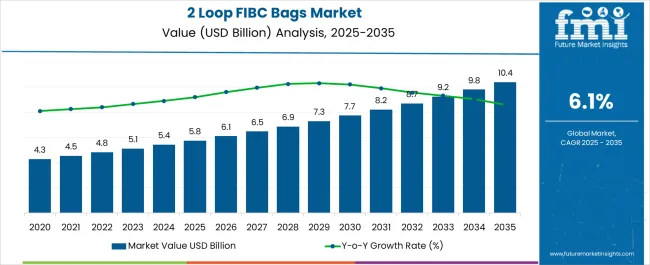

The 2 Loop FIBC Bags Market is estimated to be valued at USD 5.8 billion in 2025 and is projected to reach USD 10.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

| Metric | Value |

|---|---|

| 2 Loop FIBC Bags Market Estimated Value in (2025 E) | USD 5.8 billion |

| 2 Loop FIBC Bags Market Forecast Value in (2035 F) | USD 10.4 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

The 2 loop FIBC bags market is experiencing steady expansion as demand intensifies from agriculture, food processing, and industrial sectors. Current dynamics reflect the growing need for cost-efficient, durable, and flexible bulk packaging solutions that streamline logistics and reduce material handling costs.

Market adoption is being reinforced by improvements in woven polypropylene fabric quality, increased resistance to moisture and contamination, and compliance with international safety standards. Future outlook remains favorable as rising global trade in bulk commodities, combined with accelerated infrastructure development, continues to expand application scope.

Growth rationale is based on the superior load-bearing capacity, reusability, and adaptability of 2 loop FIBC bags, which have positioned them as a preferred packaging choice for high-volume storage and transportation Investments in automated manufacturing, customization of designs for sector-specific needs, and enhanced sustainability through recyclable materials are expected to further strengthen long-term adoption and ensure consistent revenue generation across both developed and emerging economies.

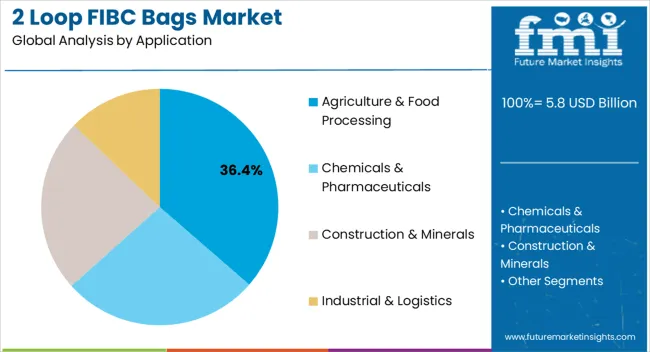

The agriculture and food processing segment, holding 36.4% of the application category, has emerged as the dominant area of adoption due to the critical requirement for efficient bulk handling of grains, seeds, and food-grade products. Demand has been supported by the segment’s ability to ensure protection against contamination, simplify logistics, and provide cost advantages in large-scale operations.

Regulatory compliance for safe food handling and increasing export activities have further reinforced adoption. Ongoing modernization of agricultural supply chains, coupled with rising demand for packaged food, is expected to strengthen this segment’s contribution.

Sustainability initiatives focusing on reusable and recyclable bag formats are also enhancing its growth prospects.

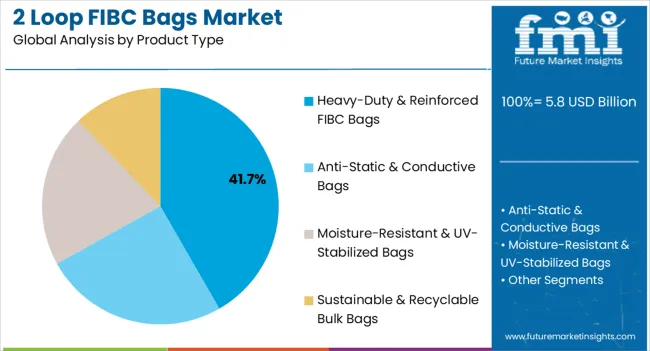

The heavy-duty and reinforced FIBC bags segment, representing 41.7% of the product type category, has maintained leadership due to its superior load-bearing capacity and ability to withstand harsh handling conditions. Market preference has been sustained by the reliability these bags provide in transporting high-density and heavy bulk products across long distances.

Advances in fabric technology, combined with precision weaving and reinforcement techniques, have enhanced product durability and safety compliance. Industrial end-users have increasingly relied on these bags for transporting construction materials, chemicals, and other heavy goods, ensuring consistent demand.

Future growth is expected to be supported by the expansion of global supply chains and the growing need for robust, high-performance packaging solutions.

The global demand for 2 loop FIBC bags increased at a CAGR of 2.0% during the forecast period between 2020 and 2025, reaching a total of USD 10.4 billion in 2035. According to Future Market Insights, a market research and competitive intelligence provider, the 2 loop FIBC bags market was valued at USD 5.8 billion in 2025.

The rise of e-commerce and online retail has significantly transformed the way products are bought and sold, leading to a surge in demand for efficient and reliable packaging solutions for bulk products. 2 Loop FIBC bags have emerged as a valuable solution in the e-commerce and logistics sectors due to their ability to address the unique challenges of these industries.

In the e-commerce landscape, efficient utilization of warehouse space is crucial. 2 Loop FIBC bags offer a space-efficient packaging solution that allows for better stacking and storage compared to individual or smaller packages. The efficiency enables warehouses to maximize their storage capacity and better organize products, facilitating streamlined order fulfillment processes.

E-commerce platforms often deal with bulk orders or large quantities of products that need to be transported from distribution centers to end customers. 2 Loop FIBC bags provide a convenient way to package and transport bulk items, reducing the need for excessive packaging materials and minimizing the number of shipments required.

Ensuring that products remain secure and intact during transit is a critical concern in e-commerce and logistics. 2 Loop FIBC bags are designed with reinforced loops that enable easy lifting and handling using machinery, while the bag's sturdy construction helps protect the contents from damage, moisture, and contamination during transportation.

Advanced Manufacturing Technologies is Likely to be Beneficial for Market Growth

Advanced manufacturing technologies are playing a crucial role in revolutionizing the production and design of 2 Loop FIBC bags. The innovations are driving the development of bags that offer superior strength, durability, and operational efficiency, addressing the evolving needs of various industries.

Traditional sewing methods used in bag construction have given way to more advanced stitching techniques. High-quality stitching, often utilizing computer-controlled sewing machines, ensures that seams are tightly sealed and resistant to stress and load. The technology enhances the overall structural integrity of the bags, making them capable of withstanding heavy loads without seam failure.

Advanced heat-sealing and welding technologies are increasingly being employed to create strong and secure seams in 2 Loop FIBC bags. The techniques involve the fusion of bag materials using heat and pressure, resulting in leak-proof and durable seams that can withstand rigorous handling and transportation.

Advanced manufacturing has paved the way for the use of innovative materials in 2 Loop FIBC bag production. High-strength woven fabrics, coated materials, and laminates are being employed to enhance the bags' resistance to abrasion, tearing, and puncture. The materials contribute to the overall ruggedness and longevity of the bags.

Global Trade Expansion to Fuel the Market Growth

Global trade expansion has led to an increased demand for packaging solutions that can effectively and efficiently transport bulk goods across borders and regions. In this context, 2 Loop FIBC bags have emerged as a versatile and standardized packaging option that aligns well with the demands of international trade.

One of the key advantages of 2 Loop FIBC bags is their standardized design and dimensions. The uniformity ensures consistency in packaging and handling procedures, making it easier for manufacturers, exporters, and importers to manage and transport goods across different countries and supply chains. The standardized nature of these bags simplifies logistics and reduces potential complications that could arise from varying packaging methods.

Global trade often involves large volumes of goods being transported over long distances. 2 Loop FIBC bags offer a cost-efficient solution for bulk packaging, as they can hold substantial quantities of materials while minimizing the need for excess packaging or containers, which reduces transportation costs, optimizes container space, and contributes to overall cost savings in the supply chain.

The nature of international trade exposes goods to a range of environmental conditions during transportation, including humidity, temperature fluctuations, and exposure to the elements. 2 Loop FIBC bags are designed to withstand such conditions, providing a protective barrier that helps preserve the quality and integrity of the packaged goods. The protective feature is particularly crucial for goods that are sensitive to moisture or other environmental factors.

By packaging type, bottles segment is estimated to be the leading segment at a CAGR of 2.9% during the forecast period. Bottles are commonly used to package liquids and semi-liquids, including beverages, chemicals, pharmaceuticals, and industrial fluids. The products often need to be transported and stored in bulk quantities, and 2 Loop FIBC bags provide an efficient and secure solution for handling large volumes of bottled liquids. The bags can accommodate multiple bottles, providing a safe and organized way to transport and store bottled products.

Bottles, especially glass ones, are susceptible to breakage during transportation and handling. 2 Loop FIBC bags offer a protective layer that reduces the risk of bottle breakage due to impacts or vibrations during transit. The bags' sturdy construction and cushioning properties help safeguard bottled products, minimizing losses and ensuring product integrity.

Bottled liquids are often transported in crates or cartons, which can be bulky and require additional packaging materials. 2 Loop FIBC bags offer a space-efficient alternative, allowing more bottles to be transported in a single bag. The efficient use of space can lead to cost savings in terms of transportation, handling, and storage.

2 Loop FIBC bags are versatile and can accommodate various sizes and shapes of bottles. The adaptability is advantageous for businesses that deal with different bottle dimensions or types of liquids. The bags can be customized to fit the specific requirements of different bottled products, making them a flexible packaging solution.

By application, the pharmaceuticals segment is estimated to be the leading segment at a CAGR of 2.9% during the forecast period. Pharmaceuticals are sensitive products that require stringent handling and protection to ensure their quality and integrity. 2 Loop FIBC bags offer a secure and contamination-free packaging solution for transporting pharmaceuticals in bulk quantities. The bags' design prevents external contaminants from entering and maintains a controlled environment, safeguarding the efficacy of pharmaceutical products.

The pharmaceutical industry is subject to strict regulatory guidelines regarding packaging and transportation. 2 Loop FIBC bags can be customized to meet regulatory requirements, such as tamper-evident closures, labels, and documentation pockets, which ensures that pharmaceuticals are transported in compliance with regulatory standards, reducing the risk of legal and quality-related issues.

Pharmaceuticals often need to be transported between manufacturing facilities, distribution centers, and pharmacies or healthcare institutions. 2 Loop FIBC bags provide an efficient method for handling and distributing pharmaceutical products. They can be easily loaded onto pallets or transport vehicles and offer a standardized packaging solution that simplifies logistics processes.

Pharmaceuticals can be sensitive to environmental factors such as moisture, light, and temperature fluctuations. 2 Loop FIBC bags can be designed with specialized materials, such as moisture-resistant or UV-protective coatings, to provide enhanced protection against these factors, which helps maintain the stability and shelf life of pharmaceutical products.

The rapid growth of e-commerce and online retail in North America has led to increased demand for efficient and cost-effective packaging solutions for bulk goods. 2 Loop FIBC bags offer a practical solution for transporting a wide range of products, including industrial materials, agricultural products, and consumer goods, in a secure and organized manner.

North America is a hub for various industrial and manufacturing activities, including chemicals, construction, and agriculture. 2 Loop FIBC bags are widely used to transport raw materials, ingredients, and finished products within these industries. The bags' durability and capacity make them suitable for bulk handling, contributing to their increased adoption.

The agricultural industry in North America relies heavily on efficient packaging and transportation solutions for crops, seeds, and fertilizers. The bags provide a convenient way to store, transport, and distribute agricultural products, helping to streamline supply chain processes and minimize handling.

The growing emphasis on sustainability and waste reduction has led to increased demand for packaging solutions that support recycling and waste management. The bags are often used to transport recyclable materials, such as plastic, paper, and metal, contributing to efficient waste collection and recycling efforts. The region is expected to hold a CAGR of 2.9% over the analysis period.

Asia Pacific is known for its robust industrial and manufacturing sectors, which require efficient packaging solutions for the transportation of raw materials, intermediate products, and finished goods. 2 Loop FIBC bags provide a cost-effective and convenient means of handling and transporting bulk materials, contributing to the growth of the market.

The region's extensive agricultural activities, including crop cultivation and agribusiness, create a strong demand for packaging solutions for products such as grains, seeds, fertilizers, and agricultural produce. The bags offer a reliable method of packaging and transporting these goods, supporting efficient supply chain operations.

Rapid urbanization and infrastructure development projects in Asia Pacific require the transportation of construction materials, aggregates, and cement. The bags are well-suited for the bulk transportation of these materials, contributing to the growth of the construction sector and the demand for these bags.

The burgeoning e-commerce market in Asia Pacific has led to an increased need for efficient and secure packaging solutions for bulk products. 2 Loop FIBC bags are adopted for their ability to optimize warehousing, handling, and transportation processes, meeting the logistics demands of the e-commerce supply chain. The region is expected to hold a CAGR of 2.8% over the analysis period.

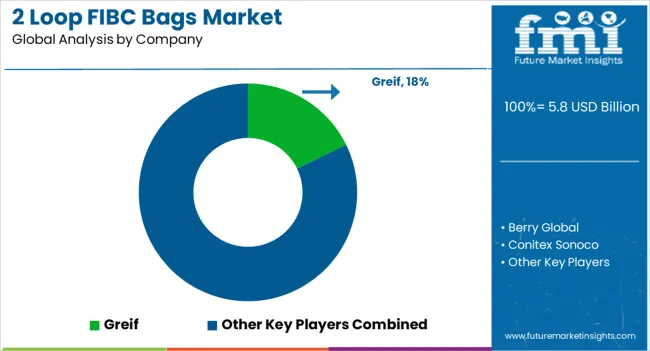

Key players in the 2-loop FIBC bags market are strongly focusing on profit generation from their existing product portfolios along while exploring potential new applications.

The players are emphasizing on increasing their 2 loop FIBC bags production capacities, to cater to the demand from numerous end use industries. Prominent players are also pushing for geographical expansion to decrease the dependency on imported 2 loop FIBC bags.

Recent Developments:

| Attributes | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Expected Value in 2025 | USD 2.68 billion |

| Projected Value in 2035 | USD 3.6 billion |

| Growth Rate | CAGR of 3% from 2025 to 2035 |

| Market Analysis | USD billion for value and Tons for Volume |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia & Pacific; East Asia; Middle East & Africa |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Segments Covered | Size, Packaging Type, Application, Region |

| Key Companies Profiled | Greif; Chuangda Group; Rockleigh Industries; Propex Operating Company LLC; CHK Manufacturing Inc.; Delta Big Bag, LARE FIBC LLC; Rosenflex UK Ltd.; CHK Manufacturing Inc.; Bulk Corp International; TechnoPac GmbH |

| Customization & Pricing | Available upon Request |

The global 2 loop FIBC bags market is estimated to be valued at USD 5.8 billion in 2025.

The market size for the 2 loop FIBC bags market is projected to reach USD 10.4 billion by 2035.

The 2 loop FIBC bags market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in 2 loop FIBC bags market are agriculture & food processing, chemicals & pharmaceuticals, construction & minerals and industrial & logistics.

In terms of product type, heavy-duty & reinforced FIBC bags segment to command 41.7% share in the 2 loop FIBC bags market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breaking Down Market Share in 2 Loop FIBC Bags

2-(4-(Bromomethyl)phenyl)propionic Acid (BMPPA) Market Forecast and Outlook 2025 to 2035

2-tert-Butylcyclohexanol Market Forecast and Outlook 2025 to 2035

2-Fluorobenzotrifluoride Market Forecast and Outlook 2025 to 2035

2-Methoxynaphthalene-1-Boronic Acid Market Forecast and Outlook 2025 to 2035

20MnCr5 Steel Market Size and Share Forecast Outlook 2025 to 2035

2-Ethoxy Propene Market Size and Share Forecast Outlook 2025 to 2035

2-in-1 Material Rack Correction Machine Market Size and Share Forecast Outlook 2025 to 2035

2-Ethyl-3,4-ethylenedioxythiophene Market Size and Share Forecast Outlook 2025 to 2035

2D Barcode Reader Market Size and Share Forecast Outlook 2025 to 2035

2-Methylfuran Market Size and Share Forecast Outlook 2025 to 2035

2K Epoxy Adhesives Market Size and Share Forecast Outlook 2025 to 2035

2D Transition Metal Carbides Nitrides Market Size and Share Forecast Outlook 2025 to 2035

2-Hexyldecanol Market Size and Share Forecast Outlook 2025 to 2035

2-EthylHexyl Acetate Market Size and Share Forecast Outlook 2025 to 2035

2 Piece Cans Market Size and Share Forecast Outlook 2025 to 2035

2 Seal Pouches Market Size and Share Forecast Outlook 2025 to 2035

2-ethylhexanol (2-EH) Market Growth - Trends & Forecast 2025 to 2035

2D Bar Code Marketing Market Analysis by Technology, Code Types, Applications, and Region Through 2035

2-Iodophenol Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA