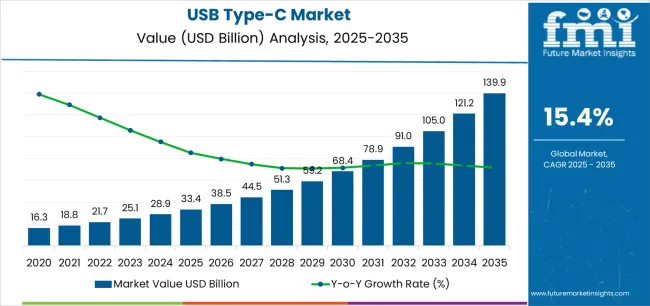

The global USB Type-C market is valued at USD 33.4 billion in 2025. It is slated to reach USD 139.9 billion by 2035, recording an absolute increase of USD 106.5 billion over the forecast period. This translates into a total growth of 318.9%, with the market forecast to expand at a CAGR of 15.4% between 2025 and 2035. The overall market size is expected to grow by nearly 4.19X during the same period, supported by increasing demand for universal connectivity standards and reversible connector designs, growing adoption of USB Type-C across smartphones, laptops, and consumer electronics, and rising emphasis on fast charging capabilities and high-speed data transfer across diverse consumer electronics, automotive, media & entertainment, telecom & tech, and healthcare applications.

Between 2025 and 2030, the USB Type-C market is projected to expand from USD 33.4 billion to USD 68.4 billion, resulting in a value increase of USD 35.0 billion, which represents 32.9% of the total forecast growth for the decade. This phase of development will be shaped by increasing mandatory adoption of USB Type-C in mobile devices and laptops driven by regulatory initiatives, rising integration of USB Type-C ports in automotive infotainment and electric vehicle charging systems, and growing demand for universal connectivity across peripheral devices and accessories. Electronics manufacturers and semiconductor companies are expanding their USB Type-C capabilities to address the growing demand for standardized connectivity solutions that ensure interoperability and enhanced user experience while supporting power delivery and data transfer requirements.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 33.4 billion |

| Forecast Value in (2035F) | USD 139.9 billion |

| Forecast CAGR (2025 to 2035) | 15.4% |

From 2030 to 2035, the market is forecast to grow from USD 68.4 billion to USD 139.9 billion, adding another USD 71.5 billion, which constitutes 67.1% of the overall ten-year expansion. This period is expected to be characterized by the expansion of USB4 and Thunderbolt integration enabling enhanced performance capabilities, the development of advanced power delivery protocols supporting up to 240W charging, and the growth of specialized applications for augmented reality devices, IoT ecosystems, and industrial automation. The growing adoption of USB Type-C as the universal standard across all device categories will drive demand for USB Type-C solutions with enhanced bandwidth capabilities and intelligent power management features.

Between 2020 and 2025, the USB Type-C market experienced robust growth, driven by smartphone manufacturer adoption of USB Type-C as standard charging and data interface, and growing recognition of USB Type-C as essential connectivity standard for modern electronic devices requiring reversible connection and multi-functional capabilities. The market developed as device manufacturers and semiconductor companies recognized the potential for USB Type-C technology to simplify user experience, enable higher power delivery, and support advanced protocols while maintaining backward compatibility. Technological advancement in USB Power Delivery and alternate mode capabilities began emphasizing the critical importance of versatile connectivity supporting display output, charging, and data transfer through single connector.

Market expansion is being supported by the increasing global shift toward universal connectivity standards driven by regulatory mandates and consumer convenience preferences, alongside the corresponding need for versatile connector solutions that can support multiple protocols, enable high-power charging, and provide high-speed data transfer across various smartphone, laptop, tablet, automotive, and peripheral device applications. Modern electronics manufacturers are increasingly focused on implementing USB Type-C solutions that can reduce connector variety, enhance user experience, and provide future-proof connectivity in rapidly evolving technology ecosystems.

The growing emphasis on device interoperability and accessory compatibility is driving demand for USB Type-C connectors that can support universal charging, enable cross-platform connectivity, and ensure comprehensive protocol support. Device manufacturers' preference for single-connector solutions that combine power delivery with data transfer and display capabilities is creating opportunities for innovative USB Type-C implementations. The rising influence of European Union's common charging regulation and environmental sustainability initiatives is also contributing to accelerated adoption of USB Type-C that can reduce electronic waste through standardized connectivity.

The market is segmented by product type, standard, industry, and region. By product type, the market is divided into USB Type-C receptacle and USB Type-C plug. Based on standard, the market is categorized into USB 3.2, USB 2.0, USB 3.0, USB 3.1, and others. By industry, the market includes consumer electronics, automotive, media & entertainment, telecom & tech, healthcare, and others. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

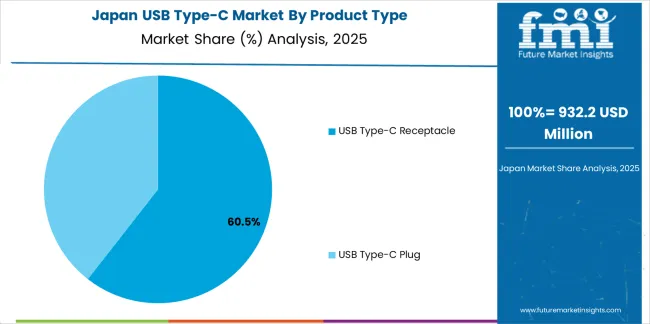

The USB Type-C receptacle segment is projected to maintain its leading position in the USB Type-C market in 2025 with a 58.0% market share, reaffirming its role as the preferred product category for device integration and host system implementation. Device manufacturers increasingly utilize USB Type-C receptacles for their superior durability requirements, excellent mechanical design for device mounting, and proven effectiveness in providing reliable connectivity while maintaining compact form factors. USB Type-C receptacle technology's proven effectiveness and application versatility directly address the industry requirements for device-side connector implementation across diverse electronic products and system integration applications.

This product segment forms the foundation of modern device connectivity, as it represents the connector type with the greatest contribution to device interface standardization and established performance record across multiple device categories and application scenarios. Electronics industry investments in USB Type-C adoption continue to strengthen integration among smartphone manufacturers and computer makers. With device design requirements demanding space-efficient and durable connectivity solutions, USB Type-C receptacles align with both engineering objectives and reliability requirements, making them the central component of comprehensive device connectivity strategies.

The USB 3.2 standard segment represents significant market share, driven by its position as the latest widely adopted USB specification offering enhanced data transfer speeds up to 20 Gbps while maintaining backward compatibility. USB 3.2 enables high-performance applications including external storage, professional video capture, and high-resolution display connectivity requiring superior bandwidth capabilities.

Other USB standards including USB 2.0, USB 3.0, and USB 3.1 maintain market presence serving diverse application requirements and price points. USB 2.0 continues supporting cost-sensitive applications where basic charging and low-speed data transfer suffice, while USB 3.0 and USB 3.1 serve mid-range performance requirements across consumer electronics and peripheral devices. This standard diversity enables market segmentation addressing varied performance needs and cost constraints across global electronics markets.

The consumer electronics application segment is projected to represent the largest share of USB Type-C demand in 2025 with a 43.0% market share, underscoring its critical role as the primary driver for USB Type-C adoption across smartphones, laptops, tablets, and personal electronics. Consumer electronics manufacturers prefer USB Type-C connectors due to exceptional versatility, consumer demand for universal charging, and ability to support multiple device functions through single port while enabling sleek device designs. Positioned as essential interface standard for modern consumer devices, USB Type-C offers both functional advantages and user experience benefits.

The segment is supported by continuous device innovation and the growing proliferation of USB Type-C across all consumer electronics categories from premium flagship devices to budget-oriented products. The manufacturers are investing in comprehensive USB Type-C ecosystem development to support accessory markets and charging infrastructure. As device convergence accelerates and universal standards become mandatory, the consumer electronics application will continue to dominate the market while supporting seamless connectivity and enhanced user convenience.

The USB Type-C market is advancing rapidly due to increasing regulatory mandates for universal charging standards driven by environmental concerns and consumer protection objectives, growing consumer demand for convenient single-cable solutions that require versatile connector technologies providing comprehensive protocol support and power delivery benefits across diverse smartphone, laptop, automotive, and IoT device applications. The market faces challenges, including implementation costs for device manufacturers transitioning from legacy connectors, counterfeit and non-compliant cable products compromising safety and performance, and technical complexity related to protocol negotiation and power delivery management. Innovation in intelligent controller chips and enhanced safety features continues to influence product development and market expansion patterns.

The implementation of common charging regulations, particularly the European Union's requirement for USB Type-C as mandatory charging port for mobile devices and electronics, is driving unprecedented adoption acceleration across consumer electronics manufacturers globally. These regulatory initiatives mandate USB Type-C implementation addressing e-waste reduction, consumer convenience enhancement, and market standardization while eliminating proprietary connector ecosystems. Device manufacturers are increasingly recognizing the universal standard advantages of USB Type-C compliance for regulatory alignment and global market access, creating opportunities for rapid market expansion as manufacturers transition entire product portfolios to USB Type-C connectivity across smartphones, tablets, laptops, and peripheral devices.

Modern USB Type-C implementations are incorporating USB Power Delivery 3.1 supporting up to 240W power transmission, programmable power supply protocols enabling optimized charging profiles, and intelligent power management systems through advanced controller chips and authentication mechanisms. Leading semiconductor manufacturers are developing high-integration USB Type-C controller solutions with embedded security features, implementing dynamic power allocation for multi-port chargers, and advancing charging technologies that optimize battery health while minimizing charging time. These capabilities improve user experience while enabling new applications, including laptop charging through USB Type-C, high-power device operation through single cable, and intelligent power sharing across connected device ecosystems. Advanced power delivery integration also allows manufacturers to support comprehensive device consolidation objectives and accessory simplification beyond traditional connectivity approaches.

The expansion of USB4 specification incorporating Thunderbolt 3 protocol compatibility is driving development of USB Type-C solutions with enhanced bandwidth up to 40 Gbps, supporting multiple 4K displays, enabling PCIe tunneling for external graphics, and providing comprehensive protocol convergence. These advanced implementations require sophisticated USB Type-C connectors and cables with precise signal integrity characteristics that exceed basic USB specifications, creating premium market segments with differentiated value propositions. Manufacturers are investing in high-performance USB Type-C components, advanced cable designs with active electronics, and certification programs ensuring USB4 and Thunderbolt compatibility to serve emerging high-performance computing applications while supporting professional creative workflows across video production, 3D rendering, and data-intensive industries.

| Country | CAGR (2025-2035) |

|---|---|

| China | 20.8% |

| India | 19.3% |

| Germany | 17.7% |

| USA | 14.6% |

| UK | 13.1% |

| Japan | 11.6% |

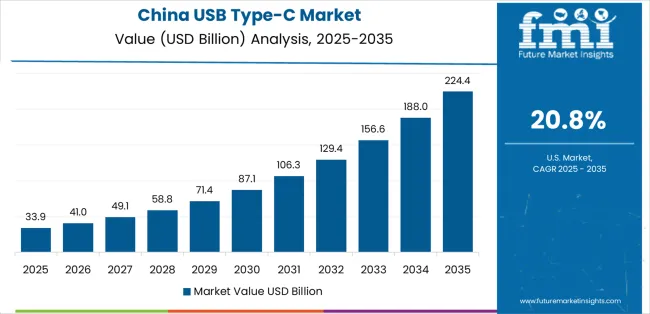

The USB Type-C market is experiencing exceptional growth globally, with China leading at a 20.8% CAGR through 2035, driven by massive consumer electronics manufacturing base, expanding smartphone and laptop production, and domestic semiconductor industry development supporting USB Type-C controller manufacturing. India follows at 19.3%, supported by rapidly growing smartphone market, expanding electronics manufacturing ecosystem, and increasing consumer electronics consumption across urban and rural populations.

Germany demonstrates 17.7% growth, supported by automotive industry USB Type-C integration, industrial electronics adoption, and premium consumer electronics market. The United States records 14.6%, focusing on technology innovation leadership, premium device market, and automotive electrification driving USB Type-C adoption. The United Kingdom exhibits 13.1% growth, emphasizing consumer electronics penetration and automotive technology integration. Japan shows 11.6% growth, emphasizing advanced electronics manufacturing and quality-focused USB Type-C implementation across diverse device categories.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

Demand for USB Type-C components in China is projected to exhibit exceptional growth with a CAGR of 20.8% through 2035, driven by massive consumer electronics manufacturing capacity and expanding domestic semiconductor capabilities supported by government technology self-sufficiency initiatives and electronics industry development programs. The country's dominant position in global electronics manufacturing and growing design capabilities are creating substantial demand for USB Type-C solutions. Major electronics manufacturers and semiconductor companies are establishing comprehensive USB Type-C production and innovation capabilities to serve both domestic and global markets.

Revenue from USB Type-C components in India is expanding at a CAGR of 19.3%, supported by the country's rapidly growing smartphone market, expanding electronics manufacturing under Make in India initiatives, and increasing consumer electronics adoption across growing middle-class populations. The country's electronics industry development and rising consumer demand are driving USB Type-C capabilities throughout manufacturing and consumption sectors. International electronics manufacturers are establishing production facilities to serve domestic market growth.

Revenue from USB Type-C components in Germany is expanding at a CAGR of 17.7%, driven by the country's automotive industry USB Type-C integration for infotainment and charging systems, advanced industrial electronics applications, and premium consumer electronics market demanding high-quality connectivity solutions. Germany's engineering excellence and quality standards are driving sophisticated USB Type-C implementation throughout automotive and industrial sectors. Leading automotive suppliers and industrial electronics manufacturers are establishing comprehensive USB Type-C integration programs.

Revenue from USB Type-C components in the United States is expanding at a CAGR of 14.6%, supported by the country's technology innovation leadership, premium consumer electronics market, and expanding automotive electrification driving USB Type-C integration across diverse applications. The nation's technology development capabilities and sophisticated consumer market are driving demand for advanced USB Type-C solutions. Technology companies and semiconductor manufacturers are investing in USB Type-C innovation and ecosystem development.

Revenue from USB Type-C components in the United Kingdom is expanding at a CAGR of 13.1%, supported by the country's consumer electronics market adoption, automotive technology integration, and regulatory alignment with EU common charging standards. The UK's developed consumer market and automotive sector are driving demand for USB Type-C solutions. Electronics retailers and automotive manufacturers are expanding USB Type-C product offerings.

Revenue from USB Type-C components in Japan is growing at a CAGR of 11.6%, driven by the country's advanced electronics manufacturing excellence, quality-focused consumer electronics market, and comprehensive USB Type-C adoption across devices and industrial applications. Japan's technology sophistication and quality standards are supporting high-grade USB Type-C implementation. Leading electronics manufacturers are maintaining comprehensive USB Type-C product portfolios.

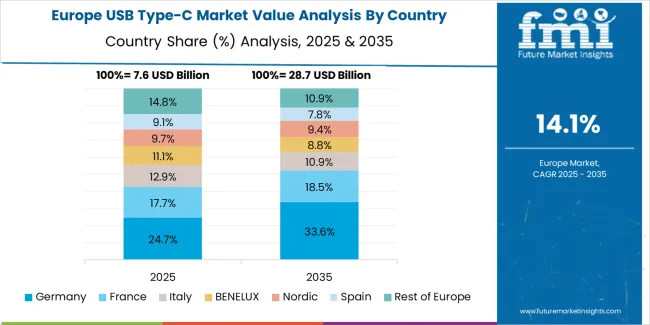

The USB Type-C market in Europe is projected to grow from USD 8.6 billion in 2025 to USD 34.2 billion by 2035, registering a CAGR of 14.8% over the forecast period. Germany is expected to maintain leadership with a 27.4% market share in 2025, moderating to 27.1% by 2035, supported by automotive industry integration, industrial electronics applications, and premium consumer electronics market presence.

The United Kingdom follows with 17.8% in 2025, projected at 17.5% by 2035, driven by consumer electronics adoption, automotive technology integration, and regulatory compliance with EU charging standards. France holds 15.3% in 2025, reaching 15.5% by 2035 on the back of consumer electronics market and automotive industry presence. Italy commands 12.4% in 2025, rising slightly to 12.6% by 2035, while Spain accounts for 10.2% in 2025, reaching 10.4% by 2035 aided by growing consumer electronics penetration and automotive manufacturing. The Netherlands maintains 6.7% in 2025, up to 6.8% by 2035 due to technology distribution hub role and consumer electronics market. The Rest of Europe region, including Nordics, Central & Eastern Europe, and other markets, is anticipated to hold 10.2% in 2025 and 10.1% by 2035, reflecting steady growth in USB Type-C adoption, regulatory compliance, and electronics market development.

The USB Type-C market is characterized by competition among established semiconductor manufacturers, connector component suppliers, and integrated solution providers. Companies are investing in controller chip innovation, high-power delivery technology development, protocol compatibility enhancement, and ecosystem partnership building to deliver high-performance, reliable, and standards-compliant USB Type-C solutions. Innovation in intelligent power management, advanced signal integrity, and integrated security features is central to strengthening market position and competitive advantage.

STMicroelectronics NV leads the market with a 25.0% share, offering comprehensive USB Type-C solutions with focus on controller chips, power delivery management, and protocol support across diverse consumer electronics and automotive applications. The company has announced major investments in USB4 controller development and advanced power delivery technologies supporting up to 240W charging capabilities. Texas Instruments Inc. provides innovative USB Type-C and power delivery solutions with emphasis on integration, efficiency, and comprehensive protection features across global markets.

NXP Semiconductors delivers specialized USB Type-C solutions with focus on automotive-grade components and industrial applications requiring enhanced reliability. Infineon Technologies AG offers comprehensive power management and USB Type-C controller products emphasizing safety and performance across consumer and automotive segments. Analog Devices Inc. provides high-performance USB Type-C solutions with focus on signal integrity and power delivery optimization. Additional market participants include connector manufacturers, cable assembly companies, and emerging semiconductor firms serving diverse application requirements and regional markets across global USB Type-C ecosystem.

USB Type-C represents a transformative connectivity standard within global electronics markets, projected to grow from USD 33.4 billion in 2025 to USD 139.9 billion by 2035 at a 15.4% CAGR. These universal connector solutions—primarily receptacle and plug configurations supporting multiple protocols—serve as essential connectivity interfaces in consumer electronics, automotive systems, media & entertainment equipment, telecommunications infrastructure, and healthcare devices where reversible connection, power delivery, and high-speed data transfer are functional requirements. Market expansion is driven by regulatory mandates for universal charging, growing consumer demand for simplified connectivity, expanding device ecosystem requiring interoperability, and rising emphasis on fast charging and high-bandwidth applications across diverse electronics categories and industrial sectors.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 33.4 billion |

| Product Type | USB Type-C Receptacle, USB Type-C Plug |

| Standard | USB 3.2, USB 2.0, USB 3.0, USB 3.1, Others |

| Industry | Consumer Electronics, Automotive, Media & Entertainment, Telecom & Tech, Healthcare, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | STMicroelectronics NV, Texas Instruments Inc., NXP Semiconductors, Infineon Technologies AG, Analog Devices Inc. |

| Additional Attributes | Dollar sales by product type, standard, and industry category, regional demand trends, competitive landscape, technological advancements in power delivery, protocol support innovation, safety feature enhancement, and connectivity performance optimization |

The global USB type-C market is estimated to be valued at USD 33.4 billion in 2025.

The market size for the USB type-C market is projected to reach USD 139.9 billion by 2035.

The USB type-C market is expected to grow at a 15.4% CAGR between 2025 and 2035.

The key product types in USB type-C market are USB Type-C Receptacle and USB Type-C Plug.

In terms of industry, consumer electronics segment to command 43.0% share in the USB type-C market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Insights of the USB Type-C Industry

Busbars Market Size and Share Forecast Outlook 2025 to 2035

Laminated Busbar Market Forecast and Outlook 2025 to 2035

Ultra Short Base Line (USBL) Positioning Systems Market Size and Share Forecast Outlook 2025 to 2035

Type-C Bulk Bags Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Type-C Bulk Bags Companies

Type 1 Commercial Surge Protection Devices Market Size and Share Forecast Outlook 2025 to 2035

V Type Fin Condenser Market Size and Share Forecast Outlook 2025 to 2035

V Type Air Cooled Condenser Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Transformer Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Current Transformer Market Size and Share Forecast Outlook 2025 to 2035

Gel-Type Strong Acid Cation Exchange Resin Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Automated Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Epoxy Type Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Grill-type Flavours Market Size and Share Forecast Outlook 2025 to 2035

X-Arm Type Window Regulator Market

Wound Type Current Transformer Market Size and Share Forecast Outlook 2025 to 2035

Sinker Type EDM Market Size and Share Forecast Outlook 2025 to 2035

Through-Type Shelves Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA