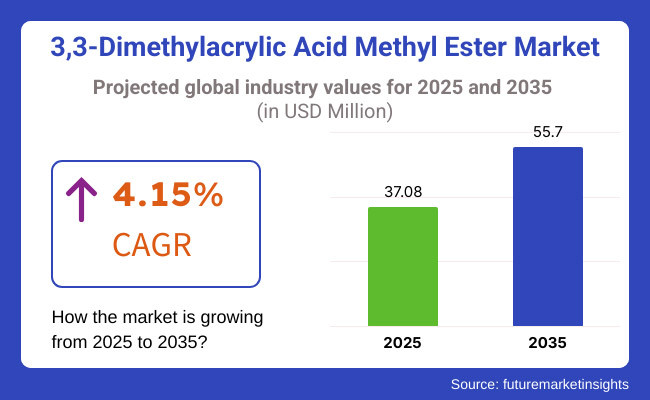

The 3,3-Dimethylacrylic Acid Methyl Ester market is likely to grow at 4.15% CAGR from USD 37.08 million in 2025 to USD 55.70 million in 2035. 3, 3-dimethylacrylic Acid Methyl Ester is a major building block for organic synthesis and is present in abundance because of its characteristics such as strong reactivity, stability, and versatile chemical properties.

The increasing applications of green chemistry and high-purity pharmaceutical synthesis are poised to generate new opportunities for the industry. Regulatory agencies are increasingly focusing on the green and bio-based synthesis pathways, pushing companies toward the implementation of low-emission production methods for compliance with environmental regulations.

One of the leading consumers of this compound is the pharmaceutical sector which consumes it mainly in the production of active pharmaceutical ingredients (APIs), specialty drugs, and complex medical compounds. Besides, the agrochemical business also has a considerable contribution to rising sales, for example, the chemical building block is employed in the formulation of fungicides, herbicides, and plant growth regulators that work together to protect crops and increase agricultural production.

The industry growth also faces challenges like the price fluctuations of raw materials and strict regulatory compliance. The volatility in the petroleum-derived chemicals sector and the availability of specialized feedstocks causes a burden to the manufacturers while the disruption in supply chains and geopolitical factors affect production costs as well.

Despite these challenges, the specialty chemical and pharmaceutical industries offer opportunities for enormous growth in which the need for ultra-pure intermediates is constantly on the rise. Also, the growth of the polymer and coatings industries, especially high-performance adhesives, composite materials, and environment-friendly coatings, is expected to aid in the product demand. The automotive, aerospace, and manufacturing sectors are progressively interested in utilizing composite materials that have a better ratio of strength-to-weight, which in turn helps the industry to flourish.

Explore FMI!

Book a free demo

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Compliance with chemical safety regulations such as REACH and EPA guidelines | Stricter environmental policies and increasing demand for sustainable and green chemistry solutions. |

| Improvements in synthesis processes and production efficiency | Adoption of AI-driven chemical modeling and greener production methodologies. |

| The demand was high from agrochemicals, pharmaceuticals and coating industry. | Expansion into new uses in sustainable agriculture, bio-based chemicals, and innovative materials. |

| Preliminary attempts to lessen trash production and its effects on the environment. | Incorporating environmentally friendly and biodegradable substitutes into manufacturing procedures. |

| Growing industrial need and expanding chemical synthesis applications | Increased R&D spending for creative uses and environmentally sustainable product creation. |

Between 2020 and 2024, the 3, 3-dimethylacrylic acid methyl ester market experienced consistent growth, fueled most notably by growing demand for this ester within the pharmaceuticals and agrochemical industries. Growth in pharma research, as well as the creation of active pharmaceutical ingredients (APIs), was an important factor boosting industry growth.

The agrochemical industry also experienced higher acceptance of this ester within formulations of pesticides and herbicides, particularly as agricultural production globally expanded to address issues of food security. Yet, supply chain interruption due to the COVID-19 pandemic in 2020 and 2021 led temporarily to disruptions in production and distribution, affecting raw material supply and pricing. From 2023 and 2024, the industry rebounded on the back of developments in chemical synthesis technologies and higher investment in high-purity specialty chemicals.

From 2025 to 2035, the industry will tend toward sustainability, regulatory issues, and sophisticated applications. With tighter environmental laws on chemical production, businesses will have to switch to cleaner production methods to lower emissions and waste. The pharma industry will remain a key driver of demand, but with increased emphasis on precision medicine and high-performance intermediates.

Moreover, the increasing biotechnology and specialty chemicals sectors could provide new application opportunities for 3,3-Dimethylacrylic Acid Methyl Ester in novel drug products and polymer science. The process optimization and advancements in catalytic synthesis will further be important to enhance cost-effectiveness and scale up production.

3,3-Dimethylacrylic acid is not a mainstream chemical-it has limited applications in pharmaceuticals, agrochemicals, and specialty syntheses. Market volatility is high - any slump in major end-use sectors or a transition to alternative chemicals could severely contract demand. On the other hand, new applications can lead to unexpected spikes. The market is small, and depending on some large-customers carries risks when losing a contract can some have drastic effect on producers.

Their production and transport is governed by strict environmental and safety rules. OSHA, REACH, and other frameworks require revenue to be invested in emission controls and waste treatment. Increased costs may result from changes to the classification as a hazardous and toxic chemical substances. Specific strict GMP and purity regulations apply if used in pharmaceuticals or food applications. There were also regulatory problems with end-use products, such as a banned pesticide or a failed drug, which could indirectly affect demand.

While manufacturing requires specific precursors - often derived from petrochemicals - it is vulnerable to fluctuations in the price of oil. With few global suppliers, disruptions of any kind - geopolitical, logistical or plant outages - can result in shortages. Producers reliant on individual buyers have unstable revenue and smaller manufacturers have difficulties in achieving economies of scale, which makes cost control difficult.

An interim pricing model that is predominantly cost-plus; it factors raw materials, process yields, and compliance costs. Common human-like style flexibility: High unit costs, low production volumes, and few economies of scale Sales tend to be under long-term contracts at fixed or index-linked prices. Some producers introduce penetration pricing, providing an attractive rate, or favorable payment terms to enter the new market.

Price depends on quality variations, as pharmaceutical-grade (≥99% purity) is ensued the utmost price, and then followed by industrial-grade (≥97% purity). High-throughput sellers are able to negotiate lower price-per-unit costs, while lab-scale quantities are sold at much higher prices. High purity markets have additional documentation, batch consistency in addition to regulatory support which further supports higher margins.

While a niche product, pricing can vary with supply-demand shifts. A price surge can occur with the failure of even one producer; while new, low-cost entrants, especially China or India, can drive prices down. Because buyers watch alternative suppliers for price benchmarks, you get negotiation driven pricing - not market rates.

Pricing depends on long-term relationships; repeat customers generally get better rates. Producers gain differentiation through value added services like custom formulations, consignment stock, and JIT supply. In a tight market, incumbents may offer discounts in the short term in order to retain important clients. Regulatory changes, patent expirations and new synthesis methods also influence pricing strategies.

3,3-dimethylacrylic acid methyl ester with purity of >98% is used extensively because of its high chemical stability, reactivity, and applicability in a wide range of industrial applications. Its high purity guarantees very low impurities, and thus it is a choice in precision-oriented industries like pharmaceuticals, agrochemicals, and specialty chemicals.

In the pharmaceutical sector, this compound is an important intermediate in the synthesis of active pharmaceutical ingredients (APIs), where high purity levels are required to satisfy regulatory and quality requirements. Its application in drug development and formulation renders it indispensable to researchers and manufacturers.

3,3-dimethylacrylic acid methyl ester is widely utilized in pharmaceutical applications because of its status as a pivotal intermediate in the production of active pharmaceutical ingredients (APIs). Its molecular composition makes it a catalyst in fundamental chemical reactions, thus making it a vital building block in drug synthesis. The enhanced reactivity and selectivity of this ester facilitate the synthesis of complicated pharmaceutical drugs with stringent structural needs, promoting maximum efficacy and negligible side effects in final drug formulations.

Another key factor for its application is its high purity (>98%), which is essential in drug applications. Lower-purity variants or contaminants may jeopardize the safety and efficacy of drugs, resulting in regulatory issues and potential health hazards. The strict quality requirements in the pharmaceutical industry require highly pure intermediates to achieve Good Manufacturing Practice (GMP) standards and regulatory approvals by agencies such as the FDA and EMA.

| Country/Region | CAGR (2025 to 2035) |

|---|---|

| USA | 3.8% |

| UK | 4% |

| China | 4.8% |

| Japan | 3.7% |

| European Union | 4.1% |

The USA industry growth is mainly due to the product’s wide use in pharmaceuticals, specialty chemicals, and polymer synthesis. The compound is prominently used in conjunction with the advanced drug formulations to act as an intermediate agent. Increasing research in active pharmaceutical ingredients (APIs) is boosting demand, particularly for drug synthesis and formulation. FMI is of the opinion that the USA 3,3- dimethylacrylic acid methyl ester market is set to grow at 3.8% CAGR during the study period.

The primary factors propelling the UK industry's consistent expansion are expanding applications in biotechnology, innovative materials, and pharmaceuticals. The pharmaceutical sector is a significant force, and the country is a key hub for research on the creation and formulation of pharmaceuticals. The rising demand for specialized chemical intermediates in novel drug synthesis is propelling the industry forward. FMI is of the opinion that the UK industry is set to grow at 4.0% CAGR during the study period.

The European Union industry is characterized by a rise of equipment and machinery used in industrial processes and also strengthening of environmental regulations that are promoting the development of sustainable chemistry. The chemical sector of the region emphasizes shifting to environmentally friendly production methods with the European Commission's Green Deal that promotes the sustainability initiative in many sectors.

This contributes significantly to the industry of 3,3-dimethylacrylic acid methyl ester, which is being impacted as companies look to reduce their carbon footprint. FMI is of the opinion that the European Union industry is set to grow at 4.1% CAGR during the study period.

The industry in China is growing owing to its well-developed, low-cost manufacturing capabilities, rapid industrialization, and profitable investments in research and development. The innovation of the Chinese chemical sector is growing at a super-high speed, with solid government support for investment in the special and high-performance chemicals. FMI is of the opinion that the Chinese industry is set to grow at 4.8% CAGR during the study period.

Japan is the place where engineering chemistry, precision manufacturing, and the introduction of sustainable production go together. Additionally, the country has a well-established pharmaceutical industry. This is, in fact, the basis for the development of the advanced materials and the eco-friendly chemical technologies. FMI is of the opinion that the Japanese market is set to grow at 3.7% CAGR during the study period.

Key players account for more than 45% share in the 3,3-dimethylacrylic acid methyl ester industry. Companies like WeylChem International GmbH, Qingdao Bangli Chemical Co., Ltd., and Shandong Xinhua Pharma, for example, are the main producers and the production is predominantly managed by contract manufacturing organizations (CMOs).

As per FMI analysis, East Asia and North America are the main regions for production and consumption, with the >98% pure product segment making up 85-90% of the industry. Chemical reagent applications dominate consumption, totaling for 65% of global production. The industry is showing moderate concentration which implies the possibility for new entrants and existing players to expand their footprint as long as the demand keeps rising.

The 3,3-dimethylacrylic acid methyl ester market is moderately consolidated, with key players holding about 45% of the industry share. Companies such as WeylChem International GmbH, Qingdao Bangli Chemical Co., Ltd., as well as Shandong Xinhua Pharmaceutical Co., Ltd. significantly influence the competitive structure. Major companies explore expansion of the production facility or optimization of production processes to satisfy the growing demand from agriculture, pharmaceuticals, and specialty chemicals.

Many are utilizing an on-demand production approach instead, ensuring that the combined needs of customers across many industrial applications are being met. Regional markets like East Asia and North America hold a paramount importance in the industry. While East Asia is quickly modernizing, North America is a center for innovation and regulatory alterations. These factors are responsible for changes in the industry dynamics.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| WeylChem International GmbH | 12-15% |

| Qingdao Bangli Chemical Co., Ltd. | 10-12% |

| Shandong Xinhua Pharmaceutical Co. Ltd. | 8-10% |

| Synerzine, Inc. | 6-8% |

| Aurora Fine Chemicals | 5-7% |

| Other Companies (combined) | 45-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| WeylChem International GmbH | Specializes in fine chemicals, intermediates, and customized solutions for industrial applications. |

| Qingdao Bangli Chemical Co., Ltd. | Focuses on large-scale manufacturing of specialty chemicals and agricultural intermediates. |

| Shandong Xinhua Pharmaceutical Co. Ltd. | Develops and supplies pharmaceutical intermediates and industrial chemicals. |

| Synerzine, Inc. | Engages in high-purity chemical production for specialty applications. |

| Aurora Fine Chemicals | Offers advanced chemical solutions with a focus on research-driven innovation. |

Key Company Insights

WeylChem International GmbH (12-15%)

WeylChem is one of the front runners in the arena of fine chemicals and specialty intermediates on a global scale. It concentrates primarily on custom synthesis, contract manufacturing, as well as innovation-driven chemical solutions.

Qingdao Bangli Chemical Co., Ltd. (10-12%)

Qingdao Bangli specializes in large-scale specializing production of specialty chemicals and intermediates for industrial applications. The company has been continually expanding its manufacturing facilities in response to industry demands.

Shandong Xinhua Pharmaceutical Co. Ltd. (8-10%)

Shandong Xinhua is one of the key forces in pharmaceuticals and industrial chemicals. It seeks to invest into quality control and research, spread its presence strategically through investments and partnerships to meet worldwide needs of clients.

Synerzine, Inc. (6-8%)

Synerzine manufactures high purity chemical solutions, targeting in particular pharmaceuticals, cosmetics and specialty applications. The company puts great emphasis on regulatory compliance and product development.

Aurora Fine Chemicals (5-7%)

Aurora Fine Chemicals offers innovative research-based chemical solutions for biotechnology, pharmaceutical, and industrial markets.

The market is poised to be worth USD 37.08 million in 2025.

The market is anticipated to be worth USD 55.70 million by 2035.

Some of the key players include Weylchem International GmbH, TCI Chemicals India Pvt. Ltd., Synerzine, Inc., Aurora Fine Chemicals, Qingdao Bangli Chemical Co., Ltd., Gansu Zeyou New Materials Co., Ltd., Shandong Xinhua Pharmaceutical Co. Ltd., Innopharm Chem, HANGZHOU LONGSHINE BIO-TECH CO., LTD, Spectrum Chemical Mfg. Corp., Hefei TNJ Chemical Industry Co., Ltd., Vortex Product Limited, Hunan Huateng Pharmaceutical Co., Ltd., and Dayang Chem (Hangzhou) Co., Ltd.

Products of purity >98% are widely used.

China is slated to be a key growth hub for the market at a rate of 4.8% CAGR during the study period.

Based on purity, the industry is classified as < 98% and > 98%.

By application, the industry is divided into pharmaceuticals, chemical reagent, flavoring agent and others.

By region industry is classified into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

Aluminum Phosphide Market Growth - Trends & Forecast 2025 to 2035

Magnesium Metal Market Report - Demand, Growth & Industry Outlook 2025 to 2035

LATAM Road Marking Paint & Coating Market Analysis by Material Type, Marking Type, Sales Channel, and Region Forecast Through 2035

Refinery and Petrochemical Filtration Market Analysis by Filter Type, Application, End-User and Region 2025 to 2035

Plastic Market Growth Analysis by Product, Application, End Use, and Region 2025 to 2035

Industrial Oxygen Market Report - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.