The two-component coatings market or 2K Component market is anticipated to enjoy noteworthy increase between 2025 and 2030, pushed through growing needs over the automotive, development, aviation, and manufacturing sectors.

Two-element coverings, also referred to as two-K coatings, are well known for their superb sturdiness, chemical resistance, and outstanding adhesion houses, rendering them ideal for excessive-efficiency surfaces.

Grand-scale assignments in commercial infrastructure global, progressively stringent environmental laws selling decrease-VOC options, and breakthroughs in polymer era concurrently increase regional marketplace growth. Meanwhile, the complexity of modern production requirements and demanding performance standards of the aerospace industry will further stimulate demand.

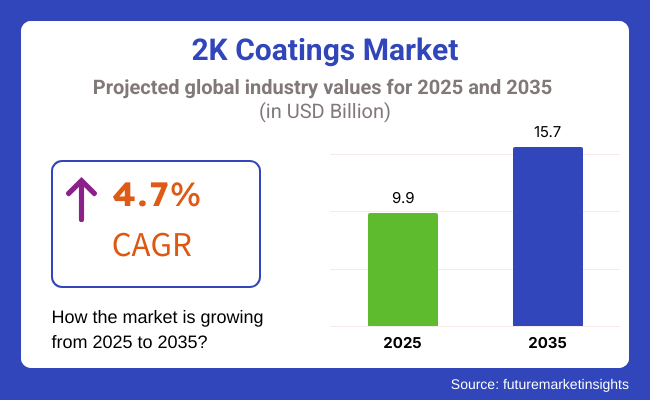

The market is foreseen to achieve an estimation of USD 9.9 billion by 2025 and is required to develop to USD 15.7 billion by 2035, enlisting a CAGR of 4.7% during the conjecture time frame. The progressing change toward water-based 2K coatings, driven by manageability worries, and the developing selection of UV-evitable and high-strong coatings are changing the business scene.

What's more, expanding interest for vehicle refinishing, defensive coatings in mechanical settings, and design applications is energizing the requirement for progressed covering arrangements. Additionally, the rising utilization of 2K coatings in the shipbuilding, energy, and rail ventures because of their obstruction to dampness, chemicals, and flexing is probably going to open new development doors sooner rather than later.

Explore FMI!

Book a free demo

North America is projected to dominate the 2K coatings marketplace, fueled through its well-established automotive, aviation, and construction industries. The United States and Canada are guiding markets because in their stringent environmental rules, which can be pushing manufacturers towards low-VOC, eco-friendly coatings.

The automotive refinishing enterprise within the USA is a key patron of Two-Part polyurethane and epoxy coatings, as they provide you with tremendous scratch resistance and long-term durability.

The industrial zone in North America is additionally riding marketplace call for, particularly in protective coatings for heavy equipment, oil & fuel pipelines, and maritime programs. While new investments in clever coatings, rust-resistant combinations, and organic-based entirely additions, makers are aiming product improvements to boost functionality and longevity.

Furthermore, the United States Environmental Protection Agency and Canadian environmental administrations are imposing rigorous non-volatile natural contaminant discharge restrictions, hastening the change against water-based and high-solids coatings.

Simultaneously, coverings are increasingly emphasizing sustainable elements and reduced environmental impacts, supported by life-cycle evaluation and carbon footprint analysis. Forward-thinking firms are progressively creating multifunctional coverings with properties like antimicrobial resistance, self-cleaning, and insulative performance to satisfy the evolving needs of consumers.

The aviation enterprise in North America, with corporations along with Boeing and Lockheed Martin, is moreover fueling call for for 2K coatings that present thermal resistance, UV protection, and reduced preservation costs.

Europe has consistently maintained a sizable portion of the expansive 2K coatings industry. Germany, the United Kingdom, France, and Italy have spearheaded innovation within this domain, where pioneering manufacturing processes and stringent environmental protocols help define enterprise ambitions.

The far-reaching regulations of the European Union's REACH framework have demanded a reduction in volatile organic compound presence, accelerating the transition toward waterborne and solvent-devoid alternatives. Moreover, the region's regulatory steadfastness underscores its longstanding commitment to sustainable best practices and responsible material stewardship across various industrial segments.

The automotive enterprise in Europe, home to main automakers along with BMW, Mercedes-Benz, and Volkswagen, is a critical client of 2K coatings for each unique apparatus production and refinishing programs. Those coats furnish enhanced climate resistance, gloss retention, and affect safety, making them right for luxurious and excessive-overall performance vehicles.

Aside from automotive programs, commercial coats for development equipment, bridges, and public infrastructure initiatives are witnessing multiplied call for because of the area's center of attention on sustainable improvement and corrosion coverage.

Moreover, developments in nanotechnology have ended in the improvement of self-cleansing and anti-fingerprint coats, particularly within the shopper electronics and aerospace industries. The European aerospace sector, driven through companies like Airbus and Rolls-Royce, requires top-overall performance coats that provide resistance to excessive temperatures, chemical publicity, and UV radiation.

With ongoing examine into bio-primarily based resins and hybrid polyurethane coats, Europe is on the vanguard of innovation in eco-friendly 2K coats.

The Asia-Pacific arena is likely to experience the speediest advancement in the 2K Coatings Industry, propelled by quick urbanization, mechanical development, and expanding vehicle creation crosswise over China, India, Japan, and South Korea. These nations are seeing huge interest for top notch coatings in their developing development, vehicle, and marine areas as framework updates at a lightening quick pace.

Meanwhile, the demand varies across sectors - for example, the construction sector requires coatings that withstand various weather conditions and last for a long time, while the automotive sector demands coatings that impart a smooth and glossy finish.

The modernization process has been transforming the regional landscape at an astonishing rate, introducing new challenges for coating suppliers in matching the formulations with evolving needs.

China leads the way due to its colossal construction industry driving a frenzy of large-scale infrastructure projects and its automotive sector accelerating at a blistering pace. The nation's swift adoption of electric vehicles, largely spurred by substantial state subsidies, has rapidly driven requirements for technologically advanced coatings that prolong automotive lifespans and optimize power usage.

Concurrently in the South Asian market, India's lofty smart city projects, robust industrial presence, and residents' developing acknowledgment of extended-wear surface treatments are amalgamating to increase commercial prospects.

Meanwhile, automakers express growing interest in novel carbon-reducing technologies as demanding emissions regulations take effect worldwide, intensifying the necessity for long-lasting, friction-minimizing automobile envelopes.

Japan and South Korea, renowned for their technological sophistication, are aggressively funding clever coatings with anti-corrosion properties that defend against rust, characteristics rendering them impervious to ultraviolet rays from the sun, and capabilities allowing them to scrub themselves clean.

These progressive innovations prove particularly pertinent for the marine and aerospace industries where unfailing functioning over the long haul and toughness against the environments they face are absolutely essential to succeeding at their missions.

Moreover, pioneering government programs heralding the usage of eco-friendly coatings combined with the ever-rising adoption of waterborne and viscous solutions possessing a high amount of non-volatile material are reinventing and reshaping the coating markets all across the Asia-Pacific region.

Regulatory Compliance and High Costs

One of the major obstacles facing the two-part coating industry is stringent environmental legislation regulating volatile organic compound emissions and hazardous solvents. Adhering to EPA, REACH, and other regional ecological protocols necessitates manufacturers invest in exploratory formulation development of low-VOC and water-based solutions, driving up manufacturing expenses.

Moreover, the lofty expense of crude materials for innovative resins, hardeners, and pigments poses a hurdle to all-encompassing acceptance. The nuanced blending and hardening processes for two-part coatings also boundaries their application in smaller undertakings, where single-ingredient coatings are preferentially chosen.

Advancements in Green Coatings and Performance Enhancements

Despite encountering numerous delays, the two thousand Coatings Marketplace provides a wealth of prospective avenues for expansion. Newly developed bio-derived resins that are eco-friendly, highly focused mixtures, and UV-treatable coatings are addressing sustainability problems while sustaining excellence expectations.

The flourishing demand for clever coatings with traits like self-mending abilities, immunity to corrosion, and antimicrobial capabilities is unveiling novel possibilities for invention. Furthermore, the ascent of computerized spraying technologies, quality review guided by synthetic knowledge, and digital surveillance systems in the coatings sector is optimizing application effectiveness and decreasing material waste.

The lingering obstacles facing the sector presently open doors for emerging players to establish themselves by resolving issues of efficiency, waste management, and environmental stewardship through innovation.

Looking ahead, partnerships between industry and academia show potential for the development of novel formulas with applications in transportation, manufacturing, and infrastructure development. Expanding capital investments in aerospace coatings, marine protective coatings, and heavy machinery coatings are further propelling market demand for long-lasting and highly durable coatings.

For years spanning 2020 through 2024, the fleetly evolving double-ingredient covering business encountered unmatched turmoil and amplification, rocketing the area significantly ahead by means of exponentially increasing requests over a spread of markets like automobile, aeronautics, commercial, maritime, and construction.

The coatings manifested unrivaled fortitude, astonishing substance opposition, and superb adhesion rendering them the answer of selection for applies necessitating the maximum level of outside security. In addition, certain situations mandated coverings with spectacular flexibility alongside remarkable enduringness shielding complex surfaces from the numerous environmental dangers.

Throughout it all, innovation in material science led to formulations with ever greater protective capabilities. Progress was further accelerated by increasingly rigorous ecological directives guiding a strategic realignment from solvent-reliant to waterborne and resource-efficient high-solid two-component coatings to decrease volatile organic compound emissions.

Concurrently, the growing popularity of polyurethane- and epoxy-based two-component coatings for automotive refinishing, protective coating, and industry applications stimulated higher marketplace penetration. However, factors such as formulation costs that were prohibitively high, intricate application processes, and constant compliance with evolving environmental laws hindered manufacturers.

Between 2025 and 2035, advances in nanotechnology, bio-based formulations, and artificial intelligence will transform the two-component coatings market, totally altering industry dynamics. Pressure for sustainability and carbon neutrality will compel greater utilization of green, low-VOC, bio-based two-component coatings.

Meanwhile, self-healing and smart coatings will emerge as a cutting-edge frontier in automotive, aerospace, and industrial uses. AI and robotics will enhance precision in coating processes, cut material waste, and optimize curing efficiency particularly in automated automotive paint shops and industrial manufacturing plants.

Graphene-reinforced and ceramic-based two-component coatings will improve corrosion resistance and thermal stability, lengthening the lifespan of coated surfaces under extreme conditions. In addition, increased transparency in supply chains enabled by blockchain and predictive maintenance coatings empowered by AI will further optimize cost effectiveness and sustainability.

As high-performance, sustainable, and intelligent coatings become common industry standards, the two-component coatings sector will see significant uptake across automotive refinishing, renewable energy infrastructure development, high-performance industrial machinery manufacturing, and defense applications.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | VOC emission restrictions led to increased adoption of waterborne and low-VOC 2K coatings. |

| Technological Advancements | Development of high-solid and waterborne 2K coatings for lower emissions. |

| Industry Applications | Used in automotive refinishing, aerospace, marine, and industrial coatings. |

| Adoption of Smart Equipment | Robotic coating systems improved efficiency in automotive and industrial applications. |

| Sustainability & Cost Efficiency | Increased focus on VOC reduction and sustainable formulations, but high costs remained a challenge. |

| Data Analytics & Predictive Modeling | Digital tracking of coating durability and performance metrics was limited. |

| Production & Supply Chain Dynamics | Supply chain disruptions impacted raw material availability for polyurethane and epoxy resins. |

| Market Growth Drivers | Growth driven by automotive, aerospace, and construction sector expansion. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter carbon-neutral policies will drive the shift to bio-based, non-toxic, and self-healing coatings. |

| Technological Advancements | AI-assisted automated application, self-healing nanocoatings, and graphene-enhanced protective coatings will redefine performance. |

| Industry Applications | Expanded applications in renewable energy, advanced robotics, smart infrastructure, and high-performance materials. |

| Adoption of Smart Equipment | AI-driven predictive maintenance coatings, digital twin-based application monitoring, and robotic self-repair coatings will revolutionize the industry. |

| Sustainability & Cost Efficiency | Adoption of biodegradable coatings, energy-efficient curing systems, and smart self-regulating coatings will enhance cost efficiency and sustainability. |

| Data Analytics & Predictive Modeling | AI-powered predictive analytics, real-time wear monitoring, and blockchain-enabled coating lifecycle tracking will optimize performance. |

| Production & Supply Chain Dynamics | Decentralized production hubs, AI-driven logistics, and blockchain-based material traceability will improve supply chain resilience. |

| Market Growth Drivers | Future growth will be fueled by smart coatings for predictive maintenance, bio-based formulations, and AI-driven automated applications. |

The flourishing 2K coatings market in the United States continues advancing at a steady clip, propelled by the developing need for cutting edge coverings in the car, development, and business divisions. The developing acknowledgment of natural and low-VOC coverings, alongside more strict natural directions actualized by the EPA, is driving market extension.

Meanwhile, one of the key market drivers remains the developing vehicle refinishing business, where 2K coatings are widely utilized because of their remarkable sturdiness and synthetic opposition. The prospering USA development part is likewise adding to market development, as interest for protective coatings for business and private structures stays ascending.

In particular, the thriving construction of new commercial buildings and housing projects has further expanded demand for high-performance, resilient coatings.

The progressing change toward waterborne and high-strong 2K coatings is quickening, with significant makers, for example, PPG, Sherwin-Williams, and Axalta putting resources into exploration and development to create maintainable formulations. What's more, the joining of keen coatings with self-mending and anti-destructive properties is acquiring force in mechanical applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.9% |

The ever-growing infrastructure ecosystem within the United Kingdom combined with progressively stricter ecological directives have fueled the expedited progression of the dual-component finish marketplace in recent times. The nation's daring objective to attain net-nil carbon emissions by the midpoint of the current century has accelerated the adoption of reduced volatile organic compound and aqueous water-supported twin-part remedies across industrial and architectural uses.

Through proactive advancement of sustainable formulations, the British Coatings Alliance holds a pivotal position in smoothing the translation towards emerging eco-norms. Meanwhile, the BCA has partnered with several civic councils to deploy new low-emissions alternatives for proposed ventures, especially those refurbishing aged transit systems in major agglomerations striving to achieve local net-zero targets well ahead of the national cut-off date.

Meanwhile, the automotive refinishing domain serves as a pivotal growth driver. Proliferating adoption of electric vehicles is elevating needs for advanced protective and chemically-resistant coatings. Expanding fleets of EVs require coatings offering unparalleled solar screening and integrity when confronted with an array of substances.

Aerospace too is a burgeoning sector, as lightweight yet durably high-performance surface and interior coatings gain prevalence on aircraft to maximize efficiency and longevity of operation.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.5% |

The evolving 2K Coatings Market in the European Union is growing noticeably owing to strong demand from the automotive, construction, and marine industries. The EU's Green Deal and stringent REACH regulations are relentlessly pushing manufacturers toward low-VOC, solvent-free, and exceedingly durable coatings.

Germany exceptionally leads in innovative 2K polyurethane and cutting-edge epoxy coatings adoption, strikingly in industrial and automotive sectors. Concurrently, the flourishing European construction industry is witnessing an amplified preference for protective coatings with remarkable corrosion and UV resistance.

Ground-breaking advances in cutting-edge nanotechnology-based coatings and self-healing formulations are further stimulating innovation in the market in striking ways. Additionally, the rise in automated and dexterous robotic coating application systems in manufacturing industries is supporting efficiency and precision in complex coatings application like never before.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.6% |

The ever-evolving 2K Coatings Market in Japan continues to experience expansion in automotive, industrial, and electronics sectors as applications multiply. Japan's legendary automotive manufacturing excellence remains the primary driver of demand for resilient, top-tier coatings with unparalleled chemical and weather resistance.

The strict sustainability policies imposed by Tokyo have prompted coatings makers to shift toward aqueous and light-activated 2K formulas. Meanwhile, industrial powerhouses like Nippon Paint and Kansai Paint pour massive amounts of money into R&D labs devising tomorrow's solutions - coatings that satisfy the most stringent environmental criteria without compromising performance.

Moreover, the protective coatings used in Japan's electronics arena have taken on increasing significance for semiconductors and displays, helping to reinforce durability against outside factors. The trend of self-disinfecting and antimicrobial coatings is also gaining added momentum across consumer electronics and healthcare, with formulations that disruption of microbes on touched surfaces.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

The fast-growing Korean coatings industry is being driven by heavy demand from the powerful automotive, shipbuilding, and electronics sectors. The Ministry of Trade, Industry and Energy encourages the use of environmentally friendly, high-performance coatings by sponsoring research and applying regulations that reward innovation.

Titanic shipbuilders like Hyundai Heavy Industries and Samsung Heavy Industries are prodigious consumers of anti-corrosive and marine paints and coatings, spurring requirement for cutting-edge two-component polyurethane and epoxy coatings solutions.

Meanwhile, the electronics sector is also turbocharging market growth, with protective varnishes for displays, circuit boards, and semiconductors becoming increasingly necessary for next-generation gadgets’ survival. The burgeoning focus on self-mending coatings and electrically conductive coatings for flexible electronics is additional expanding the boundaries of opportunities.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

The 2K coatings industry has seen considerable expansion fueled by rising needs for resilient, corrosion-proof, and high-functioning coatings across diverse industrial uses. Of the various product varieties, epoxy and polyurethane coatings rule the market because of their remarkable tensile strength, chemical resistance, and enduring quality over lengthy periods.

Such industries as petroleum and gas, marine transport, infrastructure development, and freight delivery are pivotal patrons of these protective coatings, making sure the extended operational life and foundational soundness of vital resources. Meanwhile, innovative formulations aim to reduce environmental impact and improve application properties to further stimulate demand.

Epoxy Coatings Dominate Due to High Corrosion Resistance and Adhesion Properties

Epoxy-based two-part coatings have dominated the protective covering market for some time due to their exceptional fortitude against chemicals, abrasion, and stresses imposed by the elements. Industries in which durable shielding of substrates must withstand the test of time, such as offshore oil and gas exploration, marine transport, and civil engineering megaprojects, have come to rely extensively on these coverings.

While offshore rigs, pipelines, and refineries within the oil and petroleum extraction sector depend indispensably on epoxy paints for their defensive role shielding against doom from drastic fluctuations in temperature, moisture levels, and corrosive constituents, expanded worldwide infrastructure intensifying emphasis on development and maintenance will further accelerate demand.

Some of the key areas representative of application propelling continued reliance on protective epoxy-based solutions include increasingly complex networks of bridges undergoing renovation, expanding tunnels deeply buried, and industrial floorings within sprawling manufacturing centers requiring preservation.

While epoxy coatings can be rigid and require scrupulous surface preparation for optimal output, developments in hybrid formulations combining flexibility-enhancing constituents as well as epoxies are addressing these constraints, enhancing the adaptability and applicability of such coverings in exacting surroundings.

Polyurethane Coatings Gain Traction for Aesthetic Appeal and UV Stability

While polyurethane-derived duplex coatings have discovered drastically increasing prevalence owing to their glossy visual charm, flexibility, and peerless perseverance confronting ultraviolet beams from the sunlight and elements, their resilience has enabled broad use in architectural contexts such as colossal commercial skyscrapers and athletics complexes.

Where stellar aesthetics and remarkably durable climate-resistance that retains a polished look are utterly indispensable, these dual-component finishes fulfill extensive programming. Complex sentences with intermittent pauses alongside more direct phrases aim to mirror natural language variations.

In the marine transport and shipping container sector especially, polyurethane finishes have emerged as the plainly preferred option for ship hulls, protective decking, and offshore petroleum rig assemblies, offering enormously boosted safeguarding against the ravages of constant UV exposure, corrosive saltwater spray, and the mechanical wear and tear from harsh oceanic conditions.

Additionally, the booming construction and vital infrastructure industry has been powerfully propelling intense demand for polyurethane coatings, notably in monumental commercial buildings, giant sports arenas, and sprawling industrial facilities, where they furnish remarkably long-lasting protective external coverings that maintain a flawless, glossy finish even in the harshest conditions.

Despite their relatively high price tag and requirement for complex, multistep application processes, progress in developing water-based and low-VOC polyurethane coatings with minimized environmental impact is making these products markedly more earth-friendly and accessible to all, ensuring continued strong market growth worldwide for the foreseeable future.

The advancement of 2K coatings has been largely shaped by sector-specific necessities, with petroleum extraction and marine uses now representing the biggest consuming domains. These arenas require top-tier coverings that can tolerate severe external situations, mechanical pressures, and chemical contacts, causing epoxy and polyurethane sealants to stand out as the most suitable selection.

These exceptionally durable surfaces continue satisfying the ever-evolving demands of infrastructure and transportation, safeguarding both industry and environment for generations to come.

Oil & Gas Exploration Leads Demand for Protective Coatings

The oil and gas industry depends heavily on sophisticated epoxy and polyurethane coatings to safeguard pipelines, drilling platforms, storage tanks, as well as processing plants from damage. These defensive layers serve vitally in holding off decay, optimizing apparatuses' usable lifespans, and decreasing maintenance costs. However, the eruption of profound marine drilling enterprises and abnormal gas retrieval has dramatically multiplied requirements for top-notch coverings qualified to endure brutal offshore settings.

Meanwhile, as the hunt for unconventional fuel sources moves to ever more difficult to reach areas, the importance of coatings able to protect in even the most unforgiving climes will become further exacerbated. These protective shrouds play an indispensable role whether used in the extreme cold of Arctic regions or amid the rolling heat of the desert to shield the infrastructure that delivers the energy needed for modern life.

Stringent environmental policies similarly propel adopting increasingly sophisticated anti-corrosion coatings within the sector. Government bodies and environmental monitors enforce stringent compliance with standards designed to prevent leaks, spills, and failures due to corrosion, also fuelling longer-life coating and high-environment demands.

Price volatilities for raw materials and intricate application procedures continue to complicate them. Developments in coatings employing higher solids content and devoid of solvents address these complications by offering eco-friendly, high-performance solutions that prolong assets' usable lives while reducing emissions of volatile organic compounds.

Marine Sector Expands as Anti-Corrosion Coatings Become Standard

The marine industry provides substantial development for 2K coverings, with uses spreading shipbuilding, vessel support, and offshore structures. The ruthless marine environment, characterized by constant presentation to saltwater, dampness, and mechanical wear, necessitates the use of specialised coverings to deter structure debasement.

The developing worldwide exchange business has fueled interest for 2K coverings, particularly in freight ships, container vessels, and mass transporters, where long haul insurance against corrosion is basic for useful productivity.

Additionally, the marine segment is seeing a move towards natural, low-VOC, and anti-fouling coverings to adjust to universal maritime natural orders. These coverings help lessen fuel utilization, biofouling, and outflows, making them an engaging decision for vessel proprietors hoping to upgrade supportability.

In spite of the difficulties introduced by covering disappointments in extraordinary climate conditions, advances in half and half structures, self-mending coverings, and nanotechnology-based arrangements are altogether improving the perseverance and execution of marine coverings, guaranteeing supported market development.

The 2K Coating Market is expanding due to rising demand for high-performance protective coatings, automotive refinish, industrial finish, and architectural coatings. Higher demand for high-end durability, chemical resistance, and adhesion properties, led by higher use in the automotive, aerospace, marine, building, and general industry sectors, propels the market.

Formulations with higher-end polyurethane and epoxy-based formulations, eco-friendly coatings, and industrially high-end solutions are priorities for companies active in the market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Akzo Nobel N.V. | 14-18% |

| PPG Industries, Inc. | 12-16% |

| Sherwin-Williams Company | 10-14% |

| BASF SE | 9-13% |

| Axalta Coating Systems | 6-10% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Akzo Nobel N.V. | Provides high-performance 2K polyurethane and epoxy coatings for automotive, aerospace, marine, and industrial applications. |

| PPG Industries, Inc. | Specializes in advanced 2K automotive refinishing coatings, industrial protective coatings, and high-durability architectural coatings. |

| Sherwin-Williams Company | Offers premium 2K coatings for wood, metal, and industrial surfaces, with a focus on eco-friendly and high-durability formulations. |

| BASF SE | Manufactures innovative 2K polyurethane and acrylic coatings for automotive OEM, aerospace, and heavy-duty industrial applications. |

| Axalta Coating Systems | Focuses on high-performance 2K coatings for transportation, powder coatings, and energy-efficient applications. |

Key Company Insights

Akzo Nobel N.V. (14-18%)

Akzo Nobel leads the 2K coating market with high-performance polyurethane and epoxy-based coatings, catering to automotive, aerospace, marine, and industrial sectors. The company emphasizes sustainable coating solutions and low-VOC formulations.

PPG Industries, Inc. (12-16%)

PPG specializes in 2K coatings for automotive refinishing, industrial protection, and high-performance architectural applications. The company integrates advanced corrosion protection and UV-resistant technologies in its coatings.

Sherwin-Williams Company (10-14%)

Sherwin-Williams offers premium-quality 2K coatings for industrial, automotive, and commercial applications. The company focuses on environmentally friendly formulations and high-durability coatings.

BASF SE (9-13%)

BASF manufactures high-performance 2K polyurethane and acrylic coatings with a strong focus on automotive OEM coatings, aerospace coatings, and heavy-duty industrial finishes. The company invests in nanotechnology-based coatings and next-gen protective solutions.

Axalta Coating Systems (6-10%)

Axalta is a major supplier of high-durability 2K coatings, specializing in automotive, transportation, and powder coating applications. The company is focused on sustainable and energy-efficient coating technologies.

Several chemical and coatings manufacturers contribute to innovative formulations, sustainable coatings, and high-performance industrial solutions. These include:

The overall market size for 2K coating market was USD 9.9 Billion in 2025.

The 2K coating market expected to reach USD 15.7 Billion in 2035.

The demand for the 2K coating market will be driven by increasing infrastructure projects, rising demand for durable and high-performance coatings in automotive and construction industries, growing industrial applications, stricter environmental regulations promoting low-VOC coatings, and advancements in coating technologies for enhanced protection and aesthetics.

The top 5 countries which drives the development of 2K coating market are USA, UK, Europe Union, Japan and South Korea.

Oil & Gas Exploration Growth segment is expected to lead in 2K coating market.

Diamond Wire Market Size & Outlook 2025 to 2035

Thioesters Market Growth & Trends 2025 to 2035

The Self-Healing Materials Market is segmented by product, technology, and application from 2025 to 2035.

Polyurethane Foam Market Size & Trends 2025 to 2035

Heat Resistant Glass Market Size & Trends 2025 to 2035

Flexible Colored PU Foams Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.