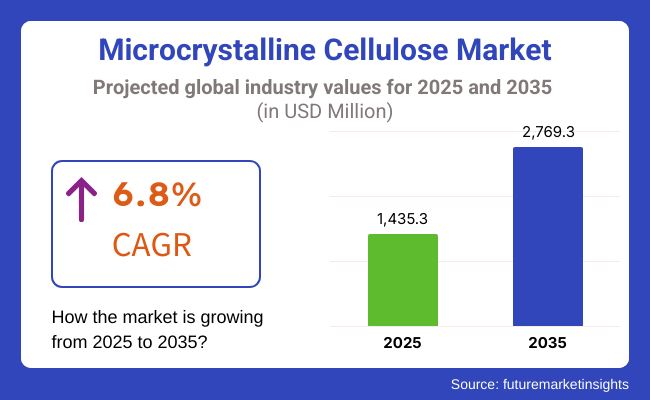

The global microcrystalline cellulose (MCC) market is poised for significant expansion, with a projected market size of USD 1,435.3 million in 2025, growing to USD 2,769.3 million by 2035 at a CAGR of 6.8%. The increasing demand for MCC from the pharmaceutical, food and beverage, and cosmetics industries, where it is commonly used as an excipient, stabilizer, and texturizing agent, is propelling this increase. Evolving consumer trends towards health-consciousness and it enabler like formulation science, further propelling growth prospects.

The demand for sustainable and plant-derived ingredients is expected to drive MCC market growth across the pharmaceutical and food industries. This further upped demand, given the surging demand for nutraceuticals, functional foods and dietary supplements. The growing availability of drug formulation technologies and low environmental impact excipients is further propelling the growth of the market. The trend of innovation and development investment will most likely yield improved features and range of application to MCC across various industries during the forecast period.

Pharmaceutical industry is still the leading MCC consumer due to its better binding and disintegration properties in tablet formulations. The demand is also supported by the rapidly growing trend toward plant-based and clean-label food products, since MCC is used as a bulking agent and fat replacer in the end product. Moreover, rising usage in cosmetics and personal care products as a stabilizing and thickening agent are further growing market opportunities.

Nano cellulose technology and sustainable production methods are driving innovation in the market as manufacturers strive to use environmentally friendly extraction processes to minimize their ecological footprint. The necessary regulatory approvals and compliance with standards specified by organizations such as the FDA, EMA, FSSAI, and others, are also a crucial prerequisite for penetration into markets across regions.

Explore FMI!

Book a free demo

North America dominates the microcrystalline cellulose market, driven by a well-established pharmaceutical sector and stringent FDA regulations ensuring high-quality excipient usage. The rising demand for nutraceuticals and dietary supplements in the USA and Canada is further propelling market growth.

The processed food industry is expanding, boosting MCC demand as a texturizer and stabilizer. Investments in biodegradable packaging and clean-label ingredients are creating new opportunities. The presence of leading pharmaceutical and food processing companies, along with increasing research and development in nano-cellulose technology, further solidifies North America’s position as a key market for MCC over the forecast period.

Germany, France and the UK are some of the leading countries contributing to the microcrystalline cellulose market in Europe due to rising pharmaceutical innovation and strict EU regulations about excipients and food additives. Surging preference for organic and plant based ingredients in food and beverage industry is supporting MCC adoption.

Sustainable packaging solutions along with increasing awareness towards low-calorie food options are positively impacting demand. However, the market is also driven by the region’s cosmetics and personal care industry, particularly in France and Italy, where MCC is widely used in skin care formulations. Support for bio-based materials from the government accelerates the growth potential of the market.

Microcrystalline cellulose has witnessed the fast growing market in Asia-pacific regions lead by China, India, Japan and so forth with the fast developing pharmaceutical manufacturing centres in the regions resulting in increased investment in production of generic drugs. Growing health awareness and a rapidly expanding middle-class population in the region are driving demand for functional foods and dietary supplements areas in which MCC has a key role.

The food processing industry, especially in China and Southeast Asia, is growing rapidly, which is also hastening the adoption. The region also witnesses technological innovation in bio refinery processes that will reduce the cost of producing MCC. The markets are undergoing long-term growth supported by favourable government policies and traffic growth in foreign investments.

The Rest of the World (RoW) market, which includes Latin America, the Middle East, and Africa, is steadily growing, led by higher pharmaceutical production in Brazil and Mexico. People in Latin America increasingly living in cities and changing their diets are driving demand for processed and convenience foods, for which MCC serves as a stabilizer.

Growth in Middle East and Africa will be driven by growing cosmetics and personal care industries in the region, especially in UAE and South Africa. Emerging markets in South America and Europe also have potential, with government initiatives encouraging local production of pharmaceutical drugs and other plant-based food ingredients that contribute to high growth opportunities.

Challenges

High Production Costs and Raw Material Dependency

Microcrystalline cellulose is an energy-intensive process, that used advanced processing technologies which had high production costs. As Smithers noted, the market depends on wood pulp and other plant-based sources, making it vulnerable to price fluctuations and other supply chain disruptions for those materials.

Moreover, stringent environmental regulations regarding deforestation and chemical processing methods increase operating costs. There is a growing demand for cost-effective and sustainable alternatives, including non-wood-based MCC; however large-scale production has been difficult. Organizations that focus on bio refinery innovations and waste valorization strategies become competitive for their lower reliance on conventional raw material sources.

Regulatory Hurdles and Compliance Issues

Microcrystalline cellulose is subject to strict safety and quality regulations in various regions for use in pharmaceutical and food applications. MCC, as an excipient or food additive, requires strict compliance approach by FDA, EMA, FSSAI, etc. as a result for approvals processes. Variations in global standards and labelling requirements create challenges for international market expansion.

As a result, there has been increasing consumer scrutiny regarding synthetic additives and processing aids in MCC production. The challenges and new rules in market regulation require companies to constantly adapt and invest in quality assurance measures so that they can both secure the trust of the market and comply internationally.

Opportunities

Growing Demand for Plant-Based and Clean-Label Products

In food, pharmaceuticals, and cosmetics processing industries, there is increasing demand for microcrystalline cellulose as a direct result of consumers' growing preference for natural, plant-based, and clean-label ingredients. A plant-based product, MCC falls in line with the growing trend toward vegan, gluten-free and non-GMO.

As such, it can be used in the food industry as a fat replacer, stabilizer and anti-caking agent in low-calorie and functional foods. Likewise, the pharmaceutical sector is undergoing a shift toward the use of natural excipients, which creates a new avenue for MCC manufacturers. This will create opportunities for companies that base on organic and sustainable MCC production.

Advancements in Biorefinery and Sustainable Production Methods

The development of eco-friendly and cost-effective production techniques is a significant opportunity for the microcrystalline cellulose market. Further advancements in biorefinery technologies are permitting the production of MCC from agricultural waste and non-wood material, decreasing dependence on conventional wood pulp. Besides, innovations regarding the nanocellulose technology are unlocking possibilities for application of MCC in biodegradable uses, medical implants, and high performance materials.

As governments and industries enact policies to reduce carbon footprints, wherever economically and technically feasible, investing in sustainable MCC manufacturing and green chemistry processing can improve market competitiveness. Businesses that can adopt circular economy principles and waste valorization methods will gain a competitive edge in this evolving market.

The microcrystalline cellulose (MCC) market has witnessed a steady growth during the period from 2020 to 2024, owing to expanding applications in pharmaceutical, food and beverages, and personal care industries.

MCC manufacturers have reported a rise in demand owing to its increasing usage as excipients in drug formulations, growing adoption of clean-label ingredients in food products, and for its stabilizer and thickener (in cosmetic applications). Regulatory shifts leaning toward plant-based and sustainable ingredients have also influenced the market.

In the period from 2025 to 2035, the MCC market is anticipated to expand even further owing to enhanced pharmaceutical manufacturing, mounting customer requirements for natural and organic food ingredients, and enhanced automation due to automation in MCC manufacturing. Focus areas would continue to be on sustainability and regulatory compliance - with stricter requirements for source of environmentally sound raw materials and manufacturing processes.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with food and pharmaceutical safety standards (FDA, EMA, EFSA). |

| Technological Advancements | Advanced purification processes and increased production yields. |

| Industry-Specific Demand | High demand in pharmaceuticals, food and beverages, and cosmetics. |

| Sustainability and Circular Economy | Early steps toward sustainable sourcing and manufacturing. |

| Market Growth Drivers | Increasing use in tablet binding, dietary fibers, and personal care products. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Tighter sustainability requirements; emphasis on biodegradable and renewable inputs. |

| Technological Advancements | AI-driven quality control, sustainable extraction methods, and bio-based MCC alternatives. |

| Industry-Specific Demand | Expansion into bioplastics, 3D printing, and advanced nutraceutical formulations. |

| Sustainability and Circular Economy | Focus on carbon-neutral production, circular economy principles, and zero-waste processes. |

| Market Growth Drivers | Growth in biodegradable packaging, personalized medicine, and functional food ingredients. |

The USA microcrystalline cellulose (MCC) market is projected to grow at a CAGR of 5.2% from 2025 to 2035, driven by increasing demand in the pharmaceutical and food industries. Market growth is attributed to the increasing emphasis on excipient quality in drug formulations and continued demand for low-calorie food additives.

The growth is further bolstered by the regulatory support of the FDA for safe cellulose-based ingredients. However, rising raw material prices wood pulp and other items can become an issue. The trends in the field of sustainability and advances made in biopolymer production brings new aspirations for the manufacturers of MCC who are on a lookout for innovations and wish to the meet the changing requirements of the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.2% |

The United Kingdom's MCC market is expected to grow at a CAGR of 9.8% between 2025 and 2035, making it one of the fastest-growing regions. The expansion is fueled by rising demand in the pharmaceutical, cosmetics, and food industries. MCC adoption has been further boosted by factors such as the rising trend of clean food products and plant-based formulations.

Strict EU and UK regulations around natural and biodegradable excipients also work in favour of growth within the market. The cosmetics sector is also experiencing an upsurge in the demand for MCC due to its moisture-retaining and texturizing characteristics. Sustainable sourcing and bio-based MCC production provides growth opportunities.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 9.8% |

The European Union MCC market is projected to expand at a CAGR of 7.3% from 2025 to 2035, driven by strong demand in pharmaceuticals, personal care, and food industries. As such, the region has strict REACH regulations that focus on sustainable and bio-based excipients making MCCs a preferred choice over synthetic and chemically modified excipients.

MCC finds its place as a binder and stabilizer in the nutraceuticals and dietary supplements market, which is thriving evermore. The move towards sustainable packaging solutions has also generated interest in cellulose-based alternatives. Nanocellulose technology is a fast-evolving field in terms of research and development, and being able to provide it in large quantities at low costs offers extensive business opportunities for players in the EU.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.3% |

Japan’s MCC market is set to grow at a CAGR of 5.9% between 2025 and 2035, driven by the pharmaceutical and food industries. The focus on high-quality excipients for drug formulations, coupled with the increasing demand for improved pharmaceutical formulations among the aging population in the country, is expected to contribute to the growth of the market.

The functional food and dietary supplement sectors are also growing, leading to an expanding MCC demand as a bulking agent and stabilizer. Japanese manufacturers are developing cellulose processing technology and green manufacturing process. Environmentally-friendly innovations in new products, as well as sustainable and biodegradable MCC-based materials, are taking off in Japan.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.9% |

The South Korean MCC market is expected to expand at a CAGR of 8.2% from 2025 to 2035, driven by increasing demand in pharmaceuticals, food, and cosmetics. A strong domestic pharmaceutical industry as well as increasing investment in excipient research are the main drivers for the country. MCC’s role in K-beauty formulations is also expanding for the way it improves texture and stability in skin and make-up products.

Moreover, South Korea’s emphasis on sustainable and biodegradable ingredients further complements MCC’s environmentally friendly characteristic, increasing its uptake. The government’s promotion of bio based product innovations and regulations against synthetic additives further boosts market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.2% |

Wood-Based Microcrystalline Cellulose Dominates the Market Due to Abundant Raw Material Availability

The wood-based microcrystalline cellulose (MCC) segment dominated the market, attributable to its abundant availability and economical production. Extracted from linden and pine, it contains the highest purity and homogeneity, thus, it is used in pharmacies, food and industry.

Its excellent binding and disintegration characteristics in tablets make it an important part of the pharmaceutical industry. It is also used by the food industry in propriety stabilizers and fat replacers. Demand in the US and Europe play a big role, as they have high-quality regulations and sophisticated pharmaceutical manufacturing. Investment in greener extraction technologies to address sustainability concerns is another factor bolstering growth in this segment.

Non-Wood-Based MCC Gains Traction Due to Sustainability and Alternative Raw Material Adoption

Non-wood-based MCC, derived from sources like cotton linters, bamboo, and agricultural residues, is gaining momentum as a sustainable alternative. High demand for wood pellets is driven by climate change concerns and deforestation regulations, especially in regions with plenty of non-wood biomass such as Asia-Pacific.

This section, which offers functionality like wood-based MCC, appeals to industries looking for environmentally conscious solutions. This segment is increasingly being explored by food and pharmaceutical industries to reduce their carbon footprint. Nonetheless, elevated processing costs and heterogeneous raw material quality still pose challenges. With ongoing improvements in processes for extracting and purifying it, its commercial potential is only likely to grow in coming years.

Pharmaceutical Grade MCC Leads Due to Its Essential Role in Drug Formulation

Microcrystalline cellulose (MCC) pharmaceutical grade the largest category of market share as widespread use as a binder, disintegrate, and filler at tableting. Such properties, including great compressibility and chemical stability, read into it an unavoidable role in solid dosage forms for drug release uniformity. Regulatory compliance with standards such as the FDA, USP, and European Pharmacopeia further enhances its demand across North America and Europe.

As the global pharmaceutical industry grows, particularly in these developing economies such as India and China, the demand for high-purity MCC is increasing. The growth of the market of excipients with innovative excipient development and drug formulation capabilities adds to the growing dominance of the segment in the market

Food-Grade MCC Expands Due to Its Role in Texture Enhancement and Fat Replacement

Food-grade MCC is growing rapidly due to its multifunctional properties in food processing. It works as a stabilizer, emulsifier, anti-caking agent, fat replacer, in dairy, bakery, and processed food products. The increased penetration of health-aware meat substitutes is an import driver of the segment in health faddist regions such as North America and Europe.

Moreover, now adoption in several segments of food formulations has been aided by their regulatory approvals from the FDA, EFSA, etc. High production costs and consistent quality need an upright solution. Its growth in the market is anticipated due to continuous research for cost-effective techniques to produce products.

The Microcrystalline Cellulose (MCC) Market finds its place as a niche one within the excipient and additive industries, with growing demand stemming from across pharmaceutical, food and beverage, and personal care end-use industries. The market is dominated by key global players through their technological advancements, sustainable sourcing practices, and expansion of capacity. The market is constantly consolidating through mergers and acquisitions along with an emphasis on bio-based and high-purity MCC products.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| International Flavors and Fragrances Inc. (IFF) | 18-22% |

| Asahi Kasei Corporation | 15-18% |

| DFE Pharma | 12-16% |

| Accent Microcell Ltd | 10-14% |

| Foodchem International Corporation | 7-10% |

| Sigachi Industries | 5-9% |

| Anhui Shanhe Pharmaceutical Accessories Co. Ltd | 3-7% |

| Roquette Frères | 3-7% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| International Flavors and Fragrances Inc. (IFF) | Produces high-purity MCC for pharmaceuticals, expanding production capacities. |

| Asahi Kasei Corporation | Specializes in excipients for drug formulations, focusing on sustainability. |

| DFE Pharma | MCC grades development for food and nutraceutical applications. |

| Accent Microcell Ltd | Specializes on reformulated MCC for controlled-release formulations. |

| Foodchem International Corporation | Provides MCC for food and industrial uses with focus on efficiency. |

| Mingtai Chemical Co. Ltd | MCC innovations and offerings from our key supplier in Asia, enabling one of the most cost-effective solutions. |

| Sigachi Industries | Specializes in high-quality MCC for pharmaceutical applications. |

| Chemfield Cellulose | Emphasizes customized MCC formulations for different industries. |

| Anhui Shanhe Pharmaceutical Accessories Co. Ltd | Develops MCC for pharmaceutical and nutraceutical sectors. |

| Roquette Frères | Leading manufacturer with a focus on sustainability and innovation. |

Key Company Insights

FMC Corporation

FMC Corporation -A key MCC market player; FMC Corporation is a leading provider of high-purity cellulose solutions for a range of pharmaceutical and food applications. Innovation is at the heart of the company, developing MCC with low compressibility and high flow ability for better processing in tablet manufacturing and food products stability. By prioritizing high standards in regulatory compliance, FMC Corporation sets itself apart as a reliable supplier by ensuring its products meet the highest international quality standards.

Furthermore, FMC is expanding its sustainable raw material sourcing, allowing it to align with growing consumer demand for sustainable-SACH inputs. Recognized as a market leader, the corporation's global presence is being bolstered, with the expansion of its manufacturing platforms designed to accurately service the growing needs of the pharmaceutical and food processing sectors. This innovation extends to FMC's production processes, which heavily rely on automation and digitalization, allowing for increased efficiency and waste reduction, making it a leader in the MCC space.

DuPont de Nemours, Inc.

MCC-based Excipients DuPont is a leading innovator of MCC-based excipients, with a broad portfolio of tailored solutions for pharmaceutical, food and cosmetic applications. MCC formulations by the company ensure better disintegration of tablets, increased food texture and uniformity in formulations. DuPont has invested heavily in R&D, targeting functional improvements on MCC mainly in controlled-release drug delivery systems and clean-label food products.

[12] You are watching: Good MCC as Enabling & Government Networks Supplier MCCs - Sustainability is a key driving force for DuPont, as demonstrated by the development of biodegradable MCC formulations and the growing demand for more sustainable excipients. The company is accelerating strategic contacts with universities and research institutions to discover new MCC application fields in biotechnology and advanced material science, enhancing its competitive advantage on the market.

Asahi Kasei Corporation

Asahi Kasei Corporation - A top MCC producer, advance processing technology helps to enhance the product quality and functionality. The company’s MCC is used in medical formulations, food stabilizers, and industrial applications.

Research initiatives at Asahi Kasei are geared toward developing next-generation MCC grades that meet changing market needs. The company is well positioned at forefront of MCC innovations with strategic partnerships with pharmaceutical & food industry, defining future of industry in compliance with international safety & quality standards.

Asahi Kasei is expanding its investments in automation and AI-powered quality control technologies to improve the efficiency of production and decrease the environmental impact of manufacturing. The company is working to increase MCC production using bio-based raw materials in response to the growing consumer demand for sustainable and renewable excipient solutions.

DFE Pharma

DFE Pharma specializes in high-quality MCC excipients designed for solid dosage forms in the pharmaceutical and nutraceutical industries. The MCC solutions provided by the company optimize the binding properties of a tablet dosage form ensuring greater stability of the drug and controlled release. Sustainability DFE Pharma has a clear focus on sustainability and implements sustainable manufacturing methods.

The company, with a customer-oriented approach and a global footprint, has expanded its portfolio to provide tailor-made MCC formulations for a variety of applications. The DFE Pharma team is also working with research institutes on next-generation MCCs with improved bioavailability and compatibility with current drug formulations.

The company also aims to drive organizational growth through digital transformation by integrating data analytics and automation into its production plants to streamline operations and ensure product consistency.

JRS Pharma

JRS Pharma is a pioneer in sustainable MCC production, focusing on organic and plant-derived cellulose solutions for pharmaceutical and food industries. The brand is all about the power of nature and the use of biodegradable ingredients, making it perfect for the growing number of consumers seeking clean-label options. That's why JRS Pharma's MCC is known for its great binding and stabilizing properties and is the excipient of choice in many formulations.

These factors characterizing the next-generation MCC products are being implemented through the company's ongoing investment into R&D, emphasizing the significance of innovation and sustainability in its strategies. JRS Pharma is also increasing its distribution network, making its premium MCC solutions for diverse industries readily available in international markets. Its sustainability initiatives have been bolstered with investments in alternative sources for MCC, such as agricultural by-products.

The global Microcrystalline Cellulose market is projected to reach USD 1,435.3 million by the end of 2025.

The market is anticipated to grow at a CAGR of 6.8% over the forecast period.

By 2035, the Microcrystalline Cellulose market is expected to reach USD 2,769.3 million.

The Wood Based segment is expected to dominate the market, due to abundant raw material availability, cost-effectiveness, high purity, and widespread use in pharmaceuticals, food, and personal care industries for its superior functional properties.

Key players in the Microcrystalline Cellulose market include International Flavors and Fragrances Inc. (IFF), Asahi Kasei Corporation, DFE Pharma, Accent Microcell Ltd, Foodchem International Corporation.

In terms of Material, the industry is divided into Wood Based, Non-wood Based

In terms of Product Grade, the industry is divided into Pharmaceutical Grade, Industrial Grade, Food Grade

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

Anti-seize Compounds Market Size & Growth 2025 to 2035

Phosphate Conversion Coatings Market 2025 to 2035

Technical Coil Coatings Market Growth 2025 to 2035

Perfluoropolyether (PFPE) Market Size & Trends 2025 to 2035

Cold Rolling Oils/Lubricants Market Size & Growth 2025 to 2035

Basic Methacrylate Copolymer Market Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.