The 2-Acetylthiophene Market is anticipated to expand at a considerable rate between 2025 and 2035 due to the rising use of 2-Acetylthiophene in personal care product manufacturing, agrochemicals and the food and beverage industry.

Due to the increasing expansion of research on heterocyclic compounds, there is a growing need to find 2-Acetylthiophene as a significant precursor in drug synthesis. The burgeoning agrochemical industry also needs this compound to manufacture new pesticides and herbicides.

Manufacturers are increasingly adopting green synthesis methods owing to stringent environment regulations, which is another factor promoting growth of the manufacturing market. 2-Acetylthiophene is increasingly used in aroma chemicals, especially in synthetic flavouring and perfume formulations, and these factors are expected to contribute to the growth of the industry further.

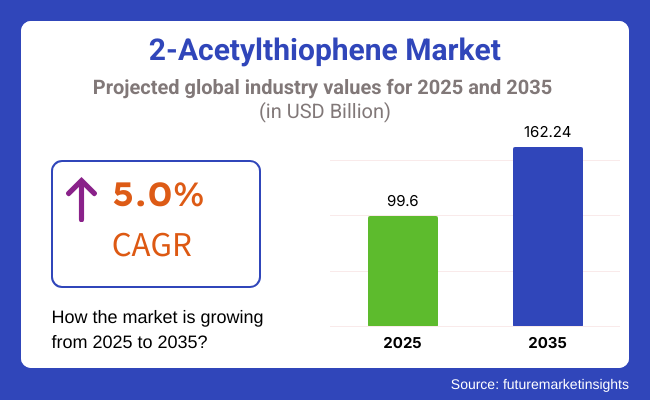

The market is anticipated to be worth USD 99.60 Billion by 2025 and USD 162.24 Billion by 2035, during which the CAGR will continue at 5.0%. Pharmaceutical R&D growth, increased demand for specialty chemicals, and innovation in sustainable production technology are the three most important driving forces of the market.

Explore FMI!

Book a free demo

North America is expected to be a leading region in the 2-Acetylthiophene market, with strong pharmaceutical and agrochemical sectors. Meanwhile, the United States and Canada are investing heavily in the manufacturing of active pharmaceutical ingredient (API), where 2-Acetylthiophene is an important intermediate in drug synthesis.

As per the stringent regulatory oversight by the USA Food and Drug Administration (FDA), there are high-quality standards for pharmaceutical intermediates which compels companies to upgrade the synthesis techniques and advanced purification methods.

These regulatory efforts are encouraging the well-timed innovation of manufacturing high purity 2-Acetylthiophene and increasing its usability in pharmaceutical flux-flow syntheses.

Moreover, the growing emphasis on sustainable chemistry is influencing market trends manufacturers are now increasingly considering bio-based and green synthesis processes to minimize their environmental footprint. Demand from the agrochemical industry is also stimulating due to the application of 2-Acetylthiophene in the formulation of crop protection agents and pesticides.

Moreover, continuous progress in chemical manufacturing is further expected to fortify North America's position in the 2-Acetylthiophene market, where the region will act as a major hub for high-quality specialty chemical production.

Europe will stay accountable for development in specialty chemicals and pharmaceutical through the 2-Acetylthiophene Market. When it comes to production, Germany, France, and the UK are among the leading front-runners, leveraging their extensive development of manufacturing. In addition, expertise in high-purity chemical synthesis is helping these nations develop their ability to manufacture effectively.

A key inductive trend supporting this chemical is its use in the fragrance compositions along with its function as a taste enhancer in food, drinks, &personal care items, which is depicted by the signification of fragrance & flavour industry in the region. Moreover it is being used as a critical intermediate for preparation of active pharmaceutical ingredient (API) in pharmaceutical sector.

2-Acetylthiophene finds a robust and growing market in Europe, where the high standards of chemicals manufacturing and sustainable innovation have created a fertile ground for investment in cutting-edge synthesis technologies and greener production methods.

The highest growth in the 2-Acetylthiophene market will be observed in the Asia-Pacific region owing to the rapid scale of pharmaceutical and agrochemical production in China, India, and Japan. Growing investments across generic drug production, pesticide formulation, and fragrance applications are driving demand, making the region a minor contributor to global supply chains.

2-Acetylthiophene intermediates are primarily manufactured in China, which is the leading supplier and producer of the compound, and such dominance can be attributed to the availability of cheap labour, well-established chemical manufacturing infrastructure, and outstanding export capabilities.

India’s booming pharmaceutical and specialty chemical industries, bolstered by government initiatives such as “Make in India” to foster domestic manufacturing, are also helping to reduce reliance on imports. Japan, with its strong emphasis on precision chemical manufacturing, is prioritizing high-purity synthesis techniques to serve pharmaceutical and aroma industries.

Asia-Pacific leads the way in adopting next-generation manufacturing technologies as well. The region's countries showcase investments in 5G-connected smart manufacturing, AI-based processing of chemicals, and automation to increase production efficiency and quality inspection. This process is leading the region to become a hotspot for sophisticated chemical operations, from planning the supply chain to producing sustainably.

2020 to 2024: Growth Driven by Rising Demand in Pharmaceuticals and Agrochemicals

From 2020 to 2024, the 2-Acetylthiophene industry developed to a steady advance due to its increasing uses in pharmaceuticals, agrochemicals and great concoction amalgamation. Due to its high reactivity and participation in selective synthesis, it is an essential factor in complex pharmaceutical forms.

For example, the agrochemical industry is booming wherein advanced fungicides and insecticides were in considerable demand which has led to the expansion of the market especially in areas where improving agricultural efficiency was a priority. Emerging economies emphasis on enhancing crop yields, and safeguarding crops from emerging pest threats, led to augmenting the use of 2-Acetylthiophene in pesticide formulations. The compound's function in the fragrance and flavour industry gained momentum, where it was employed in the aim of synthesizing aroma chemicals that would eventually flavour items such as food and beverages, or personal care products.

Chemical producers were systematically accelerating through the development of more efficient catalytic processes and the practices of green chemistry. Most with environmentally friendly synthesis methods to establish its sustainability, eliminate hazardous by products, and improve overall yield.

A majority of companies investigated bio-based feedstock or novel reaction pathway to not only reduce dependency on petroleum-derived precursors but also maintain consistency and cost-effectiveness in product quality.

Though the growth trajectory seems positive, the market had its fair share of challenges. Raw material price movement: Prices of raw materials oscillating can affect production costs and the basis price and profit margins as well. Stringent environmental regulations for the disposal of thiophene derivatives forced manufacturers to adopt sustainable waste disposal methods and emissions controlling technologies.

The same challenges of optimizing process safety, ensuring regulatory compliance, and increasing supply chain efficiency persisted for manufacturers and suppliers hoping to achieve success in a changing market.

Moreover, as technology progresses and regulations evolve, the 2-Acetylthiophene industry is likely to adapt, reflecting trends in sustainability, high-purity synthesis and diversified end-use applications.

2025 to 2035: Expansion Fuelled by Green Chemistry, Biotechnology, and Advanced Applications

Sustainability initiatives, biotechnology advances, and the growing role of 2-Acetylthiophene in high-performance materials will transform the 2-Acetylthiophene market. Technologies such as bio-based synthesis routes and catalytic oxidation methods will be in high demand as soon as regulatory agencies are demanding to reduce the ecological footprint of manufactured products.

Thus process innovations that lower hazardous by products, reduce energy consumption, and rely on renewable feedstock can provide a competitive edge for companies looking to become more sustainable without sacrificing product quality.

In the pharmaceutical sector, 2-Acetylthiophene's critical role as an intermediate in the formulation of next-generation drugs will continue to drive demand. As demand for antifungal, antibacterial, and specialty therapeutic drugs increases, pharmaceutical manufacturers will refine synthesis pathways to improve purity, scalability, and regulatory compliance.

The growth in personalized medicine and biopharmaceuticals will create fresh commercial opportunities for thiophene derivatives, considering customized drug formulations necessitate diversified and particularized chemical intermediates.

Demand in the agrochemical space will also remain strong, as the need for high-performing crop protection solutions will only grow as food security worldwide and shifting pest resistance trajectories come to the fore. With a wide range of usage of 2-Acetylthiophene (purity ≥99%) in biotechnological and biochemical applications, it can be used in the synthesis of next-gen fungicides and insecticides as an innovative pesticide formulation to improve the formulation efficacy and stability.

Crop-matching agrochemical and innovation highlights flying farming flying farming has played a role in the rise of hydroponics and surface growing forms, while providing new opportunities for crop-matching, both based on a ground-based version and adapting from the air-based basis and will focus on eco-tiered prevention.

In addition to its conventional uses, it is becoming increasingly noteworthy in the emerging materials field. Researchers are also probing its potential for use in organic electronics, OLED materials and as a high-performance polymer, widening the compound’s potential application realms beyond pharmaceuticals and agrochemicals.

As flexible electronics and lightweight conductive materials continue to grow in interest, thiophene-based compounds are attractive candidates due to their excellent electronic properties for growing technologies. This will not only offer manufacturers new revenue streams but will also energise them in moving away from traditional manufacturing.

Moreover, digitalization and AI-based chemical research will overrule formulation strategies leading to cost-effective and high yield synthesis pathways. Application of AI for molecular modelling and reaction optimization will speed up discovery of efficient synthetic pathways, enhance predictability of reactions, and reduce wastage of resources.

Automation in chemical production will improve process control, giving consistently high quality and lower production cost.

With the evolution of the market, industry players will have to navigate changing regulatory environments, technological innovations, and sustainability pressures. Those manufacturers that adopt green manufacturing processes, invest in research & development for emerging applications, and use digital tools for process enhancement will gain most in the dynamic 2-Acetylthiophene market.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter environmental regulations on thiophene derivatives |

| Technological Advancements | Traditional chemical synthesis and catalytic oxidation techniques |

| Industry Adoption | Pharmaceuticals and agrochemicals dominated market demand |

| Supply Chain Efficiency | Supply chain disruptions and raw material price volatility |

| Market Competition | Major chemical companies led production and distribution |

| Market Growth Drivers | Demand for pharmaceutical intermediates and agrochemical applications |

| Sustainability and Energy Efficiency | Initial efforts in reducing hazardous waste and improving efficiency |

| Raw Material Sourcing | Dependence on petroleum-based precursors for synthesis |

| Automation & Digitalization | Limited AI integration in production processes |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Widespread adoption of green chemistry and bio-based synthesis methods |

| Technological Advancements | AI-optimized synthesis, biotechnological production, and nanotechnology-driven applications |

| Industry Adoption | Expansion into organic electronics, OLEDs, and high-performance polymers |

| Supply Chain Efficiency | Decentralized production hubs, sustainable sourcing, and AI-driven supply chain management |

| Market Competition | Emergence of biotech-driven start-ups and eco-friendly chemical manufacturers |

| Market Growth Drivers | Expansion in organic semiconductors, green synthetic routes, and next-generation APIs |

| Sustainability and Energy Efficiency | Full-scale integration of green chemistry, bio-based production, and carbon-neutral manufacturing |

| Raw Material Sourcing | Shift toward bio-based thiophene derivatives and sustainable feedstock sourcing |

| Automation & Digitalization | AI-powered process optimization, real-time quality monitoring, and automated chemical formulation |

The 2-Acetylthiophene market in the United States is fuelled by high demand from pharmaceutical and agrochemical sectors and ongoing progress in chemical research. This compound is widely utilized by larger pharmaceutical companies as a critical precursor in drug formulations, especially for antimicrobial, anti-inflammatory, and specialty therapeutic uses.

The strong pharmaceutical market in the region, along with high levels of R&D and regulatory compliance, provides a persistent market for high-purity intermediates.

USA regulatory policies are having a similar influence on the growth of the market by promoting the use of eco-friendly methods of chemical production. The EPA and FDA are championing sustainable synthesis techniques that reduce toxic by-products and enhance overall process efficiency.

In addition, Government-backed initiatives to strengthen domestic pharmaceutical manufacture, lessen reliance on imports, and create supply chain resilience provides additional impetus for market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.7% |

The United Kingdom market is also registering considerable growth owing to the country's strong pharmaceutical and agrochemical sectors. This compound is still essential to pharmaceutical companies for active pharmaceutical ingredient (API) synthesis in many antimicrobial and anti-inflammatory drugs, and agrochemical designers include this compound into advanced pesticide formulations.

As an industry in the UK that is subject to increasingly straightened environmental legislation, there has been a significant movement towards sustainable manufacturing, with many companies now investing in both green chemistry and bio catalytic synthesis in a bid to improve their efficiencies and minimise waste.

Furthermore, the increasing need for thiophene-based derivatives in specialty chemicals such as perfumes and high-performance materials continues to drive the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.5% |

The market of 2-Acetylthiophene in European region is growing steadily, driven by growth in pharmaceutical and fine chemical sectors. Research on thiophene derivatives started first in Germany, France and Italy, where they have been used in drug synthesis, high-performance dyes and modern areas of application of organic electronics.

Due to stringent EU legislation like REACH, the use of bio-based chemical synthesis is increased as the manufacturers are persuaded to adopt sustainable methods of production. Moreover, the application of artificial intelligence (AI) as well as automation in the operation of chemical processing helps to optimize the efficiency of synthesis, reduces waste, and improves cost-effectiveness which are some more factors accelerating the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.6% |

The 2-Acetylthiophene market across Japan is nurtured by cutting-edge developments across industries like specialty chemicals and pharmaceuticals. For drug synthesis, leading firms focus on high-purity synthesis to produce pharmaceutical formulations that consistently comply with stringent regulatory standard.

Aside from healthcare, electronics also drives demand, as the company reports increasing use of thiophene derivatives as organic semiconductors in flexible displays and next-generation electronic devices. These initiatives, combined with government-backed R&D initiatives, aim to boost the nation’s competitive advantage in high-performance materials and sustainable production methods enabled by novel chemical synthesis technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

South Korea 2-Acetylthiophene market is growing steadily, with increasing demand in pharmaceutical, agrochemical, and electronic materials sectors. To accommodate these growing global demands, organizations are developing scalable production technologies with the utmost purity for pharmaceutical and crop protection uses.

State-of-the-art methods for chemical processing are relating that trendy product standards with efficiency and lower cost, keeping South Korean products competitive around the world. Meanwhile, the nation's heavy emphasis on high-performance materials and biotechnology enhances innovative capacity, which strategically bolsters market development and access to new opportunities within emerging applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

The demand for 2-acetylthiophene is primarily attributed to the purity (>99%) and purity (99%-95%) segments as various industries are on the lookout for goods with high-quality raw materials for the purpose of synthesizing pharmaceutical products, food supplements, and fat processing.

Purity (>99%) Segment Takes Lead with High-Grade Applications Demand Rise

Pharmaceuticals and specialty chemicals manufacturers prefer the higher uniformity, stability, and compliance with strict regulatory guidelines that 2-acetylthiophene with purity higher than 99% provides. This variant of high purity is used as an important intermediate in APIs and advanced chemical formulations.

2-Acetylthiophene with high purity level is preferred in pharmaceutical and biotechnology industries due to its low level of impurities, better reactivity, and improved formulation property. This is particularly true for drug development research in antifungal and anti-inflammatory compounds. Nevertheless, high production, purification, and quality control costs challenge market players.

Modern crystallization techniques, chromatography purification, and solvent refining are being used to achieve higher levels of efficiency at equally high levels of purity by manufacturing companies.

Spray-dried Purity (99%-95%) Segment Gaining Traction in Food and flavour Industries

The food and flavour industries utilize increasing amounts of 2-acetylthiophene (99% - 95% purity) as a branched sulphur-rich aroma compound to enhance the taste profile of food products, tobacco, and confectionery. Its balance of low cost with a high functional quality makes this segment an excellent choice for high-volume flavour production.

2-acetylthiophene, due to its ability to enrich roasted, nutty and meaty aromas, has witnessed moderate demand due to the increasing natural & synthetic formulations of flavours for various food applications. However, regulatory scrutiny around synthetic additives, competition from bio-based alternatives and consumer demand for clean-label ingredients create challenges.

Strictly regulated, companies are answering the call through sustainable extraction processes, bioengineered flavour enhancers and AI-facilitated compound analysis, meeting rapidly evolving food safety regulations.

Pharmaceutical companies incorporate 2-acetylthiophene into drug synthesis as an important intermediate in antifungal, anti-inflammatory, and central nervous system (CNS) drugs. This compound is used to optimize targeted drug formulation and enhance the efficacy and bioavailability of medicinal compounds.

The growing prevalence of precision medicine and the increased expenditure on R&D have hastened adoption, while needs for tailored active pharmaceutical ingredients (APIs) remain high.

These companies are overcoming regulatory hurdles, high production costs, and supply chain fluctuations using green chemistry principles, AI-assisted compound screening, and block chain-enabled traceability. The manufacturing, compliance, and sustainability improvements have come from these innovations in pharma.

Food industry expands use of white truffles as demand for complex flavours grows

Food product makers are using 2-acetylthiophene in greater amounts to give the roasted, caramelized, and umami qualities of baked goods, tobacco, and dairy products. They create high quality snacks, gourmet seasonings, and plant-based food alternatives that meet changing consumer demand for multi-dimensional taste experiences and authentic sensory elevating enhancements.

Investments emerge in natural synthesis methods and AI-led sensory analysis to overcome challenges presented in relation to perception of synthetic ingredients, changing food additive regulations, and the clean-label movement. Following regulatory-compliant formulation practices, they guarantee the safety of their products and overall competitiveness in the competitive food industry.

The growing need for high-purity compounds in pharmaceuticals, agrochemicals, and fragrance formulations is fuelling the growth of the 2-Acetylthiophene industry. This is one of the factors that is aggressive in synthesis types, quality control, and customized chemical formulations that industries are investing in to make their market share stronger.

As sustainability takes precedence in the industry, green chemistry innovations such as bio-based synthesis and catalytic process optimization are becoming popular. These scalable production technologies affordably meet increasing global demand.

The need for regulatory compliance, notably within the context of pharmaceutical and environmental safety standards, adds another layer of competition for global and specialty chemical producers, which spurs ongoing enhancements in product quality and process efficiency.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| TCI (Tokyo Chemical Industry) | 14-18% |

| Acorn PharmaTech Product | 10-14% |

| Aaron Chemicals LLC | 9-13% |

| Acros Organics | 8-12% |

| Ark Pharm Inc. | 7-11% |

| Hefei Hirisun Pharmatech Co. Ltd | 6-10% |

| Achemo Scientific Limited | 5-9% |

| Arvee Labs | 4-8% |

| A.B. Enterprises | 4-8% |

| Alpha Chemical | 3-7% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| TCI (Tokyo Chemical Industry) | Manufactures high-purity 2-Acetylthiophene for pharmaceutical and agrochemical synthesis, ensuring strict regulatory compliance. |

| Acorn PharmaTech Product | Supplies research-grade and bulk 2-Acetylthiophene for API development and specialty chemical applications. |

| Aaron Chemicals LLC | Focuses on industrial-scale synthesis, providing customized formulations and supply chain solutions. |

| Acros Organics | Distributes lab-grade 2-Acetylthiophene for research and development in drug discovery and material science. |

| Ark Pharm Inc. | Develops advanced intermediates for pharmaceutical applications, integrating green chemistry in production. |

| Hefei Hirisun Pharmatech Co. Ltd | Specializes in high-purity fine chemicals, including 2-Acetylthiophene, for biotech and pharmaceutical industries. |

| Achemo Scientific Limited | Produces specialty chemicals with a focus on sustainable synthesis and high-performance intermediates. |

| Arvee Labs | Supplies bulk 2-Acetylthiophene for fragrance and flavour applications, ensuring compliance with industry standards. |

| A.B. Enterprises | Develops custom chemical solutions, providing high-quality 2-Acetylthiophene for industrial applications. |

| Alpha Chemical | Manufactures pharmaceutical intermediates, leveraging advanced chemical synthesis techniques for scalability. |

Key Company Insights

TCI (Tokyo Chemical Industry) (14-18%)

TCI leads the 2-Acetylthiophene market with high-purity compounds tailored for pharmaceutical and agrochemical applications. The company ensures strict quality control and regulatory compliance, catering to research and commercial production.

Acorn PharmaTech Product (10-14%)

Acorn PharmaTech supplies research-grade and bulk 2-Acetylthiophene for API synthesis and specialty chemical applications. The company enhances its market presence by offering customized formulations.

Aaron Chemicals LLC (9-13%)

Aaron Chemicals scales industrial production, delivering customized 2-Acetylthiophene solutions for large-scale pharmaceutical and chemical manufacturing.

Acros Organics (8-12%)

Acros Organics distributes lab-grade 2-Acetylthiophene for R&D, drug discovery, and material science, supporting innovation in the chemical industry.

Ark Pharm Inc. (7-11%)

Ark Pharm integrates green chemistry principles in manufacturing pharmaceutical intermediates, including high-quality 2-Acetylthiophene for API synthesis.

Hefei Hirisun Pharmatech Co. Ltd (6-10%)

Hefei Hirisun specializes in fine chemicals and biotech intermediates, ensuring high-purity 2-Acetylthiophene for pharmaceutical applications.

Achemo Scientific Limited (5-9%)

Achemo Scientific focuses on sustainable synthesis, producing specialty chemicals and high-performance intermediates to support various industries.

Arvee Labs (4-8%)

Arvee Labs supplies bulk 2-Acetylthiophene for fragrance and flavour applications, complying with industry safety and regulatory standards.

A.B. Enterprises (4-8%)

A.B. Enterprises delivers custom chemical solutions, ensuring high-quality and scalable production for pharmaceutical and industrial needs.

Alpha Chemical (3-7%)

Alpha Chemical manufactures pharmaceutical intermediates, leveraging advanced chemical synthesis for high-purity and scalable 2-Acetylthiophene production.

Smaller manufacturers and specialty chemical companies contribute to advancements in synthesis techniques, quality control, and sustainable production. Notable contributors include:

The overall market size for 2-acetylthiophene market was USD 99.60 Billion in 2025.

The 2-acetylthiophene market expected to reach USD 162.24 Billion in 2035.

The demand for the 2-Acetylthiophene market will be driven by its growing applications in pharmaceutical synthesis, increasing use in agrochemicals, rising demand in fragrance and flavour industries, expanding chemical research activities, and advancements in organic synthesis for specialty chemicals and intermediates.

The top 5 countries which drives the development of 2-acetylthiophene market are USA, UK, Europe Union, Japan and South Korea.

Pharmaceutical and Biotechnology and Food Industry growth to command significant share over the assessment period.

Diamond Wire Market Size & Outlook 2025 to 2035

The Self-Healing Materials Market is segmented by product, technology, and application from 2025 to 2035.

Polyurethane Foam Market Size & Trends 2025 to 2035

Polyurethane Adhesives Market Trends 2025 to 2035

Heat Resistant Glass Market Size & Trends 2025 to 2035

Flexible Colored PU Foams Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.