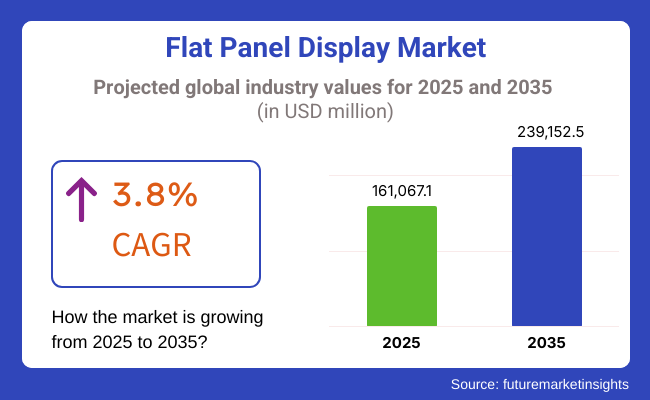

The global flat panel display market is projected to reach USD 161,067.1 million in 2025 and expand to USD 239,152.5 million by 2035, reflecting a compound annual growth rate (CAGR) of 3.8% over the forecast period. This steady growth is fueled by expanding applications of flat panel displays in consumer electronics, automotive, and healthcare sectors.

Key drivers include the rising demand for high-definition displays in smartphones, televisions, and laptops, along with the rapid expansion of OLED and micro-LED technologies. Additionally, increasing adoption in emerging industries and the growing trend toward larger, thinner, and energy-efficient displays are boosting expansion globally.

Restraints include high production costs of advanced display technologies, supply chain disruptions affecting component availability, and intense competition leading to price pressures. Environmental concerns related to e-waste and the energy consumption of large displays also pose challenges to sustained growth.

Opportunities lie in the development of flexible and transparent displays, rising demand for display panels in electric vehicles and wearable devices, and integration of display technologies in industrial and medical equipment. Smart home devices and 8K television adoption are expected to drive future demand further.

Trends shaping the industry include the proliferation of OLED displays in smartphones and TVs, the growth of ultra-thin and bezel-less display designs, and advancements in touch and gesture-enabled interfaces. Emerging display formats like foldable screens and augmented reality (AR) displays are poised to open new applications across consumer and enterprise sectors.

Explore FMI!

Book a free demo

From 2020 to 2024, flat panel display sales saw dramatic growth due to technological innovation, growing demand for high-resolution displays, and growth in digital entertainment. The transition from LCD to OLED and MicroLED technology increased, with OLED panels becoming a norm in smartphones, TVs, and car screens because of their better color quality and flexibility.

MicroLED made inroads into high-end televisions and retail signage due to its brightness and lifespan. High-refresh-rate monitors (144Hz to 360Hz) with HDR and VRR capabilities were made mainstream by gaming, enhancing the experience of gamers. The pandemic opened up the demand for premium monitors and tablets for virtual work and learning and drove vendors toward energy efficiency and eye comfort. In spite of supply chain shock and semiconductor shortages, companies optimized production and regionalized supply chains to stabilize manufacturing through 2024.

From 2025 to 2035, the FPD industry will be dominated by AI-enabled displays, quantum dot technology, and flexible form factors. AI-driven screens will adaptively adjust refresh rates, contrast, and brightness dynamically according to user and environmental settings, with sophisticated upscaling to make low-resolution content look better. MicroLED and Quantum Dot OLED (QD-OLED) will go mainstream with deeper blacks, broader color gamut, and modularity for flexible screen sizes.

Foldables and rollables will find their way to TVs, wearables, and car consoles, with self-healing materials providing extended longevity. AR and VR will propel ultra-light, next-generation high-definition displays for healthcare, education, and smart homes. Sustainability will take center stage, with reflector display technology, energy-saving backlighting, and recyclable materials minimizing ecological footprint. Vehicle screens that are transparent and have curves, such as heads-up displays (HUDs) and smart windows, will make driving safer and more comfortable, ushering in a new age of display technology.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| High refresh rates, HDR gaming monitors | AI-optimized, adaptive screens using MicroLED and QD-OLED |

| Dominance in e-commerce, TV personalization for smart TVs | Shopping with AR integration, product demonstrations virtually |

| Backlight energy efficiency, eco-friendly packaging made from recycled material | Zero-emission production techniques, fully recyclable screens |

| Mainstream usage of OLEDs, the emergence of Mini-LED | Roll-out screens, holographic screens, AI-optimized screens |

| Factory-calibrated professional screens | Personalized color profiles, changeable screen module sizes |

| Localized production, shortage of semiconductors | Sustainable extraction of rare resources, AI-enabled manufacturing |

| Remote work, digital entertainment, gaming | Smart car screens, AR/VR penetration, foldable technology adoption |

The industry is growing very fast with the high demand for high-resolution, energy-efficient, and long-lasting displays in many different sectors. Consumer electronics are still the leading sector, with the growth of smartphones, tablets, and televisions.

The automotive sector is quickly adopting it, as a more integrated flat panel display is being used for infotainment and digital dashboards. In healthcare, displays are a necessity for telemedicine applications, patient monitoring, and diagnostic imaging, and clarity and reliability are the primary considerations.

Retail companies are implementing digital signage and interactive screens with high resolution and customization capabilities in an effort to gain an upper edge in customer interaction. The industrial sector champions the usage of ruggedized flat panel displays in plant manufacturing control and automation, with energy efficiency and durability being their primary focus.

Today's trends include OLED, Mini-LED, and Micro-LED technologies, which are instrumental in providing higher brightness, better contrast, and longer durability. Companies are more and more committed to promoting eco-friendly business by using sustainable and power-efficient displays to comply with environmental regulations.

Contract & Deals Analysis

| Company | Contract Value (USD million) |

|---|---|

| Samsung Display | Approximately USD 120 - 130 |

| LG Display | Approximately USD 100 - 110 |

| BOE Technology Group | Approximately USD 90 - 100 |

| AU Optronics | Approximately USD 70 - 80 |

| Sharp Corporation | Approximately USD 60 - 70 |

In 2024 and early 2025, there was notable growth driven by the rising demand for high-resolution, energy-efficient displays across consumer electronics, automotive, and commercial applications. Key players such as Samsung Display, LG Display, BOE Technology Group, AU Optronics, and Sharp have secured significant contracts and strategic partnerships, underscoring their commitment to technological innovation and industry expansion.

Multiple risks abound, which include the riskdanger of becoming technologically obsolete, supply chain malfunction, and raw material cost rates that are not stable. The speed with which OLED, MicroLED, and flexible display technologies are progressing forms a threat to manufacturers who might have to keep obsolete stocks. Companies are required to constantly innovate as a means of staying competitive. Thus, R&D costs go up.

As intensive competition takes place, the production is especially dominated by such significant players as Samsung, LG and BOE. Startups are faced with barriers to entry due to the high cost of the manufacturing process. Furthermore, geopolitical tensions such as the one between the USA and China can also influence semiconductor and display panel supply chains, thereby leading to production being delayed and cost increments.

The other predominant risk attached is the instability in the price of raw materials like indium tin oxide, which in turn affects the general cost structure. The increasing emphasis on sustainability and energy efficiency rules also makes it necessary to abide by them, thus creating another layer of expenditure in the operations.

| Segment | Value Share (2025) |

|---|---|

| Liquid Crystal Display (LCD) | 52.7% |

Because of its comparatively low price and widespread manufacturing process, Liquid Crystal Display (LCD) will maintain an estimated 52.7% of the global share in 2025. Liquid-crystal-display (LCD) technology therefore remain preferred for televisions, portable computers, computer-based monitors, and automotive displays where durability and low cost are key. To meet demand, companies such as Samsung, LG Display, and BOE Technology are optimizing LCD efficiency, brightness, and power consumption. So, for example, new developments in quantum dot LCDs (QLEDs) are improving color accuracy and contrast and keeping LCDs competitive in mid-range and budget consumer electronics.

Organic Light Emitting Diode (OLED) will hold 47.3% of the share on the back of surging demand for premium smartphones, high-end televisions, and wearables. THE BEST FROM THE WEB OLED's better contrast ratios, flexibility, and energy efficiency are fueling its adoption.

As always, major brands such as Apple, Samsung, or Sony incorporate OLED technology in flagship smartphones and foldable or high-performance gaming monitors. OLED tech is also finding its way into the automotive space as it is being used for infotainment systems and digital instrument clusters that complement the interiors of the vehicle.

Although emerging technologies like mini-LED and micro-LED are making their mark right now, LCD and OLED will still be the cornerstones of the display market in 2025. LCD is low-cost and will thus always have its place in mass-market applications, while OLED's better visual quality and flexibility will bring premium devices.

Tyre experts believe that these rollable and transparent OLEDs will be the next generation of consumer electronics video screens, transitioning away from televisions to digital displays in factories, offices, elevators, restaurants, hotels, and more.

| Segment | Value Share (2025) |

|---|---|

| Consumer electronics | 45.8% |

Driven by this demand for high-resolution displays in smartphones, tablets, laptops, and televisions, in 2025, the consumer electronics segment is projected to account for 45.8% of the global share. The increasing implementation of OLED tech in high-end smartphones and high-end TVs is driving growth; for instance, foldable and rollable OLED screens are being incorporated into flagship devices from companies such as Apple, Samsung, and Sony, providing superior user experiences. The segment also receives a boost from increasing demand for gaming monitors, 4K and 8K TVs, and smart wearables. For example, the global gaming monitor industry is forecast to grow at 10.5% CAGR, increasing the demand for high-refresh-rate LCD and OLED panels.

The commercial segment is expected to have the highest share of 54.2% due to the growing adoption of flat panel displays in various industries like retail, healthcare, automotive, and education. The increasing demand for digital signage solutions, interactive kiosks, advertisement billboards, and medical imaging displays is also propelling the growth. In automotive sector, players such as Tesla, Mercedes-Benz, and BMW are utilizing high-resolution OLED and LCD panels with an aim to enhance user experience through infotainment system, digital instrument cluster and head-up displays (HUDs). Retailers and advertisers are also using large LED and OLED signage to engage customers directly.

Many leading companies, including LG Display, Panasonic, and BOE Technology, must invest heavily in commercial-grade flat panel displays that feature enhanced durability, brightness, and energy efficiency, guaranteeing long-term growth in industrial and retail applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| The USA | 6.9% |

| The UK | 6.5% |

| France | 6.7% |

| Germany | 7.1% |

| Italy | 6.4% |

| South Korea | 7.3% |

| Japan | 6.8% |

| China | 7.5% |

| Australia | 6.3% |

| New Zealand | 6.2% |

2025 to 2035 CAGR is 6.9%. The USA flat panel industry is changing incrementally with rising demand for high-resolution displays for consumer electronics, gaming, and automotive. Increased adoption of OLED and micro-LED technology and AI-based display calibration is revolutionizing the industry.

Heavy investments in domestic semiconductor and display panel production are lowering reliance on foreign suppliers, strengthening the supply chain, and promoting innovation. The industry is shifting toward bendable, energy-efficient, and ultra-thin displays to respond to changing customer requirements.

Apple, Corning, and Universal Display Corporation are making investments in the future generation of OLEDs, flexible display materials, and quantum dot-enriched displays for performance and efficiency improvements. Development is being fueled by 4K and 8K display demand for laptops, smartphones, and smart TVs.

The automobile industry via next-generation infotainment systems and heads-up displays (HUDs) is also growing. Additionally, the development of AR/VR technologies is creating new opportunities, and the USA is emerging as a leading industry.

CAGR in the years 2025 to 2035 is predicted to be 6.5%. The sales of flat panel displays in the UK are rising with growing digital signage demand, uses of AR/VR applications, and high-performance display needs. The concentration on smart city infrastructure and wise interactive displays across the country is driving touchless interface and dynamic ad screen demand. Moreover, advancements in the field of sustainable display material and recyclable screen technologies are shaping the trends.

Players like Samsung Electronics, Sony, and LG Display are driving innovation in OLEDs and micro-LED and power-saving display solutions, as well as AI-enabled color enhancement to address consumer and commercial demands. Growing demands for ultra-thin, high-brightness displays in retailing, entertainment, and public sector end-use applications are driving growth. Focused on energy efficiency and sustainability, players are implementing green manufacturing methods in order to comply with the environmental objectives of the UK

The market is being influenced by augmented spending on R&D for display technology, demand for premium TVs, and penetration for flexible screens into wearables and automotive sectors. Energy efficiency and sustainability are stimulating the requirement for low-power, green display panels with little or no environmental burdens and superior performance.

French technology firms like Thales Group are utilizing their technical competence in high-tech optics to drive innovation for high-precision displays in defense, aviation, and medicine. Increasing demand for in-home entertainment with immersive experiences and smart displays in the corporate world is also driving sales. Increased application of AI-driven image processing and quantum dot technology is improving the quality of the screen, positioning France at the forefront of display technologies.

Germany's flat panel display industry is thriving as a result of its position at the forefront of industrial automation, automotive electronics, and high-end consumer electronics. Being the center of engineering innovation, Germany is witnessing strong demand for OLED, QLED, and HDR display technology across industry segments. Requirements to enable autonomous car infotainment systems and smart displays based on artificial intelligence are also fueling industry requirements.

Bosch, Siemens, and Merck KGaA are investing in future display materials, micro-LEDs, and low-power panels. Growing Industry 4.0 is driving the growth of smart displays for industrial use. Moreover, the growing demand for AR/VR-based solutions in the healthcare sector, games, and professional training is fueling innovation in high-refresh-rate and high-brightness screen technology.

Italy is also growing steadily with increasing adoption in the luxury and automotive segments. The nation's dominance in high-end fashion and retail is driving demand for high-end digital signage and interactive displays. Increased penetration of OLED and flexible screen technology in consumer electronics is also changing market trends.

Italian manufacturers like Ferrari and Maserati are adopting high-definition digital screens in their new car models, improving in-car entertainment and user interfaces. Moreover, increased investment in sustainable display manufacturing and recycling materials is also boosting Italy's green initiatives. The adoption of AI-enhanced display applications in medical imaging and industrial processes is also developing industry opportunities.

South Korea leads the sales based on its dominance in OLED and QLED manufacturing. The rise in demand for high-end TVs, smartphones, and gaming monitors is driving the industry. South Korean display manufacturers are leading the innovation in foldable and rollable screen technology, revolutionizing the future of display technology.

Samsung Display and LG Display are heavily investing in micro-LED, quantum dot, and transparent OLED technologies. Increasing demand for ultra-high-refresh-rate displays for gaming and AI-based smart displays is driving further development. Further, new automotive HUD and digital signage applications are expanding the scope of the industry.

Japanese demand for flat panel displays is expanding strongly due to the pressure from revolutionary high-definition TV technology, automotive display technology, and other industrial applications. Japanese players are leaders in mini-LED and micro-LED technology, which assures greater brightness and color accuracy.

Sharp, Panasonic, and Japan Display Inc. (JDI) spearhead investment in next-gen ultra-thin, bendable, and long-lasting display technology. AI-based display calibration ensures professional display monitors and home viewing screens are optimally calibrated. Semiconductor technologies' strengths in Japan also propel innovations in next-generation display materials and high-refresh-rate gaming and smart display screens.

The Australian flat panel display industry is expanding due to the rise in digital signage deployments, smart home devices, and interactive educational displays. Manufacturers like TCL and Hisense are shifting focus towards energy-efficient and durable display panels to address consumer demands.

Australia's robust eSports and gaming industries are creating demand for gaming monitors with high refresh rates and OLED. Smart city infrastructure and green technology promotion through government schemes are also driving the use of energy-efficient and recyclable display screens.

New Zealand has a high demand for display panels in retail, healthcare, and entertainment applications. New Zealand has a focus on sustainable display technology and smart city applications.

As AI displays become more mainstream in advertising and kiosk applications, companies are targeting interactive and high-resolution displays. Increasing adoption of AR/VR applications in education and tourism further increases industry opportunity.

The flat-panel display industry is witnessing technological advances through soaring consumer demands for a high-resolution, energy-efficient, and flexible display technology framework. Innovations in OLED, Mini-LED, and Micro-LED are at the forefront of industry change, with manufacturers now focusing on the development of ultra-slim, high-refresh-rate, and power-efficient screens for applications ranging from smartphones, televisions, and automotive displays to industrial panels.

The major players are Samsung Display, LG Display, BOE Technology, AU Optronics, and Sharp Corporation, which have the upper hand in the market with contemporary solutions and mass-scale manufacturing capability. Startups and small niche providers are innovating the foldable, rollable, and transparent display segment, pushing next-gen screen technology.

Artificial intelligence (AI) for display optimization, advanced manufacturing, flexible substrates, etc., are increasing durability and performance, thereby reshaping the scenario. Companies are strengthening their competitive position by working on supply chain resilience, energy efficiency, and HDR technologies. Strategic drivers include scaling up Micro-LED production, diversification into automotive and AR/VR applications, and cooperating with semiconductor and materials science players. Innovation is repaying display technology into consumer and industrial applications by leading players and innovators.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Samsung Display | 25-30% |

| LG Display | 20-25% |

| BOE Technology Group | 15-20% |

| AU Optronics | 10-14% |

| Sharp Corporation | 6-10% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Samsung Display | Pioneers in OLED, QD-OLED, and foldable display technologies for premium devices. |

| LG Display | Specializes in OLED and advanced LCD solutions for TVs, smartphones, and automotive applications. |

| BOE Technology Group | Innovates in flexible OLED and high-resolution LCDs for global consumer electronics. |

| AU Optronics | Focuses on energy-efficient and high-refresh-rate displays for gaming and industrial use. |

| Sharp Corporation | Develops IGZO-based displays and ultra-HD LCD solutions for multiple applications. |

Key Company Insights

Samsung Display (25-30%)

Samsung is on top of the flat-panel display market with state-of-the-art OLED and QD-OLED technologies for flagship-style smartphones and TVs/foldable devices.

LG Display (20-25%)

LG is leading in OLED innovation, from premium display solutions for televisions, commercial signage, and automotive applications.

BOE Technology Group (15-20%)

BOE is working in flexible OLED technology for mobile devices, wearables, and AR/VR with great high-resolution displays.

AU Optronics (10-14%)

AU Optronics deals with high-refresh-rate and power-efficient displays, especially for gaming monitors, industrial screens, and high-performance laptops.

Sharp Corporation (6-10%)

Sharp is dealing with IGZO and ultra-HD LCD panels for the evolution of energy-saving, high-resolution display technologies.

Other Key Players (20-30% Combined)

The overall market size was USD 161,067.1 Million in 2025.

The Flat Panel Display Market is expected to reach USD 239,152.5 Million in 2035.

The demand will grow due to the increasing adoption of high-resolution screens, advancements in OLED and MicroLED technologies, and rising demand for smart TVs, smartphones, and automotive displays.

The top 5 contributors to the Flat Panel Display Market are China, South Korea, Japan, the USA, and Germany.

OLED, LCD, and MicroLED displays are expected to command a significant share over the assessment period.

By technology, the market is segmented into liquid crystal displays, plasma displays, and organic light-emitting diode displays.

By application, the market is segmented into consumer electronics, television, mobile phones, personal computers, and automotive.

By region, the market is segmented into North America, Latin America, Western Europe, Eastern Europe, Asia Pacific (APEJ), Japan, and the Middle East & Africa (MEA).

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.