systems where strong resistant toward environmental degradation and bright colour is required.

The demand for customized and specialty dyes are booming, resulting in innovation, as manufacturers use 3,5-dinitroaniline to manufacture more durable and fade-resistant colorant. The efficiency of dye formulation with 3, 5-Dinitroaniline was further boosted by advanced dye production techniques including AI-controlled pigment optimization and automated chemical amalgamation.

In addition, expanding eco-friendly dyeing solutions bolstered market growth in dyes manufacturing, as chemical producers concentrate on decreasing wastewater pollution and limiting toxic by-outputs. 3, 5-Dinitroaniline bio-based, hybrid dye formulations have been investigated for increased adoption in sustainable fashion and eco-friendly sectors.

Production of pesticides is another important segment as 3, 5-Dinitroaniline is an important precursor in the preparation of selective and broad-spectrum pesticides. Increasingly, integrated pest management strategies have given rise to better targeted pesticides formulations, where stability, solubility and efficacy are key. As being used in global agriculture continues to change, there is increasing demand for high-performance pesticide ingredients that provide better crop protection and lower environmental impact.

In addition, the global shift toward biologically-based and target-pesticides is leading to research of optimized 3, 5-Dinitroaniline formulations. Recently developed nanotechnology-based pesticide delivering systems are capable of improving target behaviour in the release of their components while minimizing chemical leakage and toxicity issues.

Both dyes and pesticide applications represent significant market opportunities, but they also entail risks, including regulatory limitations, price volatility, and supply chain constraints. Yet, the rising technology of automated compliance tracking, "AI-driven formulation customization", and block chain-based supply chain verification is emerging as a pragmatic approach to ease the market expansion and ensure global sustainability in the business world.

The growing demand for 3, 5-Dinitroaniline in numerous industrial applications, such as those in the dye, agrochemical, and pharmaceutical sectors, is also expected to offer ample growth opportunities for the global 3, 5-Dinitroaniline market during the forecast period.

Primary drivers of market growth include advancements in chemical synthesis, improved regulatory compliance, and increased investments in sustainable modes of production.

Businesses in this vertical are using advancements like AI-powered quality assurance, risk mitigation, and block chain-based supply chain management to improve efficiency, maintain compliance, and build market credibility. It is composed of global chemical manufacturers, specialty chemical providers, and research-based companies specializing in high-purity formulations and green production processes.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| BASF SE | 20-25% |

| Lanxess AG | 15-20% |

| Eastman Chemical Company | 10-15% |

| Merck KGaA | 8-12% |

| Tokyo Chemical Industry (TCI) | 5-10% |

| Other Manufacturers (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| BASF SE | Synthesized in an eco-friendly method and made sure its quality by AI. |

| Lanxess AG | Producing specialty chemicals, such as 3, 5-Dinitroaniline, emphasizing sustainable production technologies. |

| Eastman Chemical Company | Suppliers of advanced nitro compounds for specialty dyes and agrochemicals, providing a block chain-based model of supply chain tracking. |

| Merck KGaA | We offers high purity 3, 5-Dinitroaniline with extensive quality assurance processes. |

| Tokyo Chemical Industry (TCI) | Focus is on high purity organic compounds for pharmaceutical and Chemical applications |

Key Company Insights

BASF SE (20-25%)

BASF SE dominates the 3, 5-Dinitroaniline market with cutting-edge production facilities, AI-driven chemical formulation monitoring, and robust global distribution networks.

Lanxess AG (15-20%)

Lanxess focuses on environmentally sustainable synthesis techniques, reducing hazardous by products while maintaining high-purity standards.

Eastman Chemical Company (10-15%)

Integrating digital supply chain tracking and quality assurance, Eastman Chemical enhances market reliability and efficiency.

Merck KGaA (8-12%)

Specializing in research and industrial applications, Merck provides high-quality 3, 5-Dinitroaniline for pharmaceutical and chemical sectors.

Tokyo Chemical Industry (5-10%)

TCI emphasizes small-batch, high-purity synthesis for specialized research and industrial applications.

Emerging players and independent manufacturers are driving innovations such as AI-powered chemical synthesis, greener production techniques, and enhanced material purity for various industrial applications. These companies include:

The overall market size for the 3, 5-Dinitroaniline Market was USD 108 billion in 2025.

The 3, 5-Dinitroaniline Market is expected to reach USD 225 billion in 2035.

The demand will be driven by increasing applications in the chemical industry, growing demand for agricultural chemicals, advancements in synthetic processes, rising industrial use, and expanding research and development initiatives.

The top five countries driving the development of the 3, 5-Dinitroaniline Market are the USA, UK, European Union, Japan, and South Korea.

The 3, 5-Dinitroaniline Market is expected to grow at a CAGR of 7.8% during the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

3,3-Dimethylacrylic Acid Methyl Ester Market Size and Share Forecast Outlook 2025 to 2035

2-Ethyl-3,4-ethylenedioxythiophene Market Size and Share Forecast Outlook 2025 to 2035

4-Propyl-1,3,2-dioxathiolane 2,2-dioxid Market Size and Share Forecast Outlook 2025 to 2035

5G Solid State Switches Market Size and Share Forecast Outlook 2025 to 2035

5G Gain Block Amplifier Market Size and Share Forecast Outlook 2025 to 2035

5G Driver Amplifier Market Size and Share Forecast Outlook 2025 to 2035

5G Millimeter Wave RF Transceiver Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

5G in Healthcare Market Analysis Size and Share Forecast Outlook 2025 to 2035

5G Temperature-Compensated Crystal Oscillator (TCXO) Market Size and Share Forecast Outlook 2025 to 2035

5G Remote Surgery System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

5G Telemedicine Platform Market Size and Share Forecast Outlook 2025 to 2035

5G Industrial IOT Market Size and Share Forecast Outlook 2025 to 2035

5G IoT Market Size and Share Forecast Outlook 2025 to 2035

5G in Defense Market Size and Share Forecast Outlook 2025 to 2035

5Th Wheel Hitches Market Size and Share Forecast Outlook 2025 to 2035

5G Enterprise Private Network Market Size and Share Forecast Outlook 2025 to 2035

5G Edge Cloud Network and Services Market Size and Share Forecast Outlook 2025 to 2035

5G Automotive Grade Product Market Size and Share Forecast Outlook 2025 to 2035

5G Enterprise Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA