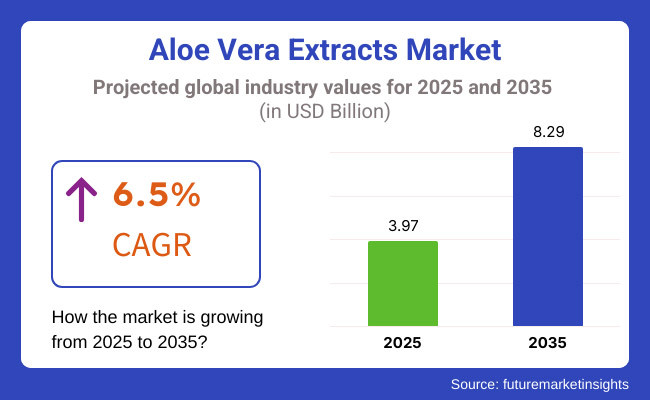

The global aloe vera extracts market is projected to expand at around USD 3.97 billion by 2025 and USD 8.29 billion by 2035, growing at a CAGR of 6.5%. This growth is attributed to the increasing use of Aloe Vera in skincare pharmaceuticals and functional food; aloe vera has become increasingly popular for other industries because of rising consumer knowledge of its therapeutic benefits.

Personal care is a billion dollar industry. Jews are turning to organic, chemical-free skin care like paraben-free moisturizers, sulfate-free shampoos and non-toxic sunscreens. The clean-label movement is strongest in North America and Europe, where regulatory bodies are cracking down on synthetic cosmetics.

With consumers increasingly favoring sustainable, plant-based and cruelty-free ingredients in formulations, manufacturers are being pressured to embrace more humane sourcing and processing methods in order to meet the growing demand for natural and non-GMO aloe vera extracts.

The functional beverage industry also drives the value-based size. Driven by their immune support, digestive aid, detoxification and hydration benefits, aloe vera beverages are on the rise. In terms of applications, aloe vera is witnessing an increase of usage in herbal drinks, fortified water and probiotic beverages, as consumers seek natural hydration products rather than the ones containing artificial sweeteners, preservatives and synthetic additives.

This trend is driving the demand for the pure and natural aloe vera-based drinks, which are currently being promoted as healthy alternatives. Innovations on formulating new range of aloe-based drinks help functional beverage segment also navigate their product line as well as retail space to receive greener pastures.

The aloe vera extracts industry share is also dominated by their uses in the pharmaceutical industry due to anti-inflammatory, antimicrobial, and wound healing properties of aloe vera. It is commonly utilized for dermatology, oral hygiene, and gastrointestinal conditions. There are a number of different species of Aloe, however Aloe barbadensis miller is the most widely used, with effective topical applications for treating sunburns, wounds, and aiding skin regeneration among others.

It helps your skin tissues repair and promotes collagen production, making this ingredient essential in acne treatments, psoriasis treatments, and antiseptics. Furthermore, aloe vera extracts are employed in salves, rubs, and oral hygiene products, which adds a pharmaceutical dimension to their usage.

With consumers now preferring natural, plant-based, and chemical-free products, the aloe vera extracts industry is expected to experience long-term growth. As it finds application in skincare, functional foods and pharmaceuticals, manufacturers are focusing on innovation and meeting the demand for quality and organic aloe vera extracts, making a strong case for growth in the years to come.

Explore FMI!

Book a free demo

The below table presents a comparative assessment of the variation in CAGR over six months for the base year 2024 and current year 2025 for global aloe vera extracts industry. This analysis reveals crucial shifts in performance and indicates revenue realization patterns, thus providing stakeholders with a better vision about the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 15.4% (2024 to 2034) |

| H2 | 16.0% (2024 to 2034) |

| H1 | 16.3% (2025 to 2035) |

| H2 | 17.0% (2025 to 2035) |

The above table presents the expected CAGR for the global aloe vera extracts space over semi-annual period spanning from 2025 to 2035. In the first half (H1) of the year 2024, the business is predicted to surge at a CAGR of 15.4%, followed by a slightly higher growth rate of 16.0% in the second half (H2) of the same year.

Moving into year 2025, the CAGR is projected to increase slightly to 16.3% in the first half and remain relatively moderate at 17.0% in the second half. In the first half (H1 2025) the industry witnessed a decrease of 16 BPS while in the second half (H2 2025), it witnessed an increase of 34 BPS.

Aloe vera extracts sold around the world grew from 2020 to 2024, driven by increased demand for natural ingredients from the cosmetics, pharmaceuticals, and functional foods industries. The sales of aloe vera juices, supplements, and skincare products received a huge boost due to the COVID-19 pandemic.

The cosmetic industry had the largest share, and aloe-infused skincare and haircare products became trendy in North America, Europe, and Asia-Pacific. Meanwhile, in the food & beverage segment, popularity grew for aloe beverages and dietary supplements with health-conscious consumers. While clean beauty trends and organic formulations fueled growth, supply chain disruptions posed challenges

Aloe vera extracts are expected to see sales increase at a CAGR of 17.8% from 2025 to 2035, with a continued demand for plant-based and functional products. Improving the extraction methods will result in enhanced purity of the final products, expanding the uses of the products like skincare, anti-aging, and digestive supplements. Sustainable sourcing and ethical trade processes will assist in defining the future of the industry, setting it up for long-term expansion.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Through soothing and moisturizing effects of aloe extracts, which have increased demand for use in skincare cosmetics and formulations. | An area of rapid advancement into cosmeceuticals and dermatological applications has arisen through research in anti-aging and skin repair benefits. |

| Functional beverages and dietary supplements utilizing aloe vera are growing for digestive health and immunity support. | Utilizations in promotion of personalized nutrition, gut health solutions, and plant-based wellness products are widening. |

| Conventional aloe vera extracts have been dominating the industry, giving way to limited innovation in formulation techniques. | Advancements in nanoencapsulation and bioavailability enhancement improve the efficacy of aloe vera extracts. |

| Sustainable sourcing initiatives focus on organic aloe farming and fair-trade practices. | Large-scale implementation of regenerative agriculture and carbon-neutral aloe vera production. |

| Strict regulations on aloe vera extract usage in food and cosmetics, with a focus on safety and purity standards. | The harmonization of global regulatory frameworks facilitates fast entry and product approvals. |

| North America, Europe, and the Asia-Pacific have strong presence and demand for natural cosmetics and health products. | Meanwhile, Latin America, the Middle East, and Africa are on the rise, thanks to growing consumer awareness and disposable income. |

| Innovations in packaging and formulation enhance shelf life and stability. | The biodegradable and sustainable packaging options therefore accepted by the industry resonate with consumers' climate consciousness. |

Scarcity of arable land and the requirement for harvesting by hand are key factors that inflate costs. Raw leaf supply can be affected by fluctuations in weather - drought or flooding - altering quality and pricing. The aloe market is difficult to regulate, and there are concerns about adulteration and misleading marketing claims.

Industry movement on account of regulatory changes can be huge. Some In vitro aloe vera preparations, particularly those containing HAD, had been banned for use in the EU in food in 2021 as part of safety concerns, leading to upset by nutraceutical and cosmetic companies. While overturned in 2024, actions spotlight regulatory uncertainties.

The FDA is even stricter in the USA about labelling and health claims, with consequences for violators. Regulatory problems still arise for economically motivated adulteration, such as diluted or mislabelled aloe extracts, increasing manufacturers’ compliance costs.

Demand for aloe vera extracts are affected by consumer trends, leading to an impact on supply and demand based on food preferences, supplements and cosmetics industries changes. Other factors influencing costs are the price variance of raw aloe leaf across regions. Surplus harvests can lead to lower prices, while bad yields can cause prices to explode, inflicting financial risks on extract producers.

Aloe is also in competition with alternate botanicals like hyaluronic acid and witch hazel in personal skin and wellness. Big companies might redo products when aloe prices increase, or the supply becomes uneven. The industry is fragmented and dominated by small producers that compete on price and struggle to retain share. Industrial-sized production by big agribusinesses may soak up more share and increase pressure on the small suppliers.

Aloe vera extracts trade as both a commodity and a specialty ingredient when certified organic or IASC-approved. Farming and processing costs are high, leading to thin supplier margins. Pricing follows a cost-plus model tied to raw leaf prices and processing expenses. The associated instability with supply, related to weather, impacts pricing directly. Droughts can drive up costs, while better yields can bring prices down, benefiting buyers but hurting supplier profits.

Premium and budget are the two segments of the industry. These high-end offerings, which include organic-certified aloe extract and cold-press extracts, fetch top-dollar prices thanks to their purity and efficacy. By contrast, budget offerings include bulk industrial aloe powder and generic gels, frequently made using cost-cutting methods. Private label/store brands drive prices lower, making aloe products affordable to value-conscious shoppers.

Value-based pricing is utilized by suppliers for extracts with known bioactive content. Products such as Desert Harvest’s FDA-approved aloe capsules command a higher price. Patented processes that improve aloe’s versatility in beverages further add value. However, smaller packaging options allow brands to reach budget-conscious markets and keep unit prices steady.

Big buyers negotiate bulk discounts, and combining aloe with other extracts adds value. New entrants typically employ penetration pricing to capture market share. Bundling and subscriptions offer a cheaper way to purchase at the consumer level.

Tier 1 companies comprise industry leaders with annual revenues exceeding USD 20 million, holding a market share of approximately 40% to 50%. These companies are recognized for their high production capacity, diversified product portfolios, and extensive global distribution networks.

They possess significant expertise in aloe vera cultivation, extraction, and formulation, allowing them to serve a wide range of applications, including cosmetics, pharmaceuticals, functional foods, and nutraceuticals. Their global presence spans multiple continents, with a strong brand reputation and consumer trust driving consistent sales.

Tier 2 companies are mid-sized firms with annual revenues between USD 5 million and USD 20 million, holding a share of approximately 25% to 35%. These firms focus on regional markets and specialized product segments, including organic, cold-pressed, and pharmaceutical-grade aloe vera extracts. While they may not have the global scale of Tier 1 companies, they excel in specific niches, catering to premium skincare, dietary supplements, and functional beverage sectors.

They often emphasize sustainable sourcing, fair trade practices, and innovative processing techniques to maintain a competitive edge Terry Laboratories, Houssy Globa Real Aloe Inc. These companies are offering premium-grade, ethically sourced aloe vera extracts for skincare and wellness products.

Tier 3 companies consist of small-scale enterprises with annual revenues below USD 5 million, holding a share of approximately 10% to 20%. These companies operate at a local or community level, often serving specific markets or private-label brands.

They lack the large-scale production and advanced R&D capabilities of Tier 1 and Tier 2 players but thrive by catering to niche consumer demands, offering artisanal, locally sourced, and customized aloe vera products. Many of these firms supply bulk extracts to private-label cosmetics, herbal medicine manufacturers.

| Countries | Value (2035) |

|---|---|

| The USA | USD 676.9 million |

| The UK | USD 451.3 million |

| Germany | USD 361.0 million |

| China | USD 225.6 million |

| India | USD 90.3 million |

The USA Clean beauty trends, functional beverages, and wellness-driven nutraceuticals dominate the USA industry for botanical extracts. Organic skincare demand is growing as consumers seek chemical-free products in moisturizers, sunscreens, and anti-aging creams. Functional beverages with plant ingredients are gaining traction in gut health and immunity-promoting beverages.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Rise in Clean Beauty Trends | Rise in organic, chemical-free skincare. |

| Rise in Demand for Herbal Skincare Alternatives | Demand for natural formulation. |

| Growth in Functional Beverages | Emerging uses in gut well-being beverages. |

| FDA Regulations for Safe Ingredients | Clean-label consumer personal care products bolstered by the formulas. |

| Nutraceutical Growth | Immunostimulating food supplements in which herbal extracts are used. |

The United Kingdom is experiencing rising consumer demand for organic, cruelty-free, and sustainable skincare solutions, making aloe vera extracts a high-demand ingredient in the beauty and personal care sector. British consumers are actively seeking eco-conscious and clean-label alternatives, leading to higher adoption of botanical and plant-based skincare products.

The functional beverage industry is expanding where vegetable health drinks and herbal detoxing drinks are increasingly popular.

Growth Drivers in the UK

| Key Drivers | Details |

|---|---|

| Sustainable Skincare Preference | High demand for organic, animal-free beauty products. |

| Tough Cosmetic Regulations | Compliance with CPR and UK REACH regulation. |

| Herbal Functional Beverages Growth | Surging demand for digestive well-being and detox beverages. |

| Need for Plant-Based Alternatives | Botanicals replacing the function of synthetic additives. |

| Expansion of Wellness & Sports Nutrition | Usage in sports and fitness hydration beverages. |

In Germany, the demand for aloe vera extracts is heavily influenced by the strong herbal pharmaceutical industry, functional food sector, and preference for organic skincare. Germany has a long-standing tradition of herbal medicine, with apothecaries and pharmaceutical companies integrating plant-based solutions into mainstream healthcare.

Aloe vera is widely used in dermatological treatments, wound care formulations, and digestive health supplements, making it a highly sought-after ingredient in pharmaceutical-grade herbal remedies. The functional beverage industry also uses botanical ingredients for probiotic beverages and herbal tea.

Growth Drivers in Germany

| Key Drivers | Details |

|---|---|

| Active Herbal Pharmaceutical Industry | Industry for plant extract-based therapeutic formulations. |

| Organic Food & Beverages Growth | Increased consumer demand for food and beverages free of GMOs and chemicals. |

| Functional Beverage & Supplement Development | Emergence of probiotic drinks and digestive health supplements. |

| Natural Cosmetics Demand | Use in anti-aging and dermatological treatments. |

| Clean-Label & Sustainability Shift | Movement towards sustainable, natural ingredients. |

China beta carotene industry is being fueled by its growing functional drink industry, heightened health awareness, and tough food safety regulations. During the post-pandemic period, immune system supplement consumption has grown significantly. It is also widely utilized in animal nutrition to enhance levels of nutrition.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| Growth in Functional Beverages | Growth in consumption of gut health and detox drinks. |

| Emergence in Herbal Medicine Market | TCM-based product extracts with plant extracts. |

| Natural Skincare Growth | Demand for herbal anti-aging and sun-protecting creams. |

| Health-Conscious Urban Consumers | Demand for natural remedies for immune system strength. |

| Strict Food & Cosmetic Regulation | Need for plant-based, safe ingredients. |

India's market for beta carotene is growing with its use in not only in Ayurveda, functional foods but also in dairy. Increased middle class and rising focus on preventive care have stimulated the use of supplements. Food processing industries are also adopting beta carotene as a natural coloring agent.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Ayurveda & Herbal Medicine Tradition | Inclusion in digestive and skin care products. |

| Emerging Nutraceutical Industry | Application in gut and immune supplements. |

| Increased Dairy & Functional Foods | Application in fortified milk and herbal beverages. |

| Government Appeal For Natural Ingredients | Boost for natural ingredient-based herbal preparations. |

| Higher Disposable Income | Growing expenditure on high-end herbal products. |

Aloe Vera gel extracts account for majority share owing to exceptionally moisturizing, skin-soothing, and wound-healing qualities of the product. These extracts are now necessary in cosmetics, skin care, and pharmaceutical products, as more and more consumers are demanding natural, plant-based products.

The increasing needs for clean-label, paraben-free, and sulfate-free skin care products have propelled the top beauty brands to integrate aloe vera gel into moisturizers, sunscreens, anti-aging creams, and soothing balms. The rising number of consumers looking for chemical-free and cruelty-free options has pushed the adoption of organic aloe vera exudate, making it as a natural substitute for synthetic moisturizers and skin protectants.

It is the anti-inflammatory, antibacterial, and cooling properties of aloe vera that are responsible for the wide use of medicated skincare products, including dermatological drugs, in the treatment of sunburn, acne, eczema, and other small wounds. Many pharmaceutical companies have adopted Aloe vera gel in particular in their prescription and over-the-counter formulations which has enhanced the good name for this ingredient in the therapeutic skincare industry.

Moreover, aloe vera whole leaf extract is poised to be the fastest growing segment of the global aloe vera extract market as it finds extensive applications in various industries including personal care, pharmaceuticals and functional beverages. Whole leaf extracts contain both the inner gel and outer rind unlike aloe vera gel extracts, which provide a rich source of bioactive compounds, antioxidants, and polysaccharides that are associated with increased health and wellness benefits.

The increasing demand for clean-label and plant-based formulations is encouraging cosmetic and personal care brands to incorporate aloe vera whole leaf extract in anti-aging creams, detoxifying masks, and scalp treatments. Its antioxidant and skin-rejuvenating properties make it a highly preferred ingredient in hydrating and protective skincare solutions, thus also attracting eco-conscious and chemical-free beauty consumers.

The aloe vera whole leaf extract that is used in the pharmaceutical industry in the preparation of several wound healing medicines, immune-modulators and also in digestive health products. Bioactive compounds like aloin enhance its effects on gut health and detoxification, so it is widely used in herbal medicine and nutritional supplements.

Rising demand for raw aloe vera gel in cosmetics, pharmaceuticals, and wellness products owing to its hydrating, anti-inflammatory, and skin-healing properties is anticipated to boost the market growth. As consumers increasingly search for plant-based skincare alternatives, the uptake of pure aloe vera gel for use on the face, after-sun skin care and hydration masks has jumped.

Apart from skincare, aloe vera gel is commonly used in medicinal purposes, with dermatologists and pharmaceutical establishments introducing medicated gel containing aloe for burns and treating wounds, acne, eczema, and psoriasis46. This unprecedented adoption emphasizes the emerging relevance of aloe vera in therapeutic skin care and pharmaceutical formulations.

Aloe vera powder displays skin-care, functional food, and herbal medicine applications, providing hydration, and having anti-inflammatory and antioxidant functions. Aloe vera powder is extensively used in pharmaceuticals and nutraceuticals such as immune-boosting supplements, digestive health formulations, detox products, and others.

Soothing and gut-healing, it’s a popular ingredient in herbal laxatives, anti-inflammatory treatments and wellness beverages. And supplementing with aloe vera powder is super concentrated and easy to formulate into some of the most effective delivery forms - capsules, tablets, and powdered drink mixes.

The competition in the aloe vera extracts market is at a moderate level with important players at the forefront focusing on vertical integration, large-scale production, and global distribution. Among the industry's largest players are Forever Living Products, Herbalife Nutrition, and Aloecorp, which dominate due to their vast supply chains and product portfolios.

The semi-active mid-sized players such as Terry Laboratories and Real Aloe Inc. are getting into the premium, organic, and niche-level segments, while the smaller organizations cater to the regional demand and private-label brands. Increased consumer preference for clean-label, organic, and functional aloe vera products is causing higher investment levels in R&D, product innovation, and sustainability initiatives.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Aloecorp Inc. | 16-20% |

| Forever Living Products | 14-18% |

| Herbalife Nutrition | 10-14% |

| Terry Laboratories Inc. | 8-12% |

| Lily of the Desert Organic Aloeceuticals | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Aloecorp Inc. | Leading supplier of aloe vera raw materials in nutraceuticals, cosmetics, and beverages for which plant it has a lot of sustainable sourcing. |

| Forever Living Products | One of the largest aloes vera growers and direct sellers serving many aloe-based personal care, nutrition, and wellness products. |

| Herbalife Nutrition | Specializes in aloe-based dietary supplements as well as beverages with an expanding global footprint focusing on wellness and weight management. |

| Terry Laboratories Inc. | Manufacture organic and high-purity aloe extracts for use in the cosmetics, foods, and pharmaceuticals markets. |

| Lily of the Desert Organic Aloeceuticals | Offers USDA-certified organic aloe vera products, with a focus on enhanced bioavailability as well as sustainability. |

Key Company Insights

Aloecorp Inc. (16-20%)

Aloecorp is a global player for its raw materials in aloe vera, practicing sustainably as a culture as well as extracting advanced technologies for applications of high purity.

Forever Living Products (14-18%)

As one of the largest vertically integrated producers of aloe vera, it specializes in personal care and nutritional products through direct selling.

Herbalife Nutrition (10-14%)

The company is one of the top names in aloe-based dietary supplements and beverages, taking advantage of a strong global network distribution coverage with which they reach out to the wellness industry.

Terry Laboratories Inc. (8-12%)

Terry Laboratories specializes in premium-grade aloe vera extracts and supplies them to the food, cosmetic, and pharmaceutical sectors. Lily of the desert organic

Aloeceuticals (6-10%)

A pioneer in organic aloe vera products, Lily of the Desert emphasizes sustainability and enhanced bioavailability in its formulations.

The market is estimated at a value of USD 3.97 billion in 2025.

The anticipated value of the market by 2035 is USD 8.29 billion.

The sales of the market are expected to increase at a CAGR of 6.5% between 2025 and 2035.

Forever Living Products, Aloe Farms Inc., Herbalife Nutrition Ltd., Lily of the Desert Organic Aloeceuticals, and Aloecorp Inc. are some of the leading manufacturers in this industry.

The Asia-Pacific region is projected to hold a revenue share of 29% over the forecast period, driven by high consumer demand for herbal skincare, functional beverages, and dietary supplements.

By product, the industry is segmented into aloe vera gel extracts, aloe vera whole leaf extracts, and others.

By form, the market is categorized into gels, powders, capsules, drinks, and concentrates.

By end-use industry, the market is divided into pharmaceuticals, food, and cosmetics.

By region, the market is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

Food Flavors Market Insights – Taste Innovation & Industry Expansion 2025 to 2035

Fish Sauce Market Growth - Global Culinary Trends & Industry Demand 2025 to 2035

Food and Beverage Microalgae Market - Demand & Future Innovations 2025 to 2035

Flax Protein Market Insights - Demand & Industry Growth 2025 to 2035

Flax-Based Protein Market Growth – Industry Applications 2025 to 2035

Food & Beverage Disinfection Market – Safety & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.