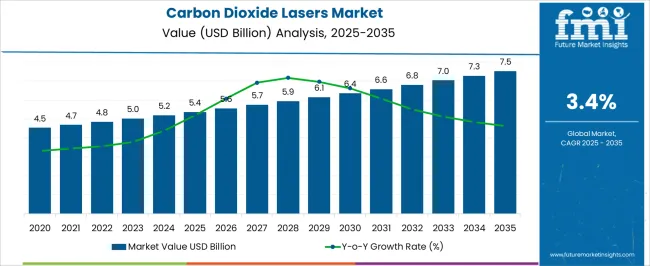

The Carbon Dioxide Lasers Market is estimated to be valued at USD 5.4 billion in 2025 and is projected to reach USD 7.5 billion by 2035, registering a compound annual growth rate (CAGR) of 3.4% over the forecast period.

| Metric | Value |

|---|---|

| Carbon Dioxide Lasers Market Estimated Value in (2025 E) | USD 5.4 billion |

| Carbon Dioxide Lasers Market Forecast Value in (2035 F) | USD 7.5 billion |

| Forecast CAGR (2025 to 2035) | 3.4% |

The carbon dioxide lasers market is expanding steadily, driven by their widespread use in precision cutting, welding, marking, and medical applications. Industry reports and corporate disclosures have emphasized the advantages of CO₂ lasers, including high efficiency, cost-effectiveness, and suitability for processing a wide range of non-metallic materials such as plastics, textiles, and ceramics. Their long-standing role in industrial manufacturing has been reinforced by advances in laser optics, cooling systems, and automation integration.

Medical institutions have also broadened the use of CO₂ lasers for dermatology, dentistry, and surgical procedures, reflecting their precision and minimal invasiveness. Investments by equipment manufacturers in compact and energy-efficient systems have further improved accessibility across small- and medium-scale industries.

Future market growth is expected to be underpinned by the increasing adoption of laser technologies in automotive, electronics, and healthcare, combined with ongoing innovations in beam quality and control systems that expand the scope of applications.

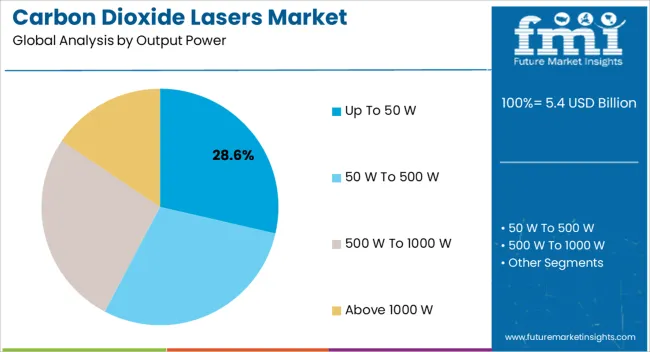

The Up To 50 W segment is projected to account for 28.60% of the carbon dioxide lasers market revenue in 2025, reflecting its importance in small- to mid-scale applications. This segment’s growth has been supported by the rising demand for compact and energy-efficient laser systems suitable for engraving, marking, and lightweight cutting operations.

Manufacturers have favored this output range due to its lower power consumption, reduced heat generation, and adaptability for integration into desktop and portable systems. Additionally, consumer product customization, electronics assembly, and educational research have increasingly relied on low-power CO₂ lasers for precise yet economical operations.

The affordability and operational simplicity of systems in this category have made them accessible to small enterprises and academic institutions. With the broader trend of miniaturization and demand for flexible manufacturing tools, the Up To 50 W segment is expected to sustain its growth trajectory in the coming years.

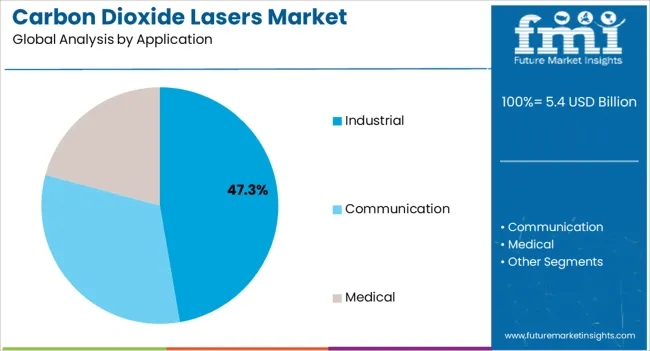

The Industrial segment is projected to contribute 47.30% of the carbon dioxide lasers market revenue in 2025, maintaining its leading position among applications. This dominance has been shaped by the extensive use of CO₂ lasers in cutting, welding, drilling, and surface treatment across industries such as automotive, aerospace, packaging, and electronics.

Industrial reports have highlighted that CO₂ lasers are valued for their ability to process a wide range of non-metals with precision, making them indispensable for materials like glass, wood, textiles, and plastics. Their cost-effectiveness, durability, and ease of maintenance have further supported high-volume adoption in manufacturing plants.

Continuous improvements in automation and laser control software have also enhanced industrial productivity, reducing waste and cycle times. With manufacturers investing in smart factory ecosystems and increasing reliance on precision tools, the Industrial segment is expected to remain the cornerstone of demand for CO₂ lasers, supported by ongoing technological refinements and expanding end-user industries.

Demand for carbon dioxide lasers grew at 4.7% CAGR between 2020 and 2025, according to Future Market Insights (FMI).

The period from 2020 to 2025 witnessed steady growth in the carbon dioxide lasers industry, driven by increasing applications in diverse industries such as medicine, manufacturing, and cosmetics. However, the forecast for 2025 to 2035 indicates a significant surge in market demand, surpassing the earlier outlook.

This upswing can be attributed to further advancements in laser technology, the continuous expansion of the laser surgery industry, and a rising trend of integrating CO2 lasers into various cutting-edge manufacturing processes.

The market is expected to benefit from the growing demand for cosmetic surgeries and the widespread adoption of CO2 lasers in addressing skincare concerns.

Overall, the future looks highly promising for the market, at a growth rate of 3.6% from 2025 to 2035, reaching USD 7.5 billion by 2035.

As per the FMI analysis, the market for carbon dioxide lasers in China is likely to be at the forefront of the global market at 3.5% CAGR from 2025 to 2035, reaching USD 1.5 billion by the end of the forecast period.

The industrial laser systems market in China is thriving primarily due to the concentration of numerous industrial manufacturing plants in the region.

These plants are affiliated with various industries, including aerospace, defense, automotive, consumer electronics, and medical devices, contributing significantly to the market's growth.

It is projected to experience the most promising market growth in the upcoming years, driven by the increasing number of automotive and consumer electronic device manufacturers expanding their operations and manufacturing facilities across different parts of the country.

The government's focus on research and development initiatives in the robotics industry is playing a pivotal role in propelling the growth of the carbon dioxide lasers industry in China.

The United States leads in technological advancements and serves as a prominent manufacturer and consumer of CO2 lasers.

The country’s market is projected to experience a significant growth rate of 3.5% during the forecast period, primarily driven by the extensive utilization of CO2 laser cutting in the healthcare and aerospace industries.

With approximately 4.5 million surgical and minimally invasive procedures performed in 2020, a 2% increase from the previous year, the demand for hygienic, precise, and residue-free tools in plastic surgery has led to the adoption of CO2 laser cutting in their manufacturing.

The resurgence of coronary heart disease has led to rising demand for various medical stents, including bioresorbable stents, bare-metal stents, and drug-eluting stents.

To meet the high precision and quality requirements, lasers are widely used in stent manufacturing due to their enhanced accuracy, superior workflow, and ability to cut complex shapes. Key players in the country involved in stent manufacturing include Abbott Laboratories, Medtronic PLC, and Boston Scientific Corporation, among others.

During the forecast period, the industrial segment is expected to witness significant market share growth, emerging as the major application segment globally with an anticipated CAGR f 3.4%.

This prominence can be attributed to the diverse capabilities of CO2 lasers, encompassing heat treatment, cutting, drilling, welding, and kiss-cutting across a wide range of materials.

To cater to industrial needs, CO2 lasers are designed with varying power levels and configurations. Low-power CO2 lasers (1kW) facilitate a simple melt-mode fusion process, while high-powered lasers are adept at executing high-speed keyhole welds.

Besides metal cutting, welding applications are anticipated to hold the greatest growth potential in this segment. The increasing demand for CO2 lasers for welding purposes has been a major driver of the global market's expansion.

Notably, high-power beam sources, cost-efficient have been incorporated into CO2 lasers to further enhance their performance in industrial applications.

The Up to 50W segment is expected to lead the market by power output due to its versatile applications and increasing demand across various industries, in turn, fostering the sub-segment’s projected CAGR of 3.5% from 2025 to 2035.

CO2 lasers with power outputs up to 50W strike a balance between affordability and performance, making them a popular choice for a wide range of cutting, engraving, marking, and drilling tasks.

These lasers find extensive use in industries such as electronics, packaging, automotive, and medical devices, where precision and cost-effectiveness are crucial.

The advancements in laser technology have improved the efficiency and reliability of these lower-power CO2 lasers, further fueling their adoption and propelling the Up-to-50W segment to a leading position in the market.

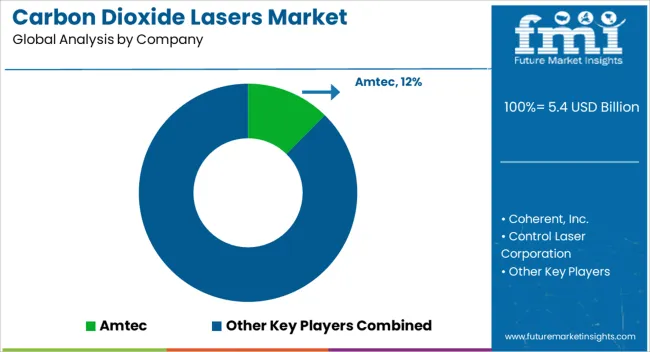

The competition in the industry is structured around key players vying for market share, innovation, and technological advancements.

Established laser manufacturers, as well as specialized companies focusing on laser systems, compete to cater to various industries' demands, including medical, manufacturing, and research.

The competition is driven by factors such as laser performance, precision, reliability, and pricing. As the market evolves, companies seek to differentiate themselves by offering customized solutions and expanding their product portfolios to meet the diverse application needs of customers.

The industry's competitive landscape is influenced by ongoing research and development efforts to enhance CO2 laser capabilities, drive efficiency, and explore novel applications, further intensifying the race for market dominance.

Key Players:

One of the Recent Developments in the Market:

The global carbon dioxide lasers market is estimated to be valued at USD 5.4 billion in 2025.

The market size for the carbon dioxide lasers market is projected to reach USD 7.5 billion by 2035.

The carbon dioxide lasers market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in carbon dioxide lasers market are up to 50 w, 50 w to 500 w, 500 w to 1000 w and above 1000 w.

In terms of application, industrial segment to command 47.3% share in the carbon dioxide lasers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carbon Dioxide Incubators Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Dioxide Synthesis Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Carbon Dioxide Enhanced Oil Recovery (CO2 EOR) Market Analysis by Application, Source and Region: Forecast from 2025 to 2035

Carbon Capture and Sequestration Market Forecast Outlook 2025 to 2035

Carbon Enhanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Cement Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tetrabromide Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Market Size and Share Forecast Outlook 2025 to 2035

Carbon Brush Market Size and Share Forecast Outlook 2025 to 2035

Carbon Offset Platform Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tapes Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Free Waste Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Carbon Labeled Packaged Meal Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Bike Wheelset Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Packaging Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Construction Repair Market Size and Share Forecast Outlook 2025 to 2035

Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Neutral Skincare Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Reinforced Plastic Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA