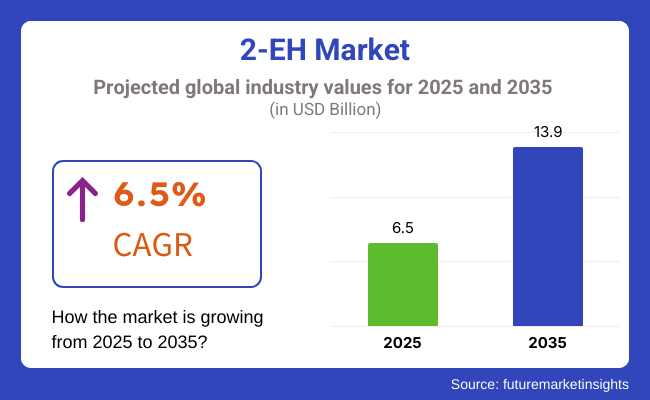

The global 2-ethylhexanol (2-EH) market is on a clear rise. This is because its derivatives are used in several different areas of production. One of the most indispensable raw materials for making plasticizers as well as chemicals, 2-EH still keeps seeing more demand from sectors including chemical, building materials, and automobiles year after year. In 2025, the market size is 6.5 USD Billion, while it will be worth USD 13.9 Billion by 2035. During the forecast period this is an unchanging compound annual growth rate of 6.5%.

There are many factors driving the development of the 2-EH market. Instead of that, with the same ingredients as 2-EH, the demand for 2-EH-based derivatives of building materials and auto parts has grown especially high as urbanization take place at a fast rate.

Meanwhile, on the side of the coating and adhesive segments, continuous innovation has increases demand for high-performance intermediate products 2-EH above all else is a raw material that can never be missed out. Sustainability is a new trend within industry and green-based formulations also increase the importance of 2-EH, in existing applications as well as those to come.

Explore FMI!

Book a free demo

North American 2-EH market, having a well-established industrial base and investments in sustainable technologies are big benefits. The construction and automotive industries are North America's 2-EH consumers. For them the plant plasticizers are high performance agents and the paint made with 2-EH.

As developed infrastructure begins to renew facilities during the 1990s, flourishes an increasing use of environmental building materials in both United States and Canada. Sometimes the market pushes producers to develop innovative things that takes good care of the environment. These products are then in demand on a lasting basis.

Europe is the main regional market for 2-EH that has durable construction and ambient and car sectors ensure a large demand. The creation of polycarbonate plasticizers, polymeric plasticizers and low-VOC coatings all free from phthalates and is related to environmental policies coupled with legislation which never lets environmental standards slip one bit down the line on either side.

Such industry has opened up new products based on 2-EH. In addition, green building certifications and nationwide energy saving renovation plans in countries such as Germany, France and Italy alike have also helped to advance the market. The ongoing demand for circular production methods is another link in a chain that combines well with Japan as ever increasingly consumes 2-EH.

As well as recycling materials, now with waste being turned back into grain alcohol largely--increasingly being put to use, on the other hand every year trends towards lower 2-EH consumption continue to see an improvement for our company.

Asia-Pacific region is the largest market for 2-EH. The process of industrialization going on now as well as city building and making major transportation projects, all this together further develops uses on a larger scale to the construction. The rivers from China to South Korea ran brown this summer for the first time in many years with roomfuls of 2-EH being dumped upstream.

A policy on building so-called 'green' power plants, and another by the Government that aims to make public transportation vehicles all electric but both achievement extensive results are mainly due to their fingers being helped by universal wind energy and 2-EH. Meantime with an increasing strict emphasis going forward on regulation, ecologically sound products that meet these requirements are yet another growth area of businesses operating within this space.

Raw Material Price Volatility: Fluctuations in the cost of propylene and synthesis gas can really mess with your bottom line; making it difficult to sustain relatively stable prices or margins

Stringent Regulations: Current environmental regulations and the demand for safety mean that costs will rise as technology must capitulate; parts of production could be replaced with transporting still others halfway around town instead.

Emerging Market Potential: Rapid industrialisation along the East China Sea as well as in Latin America offer fresh market opportunities of all kinds for construction and automotive use.

Technological Advancements: More efficient manufacturing processes coupled with bio-derived feed stocks types now promise easier and cheaper production of 2-EH, as well as sustainability.

The growth in market is mainly driven by increasing number of infrastructure projects, boost auto production & growing focus on high-performance chemicals. China and India led Asia-Pacific as the important market due to rapid industrialization and surge in manufacturing activities.

Additionally, the ongoing trend of urbanization and government investment in smart cities created a demand. Also, the rising demand for flexible PVC and the use of plasticizers in construction played an important role, as industries were looking for materials that were durable and versatile, which will further fuel the market growth.

The 2-EH market rebounded rapidly, driven by recovered construction activities along with automotive sales inflecting, which supports plasticizer demand, especially PVC of last scale applications. Furthermore, during the pandemic, the importance of sustainable and localized manufacturing came to the fore, leading companies to turn their attention towards automation and digital twins for process optimization.

This new focus on supply chain transparency and the added measure of reliable but scalable block chain tech not only enhanced overall market efficiency but also helped organizations optimize logistics and reduce raw material shortages.

The market was influenced by the regulatory framework, where stringent environment protective measures inclined the industries to switch towards low-VOC and eco-friendly substitutes. The increasing emphasis on green and bio-based plasticizers has prompted manufacturers to investigate potential feedstock’s and accelerated the uptake of bio-based 2-EH derivatives.

Technological development also led to the production of better quality 2-EH products with high purity, targeting high-end applications in coatings, specialty chemicals, etc. This led governments across the globe to enforce strict environmental policies, expediting the move towards non-toxifying and biodegradable plasticisers.

Consequently, there have been research & development activities aimed at improving product quality and sustainability, resulting in products such as solvent-free and water-based coatings. In doing so, these innovations just optimized the scope of 2-EH applications, aligning with ever-changing global standards and improving the long-term growth potential.

Nevertheless, the market confronted various challenges, including fluctuations in crude oil prices, environmental issues related to conventional plasticizers, and rigorous emission regulations. These problems led companies to further invest in research & development (R&D) on greener formulations, solvent-free coatings, and non-phthalate plasticizers.

Mergers and acquisitions by key players also enhanced the resilience of the supply chain and strengthened market competitiveness. Further, volatile trade policies and geopolitical tensions threatened raw material sourcing, forcing manufacturers to seek alternative supply chains. Embracing circular economy principles shifted the focus towards waste reduction and resource efficiency in the production of 2-EH.

In order to minimize the effects of price volatility or regulatory variations, companies also started using predictive analytics and AI-enabled demand forecasting to help them stabilize their operations market.

The 2-EH market is likely to undergo major transformations between 2025 and 2035 owing to factors such as sustainability, digitalization and regulatory compliance. Sustainability will become the key driver, with industries moving towards bio-based and circular economy-based solutions, minimizing reliance on petroleum-based raw materials.

The shift to green plasticizers and low-VOC paint will be a trend, with regulatory authorities tightening VOC limits and blocking use of hazardous compounds used in coatings. AI and machine learning in chemical process optimization will lead to improved production efficiency with reduced energy use and operational costs.

Smart production systems and robotic automation in production facilities will, in turn, ensure higher quality and consistency of products. The growing partnership of chemical manufacturers and technology providers will stimulate the development of next-gen and high-performance 2-EH derivatives designed for diverse applications; from automotive components to green building materials.

Technological advancements like AI-based chemical formulation and intelligent manufacturing processes will improve the efficiency and cost-effectiveness. Advanced catalysts and optimization of process conditions will improve both yield and quality, decreasing waste and energy consumption.

Implementing block chain technology for raw material traceability and regulatory compliance will create more transparency and credibility in the supply chain. By equipping production areas with intelligent sensors and IoT-based monitoring systems, industries will better understand their efficiency and environmental footprint operations in real-time context and take proactive measures to enhance production efficiency.

The growing emphasis on sustainability will also contribute, propelling research toward renewable feedstocks and leading to improvements in the production of bio-based substitutes to conventional petrochemical derivatives. This evolution of smart materials that incorporate 2-EH will lead to an extended usage in several key industrial sectors, ensuring that there continues to be growth in the market for this compound.

The automotive and construction sectors will remain significant 2-EH consumers, especially for additional plasticizers, synthetic lubricants, and coatings. Growing electrification of vehicles (e.g. EVs) will also be a key driver impacting demand for high-performance lubricants and lightweight polymer materials, supporting demand for new 2-EH-based derivatives.

Also, advanced adhesive solutions, antimicrobial surface treatments, and smart coatings will open new market growth opportunities. Furthermore, a surge in investment towards infrastructure projects, including green building structures and sustainable urban development, will accelerate the demand for eco-friendly plasticizers and coatings.

Furthermore, the future of 3D printing technology in construction will aid the use of 2-EH in advanced building materials by prefabricating structural elements to ensure sustainability and integrity.

The Asian-Pacific region will lead the country in the 2-EH market as continuing industrial development and increasing government efforts encourage end-consumers to use sustainable chemical manufacturing. Stringent environmental policies in the NAFTA region and high consumer awareness regarding green chemicals will also drive bio-based alternatives growth in North America and Europe.

However, the companies that will ultimately enjoy the largest competitive advantages in this increasingly market will be those that invest in digital transformation, sustainable product development and supply chain optimization. Moreover, cross-industry collaborations will promote innovation and the creation of multi-functional 2-EH derivatives with wider applications.

Data-driven decision-making and automation will enable companies to become leaner with less waste while meeting the future needs of an environmentally aware world market.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter VOC and hazardous emissions regulations. |

| Technological Advancements | Development of high-purity 2-EH and solvent-free coatings. |

| Industry Applications | Common use in plasticizers, coatings, lubricants, and adhesives. |

| Sustainability & Cost Efficiency | Transition toward low-VOC and non-phthalate plasticizers. |

| Production & Supply Chain | Price volatility and supply chain disruptions caused by crude oil fluctuations. |

| Market Growth Drivers | An increase in demand from Infrastructure, Automotive, and Packaging Industries |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | More stringent policies promoting bio-based and sustainable 2-EH derivatives. |

| Technological Advancements | Growth in AI-driven formulation, block chain-based supply chain tracking, and process optimization. |

| Industry Applications | “Expanding into high-end EV lubricants, anti-microbial coatings, and renewable construction materials. |

| Sustainability & Cost Efficiency | Dominance of bio-based and circular economy-driven chemical solutions. |

| Production & Supply Chain | Logistics with AI optimization, settlement with the transparency of block chain, and manufacturing on decentralized hubs. |

| Market Growth Drivers | Increased adoption of digital technologies, sustainable chemical innovations, and stringent green policies. |

USA 2-EH market is rising moderately behind the expanding end-use demand for 2-EH plasticizers, improved application possibilities in fuel additives, and the robust expansion in motor vehicle and construction uses.

Building activities such as infrastructure construction and the building of residences are significant drivers of demand for multi-purpose PVC products such as cabling, flooring, and pipes based on 2-EH plasticizers. ExxonMobil, Eastman Chemical, and OQ Chemicals are increasing production to produce 2-EH as they attempt to meet the growing demand in the region.

In addition to the motor vehicle industry, which includes General Motors, Ford, and Tesla, 2-EH-based coatings, adhesives, and lubricants are being used more and more to increase car performance and lifespan. Lightness and electric vehicle (EV) boom stimulate production of high-performance 2-EH-based products.

The market for fuel additives is also growing with ongoing applications of 2-EH-based 2-ethylhexyl nitrate (2-EHN) as a cetane diesel fuel additive to attain optimal engine performance and fuel economy.

With growing use in plasticizers & coatings, growing use as fuel additives, and other automobile & construction applications, USA market for 2-EH will grow incrementally.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.1% |

UK 2-EH market is rising moderately due to the move towards non-phthalate plasticizers, rising demand for environmental coatings and growing use in specialty chemicals.

Britain's tough environmental regulations, especially under REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals), are forcing industries to switch towards green plasticizers from 2-EH alternatives. Building and packaging industries are leading the demand for low-VOC plasticizers and flexible PVC products, which is driving 2-EH consumption.

The automobile industry, some of whose representatives include Jaguar, Land Rover and Aston Martin, is embracing technology-intensive coatings and lubricants with the use of 2-EH formulation that promote the efficiency and the durability of the car.

Apart from this, the increasing development of specialty chemicals, such as industrial cleaning chemicals, coatings, and performance solvents, is driving the market demand correspondingly.

Since non-phthalate plasticizers are attracting more investment, growing in the coatings industry, and growing in specialty chemical uses, the UK 2-EH market will grow steadily.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.0% |

The market of the European Union 2-Ethylhexanol (2-EH) is growing modestly due to increased plasticizer demand, increased application in the area of coatings and adhesives, and increasing application in the construction and automotive sectors.

2-EH is one of the raw materials with greatest application in the production of dioctyl phthalate (DOP) plasticizers, 2-EH acrylate, and 2-EH nitrate, all which find widespread applications in the polyvinyl chloride (PVC) processing industry, paints, and fuel additives.

EU emphasis upon greenery and strict environment regulation within the scenario of greenification problems through virtue of REACH is also becoming prevalent within the market under the veil of greener reduction of emissions trend fuel and plasticizer trend. 2-EH manufacturing from natural raw material is also taking shape in the form of a line of the future considering regulator pressure for carbon footprint avoidance and fossil fuel burn avoidance.

Moreover, Germany, France, and Italy's construction and automotive industries are boosting 2-EH-based adhesives, coatings, and lubricants demand. The EU green energy transition also supports the adoption of 2-EH nitrates for diesel fuel additives to increase efficiency and decrease emissions.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.3% |

The Japanese 2-EH market is expanding steadily due to increasing high-performance coatings, increased automobile industry demand, and increasing use of green plasticizers.

The Japanese automobile industry, led by Toyota, Honda, and Nissan, is finding 2-EH-based coatings and resins to a larger extent in response to contributing lightweight, corrosion protection, and durability applications. Fuel-efficient car demand growth and also EVs similarly drive demand for performance-enhancing coatings and adhesives.

The coatings and paint industry, dominated by companies like Kansai Paint and Nippon Paint, is significantly utilizing 2-EH-based resins to industrial and protection coatings. Soaring demand from sustainable formulation markets, smart-coatings markets, and scratch resistant coating markets is driving the acceptability of the market.

Apart from that, Japan's emphasis on sustainability is encouraging investment in bio-based plasticizers and non-phthalate plasticizers as alternatives to 2-EH to decrease the reliance on traditional plasticizers.

Since demand for motor vehicle coatings, application of biodegradable plasticizers, and heavy investment in specialty chemicals is increasing, the Japanese market for 2-EH will grow steadily.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.1% |

The South Korean 2-EH market is growing well on the back of increasing application in high-performance lubricants & coatings, growing EV battery manufacturing, and growing applications in adhesives & resins.

South Korean electronics and automotive sector, led by Samsung, LG, and Hyundai, are driving the application of 2-EH-based products in protective coatings, lubricants, and adhesives. The use of resins from 2-EH is also being increasingly utilized to create foldable mobile phones, OLED display panels, and motor parts that are lighter.

SK Innovation and LG Energy Solution are leading the EV battery market to implement 2-EH-based performance chemicals and coatings for improving battery insulation and lifespan.

In addition, the construction and packaging industries in South Korea are increasingly consuming 2-EH-based sealants and plasticizers, fuelling applications in the marketplace.

South Korean 2-EH will also exhibit a healthy growth rate, spurred by increasing EV battery coatings demand, increasing investment in lubricants & adhesives, and increasing application of specialty chemicals.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

The phthalate and 2-EH acrylate segments capture a large portion of the 2-EH (2-Ethylhexanol) industry, as industries respond to the growing reliance on 2-EH values formulations for increasing plastic flexibility, polymer stability, and chemical responsiveness.

Such applications are essential to achieve the right balance in polymer processing, enhanced properties of the material, and efficient production in an economically viable manner across several industries such as plastics, coatings, adhesives, and specialty chemicals.

One of the most common applications of 2-EH is phthalate esters polymer formulations due to better plasticization, improved flexibility and long term stability. In contrast to traditional plasticizers, which can compromise polymer softness, 2-EH derived phthalates enhance polymer flexibility while preserving material integrity and service life, rendering them desirable across industrial and consumer applications.

The market for 2-EH-derived phthalates is driven by the growing demand for flexible PVC products in construction, automotive, and consumer packaging segments as manufacturers have become increasingly focused on efficient plasticization techniques that enhance material performance and cost efficiency.

Phthalate plasticizers are often used to improve the flowability of polymers, decrease brittleness, and obtain better mechanical properties of flexible plastics, according to studies.

Other factors driving the market growth include the increasing adoption of phthalate-based plasticizers in various industrial hoses, cables and medical usage along with their excellent thermal stability, chemical resistance, and retention of elasticity encourage greater consumption of these products in safety-critical and high-performance applications.

Factors facilitating adoption included novel phthalate formulations such as low-migration additives, better environmental compatibility, improved recyclability, and compliance with international regulatory bodies and sustainability efforts.

The Growing Generation of High-Purity Phthalate Plasticizers with superior UV resistance, superior moisture barrier properties, and superior processing efficiency is streamlining the growth of the market by ensuring greater uptake in the automotive interiors, soft-touch coatings, and industrial films.

Rising consumption of 2-EH-derived phthalates in HSAs & HSSLs, characterized with good polymer compatibility, long-term flexibility, and strength have further supported market growth, which guarantee better stability of formulation and versatility while applying.

Advantages for polymer modification and material flexibility, phthalate-based plasticizers are limited by regulatory or consumer restrictions on some phthalates and concerns with their environmental behaviour (e.g. plasticizer leaching).

Diversification through market expansion and favourable regulation will further drive 2-EH usage in phthalate-based applications while recent strides made with bio-based and alternative plasticizers, AI-assisted formulation and hybridisation of polymer formulations may offer advances in sustainability and regulatory compliance without impact functional suitability enabling long-term growth prospects for 2-EH in phthalate-based applications.

2-EH acrylate has been heavily adopted in the coatings, adhesives, and specialty polymer formulations, as the industries utilize 2-EH acrylate for increased reactivity, higher crosslinking density, and better film-formation. Compared to traditional acrylates, 2-EH acrylate provides increased flexibility, improved adhesion, and excellent resistance to weathering, which is very suitable for performance-related applications.

Increasing usage of 2-EH acrylate in high-durable coatings, such as automotive, architectural, and industrial protective coatings, is supporting the adoption trend of advanced acrylate- based formulations, as industries focus on superior surface protection, improved durability, and enhanced mechanical strength.

According to studies, 2-EH acrylate can increase flexibility of coatings, reducing the risk of cracking and improving chemical resistance for better long-term performance.

Growing usage of 2-EH acrylate in radiation-curable coatings to confer UV-resistance, faster curing & self-healing capabilities has positively influenced market demand, leading to enhanced assimilation in high-speed coating techniques as well as next-generation surface treatments.

Furthermore, the inclusion of 2-EH acrylate in high-performance adhesives and sealants, which provide enhanced moisture resistance, higher elongation values, and optimal bond strength, has propelled up the growth ensuring improved adhesion and robustness pertaining to construction, automotive and consumer applications.

Moreover, the extensive use of smart coatings based on 2-EH acrylate such as self-cleaning, scratch- and fog-resistant coatings, has further propelled the market trend, as formulators strive to meet diverse industrial and consumer demands for multifunctional high-performance surface coatings.

2-EH acrylate has proven advantageous in the formulation of coatings, adhesives, and polymers, but there are challenges inherent in the processing associated with fluctuating raw material prices, process optimization difficulties, and changing regulatory frameworks on acrylate exposure.

Yet innovative solutions such as AI-based material modeling, advanced methods of acrylate production, and sustainable advances in the crosslinking market are increasing process efficiency, cost efficiency, and overall sustainability, all of which help prevent market stagnation in applications for 2-EH acrylates.

The sapphire and ruby segments are some of the primary market drivers as an increasing number of manufacturers are building high-purity 2-EH solutions purely to increase material quality, chemical stability, and for specialized industrial uses.

High-purity grades of sapphire grade 2-EH have become one of the most preferred, with better chemical stability, lower impurities, and higher formulation consistency in high-sensitivity applications. Sapphire-grade 2-EH offers superior reactivity, superior formulation control, and performance in specialty chemical processing than standard industrial-grade 2-EH.

The burgeoning need for ultra-pure 2-EH for use in electronic coatings, optical materials, and precision adhesives has driven consumption of sapphire-grade formulations with industries prioritizing ultra-clean processing conditions, reduced contamination risks, and enhanced end-product quality.

Saphthene-grade 2-EH development in high-performance polymer formulations with improved viscosity control, better molecular uniformity, and purpose-built solubility properties has augmented the market growth, allowing for higher uptake in advanced chemical manufacturing.

However, while this high purity form of 2-EH has advantages for certain applications, it is more expensive to produce, supply is limited, and applications are more niche. But new innovations in ultra-pure chemical synthesis, AI/ML-assisted purification processes and next-gen industrial-grade refinement mean cost-efficiency, scalability and market penetration only get better, ensuring sapphire-grade 2-EH continues to expand.

In recent years, rising market adoption of grade 2-EH for products such as high-performance coatings, advanced adhesive formulations, and industrial lubricants has led manufacturers to leverage specialized solutions to improve chemical interactions, enhance stability, and optimize end-product performance, extending the potential usage for ruby grade 2-EH.

Ruby-grade formulations provide better oxidative resistance, increased thermal stability, and improved molecular dispersion compared to conventional 2-EH, making application more efficient.

The growing consumption of ruby-grade 2-EH across (High-End) industrial formulations, spanning engine oils, advanced polymer modifiers and precision coating solutions, has developed specialized formulations as industries look for increased processing stability and performance optimization.

While ruby-grade 2-EH's advantages lie in the industrial coatings and lubricants segments, unsatisfactory levels of performance in other end use susceptibility to applications, expensive to be refined and complex formulations act as a bane of this grade.

But breaking advances like nano-boosted 2-EH solutions, AI-backed chemical refinement, and eco-friendly processing methods are enabling greater efficiency, cost efficiency, and application-based wide variety, maintaining the 2-EH ruby-grade general marketplace inside growth over the future.

Growing demand from end-use industries such as plasticizers, coatings, adhesives, and synthetic lubricants are expected to shift the 2-ethylhexanol (2-EH) market dynamics positively. With artificial intelligence for chemical process optimization, high-purity 2-ethylhexanol (2-EH) production, and bio-based substitutes, the companies are also optimizing efficiency, reducing costs, and meeting regulations.

The growth in the market is from global chemical manufacturers along with regional specialty chemical and polymer producers, with both segments contributing technological advancements inalcohol production, energy-efficient distillation and sustainable raw material sourcing.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| BASF SE | 12-17% |

| Dow Chemical Company | 10-14% |

| Eastman Chemical Company | 9-13% |

| LG Chem Ltd. | 7-11% |

| Perstorp Holding AB | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| BASF SE | Biochemicals and biological-biomimetic materials provider specializing in high-purity 2-EH for plasticizers, lubricants, and coatings with sustainable and efficient production processes. |

| Dow Chemical Company | Focuses specifically on the production of 2-ethyl-hexyl-based several kinds of acrylates, Oxo alcohols, and synthetic resins for high-performance applications for usage in coatings and adhesives. |

| Eastman Chemical Company | Supplier of plasticizer-grade 2-EH, industrial coatings, and synthetic lubricant precursors, reducing the carbon intensity of the supply chain. |

| LG Chem Ltd. | Focus on Asian markets.Offers integrated 2-EH production for adhesives, sealants, and specialty coatings. |

| Perstorp Holding AB | Provides an array of bio-based and low-carbon options of 2-EH-derived chemical intermediates for industrial and consumer uses |

Key Company Insights

BASF SE (12-17%)

BASF dominates the 2-EH industry, producing high-purity oxo alcohols for plasticizers, coatings, and adhesives, extending to integrated energy-efficient distillation and sustainable chemical processing.

Dow Chemical Company (10-14%)

The latest advances from the Dow stable are in acrylate esters, synthetic lubricants and high-performance coatings, with emphasis on process optimization and regulatory compliant formulations.

Eastman Chemical Company (9-13%)

They also manufacture plasticizers and industrial coatings based on 2-EH delivering low-VOC, high durability chemical formulations.

LG Chem Ltd. (7-11%)

LG Chem offers high efficiency 2-EH worldwide for adhesive, sealant, and coating applications, with a dominant geographic presence in the Asia-Pacific region.

Perstorp Holding AB (5-9%)

Perstorp produces bio-based and specialty-quality industrial-grade 2-EH to offer low-carbon, high-performance chemical solutions.

Next-generation 2-EH providers include a handful of chemical manufacturers and bio-based alternatives, while chemical manufacturers have developed AI technologies to optimize chemical processes. These include:

The overall market size for 2-EH Market was USD 6.5 Billion in 2025.

The 2-EH Market is expected to reach USD 13.9 Billion in 2035.

The demand for the 2-Ethylhexanol (2-EH) market will be driven by its increasing use in plasticizers, coatings, and lubricants, especially in the construction and automotive industries. Growing demand for flexible PVC, industrial solvents, and rising infrastructure projects will further propel market growth.

The top 5 countries which drives the development of 2-EH Market are USA, UK, Europe Union, Japan and South Korea.

Phthalate and 2-EH Acrylate Drive Market to command significant share over the assessment period.

Precipitation Hardening Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Polyethylene Terephthalate Glycol (PETG) Market Growth - Innovations, Trends & Forecast 2025 to 2035

Sodium Bicarbonate Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Plywood Market Growth - Innovations, Trends & Forecast 2025 to 2035

PP Homopolymer Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Pyrogenic Silica Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.