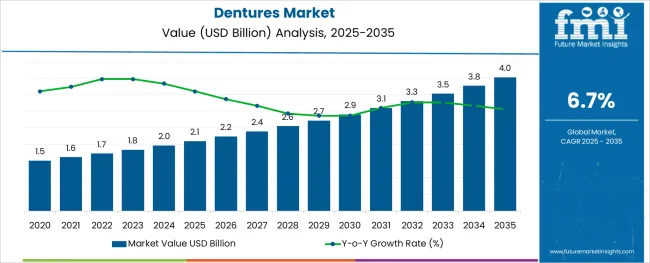

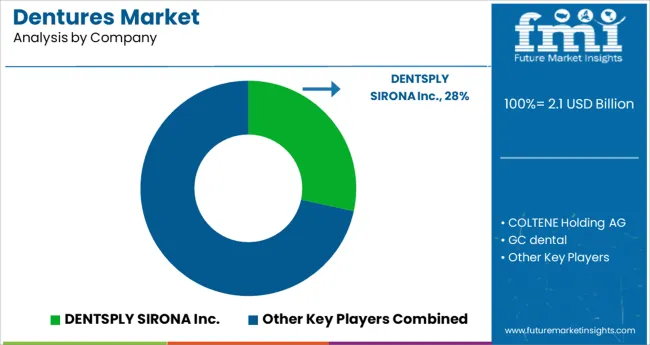

The Dentures Market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 4.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period.

The dentures market is witnessing steady expansion driven by an aging global population, increasing incidence of edentulism, and advancements in prosthetic dentistry. Public health programs and awareness around oral rehabilitation are improving access to dental care, particularly in emerging economies.

Material innovation, digital scanning technologies, and computer-aided design and manufacturing processes are streamlining the denture production lifecycle, enabling greater precision, comfort, and customization. Additionally, aesthetic preferences and demand for natural-looking dental solutions are influencing product development and consumer choices.

The market is expected to remain on a positive trajectory as dental service providers integrate digital workflows and patients seek improved functionality and cosmetic outcomes through prosthetic interventions. The continued focus on affordability, ease of use, and patient-specific solutions will likely drive future adoption across both clinical and home-use settings.

The market is segmented by Material, Type, Usage, and End User and region. By Material, the market is divided into Acrylic, Metal, and Others. In terms of Type, the market is classified into Complete and Partial. Based on Usage, the market is segmented into Removable and Fixed. By End User, the market is divided into Dental Clinics, Hospitals, and Dental Group Practices. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

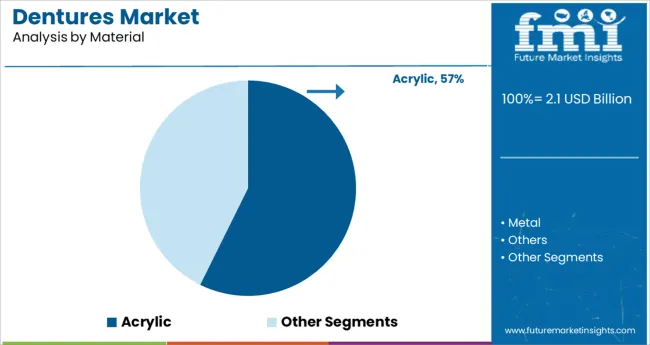

The acrylic material segment is projected to account for 57.30% of total revenue by 2025, positioning it as the leading material category in the dentures market. This dominance is attributed to its cost-effectiveness, ease of adjustment, and compatibility with a wide range of oral conditions.

Acrylic resins are known for their lightweight nature and ability to be molded with precision, which allows dental professionals to craft personalized dentures efficiently. The material’s favorable aesthetics and ease of repair have also made it a preferred choice for both patients and practitioners.

As demand for affordable and reliable dental prosthetics grows globally, the acrylic segment continues to hold a competitive advantage through its balance of functionality, appearance, and accessibility.

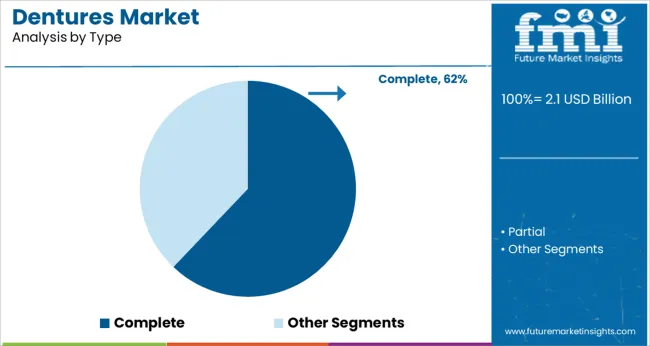

The complete type of dentures is estimated to represent 62.10% of market revenue in 2025, making it the most utilized product type. This segment’s prominence stems from its widespread use in cases of full tooth loss, which is increasingly prevalent among elderly populations.

The availability of both upper and lower arch solutions has supported its adoption in comprehensive oral rehabilitation. Advances in impression techniques and denture stability have improved the comfort and functionality of complete dentures, enhancing patient satisfaction.

As healthcare systems prioritize geriatric care and expand reimbursement policies for dental prosthetics, the complete denture type remains essential in restoring chewing efficiency and speech capabilities for fully edentulous patients.

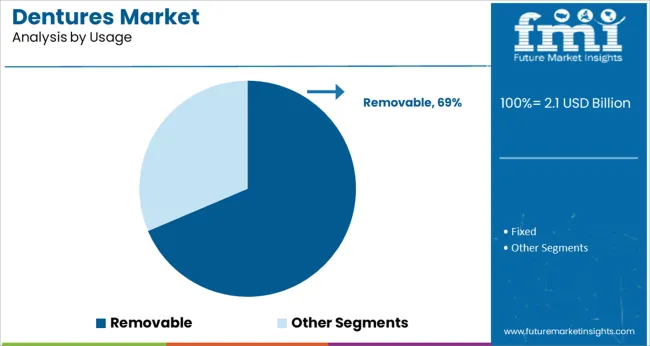

Removable dentures are expected to account for 68.60% of the market by 2025, reinforcing their position as the dominant usage format. This preference is supported by the flexibility, maintenance convenience, and affordability associated with removable designs.

These prosthetics are particularly favored in regions where dental infrastructure may limit access to implant-supported solutions. Furthermore, patients benefit from ease of cleaning and reduced procedural invasiveness.

Manufacturers have responded by offering improved fit, materials, and retention mechanisms to enhance user comfort. As the market evolves toward patient-centric solutions, removable dentures continue to offer a practical option that aligns with varying income levels and care preferences.

The market value for dentures was approximately 13.7% of the overall ~USD 2 Billion of the global dental implants and prosthetics market in 2024.

The sale of dentures expanded at a CAGR of 5.0% from 2012 to 2024.

Edentulousness is a multifaceted phenomenon with an effect on people's quality of life. Efficient rehabilitation and restoration are essential for maintaining the continuity of the chewing and swallowing process and removing any cosmetic or phonetic issues.

A removable partial denture is designed for partially edentulous patients who want replacement teeth for function but are unable to get a bridge or an implant because they lack the necessary teeth to support the bridge, the procedure is expensive, or other factors.

A well-designed partial detachable dental prosthesis is still one of the most often-used treatment modalities, meeting the needs of millions of people worldwide or being used for aesthetic purposes, among the different partial edentulism treatment strategies such as implant- and tooth-supported fixed prostheses.

Many elderly individuals require dental care, which includes removable partial dentures. According to studies, there are a variety of reasons why older individuals do not properly clean their dentures and do not develop good oral hygiene practices, including socioeconomic position, age, education, systemic diseases, and tobacco consumption.

Additionally, lack of knowledge about maintaining dental health and recurring recalls are crucial factors in the situation described above. This presents propulsion in the demand for dentures and dental implants and prosthetics, thus driving the overall market for dentures.

Because of the aforementioned factors, it is anticipated that from 2025 to 2035, the global dentures market will expand at a CAGR of 6.7%.

Recent advancements have made it possible to manufacture completely removable dental prostheses (CRDPs) using computer-aided design and manufacturing (CAD/CAM) technologies.

Evidence suggests that CRDPs produced using CAD/CAM techniques have enhanced material characteristics and are as accurate as or better than CRDPs produced using traditional manufacturing techniques.

Numerous studies have shown that CRDPs made using CAD/CAM techniques greatly increase patient satisfaction. With the advent of CAD/CAM technology, both the clinical protocols necessary for denture construction and the production processes for CRDPs are revolutionized.

Furthermore, CAD/CAM manufacture of removable full dentures is less expensive in terms of laboratory and overall costs when compared to conventional removable complete dentures.

The adoption of digital solutions for the design and development of dentures will thus provide the key competitors within the dentures market with lucrative opportunities for expansion over the forecast period.

For patients with missing teeth or who are partially toothless, removable dentures are still a popular and affordable treatment option. However, there are a number of potential issues with these dentures.

Since many physicians entrust planning to technicians, it is considered that failures are caused by the destructive impact of poorly planned and constructed dentures.

Since surgical and prosthodontic procedures are carried out to increase patients' satisfaction, it is reasonable to believe that the quality of prosthetic treatment may also have an impact on oral health. As a result, oral health and quality of life are related.

The potential impact of a decreased quality of life includes a decrease in demand for procedures involving the adoption or replacement of dentures. This is a consequence of lower patient satisfaction, thus restraining the overall market.

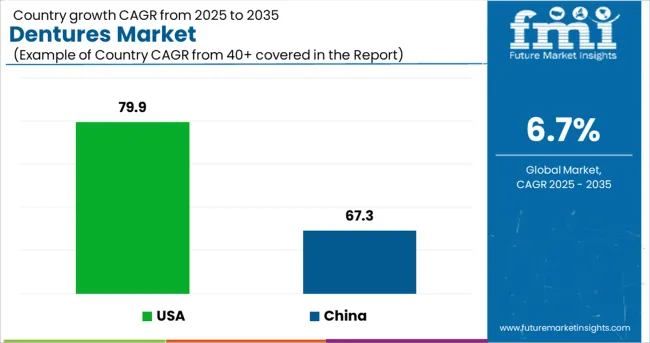

With a market share of 79.9% in all of North America in 2024, the US presently dominates the region and is expected to sustain this growth throughout the forecast period. According to the United States Census Bureau and the Simmons National Consumer Survey (NHCS), about 2 million Americans used dentures in 2024. This high rate of adoption for dentures is set to propel the overall market growth during the forecasted years.

China represents roughly 67.3% of the East Asia market in 2024, with growth at a lucrative CAGR of 6.5% throughout the forecast period. Varieties of denture and medical dental materials have entered the market as consumer awareness of oral health and aesthetics has grown. This is propelled by the high demand for facial aesthetics within the country, thus promoting sales within the overall global dentures market over the forecasted years.

During the forecast years, Germany is projected to grow at a CAGR of nearly 5.1% in the global dentures market. Germany has transformed into a hub for dental tourism. With the presence of several established and independent dental clinics and services, the market for dentures within the country is set to present lucrative growth over the forecasted years.

Acrylic dentures are expected to present high growth at a CAGR of 6.5% throughout the forecast period. Directly following tooth removal, acrylic dentures are typically used as interim or temporary dentures to fill in any gaps left by missing teeth.

Acrylic dentures, like metal clasps and component pieces, look great and can be produced in a variety of colors to complement the gums. In addition, compared to metal frame dentures, the length of treatment for acrylic dentures is shorter.

Complete dentures hold a share of around 76.5% in 2024, and this segment is expected to display gradual growth over the forecast period. Complete dentures offer a degree of aesthetics and functionality that is acceptable to many patients, are reasonably affordable, simple to construct and maintain, and are therefore boosting sales in this market segment worldwide.

Removable dentures hold a market share of around 63.4% in the global dentures market in 2024. One of the most affordable options for replacing missing teeth is removable dentures. The removable denture helps maintain the shape of the face while giving the mouth it's original functioning. Thus, many patients opt for a removable denture over fixed dentures.

Dental clinics hold the highest market share value of 41.6% during the year 2024. With the presence of skilled dental professionals, as well as the presence of a proper treatment plan, dental clinics take the lead as end users within the global dentures market. The segment is further set to present growth at a CAGR of 7.8% over the span of the projected years.

Due to the rapidly advancing state of technology, major corporations like Dentsply Sirona are focusing on developing dental implants using digital dentistry. In order to gain a competitive edge in the dentures market, numerous businesses are now pursuing strategic alliances.

Similarly, recent developments related to companies manufacturing dentures have been tracked by the team at Future Market Insights, which are available in the full report.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2012 to 2024 |

| Market Analysis | million for Value |

| Key Regions Covered | North America, Latin America, Europe, South Asia, East Asia, Oceania, and Middle East & Africa |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Argentina, UK, Germany, Italy, Russia, Spain, France, BENELUX, India, Thailand, Indonesia, Malaysia, Japan, China, South Korea, Australia, New Zealand, Turkey, GCC Countries, North Africa, and South Africa |

| Key Market Segments Covered | Material, Type, Usage, End User, and Region |

| Key Companies Profiled |

DENTSPLY SIRONA Inc.; COLTENE Holding AG; GC dental; Amann Girrbach AG; Ivoclar Vivadent AG; Zimmer Biomet Holdings Inc.; Mitsui Chemicals Inc.; Keystone Dental, Inc.; Align Technology, Inc.; VOCO GmbH |

| Pricing | Available upon Request |

The global dentures market is estimated to be valued at USD 2.1 billion in 2025.

It is projected to reach USD 4.0 billion by 2035.

The market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types are acrylic, metal and others.

complete segment is expected to dominate with a 62.1% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Removable Partial Dentures Market Analysis by Cast Metal Partial Dentures, Flexible Partial Dentures, and Tooth Flipper through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA