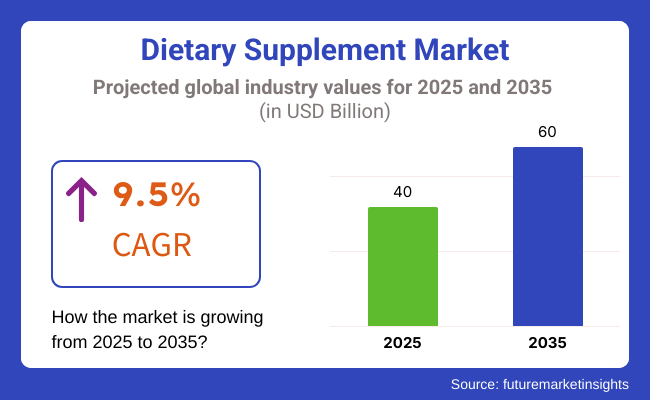

The demand for global Dietary Supplement market is expected to be valued at USD 40.0 Billion in 2025, forecasted at a CAGR of 9.5% to have an estimated value of USD 60.0 Billion from 2025 to 2035. From 2020 to 2025 a CAGR of 9.0% was registered for the market.

A dietary supplement is a product that contains at least one oral dietary ingredient. The growing demand for athletic performance-enhancing and sports-based supplements is fueling the global market. Increased consumer spending on health and wellness products and growing consumer demands to address the bodys daily micronutrient requirements are anticipated to drive the market for food supplements and nutrition.

An irreversible worldwide trend that significantly influences market growth is the aging of the population. Since they make up a large portion of the industrys demand people over 65 are a crucial target demographic for dietary supplement companies worldwide. Although the adult category (those between the ages of 25 and 65) has the highest sales penetration is much higher in the geriatric population set which accounts for about 30% of global sales.

Recent years have seen a surge in consumer confidence primarily due to the efficient rules and regulations set by international regulatory bodies which vary in their level of strictness from one nation to the next. the rise in consumer involvement in fitness and sports-related activities including gyms cycling running hiking and trekking among others. and the growth of the market is anticipated to be significantly impacted by preventive healthcare practices in the upcoming years.

Consumer preferences for what are perceived to be healthier and more sustainable options have been the main driver of the industry growing demand for plant-based natural and clean-label products. It is anticipated that manufacturers will concentrate on creating goods with natural ingredients little processing and clear labeling.

Over the upcoming years the market is anticipated to grow as a result of the increased accessibility of products for consumers brought about by the growth of e-commerce social commerce and direct-to-consumer (D2C) channels.

Explore FMI!

Book a free demo

Demand for Preventive Healthcare Measures is Driving the Market Growth

Consumers growing awareness of preventive healthcare measures and their growing preference for health-promoting products like food additives are expected to propel the global market as the prevalence of age- and lifestyle-related diseases rises. Both major and minor market participants are becoming more innovative which is boosting the markets expansion globally.

Rise in Regulations is Driving the Market Growth

Regulatory bodies like the USA Food and Drug Administration (USFDA) to guarantee that only wholesome and safe foods and dietary supplements are offered for sale. Such actions encourage consumers to use dietary supplements.

During the forecast period the market for dietary supplements is also expected to grow due to the growing use of safe clean-labeled organic ingredients in the production of food nutritional additives. The market for dietary supplements is also growing as a result of peoples growing interest in bodybuilding and sports.

Sports nutrition products and supplements are becoming more and more popular among athletes and sportspersons who want to improve their endurance and performance. The trend toward sports nutrition and vitamin supplements to improve their endurance and performance will be encouraging for the market in the upcoming years.

During the period 2020 to 2024, the sales grew at a CAGR of 9.0%, and it is predicted to continue to grow at a CAGR of 9.5% during the forecast period of 2025 to 2035.

The growing consumer emphasis on wellness management and preventive healthcare is causing a fundamental shift in the dietary supplement market. The growing need for dietary supplements that promote digestive health immunological health and general nutritional sufficiency is one indication of this shift.

Gummies liquid shots and functional beverages are examples of more consumer-friendly delivery formats that have emerged in the industry surpassing the conventional pills and capsules. Manufacturers have been working to address pill fatigue while improving the taste texture and convenience of supplements as evidenced by this evolution in product formats.

Direct-to-consumer and e-commerce are two ways that digital transformation is changing the distribution landscape of the supplement industry. channels that are becoming increasingly popular. Brands of supplements are using digital channels to provide individualized dietary plans. subscription-based services and consumer-engaging educational materials.

Brands can now come together thanks to the growth of online shopping, useful customer information resulting in more focused marketing and product development tactics. This digital evolution has also, allowed for increased transparency in the sourcing of ingredients and the production processes satisfying consumer demands for the product. legitimacy and traceability.

Tier 1 companies comprises industry leaders acquiring a 70% share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base. They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality.

Tier 2 companies comprises of mid-size players having a presence in some regions and highly influencing the local commerce and has a market share of 20%. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance.

Tier 3 companies comprises mostly of small-scale businesses serving niche economies and serving at the local presence having a market share of 10%. Due to their notable focus on meeting local needs these businesses are categorized as belonging to the tier 3 share segment, they are minor players with a constrained geographic scope. As an unorganized ecosystem Tier 3 in this context refers to a sector that in contrast to its organized competitors, lacks extensive structure and formalization.

The following table shows the forecasted growth rates of the significant three geographies revenues. USA, UK and China come under the exhibit of high consumption, recording CAGRs of 7.8%, 7.9% and 10.6%, respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 7.8% |

| UK | 7.9% |

| China | 10.6% |

The USA dominates the North American market thanks to its advanced distribution systems and well-informed consumers. pertaining to dietary supplements. The nation continues to hold a commanding market share in 2025 with about 30%. by launching creative products and maintaining a strong retail presence.

Growing demand for natural products is a defining feature of the market. and organic supplements the growing acceptance of preventive healthcare practices and the growing appeal of personalized nutrition.

A favorable regulatory environment cutting-edge research facilities and important market players all contribute to the sectors stability. dominance of the nation’s market. These factors are reflected in the size of the USA dietary supplement market highlighting the nations crucial position. in the USA supplement market.

China leads the Asia-Pacific market for dietary supplements because of its sizable population and improving health. awareness as well as the expanding middle class.

The traditional herbal market is especially strong in China. supplements that honor the nations long history of using traditional medicine. Innovation in manufacturing benefits the market. e-commerce penetration broad distribution networks and capabilities-all of which are important aspects of the food industry in the area. augments market size.

With a projected growth rate of roughly 7.9% over the next several years the UK market is the one in Europe with the fastest rate of expansion. 2025 to 2035. The market is growing quickly due to rising demand for preventive healthcare and growing health consciousness. goods as well as increased knowledge of nutritional supplements.

The UK market is especially strong in terms of innovation. individualized nutrition plans and delivery methods. the strong e-commerce sector and growing consumer base of the nation. This growth trajectory is further supported by consumer preference for high-end products which is indicative of the growing market for nutritional supplements size.

| Segment | Value Share (2025) |

|---|---|

| Soft Gel Capsule (Form) | 48% |

With about 48% of the market in 2025 the soft gels segment is still leading the dietary supplements industry. Because these formats are more convenient than combining powdered supplements in beverages consumers are adopting them at high rates which is why this segment is so popular. The growing demand for vegetarian vegan and plant-based supplements in tablet and capsule form is another factor contributing to the segments growth.

Businesses are actively diversifying their product lines by providing dietary supplements in different sizes and in bundle packaging to cater to particular customer needs. The market also gains from improvements in targeted-release technology and the capacity to keep products stable at room temperature which makes these formats perfect for customers who travel.

| Segment | Value Share (2025) |

|---|---|

| Vitamin (Ingredients) | 33% |

About 33% of global revenues in 2025 came from vitamin supplements. Growing consumer awareness of the nutritional gaps resulting from hectic lifestyles and inappropriate eating habits is responsible for this category’s expansion. In order to guarantee sufficient nutrient intake consumers are incorporating vitamin products into their daily diets more and more. Notable examples of the main vitamin categories with high demand globally are vitamin D for bone health and vitamin B for brain health.

Global conglomerates and niche regional players compete across a range of product categories and distribution channels in the highly fragmented dietary supplements market.

While specialized players concentrate on niche markets and local market knowledge major multinational corporations use their substantial research capabilities well-established distribution networks and brand equity to maintain market leadership. Mergers and acquisitions are common in the sector as bigger businesses look to broaden their product lines enter new markets and acquire cutting-edge formulations and technologies.

The market is expected to grow at a CAGR of 9.5% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 60.0 Billion.

Demand for preventive healthcare is increasing demand for Dietary Supplement.

North America is expected to dominate the global consumption.

Some of the key players in manufacturing include Pfizer Inc., NU SKIN, Herbalife Nutrition Ltd and more.

By form, methods industry has been categorized into Tablets, Capsules, Powder, Gummies, Softgels and Liquids

By ingredients, industry has been categorized into Vitamins & Minerals, Herbal Supplements, Proteins and Amino Acids, Fatty-acids and Prebiotics & Probiotics

Industry analysis has been carried out in key countries of North America; Europe, Middle East, Africa, ASEAN, South Asia, Asia, New Zealand and Australia

Liqueurs Market Analysis by Type, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast from 2025 to 2035

Yeastless Dough Market Growth - Innovations & Consumer Preferences 2025 to 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

Food Grade Lubricant Market Analysis by Base Oil Type, Product Type and Application Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.