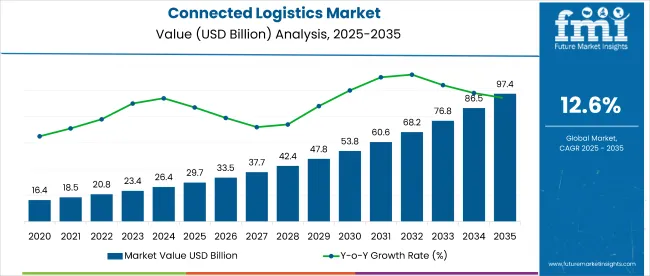

The global sales of connected logistics are worth USD 29.73 billion in 2025 and are anticipated to reach a value of USD 97.39 billion by 2035. Sales are projected to rise at a CAGR of 12.6% over the forecast period between 2025 and 2035. The market is experiencing significant growth due to the rapid advancement and integration of digital technologies across supply chains.

Companies are increasingly adopting Internet of Things (IoT) solutions, cloud computing, and artificial intelligence to streamline operations, improve shipment tracking, and enable real-time data exchange. These technologies enhance the visibility of logistics processes, reduce operational delays, and support predictive maintenance of transportation assets.

As global supply chains become more complex and interdependent, the demand for end-to-end connectivity and data-driven decision-making has intensified. This transformation is particularly critical for industries like automotive, retail, and manufacturing, where logistics efficiency directly impacts competitiveness and customer satisfaction.

Furthermore, the ongoing digital transformation of logistics providers and third-party logistics (3PL) companies is accelerating the deployment of connected systems, making connected logistics a standard expectation rather than a premium feature. In addition to technological advancements, the growth of e-commerce and evolving consumer expectations are major contributors to the expansion of the connected logistics market.

The surge in online retail, especially accelerated by the COVID-19 pandemic, has created unprecedented pressure on logistics networks to offer faster, more transparent, and more reliable deliveries. This demand is driving investments in real-time location systems (RTLS), smart warehousing, automated fulfillment centers, and last-mile delivery solutions.

Connected logistics technologies are also helping companies manage reverse logistics, inventory optimization, and dynamic route planning, which are essential in high-volume e-commerce operations. Moreover, increased urbanization and changing lifestyles are shifting supply chains toward a more customer-centric model, where connectivity and flexibility are vital. As a result, businesses are compelled to adopt connected logistics solutions to maintain a competitive edge, improve delivery accuracy, and optimize costs.

| Attributes | Key Insights |

|---|---|

| Estimated Size, 2025 | USD 29.73 billion |

| Projected Size, 2035 | USD 97.39 billion |

| Value-based CAGR (2025 to 2035) | 12.6% |

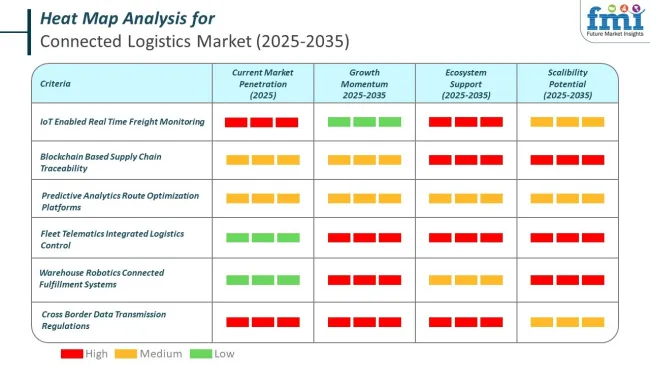

Cybersecurity type-approval compliance is a foundational benchmark in the connected logistics market, where telematics control units and vehicle gateways serve as critical nodes in fleet communication and control. Securing these components against cyber threats is essential for ensuring operational continuity and data protection.

Electronic Logging Device (ELD) and digital tachograph installation rates are critical enforcement metrics in the connected logistics market, ensuring hours-of-service compliance and enhancing fleet safety across both domestic and cross-border freight operations.

Software Update Management System (SUSMS) implementation is a strategic compliance and resilience benchmark in the connected logistics market, enabling authenticated over-the-air updates to maintain system security and performance at scale. Regulatory alignment ensures ongoing protection across distributed fleet ecosystems.

The below table presents the expected CAGR for the global Connected Logistics market over several semi-annual periods spanning from 2025 to 2035. In the first half H1 of the year from 2024 to 2034, the business is predicted to surge at a CAGR of 11.3%, followed by a slightly higher growth rate of 11.8% in the second half H2 of the same year.

| Particular | Value CAGR |

|---|---|

| H1, (2024 to 2034) | 11.3% |

| H2, (2024 to 2034) | 11.8% |

| H1, (2025 to 2035) | 12.6% |

| H2, (2025 to 2035) | 12.9% |

Moving into the subsequent period, from H1 2025 to H2 2035 the CAGR is projected to increase slightly to 12.6% in the first half and remain relatively moderate at 12.6% in the second half. In the first half H1 the market witnessed a decrease of 50 BPS while in the second half H2, the market witnessed an increase of 30 BPS.

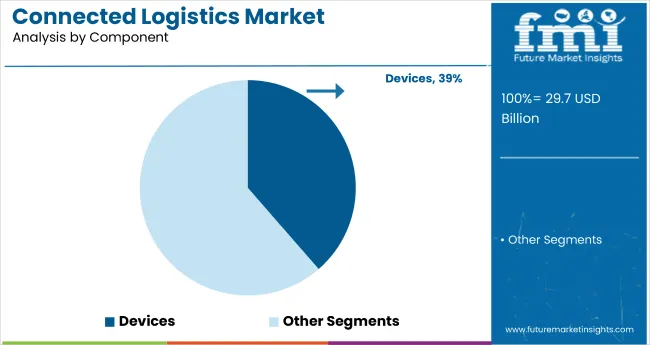

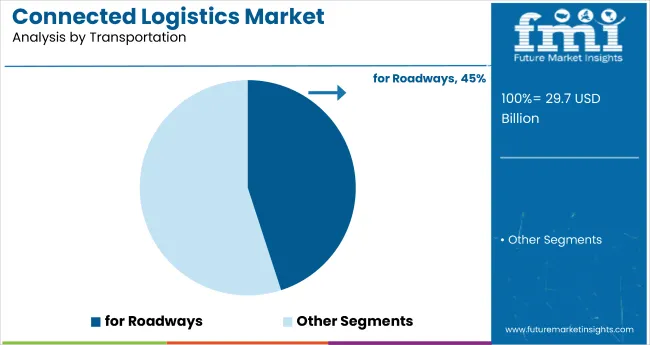

The connected logistics market is segmented by component into devices, software, and services. By transportation, the market is categorized into roadways, railways, airways, and seaways. In terms of verticals, the industry is divided into manufacturing, IT & telecom, automotive, retail & consumer goods, food & beverages, healthcare, energy & utilities, and others (aerospace & defense, construction, agriculture, and government services).

Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and the Middle East and Africa.

The devices segment holds the largest share of the connected logistics market at 38.6% in 2025, driven by the widespread deployment of IoT sensors in fleet management, warehousing, and inventory tracking. These devices enable real-time monitoring, environmental control, and predictive maintenance, which are vital for logistics efficiency.

The software segment is growing as logistics providers increasingly adopt AI-based analytics platforms, cloud dashboards, and route optimization tools to enhance decision-making and supply chain visibility. Meanwhile, the services segment is gaining traction through demand for managed connectivity solutions, system integration, and real-time technical support.

As more enterprises seek complete digital logistics ecosystems, service offerings are evolving from basic maintenance to advanced consulting and analytics-as-a-service. Over the forecast period, software and services are expected to grow steadily, supported by increased automation and platform-based logistics architectures.

| Component | Share (2025) |

|---|---|

| Devices | 38.6% |

The roadways segment is expected to grow at a CAGR of 45% from 2025 to 2035, solidifying its leadership in the connected logistics ecosystem. Connected logistics solutions for roadways are poised to lead the transportation segment, fueled by the rapid integration of vehicle telematics, GPS tracking, and real-time monitoring systems across trucking fleets.

As e-commerce and just-in-time delivery models expand, fleet operators in key markets like the USA, India, and China are adopting digital technologies to enhance efficiency, reduce fuel consumption, and minimize delivery delays. Road transport remains the most flexible and accessible mode for last-mile and urban logistics, making it central to connected logistics growth.

In contrast, adoption in railways and seaways lags due to legacy infrastructure, slower modernization cycles, and higher capital intensity. Meanwhile, airways logistics faces barriers like elevated operational costs and stringent regulatory oversight, limiting its growth to high-value or time-sensitive shipments.

| Transportation | CAGR (2025 to 2035) |

|---|---|

| Connected Logistics for Roadways | 45% |

Among all verticals, the healthcare segment is expected to witness the highest CAGR of 14.0% from 2025 to 2035, emerging as the most lucrative investment area in the connected logistics market. This rapid growth is fueled by increasing demand for cold chain logistics, real-time temperature monitoring, and secure pharmaceutical tracking, particularly for vaccines, biologics, and precision medicine.

Regulatory compliance and the need to prevent counterfeit drugs are pushing adoption of IoT, blockchain, and AI-enabled analytics in pharmaceutical logistics. Other key sectors, such as retail & consumer goods and food & beverages, are also expanding steadily, driven by last-mile delivery optimization and supply chain visibility needs.

Meanwhile, automotive and manufacturing sectors are integrating smart logistics to enable predictive maintenance and JIT inventory systems. While these verticals are growing, healthcare remains the clear leader due to its sensitivity to time, temperature, and traceability.

| Vertical | CAGR (2025 to 2035) |

|---|---|

| Healthcare | 14.0% |

Growing Adoption of IoT and AI for Real-Time Visibility and Predictive Analytics.

Real-time tracking, route optimization, and predictive analytics are some of the most common applications of IoT and AI-based technologies reshaping the Connected Logistics Market. IoT sensors embedded in fleets, warehouses and inventory systems provide insight into shipment status, environmental conditions and asset health.

AI-enabled analytics help with demand forecasting, route efficiency, and predictive maintenance, minimizing operational costs and delays. These technologies are being harnessed by businesses for end-to-end visibility across their supply chains, empowering them to operate more efficiently and make better decisions.

In addition, growing demand for automated and smart logistics operations across sectors including retail, e-commerce, manufacturing, and healthcare is also catalyzing the market growth. The evolution towards 5G connectivity and cloud synchronization has allowed for real-time logistics monitoring solutions to become both more efficient and widespread.

Expansion of E-Commerce and Demand for Fast and Efficient Last-Mile Delivery.

E-commerce and e-retailing, especially omnichannel, is growing rapidly and increasing the demand for fast, transparent, and cost-effective last-mile delivery challenges. This, in turn, is driving online retail and logistics providers to deploy connected logistics across their fleet management, automated warehousing and delivery routing processes.

When and how consumers expect packages to arrive on their doorstep has evolved, with many expecting same-day or next-day deliveries, even so, tracking real time and dynamic routing is crucial for customer satisfaction. Autonomous delivery vehicles, drones, and AI-driven logistics platforms are becoming increasingly prevalent in order to facilitate quicker deliveries with lower costs.

Logistics processes are becoming easy with the introduction of smart warehouses empowered with robotics and AI-based inventory management. With global e-commerce on a constant rise, logistics operators are placing a premium on digitization, automation, and real-time connectivity.

Rising Demand for Blockchain Technology to Improve Security and Transparency in Logistics

Blockchain technology addresses many of the security risks associated with supply chain management, thereby revolutionizing the Connected Logistics market. Traditional logistics systems can still face problems with data manipulation, fraud, and inefficiencies when it comes to processing documents.

Blockchain addresses these concerns, and that is from a single and tamper-proof digital ledger to secure transactions, smart contracts, and automated payment settlements. In particular, this tech is extremely useful in pharmaceutical, food & beverage, and high-value goods industries where real-time authentication and compliance tracking are essential.

Businesses are leveraging blockchain to securely document freight, verify suppliers, and prevent counterfeiting, streamlining this process, decreasing instances of fraud, and increasing trust among those involved. Integration of blockchain is proving to be a leading factor for market growth, with greater focus on supply chain security and compliance.

Limited Interoperability Between Legacy Systems and Modern Connected Logistics Technologies

The poor interoperability between legacy logistics infrastructure and modern digital solutions. The majority of organizations still use antiquated ERP, warehouse management, and fleet tracking systems that fail to interface with cutting-edge IoT sensors, AI-driven analytics, and cloud-based logistics platforms.

This technology gap causes inefficiencies whereby a company has to spend lots of time and money building custom integrations, single-purpose middleware or a complete overhaul of their system. Second, the variation in data formats and communication protocols used by different logistics providers creates barriers to data sharing, severely limiting end-to-end visibility.

This challenge is particularly acute for small and medium enterprises (SMEs), who often do not have the financial and technical capabilities to make a transition smoothly. To overcome this constraint, we need standardized APIs, adaptable software architectures, and government-led initiatives promoting interoperability in logistics ecosystems.

The worldwide connected logistics market experienced a compound annual growth rate (CAGR) of 10.5% over the historical period of 2020 to 2024. It was driven by IoT and AI-driven analytics and real-time tracking across supply chain operations. The pandemic accelerated demand for automated logistics and cloud-based fleet management systems from e-commerce, digital freight management, and last-mile delivery solutions, driving the growth of the space.

During this period, market recorded moderate CAGR between 2020 to 2023, driven by regional digitization initiatives as well as investments in smart logistics platforms. During the period 2025 to 2035, the connected logistics market growth will be dominated due to 5G deployment, blockchain integration, AI-enabled logistics automation and autonomous vehicle adoption. Growing requirement for real-time supply chain transparency, eco-friendly logistics, and predictive maintenance solutions will further accelerate the market growth.

The shift toward smart warehouses, robotics and AI in logistics will also change the industry. Double-digit CAGR is expected during the forecast period due to increasing investments in the global digital logistics ecosystem.

Tier 1 companies include the industry leaders such as IBM, Cisco, SAP, Intel, Microsoft, using disruptive IoT solutions with intelligent analytics and logistics cloud platforms, rcqVbgkTi. These are companies focused on end-to-end logistics digitalization that offers solutions like real-time tracking, automated warehousing, and blockchain to safeguard supply chain security.

AI, edge computing, and predictive analytics are moving toward becoming their deep expertise, and they act as key enablers of this transformation of smart logistics. Examples are IBM's Watson AI, SAP's digital supply chain solutions, and Cisco's IoT-enabled fleet management solutions, just to name a few that are widely used by large enterprises.

These players also allocate significant funds towards research & development, partnerships, and acquisitions to remain a step ahead in global connected logistics innovations and enterprise-wide digital logistics implementations.

Tier 2: AT&T, AWS, and Oracle are examples of Tier 2 Companies, and focus on cloud-based logistics connectivity, IoT infrastructure, and real-time data exchange. They also serve logistics firms on AWS’s cloud computing platforms that offer scalable and secure solutions for running AI and Internet of Things applications at scale in support of logistics.

AT&T’s 5G, along with IoT, connectivity services enable real-time fleet tracking, autonomous logistics operations, and sensor-based warehouse management. Oracle, through its Cloud SCM and digital logistics offerings, connects classical supply chain management with fully automated, AI-driven logistics ecosystems.

They serve both large enterprises and mid-sized logistics companies, which makes them important enablers of next-generation connected logistics infrastructure.

Tier 3: Some of the companies at Tier 3 are Huawei, Bosch Connected Logistics and other emerging market players that cater to industry-specific connected logistics. As a leader in 5G and cloud computing, Huawei’s smart logistics platforms powered by AI are being widely adopted in Asia-Pacific logistics operations.

He is an expert on sensor-based fleet and cargo tracking, real-time vehicle diagnostics, and predictive maintenance for automotive, industrial and retail logistics. While this was the general background of players in the IoT space, they are contributing significantly to the transformation for new markets and niche industries due to their focus on cost-effective solutions, local logistics optimization, and industry specific integrations.

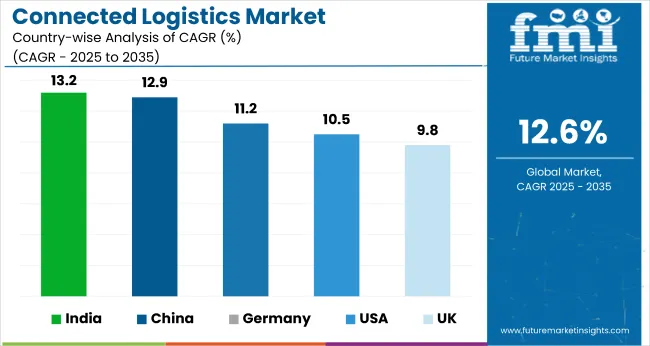

The section below covers the industry analysis for the Connected Logistics market for different countries. The market demand analysis on key countries in several countries of the globe, including USA, Germany, UK, China and India are provided.

The united states are expected to remains at the forefront in North America, with a value share of 59.9% in 2025. In South Asia & Pacific, India is projected to witness a CAGR of 13.2% during the forecasted period.

| Country | Value CAGR (2025 to 2035) |

|---|---|

| USA | 10.5% |

| Germany | 11.2% |

| UK | 9.8% |

| China | 12.9% |

| India | 13.2% |

North America is dominating the market, owing to wide adoption of artificial intelligence, IoT, blockchain, and automation to improve supply chain efficiency for their connected supply chain. Some of the biggest logistics players and retailers like Amazon, FedEx and UPS are utilizing real-time tracking, AI-led demand forecasting and automated warehouses to optimize the process.

As 5G networks and edge computing continue to be implemented more widely, logistics connectivity becomes stronger, allowing companies to monitor and track fleets more effectively as well as optimize last-mile delivery.

The USA government and private enterprises also spend significantly on smart logistics infrastructure, autonomous delivery vehicles, and predictive maintenance technologies. The USA relies on a vibrant digital ecosystem and growing cloud penetration in logistics solutions, making it a leader of next-generation logistics transformation.

In the United Kingdom, the digital transformation of supply chains along with the rising demand for sustainable logistics solutions are driving the Connected Logistics Market forward. The growing trend of e-commerce and omnichannel retailing also drives higher adoption of AI-based fleet management, IoT-based inventory management, and autonomous delivery solutions.

The commitments to carbon-neutral logistics, green supply chain initiative and green transportation in the UK also inspire investments in the areas of electric vehicles, AI-powered logistics optimization and blockchain for transparency in freight management.

Market growth is also driven by government initiatives such as smart transportation and 5G logistics facilities as well as AI-based route planning. Furthermore, logistics companies in United Kingdom are using cloud-based logistics platforms and real-time analytics to improve the visibility of supply chain and reduce operational cost.

The growth trajectory for Connected Logistics applications in India is significant, with the rapid expansion of e-commerce, the digital transformation of existing supply chains, significant investments in 3PL players, and the push for smart logistics solutions driving this outlook. IoT-based fleet management, AI-enabled predictive analytics, and cloud-integrated logistics platforms are becoming increasingly common, driving efficiency in the supply chain.

Government initiatives such as Digital India, Make in India and reforms of the logistics sector will further drive the adoption of smart warehouses, AI-driven route optimization, and blockchain-enabled freight tracking. Moreover, an increase in hyperlocal and last-mile delivery services, as well as increasing investments in automated supply chains, are driving the growth of the market.

Almost every startup and enterprise are using AI, machine learning, and big data analytics to solve for route congestion and nuisance in inventory management with real-time shipment tracking will be key for Connected Logistics, making India an important emerging market.

The competitive landscape of the Connected Logistics Market is characterized by the presence of global technology companies, logistics service providers and disruptive IoT-based start-ups. The Market is dominated by key players including IBM, Cisco, SAP, Microsoft, Oracle, and Intel offering AI-powered logistics analytics, IoT-based Fleet management, and Blockchain-enabled supply chain solutions.

AWS and AT&T will offer cloud-based logistics platforms and 5G-enabled real-time tracking solutions to improve efficiency in the supply chain. Smart IoT devices and AI-powered predictive maintenance of logistics operations are offered by Huawei and Bosch Connected Logistics.

Market competition is increasing as businesses pour money into autonomous logistics, AI-powered route optimization, and robotized warehouses. A lot of competitive strategies in this fast-growing field are still partnerships, acquisitions, and also R&D regarding smart logistics technologies.

Recent Industry Developments in Connected Logistics Market

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 29.73 billion |

| Projected Market Size (2035) | USD 97.39 billion |

| CAGR (2025 to 2035) | 12.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion |

| By Component | Devices, Software, Services |

| By Transportation | Roadways, Railways, Airways, Seaways |

| By Vertical | Manufacturing, IT & Telecom, Automotive, Retail & Consumer Goods, Food & Beverages, Healthcare, Energy & Utilities, Others |

| Regions Covered | North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Middle East and Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | IBM Corporation, Cisco Systems, Inc., SAP SE, Intel Corporation, AT&T Inc., Amazon Web Services (AWS), Oracle Corporation, Microsoft Corporation, Huawei Technologies Co., Ltd., Bosch Connected Logistics |

| Additional Attributes | Integration of IoT, AI, and cloud solutions; focus on supply chain visibility and cost reduction |

| Customization and Pricing | Available upon request |

In terms of Component, the segment is divided into Connected Logistics Devices, Connected Logistics Software, and Connected Logistics Services. The Connected Logistics Devices segment includes Vehicle Telematics, Data Loggers, GPS Tracking Devices, and RFID Tags. The Connected Logistics Software segment consists of Fleet Management, Asset Tracking, and Security Solutions. The Connected Logistics Services segment is categorized into Consulting, Integration & Deployment, and Support & Maintenance.

In terms of Transportation, the segment is distributed into Connected Logistics for Roadways, Connected Logistics for Railways, Connected Logistics for Airways, and Connected Logistics for Seaways.

In terms of Vertical, the segment is classified into Connected Logistics in Manufacturing, IT & Telecom, Automotive, Retail & Consumer Goods, Food & Beverages, Healthcare, Energy & Utilities, and Others.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & pacific, Middle East and Africa (MEA) have been covered in the report.

The global Connected Logistics industry is projected to witness CAGR of 12.6% between 2025 and 2035.

The global Connected Logistics industry stood at USD 29.73 billion in 2025.

The global Connected Logistics industry is anticipated to reach USD 97.39 billion by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 13.2% in the assessment period.

The key players operating in the global Connected Logistics industry include IBM Corporation, Cisco Systems, Inc., SAP SE, Intel Corporation, AT&T Inc. and others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Component, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Transportation, 2017 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Vertical , 2017 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Component, 2017 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Transportation, 2017 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Vertical , 2017 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Component, 2017 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Transportation, 2017 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Vertical , 2017 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Component, 2017 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Transportation, 2017 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Vertical , 2017 to 2033

Table 17: East Asia Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 18: East Asia Market Value (US$ Million) Forecast by Component, 2017 to 2033

Table 19: East Asia Market Value (US$ Million) Forecast by Transportation, 2017 to 2033

Table 20: East Asia Market Value (US$ Million) Forecast by Vertical , 2017 to 2033

Table 21: South Asia & Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 22: South Asia & Pacific Market Value (US$ Million) Forecast by Component, 2017 to 2033

Table 23: South Asia & Pacific Market Value (US$ Million) Forecast by Transportation, 2017 to 2033

Table 24: South Asia & Pacific Market Value (US$ Million) Forecast by Vertical , 2017 to 2033

Table 25: MEA Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 26: MEA Market Value (US$ Million) Forecast by Component, 2017 to 2033

Table 27: MEA Market Value (US$ Million) Forecast by Transportation, 2017 to 2033

Table 28: MEA Market Value (US$ Million) Forecast by Vertical , 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Component, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Transportation, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Vertical , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Component, 2017 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Transportation, 2017 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Transportation, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Transportation, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Vertical , 2017 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Vertical , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Vertical , 2023 to 2033

Figure 17: Global Market Attractiveness by Component, 2023 to 2033

Figure 18: Global Market Attractiveness by Transportation, 2023 to 2033

Figure 19: Global Market Attractiveness by Vertical , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Component, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Transportation, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Vertical , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Component, 2017 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Transportation, 2017 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Transportation, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Transportation, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Vertical , 2017 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Vertical , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Vertical , 2023 to 2033

Figure 37: North America Market Attractiveness by Component, 2023 to 2033

Figure 38: North America Market Attractiveness by Transportation, 2023 to 2033

Figure 39: North America Market Attractiveness by Vertical , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Component, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Transportation, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Vertical , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Component, 2017 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Transportation, 2017 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Transportation, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Transportation, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Vertical , 2017 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Vertical , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Vertical , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Component, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Transportation, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Vertical , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Transportation, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Vertical , 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Component, 2017 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Transportation, 2017 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Transportation, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Transportation, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Vertical , 2017 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Vertical , 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Vertical , 2023 to 2033

Figure 77: Europe Market Attractiveness by Component, 2023 to 2033

Figure 78: Europe Market Attractiveness by Transportation, 2023 to 2033

Figure 79: Europe Market Attractiveness by Vertical , 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: East Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 82: East Asia Market Value (US$ Million) by Transportation, 2023 to 2033

Figure 83: East Asia Market Value (US$ Million) by Vertical , 2023 to 2033

Figure 84: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: East Asia Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: East Asia Market Value (US$ Million) Analysis by Component, 2017 to 2033

Figure 89: East Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 90: East Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) Analysis by Transportation, 2017 to 2033

Figure 92: East Asia Market Value Share (%) and BPS Analysis by Transportation, 2023 to 2033

Figure 93: East Asia Market Y-o-Y Growth (%) Projections by Transportation, 2023 to 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Vertical , 2017 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Vertical , 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Vertical , 2023 to 2033

Figure 97: East Asia Market Attractiveness by Component, 2023 to 2033

Figure 98: East Asia Market Attractiveness by Transportation, 2023 to 2033

Figure 99: East Asia Market Attractiveness by Vertical , 2023 to 2033

Figure 100: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia & Pacific Market Value (US$ Million) by Component, 2023 to 2033

Figure 102: South Asia & Pacific Market Value (US$ Million) by Transportation, 2023 to 2033

Figure 103: South Asia & Pacific Market Value (US$ Million) by Vertical , 2023 to 2033

Figure 104: South Asia & Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: South Asia & Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 106: South Asia & Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia & Pacific Market Value (US$ Million) Analysis by Component, 2017 to 2033

Figure 109: South Asia & Pacific Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 110: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 111: South Asia & Pacific Market Value (US$ Million) Analysis by Transportation, 2017 to 2033

Figure 112: South Asia & Pacific Market Value Share (%) and BPS Analysis by Transportation, 2023 to 2033

Figure 113: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Transportation, 2023 to 2033

Figure 114: South Asia & Pacific Market Value (US$ Million) Analysis by Vertical , 2017 to 2033

Figure 115: South Asia & Pacific Market Value Share (%) and BPS Analysis by Vertical , 2023 to 2033

Figure 116: South Asia & Pacific Market Y-o-Y Growth (%) Projections by Vertical , 2023 to 2033

Figure 117: South Asia & Pacific Market Attractiveness by Component, 2023 to 2033

Figure 118: South Asia & Pacific Market Attractiveness by Transportation, 2023 to 2033

Figure 119: South Asia & Pacific Market Attractiveness by Vertical , 2023 to 2033

Figure 120: South Asia & Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Component, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Transportation, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Vertical , 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 126: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: MEA Market Value (US$ Million) Analysis by Component, 2017 to 2033

Figure 129: MEA Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 130: MEA Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 131: MEA Market Value (US$ Million) Analysis by Transportation, 2017 to 2033

Figure 132: MEA Market Value Share (%) and BPS Analysis by Transportation, 2023 to 2033

Figure 133: MEA Market Y-o-Y Growth (%) Projections by Transportation, 2023 to 2033

Figure 134: MEA Market Value (US$ Million) Analysis by Vertical , 2017 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Vertical , 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Vertical , 2023 to 2033

Figure 137: MEA Market Attractiveness by Component, 2023 to 2033

Figure 138: MEA Market Attractiveness by Transportation, 2023 to 2033

Figure 139: MEA Market Attractiveness by Vertical , 2023 to 2033

Figure 140: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Connected Sensors Market Size and Share Forecast Outlook 2025 to 2035

Connected Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Connected RHM (Remote Healthcare Monitoring) Market Size and Share Forecast Outlook 2025 to 2035

Connected Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Connected Packaging Market Size and Share Forecast Outlook 2025 to 2035

Connected Living Room Market Size and Share Forecast Outlook 2025 to 2035

Connected Toys Market Size and Share Forecast Outlook 2025 to 2035

Connected Vehicle Technology Market Size and Share Forecast Outlook 2025 to 2035

Connected Tire Market Size and Share Forecast Outlook 2025 to 2035

Connected Drug Delivery Devices Market Size and Share Forecast Outlook 2025 to 2035

Connected Home Surveillance Devices Market Growth - Trends & Forecast 2025-2035

Connected Game Console Market Analysis by Product Type, Application, and Region through 2035

Understanding Connected TV Market Share & Growth Trends

Connected TV’s Market Outlook 2025 to 2035

Connected Healthcare Market

Connected Car Market Growth – Trends & Forecast 2024-2034

AI-Driven Smart Home Appliances – Enhancing Home Automation

Connected Lighting Platform Market

Connected Enterprise Video Surveillance Solutions Market

Connected Energy Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA