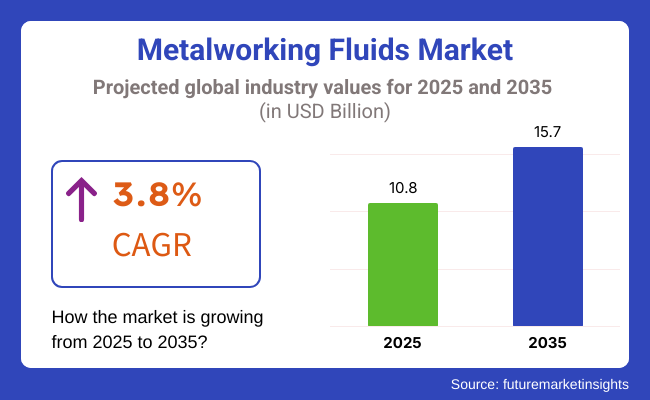

From 2025 to 2035, the metalworking fluids market is expected to grow at a strong pace, owing to the increasing demand for the product from industries like automotive, aerospace, and heavy machinery manufacturing. This market is estimated to reach approximately USD 10.8 Billion in 2025 and USD 15.7 Billion in 2035, at a CAGR of 3.8% in the forecast period.

The implementation of advanced metal Working fluids is driven by the increasing focus of manufacturers towards improved metal machining performance and metal components sustaining attributes. In addition, there is also an increased focus on sustainable and biodegradable formulations, due to strict recovery regulatory restrictions imposed by industries concerning emissions, waste disposal, and employee health & safety.

New technologies, including synthetic and semi-synthetic fluids that provide superior lubricity and thermal stability, are constantly being developed to enhance the performance and efficiency of machining. The metalworking fluid market is anticipated to develop heavily over the ensuing 10 years as industries embrace extreme accuracy machining, automatic production lines, and filigree material processing.

Explore FMI!

Book a free demo

The metalworking fluid market in North America is anticipated to be significant, owing to the strong automotive and aerospace sectors in the region. The company said the growing demand for fluids that provide optimal machining performance, increased tool life and reduced maintenance costs is further being driven by continued investment into advanced manufacturing technologies and precision engineering within the region. Especially in the USA, a mature aerospace industry is adopting high-end metalworking fluids to meet strict tolerances and consulting for the quality of parts for aircraft.

Similarly, the area’s intransigent environment policies prompted manufacturers to develop low-VOC and biodegradable metalworking fluids, in line with government movements toward workplace safety and sustainability. North American market as a whole, continues to grow due both to the large network of established machine tool manufacturers & suppliers (as well as access to high-performance fluids) and is ideally selected and formulated to address various industrial applications.

The automotive manufacturing base in Europe, particularly Germany, France, and Italy, while the aerospace industry in some parts of the country, particularly the United Kingdom has a key influence in ruling the metalworking fluids market in the region. Manufacturers in EU are laser-focused on efficiency and minimizing carbon exposures as EU environmental legislation incentivizes the adoption of environmentally friendly metalworking fluids.

In addition, the trends towards lightweight material production, especially for aluminium and composites, are leveraging advanced fluid technologies that improve cooling and lubrication. The demand for next-generational metalworking fluids that can sustain higher speeds and lower temperatures while ensuring high performance and high energy efficiency is prompted by the rise of high-precision machine tools, automation and digital monitoring in production facilities.

Asia-Pacific, on the other end, is expected to emerge as the fastest growing regional market for metalworking fluids, by which accelerating industrialization as well as burgeoning manufacturing hubs in countries like China, India, Japan and South Korea would have a role to play. Moreover, the budding automotive sector and significant infrastructure development projects in the region boosts the demand for machining purposes involving a large application of metalworking fluids.

China has been investing significantly in state-of-the-art manufacturing technologies, while India with initiatives like the Make in India programme under the government has been trying to boost its domestic manufacturing capabilities this can present new opportunities for growth.

Moreover, progressively higher-performing metalworking fluids with better cooling performance, longer liquid life and more operator safety have also been needed with the increased use of high-speed machining and complex multi-axis milling operations.

Challenge

Environmental Regulation and Fluid Disposal Concerns

Some of the challenges facing the Metalworking Fluids Market include shifts in market dynamics as the industry evolves and increasing regulatory scrutiny for the management of metalworking fluids with evolving empathetic design patterns.

It has prompted governments across the world to establish stringent guidelines on the disposal and formulation of metalworking fluids, which includes limiting the use of hazardous chemicals and maintaining proper waste management. The industry will need to pivot and create new bio-based alternatives of plastics, in addition to moving to new forms of recycling.

How effectively you comply with these regulations will resultantly increase your production cost, since companies have to invest in environmentally friendly formulations and to dispose of waste sustainably. However, meeting compliance requirements with account for cost-effective solutions without sacrificing fluid efficiency, and machine performance is key for manufacturers to stay competitive in the marketplace.

Moreover, companies have to build extensive R&D to develop high performance formulations which are aligned to global environmental policies. Education and training programs for manufacturers and end-users regarding the best practices for the handling and disposal of metalworking fluids will likewise be at the forefront of navigating changing regulatory landscapes.

Opportunity

Potential Breakthrough Developments in Synthetic and Bio-Based Metalworking Fluids

With the increasing trend for synthetic and bio-based metalworking fluids, the market has a major opportunity to grow. Manufacturers are turning to sophisticated formulations that provide superior lubrication and cooling properties, improved fluid life and reduced environmental impact. Within automotive, aerospace and heavy machinery segments, high-performance fluids that enhance efficiency of machining processes and minimize downtime are being sought after.

Nanotechnology and additives as well as new innovation provide better stability of the fluid, less bacteria contamination, and better durability of the tools. Market participants are increasingly focusing on the development of next-generation metalworking fluids which may include features such as improved sustainability, cost-effectiveness, and performance.

In addition, it is anticipated that the development of custom formulations designed for specific machining processes will drive additional revenue streams. Working alongside organizations and research institutions focused on sustainability will enable the creation of next-generation, environmentally conscious lubricants that boost industrial efficiency and support global sustainability targets.

2020 to 2024 Fluid consumption in automotive and aerospace sectors was also substantial, with need for advanced formulations that were resource effective and reduced machinery wear and tear. However, environmental considerations and regulations contributed to a reduction in the use of conventional petroleum based fluids, thus expediting the adoption of synthetic and semi-synthetic alternatives. Organizationally, firms were attuned to creating fluid formulations better suited to biodegradation and minimizing work-site chemical hazards from long-term exposure to these fluids.

Moreover, increased investments in the development of automation and AI-enabled predictive maintenance solutions to monitor fluid performance and optimize usage efficiency also provided a tailwind for the growth of manufacturers to reduce their operational costs. There were also a number of mergers and acquisitions in the industry, as the bigger players tried to enhance their portfolios with innovative lubrication solutions.

From 2025 to 2035, the smart fluids integrated with IoT-enabled monitoring systems real-time analysis of fluid condition and the performance of fluid fluid-trip, and more will be to up to the market. Biodegradable fluids will also be developed based on the global goals of sustainability to depend less on petroleum-based chemicals.

Rising automation of manufacturing processes will fuel demand for high-performance metalworking fluids utilizing lubrication enhancement and cooling efficiency. Manufacturers will also seek to run antimicrobial solutions to extend life fluid and reduce maintenance costs. For the next decade, the dominant players in the market will be those who harness digital technologies, prioritize sustainability, and provide tailored fluid solutions for individual machining operations.

Furthermore, with increasing sentiment and initiatives for sustainability, the closed loop fluid recycling systems and the chemical filtration technologies will ensure operational efficiency with full compliance with environmental norms. AI and big data analytics will eventually allow an even more precise tracking of metalworking fluid consumption alongside predictive maintenance and cost optimization.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Courier article on the environmental impact of lithium-ion batteries |

| Technological Advancements | Growth in semi-synthetic and synthetic formulations |

| Industry Adoption | Expanded use in automotive, aerospace, and heavy machinery |

| Supply Chain and Sourcing | Variability in the price of raw materials derived from petroleum |

| Market Competition | Presence of established chemical manufacturers and niche players |

| Market Growth Drivers | Rising industrial activity and demand for efficient machining solutions |

| Sustainability and Circular Economy | Initial efforts in developing bio-based and recyclable fluids |

| Smart Metalworking Fluids | Limited use of sensor-enabled fluids in industrial applications |

| Advanced Filtration and Recycling | Basic filtration methods with minimal fluid reuse |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Increase in green policies urging bio-based fluids, as well as circular economy efforts. |

| Technological Advancements | Integration of IoT-based monitoring for real-time fluid performance optimization. |

| Industry Adoption | Growth and diversification into the areas of precision mfg, robotics, and cerebral industrial automation |

| Supply Chain and Sourcing | Move towards sustainable sourcing and renewable base oils. |

| Market Competition | Growth of specialized firms offering customized high-performance fluids for specific machining needs. |

| Market Growth Drivers | Acceleration of automation, digitalization, and sustainability-driven innovations. |

| Sustainability and Circular Economy | Full integration of closed-loop recycling systems and carbon-neutral production methods. |

| Smart Metalworking Fluids | Widespread adoption of AI-powered condition monitoring and predictive maintenance solutions. |

| Advanced Filtration and Recycling | Implementation of next-generation filtration, recycling technologies, and self-cleaning fluid systems. |

United States metalworking fluids marketplace continues developing steadily with increasing requirement from automotive, plane, and general production industries. The United States represents a worldwide pioneer in metallic machining and fabrication, with sectors depending mainly on high-performance lubricants and coolants for maximizing machining performance and instrument lifetime.

The protection and aviation business is a significant user of custom-made metallic functioning fluids, since high-tolerance manufacture and exactness machining tasks necessitate sophisticated lubrication products. The automotive sector's transfer towards electric automobiles (EVs) and light-weight materials is also propelling requirement for future-generation metallic functioning fluids.

Precision and complexity characterize operations throughout many manufacturing sectors in the USA, driving the continuing evolution of sophisticated fluids that facilitate optimized product quality and output.

With strict OSHA directives on disclosure to harmful fluids in the workplace and increasing usage of bio-based and synthetic MWFs, the evolving USA marketplace will keep growing steadily on the whole as innovative solutions address evolving industrial and environmental needs.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.1% |

UK metalworking fluids market has grown steadily due to increasing demand from precision engineering and aerospace sectors that require high-performing cutting and grinding fluids. BAE Systems and Rolls-Royce have fueled consumption in their aerospace operations.

Environmental regulations have also motivated use of less toxic, sustainable fluids. Beyond this, automakers transitioning to electric powertrains and lightweight materials increasingly turn to hybrid and synthetic metalworking options. While European REACH rules tighten oversight of industrial materials, the need for compliant fluids in the UK means its market remains primed for stable expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.6% |

The markets for metalworking fluids within the European Union have demonstrated stable increases in recent times owing to rises in automation initiatives within industry and strong manufacturing levels for vehicles and aircraft.

Germany has developed as the largest customer of these fluids in the block, with demand driven particularly by its engineering and automotive sectors that depend seriously on sophisticated metalworking fluids for intricate precision work. Italy has also become a substantial customer.

The EU's long-held concentration on sustainability and occupational safety has led fluid producers to invent innovative, less hazardous solutions that efficiently lubricate and cool intricate metal forming procedures while protecting both employees and the environment.

Policies at both the national and EU levels, such as REACH and the Industrial Emissions Directive, have necessarily pushed for alternatives like bio-based and low-VOC fluids intended to reinforce protections for workers and decrease environmental impacts.

Continuing investment in advanced production techniques for instance 3D metal printing and computer numeric control, combined with expanding execution of water-soluble synthetic fluids, implies steady growth in metalworking fluid intake across the EU for the foreseeable future. This growth will be reinforced by the bloc's emphasis on accountable utilization of resources and stringent standards that prioritize worker safety and protection of the environment throughout intricate manufacturing operations.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.9% |

The metalworking fluid market in Japan is growing gradually with precision manufacturing in the automotive, electronics, and machine sectors. The local motor vehicle sector, including auto producers such as Toyota, Honda, and Nissan in Japan, is one of the leading consumers of high-performance MWFs for metal working and machining operations.

Electronics is also the leading driving industry, requiring ultra-clean metalworking fluids in the manufacture of semiconductors and precision parts. To that end, Japan's evolving technologies in the automation and smart manufacturing sector are also spreading the demand to low-maintenance and high-efficiency metalworking fluids.

With the growing demand for low-emission and environmentally friendly industrial lubricants, the Japanese market for metalworking fluids is bound to grow on a continuous basis.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.7% |

South Korean metalworking fluid industry is expanding with rapid industrialization, strong demand in automotive and electronics manufacturing, and rapidly expanding investments in precision engineering. South Korea's automotive industry, led by Hyundai and Kia, is one of the biggest consumers of high-performance forming and cutting fluids.

The electronics and semiconductor industries, dominated by Samsung and SK Hynix, are the leading growth drivers for ultra-pure metalworking fluids applied in precision machining operations. Government initiatives toward environmentally friendly manufacturing processes also continue to fuel the demand for synthetic and bio-based lubricants.

Since there is ongoing technological innovation in industrial automation and growing investment in high-technology lubricants, South Korean metalworking fluids will experience ongoing growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.8% |

Semi-synthetic oils and synthetic oils segments would be the leading share-resting segment in the metalworking fluids market owing to the high rate of adoption of advanced lubrication techniques to improve machining efficiency, to improve tool life, and surface finishing.

These high-performance fluid types are essential in reducing friction, dissipating heat, and preventing metal corrosion, which makes them indispensable across automotive, aerospace, industrial machinery, and metal fabrication sectors.

Semi-synthetic oils have grown to become one of the most used metalworking fluids on the market today, as they strike a balance between mineral oil and synthetic additives that improve lubrication properties but have less expensive properties than fully synthetic oils. Superior machining performance is achieved through higher cooling, celerity and lower mist formation compared to conventional straight oils, and are specifically formulated for increased efficiency in various processes.

In the pursuit of better surface finish, longer tool life, and less wear, the increasing need for semi-synthetic metalworking fluids in precision machining has led to increased adoption of advanced semi-synthetic formulations as industries have begun to target process efficiency and sustainability. According to studies, semi-synthetic metalworking fluids lower tool wear up to 30%, which helps in reducing maintenance cost and enhancing operational uptime.

Increasing demand for semi-synthetic oils in high-speed cutting applications with enhanced viscosity, thermal stability performance and foam resistance bolsters market demand and further complements adoption in automotive and aerospace manufacturing.

Moreover, the adoption, ensured better compliance of workplace safety and environmental regulations, have been aided by the introduction of bio-based and environmentally viable semi-synthetic formulations, which combining low toxicity and biodegradable components.

Development of next-generation fluids that are semi-synthetically made with nano-lubricant additives to reduce friction and have superior load-bearing capability has led to improved market growth by ensuring that they are used more frequently in heavy-duty machining and the required processes for metal forming.

Free movement of different mechanical service providers across the nations have created an upsurge for semisynthetic fluids during machining of multi-metal composites, spurred by the presence of corrosion inhibitors for both ferrous and non-ferrous metals closing market entry barriers for the multi-metal machining of different metals.

Semi-synthetic oil is the one that has both the benefits of synthetic oils, for the enhancement of cost-efficiency, performance optimizations, and cleanliness but also has the added benefit of fluid stability and the emulsion of oil breaking down at both extreme operating conditions or long-term storage, so it is actually frowned upon by some but the benefits outweigh the negatives.

Yet new advancements in AI-enabled fluid monitoring, next-gen emulsifier technology, and self-healing lubrication formulations are extending fluid life, operation stability, and ecological sustainability, thus confirming semi-synthetic metalworking fluids long-term market growth.

Synthetic oils have increasingly shown robust market adoption especially in aerospace, medical device manufacturing and high-precision machining as industries continue switching to synthetic metalworking fluids to enhance lubrication efficiency and tool life and reduce contamination risk. These synthetic oils do not have the oxidation, residue formation, and chemical stability problems associated with mineral-based lubricants, making them suitable for use in very demanding machining operations.

Synthetic oil-based fluids are experiencing adoption due to the growing demand for low volatility synthetic formulation fluids for high-speed machining and high-temperature operations in the manufacturing of aerospace components, as the aerospace industry is looking for reliable and efficient metal fabrication operations. According to studies, synthetic metalworking fluids enhance machining precision due to their capability of decreasing friction and minimizing thermal deformation, leading to an improved dimensional accuracy.

The market's demand is reinforced by the growing penetration of synthetic oils in medical device and implant manufacturing, high-purity, non-toxic formulations that ensure bio-compatibility suitable for the adoption in their surgical instrument and orthopaedic implant production.

Unlike conventional oils, modern high-performance synthetic oils are formulated with ultra-refined synthetic-blends or a no-synths formula that makes use of unique synthetic additives with molecularly engineered anti-wear agents, extreme pressure (EP) additives, and oxidation stabilizers to provide the necessary protection against metal fatigue and optimum cooling for normal and extreme hauling conditions.

Increased demand for high-speed and ultra-precision machining has favourably impacted metalworking fluids in the market bolstered by the development of water-soluble synthetic metalworking fluids with low-viscosity formulations that enhance chip evacuation and cooling capacity.

These factors have propelled the market growth as synthetic oils are now used in additive manufacturing (3D printing) or in metal sintering also, with lubrication solutions for high-temperature powder metallurgy, and for sintered metal applications providing better compatibility with cutting-edge manufacturing technologies.

Synthetic metalworking fluids are efficient which blocks rust formation, appears to have high-temperature stability, long fluid life along with better lubrication properties but face challenges of high initial investment costs that limits its large-scale application along with limited compatibility with legacy or legacy machining systems and can be put under regulatory scrutiny for a few specific additives.

Nevertheless, recent advancements in innovative aspects of AI-driven lubricant formulation, environmentally friendly synthetic base oils, and recyclable fluid technologies are enhancing cost-effectiveness, sustainability, and versatility of applications and thus, the market for synthetic metalworking fluids will have steady growth.

Mechanically, industrial lubricants, particularly removal fluids and protection fluids segments, are leading the market drivers as the manufacturers of metalworking deploying metalworking fluids to improve precision cutting, prevent corrosion, and improve efficiency in various metal fabrication applications.

As industries that perform operations such as metal cutting, grinding, and drilling adopt ever more performant lubrication and cooling solutions, removal fluids have become one of the most used metalworking fluids. Unlike conventional lubrication techniques, removal fluids enable superior removal of chips from the cut place, which results in less heat generation and assures a longer tool lifespan, which means enhanced efficacy in processes of metal fabrication.

Generally, the increasing need for removal fluids in the automotive & industrial machinery manufacturing, based on application-specific formulations & high-performance characteristics suitable for high-speed CNC machining, sophisticated drilling, & grinding operations, complemented with end-use design, in order to get better surface finish & minimal work piece deformation has created adoption of high-performance metalworking fluids.

The increasing application of removal fluids in manufacturing aerospace structural components-featuring advanced coolant-lubricant such as blends of high-strength alloys and composite materials-has boosted the market demand for the product, ensuring enhanced adoption in complex aerospace machining applications.

Removal fluids have a number of advantages over other methods such as better chip removal, improved heat dissipation, and extended tool life, but also have a number of important disadvantages including the risk of fluid being contaminated, a build-up of a residue, and regulatory issues associated with certain coolant additives.

Nevertheless, newer advancements like AI-based fluid monitoring, nano-lubricant dispersion, and hybrid coolant formulations, are enhancing fluid efficiency, sustainability, and safety conformity, while also securing substantial market growth for removal fluids.

Protective fluids have seen a robust market adoption technique in industries such as automotive, shipbuilding and heavy machinery maintenance, as the various industries have begun using protective coatings to protect against oxidation, corrosion and to reduce the surface degradation of metal components.

Modern protection fluids not only offer short term prevention, like traditional rust inhibitors - but also provide proven long-term surface preservation, compatibility and endurance in even the meanest of environments.

Increasing demand for protection fluids in automotive undercoating’s, which contains polymeric additives that are resistant to weather and corrosion, has witnessed adoption of high-performance corrosion inhibitors, which assist automakers in enhancing the lifespan of components and therefore ensuring durability of the vehicle.

The rising applicability of protection fluids in marine and offshore fields, including saltwater-resistant formulations for ship hulls, drilling equipment, and port infrastructure, has bolstered market demand, facilitating significant adoption in hostile environmental conditions.

Protection fluids offer substantial benefits in terms of preserving metal surfaces, minimizing environmental pollution, and lowering maintenance expenses, but present hurdles in terms of ease of application, compatibility with various metal surfaces, and environmental concerns.

Nonetheless, new technology innovations in AI-based corrosion prediction systems, bio-derived rust inhibitors, and high-performance nano-coating systems are increasing effectiveness, sustainability, and performance durability, thus securing continued growth in the market for protection fluids.

Market of metalworking fluids (MWFs) as an integral part of industrial and manufacturing sectors of contemporary industries is expanding on account of the requirement of high-performance lubricants, cutting fluids and corrosion resistant metalworking fluids in the automotive, aerospace, heavy-machine and other manufacturing and industrial sectors.

In order to advance machining efficiency, tool life, and environmental compliance, companies are emphasizing bio-based and synthetic MWF formulations, AI-powered fluid monitoring, and sustainable metalworking solutions. Global lubricant manufacturers and specialty chemical suppliers comprise the market, and they drive technological innovations with respect to water-soluble, semi-synthetic and straight oil-based metalworking fluids.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| ExxonMobil Corporation | 15-20% |

| Quaker Houghton | 12-16% |

| Fuchs Petrolub SE | 10-14% |

| Castrol (BP plc) | 8-12% |

| TotalEnergies SE | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| ExxonMobil Corporation | Develops high-performance metalworking lubricants, semi-synthetic cutting fluids, and advanced machining coolants. |

| Quaker Houghton | Specializes in industrial metalworking fluids, corrosion inhibitors, and sustainable MWF solutions for aerospace and automotive applications. |

| Fuchs Petrolub SE | Manufactures biodegradable and synthetic metalworking fluids for precision machining and heavy-duty manufacturing. |

| Castrol (BP plc) | Provides water-based, semi-synthetic, and straight oil-based MWFs for enhanced cutting, grinding, and forming operations. |

| TotalEnergies SE | Offers low-emission and high-performance machining fluids, integrating AI-based monitoring systems for predictive maintenance. |

Key Company Insights

ExxonMobil Corporation (15-20%)

The metalworking fluids market is dominated by ExxonMobil and its high-performance coolants, semi-synthetic and synthetic cutting fluids, and AI-driven lubricant monitoring systems.

Quaker Houghton (12-16%)

Quaker Houghton developing corrosion-resistant, long-life MWFs for precision engineering, heavy-duty machining and aerospace manufacturing.

Fuchs Petrolub SE (10-14%)

Fuchs manufactures both MWFs across the spectrum of biodegradable and synthetic products, providing low-toxicity, high-performance solutions for metal processing applications.

Castrol (BP plc) (8-12%)

Castrol offers full-synthetic, water-soluble and mineral-based cutting fluids that highlight cooling and lubrication optimizations within industrial machining.

TotalEnergies SE (5-9%)

TotalEnergies produces low-emission, high-efficiency MWFs feature intelligent integrated with AI-based predictive maintenance and fluid performance analytics.

Other Key Players (40-50% Combined)

Several lubricant and specialty chemical manufacturers contribute to next-generation metalworking fluid innovations, bio-based lubricant alternatives, and AI-driven monitoring solutions. These include:

The overall market size for Metalworking Fluids Market was USD 10.8 Billion in 2025.

The Metalworking Fluids Market expected to reach USD 15.7 Billion in 2035.

The demand for the Metalworking Fluids Market will be driven by the growing automotive and manufacturing industries, increased demand for high-performance machinery, and advancements in machining technologies. Rising awareness of product quality, efficiency, and sustainability will also propel market growth during the forecast period.

The top 5 countries which drives the development of Metalworking Fluids Market are USA, UK, Europe Union, Japan and South Korea.

Semi-Synthetic Oils and Synthetic Oils Drive Market Growth to command significant share over the assessment period.

Caryophyllene Market Growth – Trends & Forecast 2025 to 2035

BBQ Charcoal Market Growth - Trends & Forecast 2025 to 2035

Bio-rational Fungicides Market Growth – Trends & Forecast 2025 to 2035

Graphite Market Growth – Trends & Forecast 2025-2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

Benzyl Trimethyl Ammonium Chloride Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.